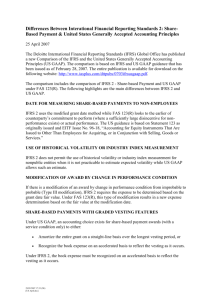

Share-based payment transactions

advertisement

Accounting 2 Lecture no 6 Prepared by: Jan Hájek Share-based Payment Related standards IFRS 2 Current GAAP comparisons Looking ahead End-of-chapter practice 2 Related Standards FAS 123 Share-based Payment 3 IFRS 2 – Overview Objective and scope Recognition Equity-settled share-based payment transactions Cash-settled share-based payment transactions Share-based payment transactions with cash alternatives Summary Disclosures 4 IFRS 2 – Objective and Scope Deals with transactions where equity instruments are used as consideration Entities must recognize these types of transactions If they create liabilities, they must be remeasured after the transaction date Examples of share-based payment transactions Remunerative option plans such as employee stock options plans Acquisitions where shares are used as consideration Situations where services are paid for with equity instruments Accounting for employee remuneration plans can be complex These plans often span numerous reporting periods Cost to the entity may be difficult to measure depending on the terms of the plans 5 IFRS 2 – Objective and Scope The standard puts all share-based transactions into three categories The definitions for the first two categories follow 6 IFRS 2 – Objective and Scope The third category is where there is a choice to settle in cash or equity Share-based payment transactions Defined as transactions in which the entity receives goods or services as consideration for equity instruments of the entity (including shares or share options), or Acquires goods or services by incurring liabilities to the supplier of those goods or services for amounts that are based on the price of the entity’s shares or other equity instruments of the entity Situations where the employee is dealing with the entity as a shareholder Either the entity has the option to determine whether to settle the transaction in cash or equity, or the counterparty has this option Not covered by IFRS 2 When the transaction in question is a business combination Covered by IFRS 3 7 IFRS 2 – Objective and Scope 8 IFRS 2 – Recognition In general, the standard requires that the transaction be recognized when the goods are received or services rendered The credit is booked to equity in an equitysettled transaction and the liability in a cashsettled transaction The debit is booked to expense or asset (if the definition of an asset is met) 9 IFRS 2 – Equity-settled Share-based Payment Transactions Overview For equity-settled transactions Transaction is measured at the fair value of the goods or services received If the fair value cannot be reliably measured, then the fair value of the equity instrument is used There is a rebuttable presumption that the fair value of the goods and services may be reliably measured In most cases, the fair value of the equity instruments would not be used An exception to this is where the transaction involves employees rendering services Transactions are measured by reference to the fair value of the equity instruments May be too difficult to measure the services if the equity instruments are given to the employee as part of the compensation/remuneration package for services normally rendered as an employee 10 IFRS 2 – Equity-settled Share-based Payment Transactions Transactions in which services are received Accounting might be affected by the vesting provisions Share-based transactions such as options have conditions attached to them Must be met before the counterparty has legal entitlement to them Legal entitlement is referred to as vesting Vesting If the equity instruments vest upfront when the contract is entered into ○ The entity assumes that the services have already been provided and recognizes the full amount of the transaction at that date If the equity instruments vest over time ○ The transaction is accrued and recognized over time 11 IFRS 2 – Equity-settled Share-based Payment Transactions Transactions in which services are received (continued) Options granted conditional upon the employee achieving certain goals Vesting period must also be conditional upon achieving those goals Entity must estimate the vesting period in order to calculate the amount of expense to recognize in each period Estimate may be revised in a subsequent period as a change in estimate If the condition is a market condition (such as the shares reaching a certain price) no subsequent revision is allowed ○ Market would have already included expectations about the future share price into the current share price 12 IFRS 2 – Equity-settled Share-based Payment Transactions Transactions measured by reference to the fair value of the equity instruments granted Determining the fair value of equity instruments granted Estimated as at the measurement date based on market conditions and prices Measurement date Generally the grant date for transactions with employees For other transactions, is the date that the goods are received or the services rendered Grant date Generally the date that the contract is agreed to by both parties 13 IFRS 2 – Equity-settled Share-based Payment Transactions 14 IFRS 2 – Equity-settled Share-based Payment Transactions Determining the fair value of equity instruments granted (continued) Market values If the equity instruments are publicly traded shares, they are available If they are stock options, they may or may not be available Options pricing models Valuation techniques - often used E.g., Black-Scholes and binomial models Model inputs (a) Exercise price (b) Life of the option (c) Current price of the shares (d) Expected volatility of the share price (e) Dividends expected on the