2011 - College of Business

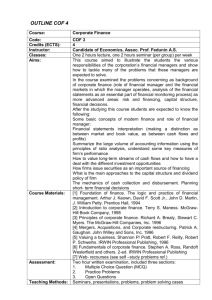

advertisement

Investment Analysis By: Devopama Pant Qiao Du Tianlin Fu Date of Presentation:11/18/2014 Agenda Current Holdings Company Overview Macro-Economic Overview Industry Analysis Strategic Analysis Financial Analysis and Projections Valuation Recommendation Current Holdings 100 shares bought on Dec 09, 2013 @ $73.13 Current Price: $81.14 (11/17/2014) Gain (as on 11/17): 10.95% Portfolio share(MV): 4.35% PORTFOLIO ABBV ABT AEO AL COF JKHY LF NHC PETM SNA COF 4.35% UNP WAG ZIXI COF: Overview U.S. based bank holding company, specializing in credit cards, auto loans, retail banking and mortgages A Fortune 500 company with more than 45M customers One of US top 10 largest banks based on deposits Founded in 1994 by Richard Fairbanks & Nigel Morris Headquartered in McLean, Virginia Richard Fairbanks is current CEO and President 41K employees with businesses in US, UK and Canada Source : http://www.capitalone.com/about/ COF: History 1994 Signet Banking Corporation announces its IPO and creation of a new credit card unit, Capital One Financial Corp. 1996 COF starts doing business in Canada and the United Kingdom. 1998 The company acquires a U.S. auto lending operation. 2001 The company buys online auto finance and elective medical and dental procedures finance businesses. 2005 Acquired New Orleans-based Hibernia Bank 2006 Acquired North Fork Bank, a New York-area lender 2009 Acquired Chevy Chase Bank 2011 Acquired Hudson’s Bay Company - Card Portfolio from GE and Kohl's - Card portfolio from Chase Feb-12 Acquired ING Direct, online banking division of ING May-12 Acquired HSBC's US Card and Retail Business Sep-13 Sale of Best Buy - Card Portfolio to Citibank Source : http://commercialobserver.com/2012/06/capital-one-grows-minus-pains/ 2011,12,13 Annual Reports Experiments USPS negotiated services at bulk discount mailing agreement Softcard (formerly Isis Mobile Wallet) Payment (Feb/2012) Clear Exchange (Feb 2014)~ P-2-P money transfer Decoupled Debit Cards (May/2007)~ opened with “merchant” financial institution Credit Card Growth after 2008 Source : http://www.nilsonreport.com/publication_newsletter_archive_issue.php?issue=1035 COF: Lines of Business COF: Lines of Business (contd..) Loan Portfolio Composition $B $250 $206 $200 Other $197 Mortgage $150 $126 $136 $100 $80 $4 1994 Source : COF Annual Reports 2004 Auto Installment Loans International Card Domestic Card $50 $ Commercial 2010 2011 2012 2013 Industry Review Primary Activities: Providing credit through credit cards Industry participants make money by collecting interest on debt and fees from card owners and merchants. Cardholder Major Products & Services: Fees ◦ Cardholder Fees (34.2%) Interchange ◦ Interchange Fees (34.3%) Fees ◦ Interest Income (31.5%) Interest Income Major Markets: Youg & ◦ Young Adults & College Students (15%) Students ◦ Adults aged 26 to 60 (59%) Adults 26 ◦ Business & Adults aged 60+ (26%) to 90 Business & Adults 60+ Source: Carusotto, Daniel. "Credit Card Issuing in the US: Market Research Report." Credit Card Issuing in the US Market Research. IBISWORLD, 1 Oct. 2014. Web. 18 Nov. 2014. <http://www.ibisworld.com/industry/default.aspx?indid=1293>. Industry Review (Cont’d) The economy is stable Spend money & paying off debt The industry makes solid returns The economy is struggling Stop paying some bills Credit card companies suffer Consumers could not pay off debt obligations Industry set aside a portion of revenue to cover losses, directly impact profit margins