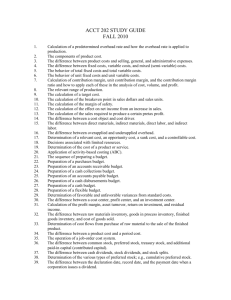

Tutorial 13

advertisement

TUTORIAL 13: Applying Direct & Interactive Marketing Math and Metrics CLASS ACTIVITIES: Revise Topic 13 Tutorial questions Case Discussion Questions Learning outcome Understand why it is important to determine customer value and be able to calculate customer lifetime value Understand the concept of marketing penetration and how it is utilized Understand the concept of a “lift” and be able to perform a “lift” calculation Understand why being able to calculate “break-even” is important and be able to perform the break even analysis Be able to describe the role that fixed costs, variable costs and unit margins play in establishing a marketing budget Be able to explain the importance of Return on Investment (ROI) and perform the ROI calculation Explain the reason for creating a test for a planned direct marketing campaign and give examples of what would be measured in a test Tutorial questions 1. Why do we bother to examine the costs of marketing? spending money on marketing? What should result from Every business is in business to make money for investors, and to do this, a company must create and keep customers. Marketing is a cost that leads to benefits. It’s the ratio between the two that matters. Direct marketing can be called successful, i.e., creates benefits, when it gains new customers (or new orders from existing customers) for a company. We need to remember that direct marketing also has costs, e.g., conducting research, acquiring lists, creating advertising campaigns, and fulfilling orders. The goal is to create a marketing campaign that not only “breaks even” – that is, gains enough sales to pay for all costs – but results in a profit. 2. Why calculate the value of customers? a. It determines how much each customer is worth to your organization. b. It tells you how much money you can afford to spend to acquire a new customer like your current customers. c. You need to identify your best customers in order to seek out new prospective customers who match the customer profiles of your best customers. 3. Why is the concept of break even important? Is this always a goal in a direct marketing campaign? What might be another goal of the campaign? A company needs to know how much it needs to sell to cover costs. But typically, companies want to make a profit, not just sell enough goods to cover costs or break even. If a marketer recovers promotion cost from the gross profit (beyond cost-of-goods sold and overhead) of the total number of units sold, he or she breaks even on those sales. Sometimes, when introducing a new product or trying to penetrate a new market, a company may have goals other than to break even, e.g., getting the new product into the market or selling to a new demographic, but at least they need to know what the break-even numbers are even in these cases. The simple formula for calculating break-even is: Break-even in units sold = Fixed Costs in Dollars Margin Per Unit in Dollars Always add the desired profit margin (in dollars) to your other fixed costs to give yourself the new number to divide by the unit margin (in dollars). 4. Why do advertising costs count as fixed costs? Advertising costs count as fixed costs because they are allocated and spent regardless of the amount of product sold – therefore they are “fixed” in the budget and do not vary with production. 5. In a specific direct marketing campaign, if we want to improve the ROI, what are some ways to do this? a. Variable costs, including costs of goods sold, could be reduced. b. The offer could be improved without adding additional marketing costs. c. Advertising costs could be reduced, for example, by finding a more cost-effective direct marketing medium or by negotiating for lower media buy rates. Case Discussion Questions: SafeLife (Textbook p.368 – 370) 1. What value propositions or offers would you recommend that the company use in targeting organization consumers? How do you plan on measuring the response to these offers? SafeLife’s alcohol detection products help to improve existing protective and safety measures in law enforcement agencies, the work environment and communities. Therefore, a central value proposition is that use of the hand-held breathalyzer will “help increase the safety of people who drink”, and this proposition should have appeal for all major market segments. A second value proposition might be that the breathalyzer “helps your clients view you as trustworthy and caring”, positioning the organizations and businesses that buy the product as being proactive and helpful to their clients. Marketing tests can be created to test different offers with each major client segment. For example, two different direct mail pieces could be developed for the restaurant/bar sector. The first offer would highlight the “help increase the safety of people who drink” message; the second would use the phrase “helps your clients view you as trustworthy and caring”. Assuming an equal number of businesses were assigned to each test, SafeLife could determine which message produces the better sales results. Similar tests could be conducted for other potential and existing market segments. 