Global Trade:5

Global Trade: Lessons

Lessons

Topics

Lesson 1

The World Economy and Global Trade:

An Overview and Stylized Facts on Global Trade

Lesson 2

Lesson 3

Lesson 4

Lesson 5

Lesson 6

Theories of International Trade-I:

The Ricardian Model:

Labor Productivity and Comparative Advantage:

Theories of International Trade-II:

The Heckscher-Ohlin Model:

Factor Endowments and Comparative Advantage

Theories of International Trade-III:

The Standard Trade Model and Gains from Trade

Combination of Labor Productivity and Factor Endowments

Policy Instruments of International Trade:

Tariffs, Export Subsidies, Import Quotas, Export Restraints

Policy Issues of International Trade:

1) Free Trade vs. Protectionism

2) Liberalization in Developing Countries

3) The Role of the World Trade Organization

2

Texts

Main Text: Required:

1. International Economics: Theory & Policy, Krugman, P.R., and Obstfeld, M.,

8th Edition, Pearson-Addison-Wesley.

Recommended:

1.

International Economics, Husted, S., and Melvin, M., 8th Edition, AddisonWesley.

2.

International Economics, Gerber, J., 5th Edition, Addison-Wesley.

3.

World Trade and Payments: An Introduction, Caves, R.E., Frankel, J.A., and

Jones, R.W., 10th Edition, Pearson-Addison-Wesley.

4.

The World Economy: International Trade, Yarbrough, B.V., and Yarbrough,

R.M., 7th Edition, Thomson-South-Western.

5.

Principles of Microeconomics, Only Chapter 3: Interdependence and the

Gains from Trade, Mankiw, N.G., 5th Ed., South-Western Cengage Learning.

3

Lesson 5

Lesson 5: Trade Policy Instruments

Procedure: The PowerPoint Presentation

Duration: 60 minutes

Overview

This lesson discusses different policy

instruments of international trade: tariffs,

export subsidies, import quotas, and

voluntary export restraint.

4

Lesson 5 (cont.)

Outline

List of Class needs: the text, a computer, and a

notebook.

Pre-class reading and preparation: Chapter 8 of the

text.

Activities and timing: Go over the entire presentation

in 60 minutes and think about the main findings of the

lesson. Practice all diagrams in this section.

Identification of Learning Objectives: Objective #5

from Section I

Identification of the Global Workforce Skills for the

lesson: Skill points 3 and 4 from Section II

5

Lesson 5 (cont.)

Lesson notes and suggestions for Instructors: Read

the relevant chapters in the recommended texts

and look for online data for the latest figures of

global trade.

Acknowledgment: The Course Developer took help of

different sources as referred while preparing the study

materials. When a considerable number of diagrams have

been developed to enhance interest in the subject, many

diagrams come from the required text for the convenience

of the students.

6

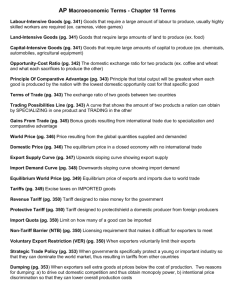

The instruments of trade policy

Previous Lessons have answered the question,

“Why do nations trade?”

While this question is interesting in itself, its

answer is much more interesting if it helps

answer the question, “What should a nation’s

trade policy be?”

This lesson examines the policies that

governments adopt toward international trade,

policies that involve a number of different

actions.

7

The instruments of trade policy (cont.)

The main instruments covered in this

Lesson are:

1)

Tariffs

2)

Export subsidies

3)

Import quotas

4)

Voluntary export restraint

8

Tariff

A tariff, the simplest of trade policies, is a

tax levied when a good is imported.

A specific tariff is levied as a fixed charge

for each unit of imported goods. For

example, $1 per kg of cheese

An ad valorem tariff is levied as a fraction

of the value of imported goods. For

example, 25% tariff on the value of

imported cars.

9

Supply, Demand, &Trade

Suppose that in the absence of trade the

price of wheat in the foreign country is

lower than that in the domestic country.

With trade the foreign country will

export: construct an export supply curve

With trade the domestic country will

import: construct an import demand

curve

10

Export supply & import demand

An export supply curve is the difference

between the quantity that foreign

producers supply minus the quantity that

foreign consumers demand, at each price.

An import demand curve is the difference

between the quantity that domestic

consumers demand minus the quantity

that domestic producers supply, at each

price.

11

Deriving Home’s Import Demand Curve

As the price of the good increases, Home consumers

demand less, while Home producers supply more, so that

the demand for imports declines.

12

Deriving Foreign’s Export Supply Curve

As the price of the good rises, Foreign producers supply

more while Foreign consumers demand less, so that the

supply available for exports rises.

