File

advertisement

INVESTMENT PLANNING

LECTURE 17: CAPM & OTHER MODELS

MARCH 16, 2015

Vandana Srivastava

Review of CAPM-- CML

efficient frontier (the straight line through rf and T) is the same for every

investor (CML)

Two fund separation:

every investor allocates his wealth between two portfolios: the riskfree asset and the Tangency portfolio T(or m)

In equilibrium, all risky assets must belong to T

for every asset, the weight in T must be the same as in the whole market

CML:

CML is applicable only to an investor’s final (combined) portfolio

E (rm ) r f

E (rp ) r f

m

p

https://www.math.ust.hk/~maykwok/courses/ma362/Topic2.pdf

Review of CAPM-- Security Market Line

is essentially a graph

representation of CAPM

formula

plots the expected return of

stocks on the y-axis, against

beta on the x-axis

intercept is the risk free rate

and the slope represents the

market premium

SML is applicable to any

security, asset or portfolio

E (r j ) r f j ( E (rm ) r f )

Deductions from SML

efficient portfolios lie on both CML and SML

All correctly priced assets lie on the SML in equilibrium

If an asset is overpriced / overvalued it will lie below the SML since it

will provide an expected return less than what is determined by the

SML given its risk (beta)

If an asset is underpriced / undervalued it will lie above the SML

since its expected return will be greater than what the SML determines

Investors will flock to buy it, driving up its price and pushing its expected

return down to the SML.

By estimating a SML and plotting an asset, the investor can determine

whether the asset is over or underpriced and make investment

decisions

http://economics.fundamentalfinance.com/capm.php

Example: Overpriced / Underpriced Security

current risk-free rate is 5%

market is expected to return 12% next year

beta of the security is 1.9

Expected return = 5% + 1.9*(12% - 5%) = 18.3%

We expect the asset to return 18.3% and be

plotted on the SML

current real rate of return for the asset is 19%.

The asset would be plotted above the SML.

Therefore, it is undervalued and should be bought

Example: Overpriced / Underpriced Security

A particular stock sells for $30. The stock’s beta is 1.25, the riskfree rate is 4%, and the expected return on the market portfolio is

10%. If forecast is that the stock will be worth $33 next year

(assume no dividends), should you buy the stock or not?

Solution:

R = Rf + B(Rm – Rf)

= 4 + 1.25 (10 – 4) = 11.5%

Return on the stock: (33-30)/30 = 10%.

Don’t buy the stock. You expect a return of 10%. The stock should

return 11.5%, according to CAPM.

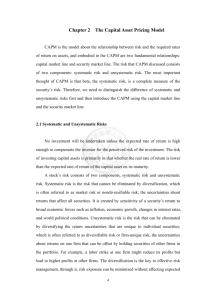

Arbitrage Pricing Theory (APT)

developed by Stephen Ross (1976)

considered as alternative of CAPM method for measuring risk

arbitrage opportunity:

if investors can invest risklessly and earn more than the riskless rate

premise of the model:

if 2 portfolios have the same risk exposure but different expected

return

investors will buy portfolio with high expected return and sell portfolio with

lower expected return and earn the difference as riskless profit

to prevent arbitrage from taking place, both portfolios should earn

the same return

https://www.academia.edu/6549296/Describe_the_Arbitrage_Pricing_Theory_APT_model

Arbitrage Pricing Theory (APT)

https://www.academia.edu/6549296/Describe_the_Arbitrage_Pricing_Theory_APT_model

Fama-French 3 Factor Model

used to explain differences in the returns of diversified equity

portfolios

started with the observation that two classes of stocks have

tended to do better than the market as a whole:

small caps

stocks with a low Price-to-Book ratio (P/B, customarily called value stocks,

contrasted with growth stocks)

• r is the portfolio's expected rate of return, rf is the risk-free return rate, and rm is the

return of the market portfolio

• SMB stands for "Small [market capitalization] Minus Big" and HML for "High [book-tomarket ratio] Minus Low"; they measure the historic excess returns of small caps over big

caps and of value stocks over growth stocks.

Estimating “Beta” in CAPM

Step 1: use past return data to compute a historical beta as proxy for the

true “future” beta

Step 2: Use approximation to the market portfolio. Choose SENSEX or Nifty

as a proxy for market portfolio, m

Step 3: Choose a time period for calculations

Step 4: Perform the following regression

R j ˆ ˆ j Rm j ..........................(1)

For SML,

R j r f ˆ ˆ j ( Rm r f ) j ..........................(2)

(1) is a good approximat ion of (2) if ˆ 0

Interpretation of Regression in Excel

•The standard error is an estimate of

the standard deviation of the coefficient

• can be thought of as a measure of the

precision with which the regression

coefficient is measured

sqrt(R)

R Square

R Square equals 0.962, which is a very good fit.

96% of the variation in Quantity Sold is

explained by the independent variables Price

and Advertising. The closer to 1, the better the

regression line (read on) fits the data.

http://www.excel-easy.com/examples/regression.html

Interpretation of Regression in Excel

Significance F and P-values

To check if your results are reliable (statistically significant), look at Significance F (2.14561E-09 )

If this value is less than 0.05, it is OK. If Significance F is greater than 0.05, it's probably better to stop

using this set of independent variables. Delete a variable with a high P-value (greater than 0.05) and rerun

the regression until Significance F drops below 0.05.

Most or all P-values should be below 0.05. In this example p-value is(2.15E-09).

Interpretation of Regression in Excel

t-statistic

The t statistic is the coefficient divided by its standard error

Coefficients

The regression line is:

•For IBM:

Example: Estimating “Beta” in CAPM

For IBM:

Estimated

beta for IBM is 1.0923 and its standard error is

.1547 or 15.47%

at 95% confidence interval

Pr ob ˆ 2ˆ ˆ true ˆ 2ˆ ˆ 0.95

Pr ob1.0923 2(0.1547) true 1.0923 2(0.1547)

Pr ob.7828 true 1.4018 0.95

Confidence interval from regression is given by {.7828, 1.4018}