2. How would you allocate a budget of $49,500? What media and message strategies would you recommend to the company for inclusion in its direct and interactive marketing campaign? Note: students should have flexibility to create a campaign that could include a number of different elements in their media mix, possibly including but not limited to: a. Direct Mail, including expenses for mailing list rentals and other costs of materials creation, mailings and response devices b. Local radio, television and/or cable direct response advertisements, including the costs of maintaining a call-in number c. Events that promote the breathalyzer, e.g., at local fairs, conventions d. Billboards, posters, bus sides Students need to be realistic about the media they use. For example, $49,500 would buy virtually no regional or national television time but could effectively be used for limited direct mail or possibly radio and special events. Messages can be tailored to market segments, e.g., different messages would be developed for the law enforcement segment, the MADD segment, and the restaurant/bar segment, although the underlying value proposition could be similar. In developing the campaign, it is important for students to remember that there are always costs of production for each medium and costs of a response vehicle whether it is a return post card, an 800 number or some other device. 3. What rate of response is needed for SafeLife to break even on this campaign? The break even in units sold before adding any desired profit is 198 units; therefore, 198 responses are needed. Calculation: Fixed marketing costs ($49,500) divided by the Unit Margin ($250) = 198 units. Unit margin is $250. Calculation: Selling Price ($1200) less Variable Cost per Unit ($950) = $250.00 4. Are Safelife’s desired profit and ROI realistic for this campaign? Why or why not? Overall, the answer is that Safelife’s desired profit and ROI are realistic, given the following calculations: 1. Units to achieve 10% better than break even: 217.8 Calculation: 10% x Fixed Costs ($49,500) = $4,950 Add Fixed Costs ($49,500) and 10% margin ($4,950) = $54,450, new target Divide new target ($54,450) by Unit Margin ($250) = 217.8 units 2. Units to achieve 15% better than break even: 227.7 Calculation: 15% x Fixed Costs ($49,500) = $7,425 Add Fixed Costs ($49,500) and 15% margin ($7,425) = $56,925 Divide new target ($56,925) by Unit Margin ($250) = 227.7 units 3. Units to achieve 20% better than break even: 237.6 Calculation; 20% x Fixed Costs ($49,500) = $9,900 Add Fixed Costs ($49,5000 and 20% margin ($9,900) = $59,400 Divide new target ($59,400) by Unit Margin ($250) = 237.6 units 4. At a 2% response level, is 10% profit achieved? Yes. In calculations #1 (above), we found that the company must sell 217.8 units to achieve a profit 10% better than break even. If there was a 2% response rate, then: 36,000 prospects x .02 = 720 units sold. Only 217.8 units needed to be sold to achieve the 10% better than break even. 5. At a 5% response level, is 15% profit achieved? Yes. In calculation #2 (above), we found that the company must sell 227.7 units to achieve a profit 15% better than break even. If there was a 5% response rate, then: 36,000 prospects x .05 = 1800 units sold. Only 227.7 units needed to be sold to achieve the 15% better than break even. 6. At an 8% response level, is 20% profit achieved? Yes. In calculation #3 (above), we found that the company must sell 237.6 units to achieve a profit 20% better than break even. If there was an 8% response rate, then: 36,000 prospects x .08 = 2880 units sold. Only 237.6 units needed to be sold to achieve the 20% better than break even. 7. ROI at the 2% response level: 263.6% Calculation: 2% response = 36,000 x .02 = 720 units sold 720 units – 198 units (break even) = 522 units achieving full profit 522 x $250 (unit margin) = $130,500 (profit) $130,500 divided by $49,500 (fixed costs) = 2.636 x 100 = ROI of 263.6% 8. ROI at the 5% response level: 809% Calculation: 5% response = 36,000 x.05 = 1800 units sold 1800 units – 198 units (break even) = 1602 units achieving full profit 1602 x $250 (unit margin) = $400,500 (profit) $400,500 divided by $49,500 (fixed costs) = 8.09 x 100 = ROI of 809% 9. ROI at the 8% response level: 1354.5% Calculation: 8% response = 36,000 x .08 = 2880 units sold 2880 units – 198 units (break even) = 2682 units achieving full profit 2682 x $250 (unit margin) = $670,500 (profit) $670,500 divided by $49,500 (fixed costs) = 13.55 x 100 = ROI of 1354.5%