Higher unemployment, more bankruptcies Collapse of several large financial institutions Hurt industry revenue and slow the profit growth Source: Carusotto, Daniel. "Credit Card Issuing in the US: Market Research Report." Credit Card Issuing in the US Market Research. IBISWORLD, 1 Oct. 2014. Web. 18 Nov. 2014. <http://www.ibisworld.com/industry/default.aspx?indid=1293>. Government Regulation & Legislation Bank Holding Company Act (1956) Truth in Lending Act (1968) & the Schumer Box The Credit Card Accountability Responsibility and Disclosure (CARD) Act (2009) The Dodd-Frank Act (2010) Basel III source: Carusotto, Daniel. "Credit Card Issuing in the US: Market Research Report." Credit Card Issuing in the US Market Research. IBISWORLD, 1 Oct. 2014. Web. 18 Nov. 2014. <http://www.ibisworld.com/industry/default.aspx?indid=1293>. Major Competitors American Express Co. (20.2%) Bank of America Corp. (17.5%) JPMorgan Chase (16.9%) Citigroup Inc. (9.4%) Discover Financial Service Inc. (7.2%) (Capital One Corp. 14.2%) HHI=1554.9 ∈(1500, 2500) CR4=68.8∈(50, ∝) Moderately Concentrated Market & Tight Oligopoly Industry Source: Carusotto, Daniel. "Credit Card Issuing in the US: Market Research Report." Credit Card Issuing in the US Market Research. IBISWORLD, 1 Oct. 2014. Web. 18 Nov. 2014. <http://www.ibisworld.com/industry/default.aspx?indid=1293>. Management Richard D. Fairbank, Founder, Chairman and CEO ◦ Founding Belief: the power of information, technology, testing and great people could be combined to bring highly customized financial products directly to customers. (1988) ◦ Recognized for his community and industry leadership ◦ Used to serve MasterCard International’s Global Board of Directors and Chairman of MasterCard’s U.S. Region Board Company Culture : ◦ Two Key Values: Excellence Do the Right Thing ◦ Widely recognized for entrepreneurial culture, progressive work place, and community engagement Risk Management: “Three Lines of Defense” risk framework Source: "Leadership." Capital One. Capital One. Web. 18 Nov. 2014. <http://www.capitalone.com/about/corporate-information/leadership/?Log=1&EventType=Link&ComponentType=T&LOB=MTS::LCTMJBE8Z&PageName=Corporate Information&PortletLocation=4;4-8-4-col;1-1-1&ComponentName=secondary_nav&ContentElement=7;Leadership&TargetLob=MTS::LCTMJBE8Z&TargetPageName=Leadership&referer=https://www.capitalone.com/about/corporate-information>. Total US Debt Source : Federal Reserve Bank of New York (http://www.newyorkfed.org/householdcredit/2014-q1/) Unemployment Rate US Unemployment Rate % 12 10 8 6 4 2 0 20 04 20 05 20 06 20 07 20 08 Source : Bureau of Labor Statistics (http://data.bls.gov/timeseries/LNS14000000) 20 09 20 10 20 11 20 12 20 13 20 14 Credit Card Delinquency Rates Source : Card Hub (http://www.cardhub.com/edu/credit-card-charge-off-delinquency-statistics) Interest Rates Source : Trading Economics (http://www.tradingeconomics.com/united-states/interest-rate) Consumer Confidence & Spending Consumer Confidence Consumer Spending Source : Trading Economics (http://www.tradingeconomics.com/united-states/consumer-spending; http://www.tradingeconomics.com/united-states/consumer-confidence) COF : Strategic Analysis Porter’s Five Forces Threat of new Entrants (Low) Bargaining Power of Suppliers (Low) • Bigger banks have significant leverage due to their bigger asset bases • Fed controlled interest rates are at a historically low level • Only 2 new banks started in last 3 years • Extensive capital, legal and regulatory requirements for a new entrant • Dominant position of existing