shares (f) Risk-free interest rate. 15 IFRS 2 – Equity-settled Share-based Payment Transactions Treatment of vesting conditions There may be certain conditions attached to the transaction that must be met before the counterparty or employee has legal entitlement (i.e., before the instruments vest) At the grant date The transaction is recognized and measured but the vesting conditions are not factored into the measurement After the grant date The transaction is remeasured for the change in the number of equity instruments due to the conditions being met/not met, but not for the fair value of the equity instrument itself Subsequent remeasurements are treated as a change in estimate in subsequent periods Where the vesting condition is a market condition (such as a target share price) this is taken into account at the measurement date and the transaction is not subsequently remeasured 16 IFRS 2 – Equity-settled Share-based Payment Transactions Treatment of non-vesting conditions Uncertainty might also be introduced with non-vesting conditions Number of equity instruments to be issued might vary depending on some future event In these cases, the transaction is recognized and measured at the grant date and the uncertainty is factored in at that point No remeasurement after the vesting date Treatment of a reload feature Contract may allow the entity to automatically issue new options when an old one is exercised using shares to satisfy the exercise price These are treated as new option grants and reload features are not taken into account when estimating fair value 17 IFRS 2 – Equity-settled Share-based Payment Transactions After vesting date After initial recognition upon vesting Equity-settled transactions are not remeasured even if the equity instruments are forfeited Entity may transfer amounts from one category of equity to another If the fair value of the equity instrument cannot be reliably estimated Where the entity is required to measure the transaction at fair value, it may use the intrinsic value Intrinsic value Difference between the fair value of the shares to which the counterparty has the right to subscribe or which it has the right to receive, and the price the counterparty is required to pay for those shares Transaction continues to be remeasured until the equity instrument is settled/exercised (or forfeited or lapses/expires) Costs related to forfeitures after the vesting date would be reversed 18 IFRS 2 – Equity-settled Share-based Payment Transactions Modifications to the terms and conditions If the equity instrument is modified afterwards and the total fair value of the transaction is increased, then this additional amount is recognized If the entity cancels or settles the grant of the equity instrument during the vesting period Treats this as an acceleration of the vesting period Recognizes all remaining amounts Any cash payments are treated as a repurchase of equity (deducted from equity) Only exception is where the payment is greater than the fair value of the equity instruments granted Excess is charged to expense Additional guidance is provided where new or replacement equity instruments are granted 19 IFRS 2 - Equity-settled Share-based Payment Transactions - Example 1 On 1 July 2011, Supplier X provides Reporting Entity Ltd with some inventory, which has a fair value of $140 000. In exchange for the inventory, Reporting Entity Ltd provides Supplier X with 10 000 shares in Reporting Entity Ltd As it is considered that the fair value of the inventory can be determined ‘reliably’, this is deemed to be the value of the shares being issued. The accounting entry would be: Dr Inventory Cr Share capital 140 000 140 000 IFRS 2 - Equity-settled Share-based Payment Transactions – Example 2 Employee X provides her services to Reporting Entity Ltd in exchange for 10 000 options in the entity. All services have been performed and the options have been granted to Employee X. The options are considered to have a market value of $1.50 each In this case, which involves an employee, the reporting entity would not determine the fair value of the services being provided but instead would consider the fair value of the options Dr Cr Employee benefits expense Share capital 15 000 15 000 If the goods or services were received in an equity-settled sharebased payment transaction, an increase in equity is recognised. If they were received as part of a cash-settled share-based transaction, a liability is to be recognised IFRS 2 – Cash-settled Share-based Payment Transactions Where the transaction will eventually be settled in cash Liability is recognized Transaction is measured at the fair value of the liability at the measurement date Liability is subsequently remeasured at every reporting date Additional expenses/income due to the remeasurement are booked to profit and loss Share appreciation rights (SARs) For transactions involving options/share appreciation rights the fair value of the liability is measured at the fair value of the options/SAR Under this type of contract, an employee is granted a certain number of rights as remuneration for services Rights allow the employee to be paid the excess of the market value of a share over a certain base price Excess may be paid in cash (which is most often the case) or in shares 22 IFRS 2 – Cash-settled Share-based Payment Transactions Share appreciation rights (SARs) continued Accounting may be inconsistent with IAS 32 In cases where the SAR may be settled in shares (according to the terms of the SAR) Under IFRS 2 If the SAR is to be settled with shares (i.e., a variable number of shares) it is accounted for as equity • Measured at the fair value of the SAR at the grant date • Credited