13

Supply, Demand, &Trade

In equilibrium, the quantities of

import demand = export supply

Domestic demand – domestic supply =

foreign supply – foreign demand

In equilibrium, the quantities of

world demand = world supply

14

World equilibrium

The

equilibrium

world price is

where Home

import

demand (MD

curve) equals

Foreign

export supply

(XS curve).

15

Effects of a tariff

A tariff can be viewed as an added cost of

transportation, making sellers unwilling to ship

goods unless the price difference between the

domestic and foreign markets exceeds the tariff.

If sellers are unwilling to ship wheat, there is

excess demand for wheat in the domestic

market and excess supply in the foreign market.

The price of wheat will tend to rise in the

domestic market. The price of wheat will tend

to fall in the foreign market.

16

Effects of a tariff (cont.)

Thus, a tariff will make the price of a good rise

in the domestic market and will make it fall in

the foreign market, until the price difference

equals the tariff.

PT – P*T = t

PT = P*T + t

The price of the good in foreign (world) markets

should fall if there is a significant drop in the

quantity demanded of the good caused by the

domestic tariff.

17

Effects of a tariff (cont.)

A tariff raises the price in Home while lowering the price

in Foreign. The volume traded declines (Note: The

description of the diagram follows in next pages).

18

Effects of a tariff (cont.)

The previous figure illustrates the effects of a

specific tariff of $t per unit of wheat (shown as t

in the figure). In the absence of a tariff, the price

of wheat would be equalized at PW.

With the tariff in place, shippers are no willing to

move wheat from Foreign to Home unless the

Home price exceeds the Foreign price by at least

$t. Thus the price in Home will rise and that in

Foreign will fall until the price difference is $t.

19

Effects of a tariff (cont.)

The tariff raises the price in Home to P and

lowers the price in Foreign to PT* = PT – t. In

Home producers supply more at the higher price,

while consumers demand less, so that fewer

imports are demanded. In Foreign the lower

price leads to reduced supply and increased

demand, and thus a smaller export supply.

Thus the whole volume of wheat traded declines

from Q W, the free trade volume, to QT, the

volume with a tariff.

20

Costs & benefits of tariffs

A tariff raises the price of a good in the

importing country, so we expect it to hurt

consumers and benefit producers there.

In addition, the government gains tariff

revenue from a tariff.

21

Export subsidy

An export subsidy can also be specific or ad

valorem

A specific subsidy is a payment per unit

exported. An ad valorem subsidy is a payment

as a proportion of the value exported.

22

Export subsidy (cont.)

An export subsidy raises the price of a

good in the exporting country, while

lowering it in foreign countries.

Also, government revenue will decrease.

In contrast to a tariff, an export subsidy

worsens the terms of trade by lowering

the price of domestic products in world

markets.

23

Effects of an export subsidy

An export

subsidy raises

prices in the

exporting

country while

lowering them

in the importing

country.

24

Effects of an export subsidy (cont.)

An export subsidy unambiguously produces a negative

effect on national welfare.

The triangles b and d represent the efficiency loss.

◦ The subsidy distorts production and consumption

decisions: producers produce too much and

consumers consume too little compared to the

market outcome.

The area b + c + d + f + g represents the cost of

government subsidy.

◦ In addition, the terms of trade decreases, because

the price of exports falls in foreign markets to P*s.

25

Import quota

An import quota is a restriction on the

quantity of a good that may be imported.

This restriction is usually enforced by issuing

licenses to domestic firms that import, or in

some cases to foreign governments of

exporting countries.

A binding import quota will push up the price

of the import because the quantity

demanded will exceed the quantity supplied

by domestic producers and from imports.

26

Import quota (cont.)

When a quota instead of a tariff is used to

restrict imports, the government receives

no revenue.

Instead, the revenue from selling imports at

high prices goes to quota license holders:

either domestic firms or foreign

governments.

These extra revenues are called quota rents.

27

Effects of the U.S. Import Quota on Sugar

28

Effects of the U.S. Import Quota on Sugar

(cont.)

As the previous figure shows, the sugar import

quota holds imports to about half the level that

would occur under free trade.

The result is that the price of sugar is $418 per

ton, versus the $210 price on world markets. This

produces a gain for U.S. sugar producers, but a

much larger loss for U.S. consumers.

There is no offsetting gain in revenue because the

quota rents are collected by foreign governments.

29

Voluntary export restraint

A voluntary export restraint works like an import

quota, except that the quota is imposed by the

exporting country rather than the importing

country.

However, these restraints are usually requested

by the importing country.

The profits or rents from this policy are earned by

foreign governments or foreign producers.

Foreigners sell a restricted quantity at an

increased price.

30

Activity/Homework

Make a summary of the effects of the

different instruments on trade policy.

If you are asked to adopt a single trade

policy, which one would you support and

why?

31