players • Difficult to grow quickly in a highly competitive market Industry Rivalry (High) • Large no. of banks offering competitive products • High volatility in market share • Banks need to respond quickly to integrate rapidly evolving technology into financial products Bargaining Power of Borrowers (Medium) • Competitor banks continuously try to woo customers by offering promotional offers • Customers can shop for best product/pricing very easily Threat of Substitutes (High) • Threat from newer players like credit unions, technology companies and growth in cash/debit card payments • Difficult to achieve product differentiation COF : SWOT S trengths • Strong returns across multiple years • Full spectrum card lender with diversification in auto and home loans • Proven track record of successfully managing credit risk in downturn W eaknesses • Big Subprime lending results in negative market perception • Lack of geographical diversification – based primarily in one market, U.S. • Virtual monopoly in Subprime card market • Lesser brand recognition in Prime and Super Prime space • Resilient performance in stress tests • Significantly lower card satisfaction rates • Known for data-driven analytics O pportunities T hreats • Growth potential in Private Label credit card space, post HSBC acquisition • Loss rates and interest rates are at all time lows, and are bound to go up • Expansion of international business in UK and Canada • Further regulations in Credit Cards • Expand in mortgage and home equity business • Privacy and customer data breach • Volatility in financial markets Ratio Analysis Multiples Analysis 2009 2010 1.4 1.6 29.9 6.4 0.7 0.7 Ratio Analysis 13.8% 11.6% 4.0% 5.2% 10.3% 8.1% P/Tangible Book P/E P/Book Tier 1 Ratio Tier 2 Ratio Leverage Ratio 16.0% 35.0 14.0% 30.0 12.0% 2011 1.3 6.0 0.7 2012 1.4 9.3 0.8 2013 1.6 10.1 1.1 12.0% 2.9% 10.1% 11.3% 2.2% 8.7% 12.6% 2.1% 10.1% 25.0 10.0% Tier 1 Ratio 8.0% 20.0 P/Tangible Book Tier 2 Ratio 6.0% Leverage Ratio 4.0% 10.0 2.0% 5.0 0.0% 2009 2010 2011 2012 Source: Bloomberg and Capital IQ 2013 P/Book 15.0 P/E 0.0 2009 2010 2011 2012 2013 Comparable Analysis Company Name P/Diluted EPS Before Extra LTM Latest P/TangBV LTM Latest NTM Forward P/E P/Book Value Per Share Bank of America Corporation (NYSE:BAC) 42.9x 1.2x 11.99x 0.82x American Express Company (NYSE:AXP) 16.9x 4.7x 15.47x 4.64x Citigroup Inc. (NYSE:C) 18.7x 0.9x 10.25x 0.80x JPMorgan Chase & Co. (NYSE:JPM) 11.2x 1.4x 10.25x 1.07x Discover Financial Services (NYSE:DFS) 12.4x 2.9x 12.08x 2.76x Capital One Financial Corporation (NYSE:COF) 11.0x 1.6x 10.30x 1.04x P/Diluted EPS Before Extra LTM Latest P/TangBV LTM Latest NTM Forward P/E P/Book Value Per Share High 42.9x 4.7x 15.47x 4.64x Low 11.2x 0.9x 10.25x 0.80x Mean 20.4x 2.2x 12.01x 2.02x Median 16.9x 1.4x 11.99x 1.07x P/Diluted EPS Before Extra LTM Latest P/TangBV LTM Latest NTM Forward P/E P/Book Value Per Share 317.95 82.83 169.28 138.17 238.53 47.40 117.61 92.25 122.85 81.35 98.68 95.25 365.84 62.69 167.86 121.45 Summary Statistics Implied COF Price High Low Mean Median Ratios P/Diluted EPS Before Extra LTM - Latest P/TangBV LTM - Latest NTM Forward P/E (Capital IQ) P/Book Value Per Share Multiples Value Weights 138.17 92.25 95.25 121.45 Weighted Average value Source: Capital IQ Implied Value 13.81717962 36.89924547 28.57547938 24.28975154 10% 40% 30% 20% $ 103.58 Technical Analysis (3 years) Source: Bloomberg Financial Valuation 1) Forecast Assets, Debt(liabilities) and Equity growth based on company’s historical data and macro economy 2) Calculate