to equity • Not subsequently remeasured after vesting date Under IAS 32 If the number of shares is variable, the instrument would be accounted for as a liability 23 IFRS 2 - Cash-settled Share-based Payment Transactions - Example On 1 July 2012 Coogee Ltd provides its managing director with a sharebased incentive according to which she is offered a bonus that is calculated as 200 000 times the increase in the fair value of the entity’s share price above $2.50 When the bonus was offered the share price was $2.25 If the managing director does not leave the organisation the accrued entitlement will be paid after three years. However, if she leaves the organisation the accrued entitlement will be paid out upon departure—that is, the benefit will not be forfeited Other information The share price at 30 June 2013 is $3.00 The share price at 30 June 2014 is $2.90 The share price at 30 June 2015 is $4.10 The managing director stays for three years and is paid the bonus on 1 July 2015 REQUIRED Prepare the journal entries that would appear in the accounting records of Coogee Ltd to account for the issue of the share appreciation rights IFRS 2 - Cash-settled Share-based Payment Transactions - Example Year end 30 June 2013 30 June 2014 30 June 2015 Remuneration expense for period $100 000 ($20 000) $240 000 Calculation 200 000 × ($3.00 – $2.50) 200 000 × ($2.90 – $2.50) – $100 000 200 000 × ($4.10 – $2.50) – $80 000 30 June 2013 Dr Employee benefits expense Cr Accrued salaries payable 30 June 2014 Dr Accrued salaries payable Cr Employee benefits expense recouped (revenue) 100 000 100 000 20 000 20 000 30 June 2015 Dr Employee benefits expense Cr Accrued salaries payable 240 000 1 July 2016 Dr Accrued salaries payable Cr Bank 320 000 240 000 320 000 IFRS 2 – Share-based Payment Transactions with Cash Alternatives Share-based payment transactions in which the terms of the arrangement provide the counterparty with a choice of settlement Where the counterparty has the option to dictate settlement, it is beyond the control of the entity and a liability may exist In reality, this is a compound instrument Part debt (the right to demand payment in cash) Part equity (the right to demand payment in shares) For transactions other than with employees and where the entire transaction is measured at fair value of the goods/services The equity component is the difference between the total transaction value and fair value of the debt component 26 IFRS 2 – Share-based Payment Transactions with Cash Alternatives Share-based payment transactions in which the terms of the arrangement provide the counterparty with a choice of settlement (continued) For other transactions, where the equity instrument is used to value the transaction • Measure fair value of debt component • Measure the equity component (considering that the entity must forfeit the right to the shares if the counterparty exercises the option to be paid in cash) As an added complexity, the entity must split the transaction into two parts the debt part the equity part The debit side of the journal entry (the expense) is also split into two parts The debt part is accounted for as a cash-settled transaction The equity part as an equity-settled transaction 27 IFRS 2 – Share-based Payment Transactions with Cash Alternatives Share-based payment transactions in which the terms of the arrangement provide the entity with a choice of settlement Where the entity has the choice of settlement options, the entity determines whether it has a liability (a present obligation to settle in cash) Where the choice has no commercial substance A liability exists The transaction is accounted for as a cash-settled transaction Otherwise, it is accounted for as an equity-settled transaction If the entity assumes equity settlement and subsequently settles in cash This is treated as a share buyback or repurchase of an equity interest (debit equity) Unless the settlement alternative is the one with the higher fair value, in which case the excess is booked as expense 28 IFRS 2 – Disclosures The entity must disclose sufficient information for the users To understand the nature and extent of these transactions To understand the impact on the profit or loss statement Specific disclosures (a) A description of each type of share-based payment arrangement that existed at any time during the period (b) The number and weighted average exercise prices of share options for each of the following groups of options (i) Outstanding at the beginning of the period (ii) Granted during the period (iii) Forfeited during the period (iv) Exercised during the period (v) Expired during the period (vi) Outstanding at the end of the period (vii) Exercisable at the end of the period 29 IFRS 2 – Disclosures (c) For share options exercised during the period, the weighted average share price at the date of exercise. (d) For share options outstanding at the end of the period, the range of exercise prices and weighted average remaining contractual life. Additional disclosures relating to fair value measurements and the impact on the profit or loss statement are required 30 Current GAAP Comparisons If fair value of received goods/services not reliably measurable, IFRS uses fair value of non-tradable equity instruments Measurement dates for share-based payments differ Treatment of vesting conditions differs Current GAAP Comparisons Differences in dealing with modifications of awards Cash-settled share-based payments measured at fair value of liability under IFRS (intrinsic value under Canadian GAAP) Where counterparty has choice of settlement, IFRS requires treatment as cash settled transaction if entity has incurred a liability – compound instrument