Interest Income, Non-Interest Income, Interest Expense and Non- Interest Expense 3) Forecast and calculate Net Income for common-shareholders 4) Calculate EPS 5) Calculate and Forecast Dividend per share 6) Calculate the Payout Ratio 7) Calculate WACC 8) Select terminal Growth Rate 9) Discount Dividend per share of Future to calculate the Present Value using Dividends Discount Method (DDM) 10) Compare with other methods Weighted Average Cost of Capital(WACC) Cost of equity using CAPM Beta 1.1 Market ri sk premi um (Rm-Rf) 7.87% 10 year treasury yei l d 2.33% Cost of equi ty usi ng CAPM 10.990% Weighted average cost of capital calculation Cost of debt 2.28% Cost of equi ty usi ng CAPM 10.99% 50.00% Real Rate of Return 8.52% 50.00% Cost Of Equi ty 9.76% Market val ue of debt 42,246.00 Market val ue of equi ty 47,447.70 Wei ght of debt 47.10% Wei ght of equi ty 52.90% Tax rate 31.56% Di scount Rate Calculated WACC 5.90% 6.90% Anal yst's Ri sk Premi um(+1%) Beta Calculation Beta (Bl oomberg) 1.105 Beta (Googl e Fi n) Beta ( Yahoo Fi n) 1.19 1.29 Beta ( Nasdaq) 0.94 Adjusted beta esti mate 1.10 Dividend Discount Method(DDM) Valuation Terminal Growth Rate Discount Rate 6.90% Dividend 2014 1.21 2015 2.13 2016 2.99 2017 3.93 PV of Dividends 1.991853556 2.620623454 3.215694778 85.02905215 Payout Ratio Retention 15% 85% 22% 78% 25% 75% 32% 68% ROE net income Equity ROE g 3.00% 4,685,269.00 50,092,800 9.35% 7.9% PV per share 5,716,028.18 62,616,000 9.13% 7.1% $92.86 7,145,035.23 75,139,200 9.51% 7.1% 7,395,111.46 78,520,464 9.42% 6.4% Institutional Investors/Analysts’ Recommendation Firm Analyst Action Recommendation Tgt Px Buckingham Research Group David Hochstim M buy 93 Rafferty Capital Markets Richard X Bove Sr M buy 107 Deutsche Bank David Ho N buy 92 Nomura Bill Carcache D neutral 86 Sanford C. Bernstein & Co Kevin St Pierre M outperform 92 Evercore ISI Bradley Ball M buy 94 Morningstar, Inc Daniel Werner M hold Argus Research Corp Stephen Biggar M hold Barclays Jason M Goldberg M overweight Edward Jones Jim Shanahan M buy Ameriprise Advisor Services, Inc Lori Wilking M buy Oppenheimer & Co Ben Chittenden M outperform William Blair & Co Robert P Napoli M market perform 93 94 UBS Matthew Howlett M buy 93 Credit Suisse Moshe A Orenbuch M neutral 90 Goldman Sachs Ryan M. Nash M buy/attractive 92 RBC Capital Markets Jason Arnold M outperform 86 JPMorgan Richard Shane Jr M overweight 95 Janney Montgomery Scott LLC Sameer Gokhale M neutral 86 Robert W. Baird & Co David A George M outperform 90 FBR Capital Markets Scott Valentin M outperform 94 Sandler O'Neill & Partners, LP Christopher R Donat M hold 85 Wells Fargo Securities Matthew H Burnell M outperform Guggenheim Securities LLC David W Darst M buy Portales Partners William H Ryan M sector perform Susquehanna Financial Group James E Friedman M neutral EVA Dimensions Neil Fonseca D underweight Drexel Hamilton LLC David B Hilder M buy 92 Keefe, Bruyette & Woods Sanjay Sakhrani M outperform 100 Average $ 93.22 Source: Bloomberg 95 85 Recommendation Current Price: $81.14 (11/17/2014) Implied Intrinsic Value: $ 92.86 Credit Card Companies : Stock Prices pre- and post-recession Change in Stock Prices for leading Card Issuers AMEX CHASE COF KBW Bank Index Source : Google Finance Bank of America CITI Credit Card Outstanding $B US Consumer Outstandigs – Revolving Credit (Primarily Credit Card debt) $1100 $1000 $900 $800 $700 $600 200 6 200 7 200 8 200 9 201 0 Source : Federal Reserve (http://www.federalreserve.gov/releases/g19/HIST/cc_hist_r_levels.html) 201 1 201 2 201 3 201 4