RETURN ON PROPERTY AND RENT INCOMES

advertisement

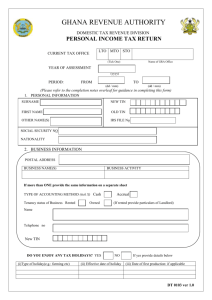

GHANA REVENUE AUTHORITY DOMESTIC TAX REVENUE DIVISION RETURN ON PROPERTY AND RENT INCOME FOR THE PERIOD TO (MM/YYYY) (MM/YYYY) Select currency in which data is presented. GH¢ US$ £ € NAME NEW OLD TIN TIN (Please refer to the completion notes overleaf for guidance in completing this form) POSTAL ADDRESS DUE DATE FOR SUBMISSION OF RETURN RESIDENTIAL ADDRESS TEL CELL e- MAIL OCCUPATION A. PARTICULARS OF PROPERTY Type of Property Land/House Number Location of property Use to which property is put( Residential, Commercial, Mixed) DT 0117 ver 1.0 TENANTS DETAILS NAMES TENANTS OCCUPANCY PERIOD FROM ANNUAL RENT TO B. COMPUTATION OF TAX Gross Income Rate of Tax Tax Payable To GRA D. DECLARATION I hereby declare that the particulars given in this return are true and correct NAME SIGNATURE OR THUMB PRINT DATE This form must be completed by every person who derives any income from rent and must be delivered to the Commissioner of Domestic Tax Revenue Division within four months after the end of the Assessment or Tax year. DT 0117 ver 1.0 RETURN ON PROPERTY AND RENT INCOMES COMPLETION NOTES Please read the following notes carefully before completing the return The Return should be completely filled. All boxes / columns should be completed, where a response is not applicable enter n/a for text or a dash (-) or zero (0) for value or number RETURN ON PROPERTY AND RENT INCOMES: This return reports on income earned on Property and Rent. Fields to be completed are: 1.0 2.0 3.0 FOR THE PERIOD: This refers to the period within which incomes were earned DENOMINATION: State the currency in which the income was earned NAME OF PROPERTY OWNER: This is the name of the person receiving the property or rent income 4.0 NEW TIN: This is the New eleven (11) character Taxpayer Identification Number. 5.0 OLD TIN: This is the Old ten (10) character Taxpayer Identification Number 6.0 ADDRESS – POSTAL & RESIDENTIAL: This refers to the contact address of the property owner and is postal and residential 7.0 TELEPHONE NUMBERS: The telephone numbers of the property owner must be stated here whether landline or cellular 8.0 E-MAIL: This refers to the E-mail address of the property owner if available. 9.0 WEBSITE: The website address of the property owner is posted here if available 10.0 OCCUPATION: This space is used to state the major business activity of the property owner 11.0 PARTICULARS OF PROPERTY: This area provides information on the various types of property on which income is earned The information include I. Type of Property i.e. description of the property II. Land/House Number refers to the number identifying the property III. Location of Property refers to the geographical location of the property and should be clear. IV. Use to which Property is put tells whether the property is used for commercial, residential or other uses 12.0 TENANT DETAILS: This item refers to information of users of the property for which income is earned and include; I. Name of Tenant Names of all economic users of the property II. Occupancy Period Start and End dates of the occupancy III. Annual Rent Amount of money paid annually for use of the property 13.0 COMPUTATION OF TAX: This refers to the method of calculating the Tax and is made up of; I. Gross Income This refers to the sum of all incomes received II. Rate Of Tax This is the approved rate of tax applicable to the income III. Tax Payable to GRA This refers to the total tax payable to GRA and is computed by multiplying Gross Income by Rate of tax (14 ii x 14 iii) 14.0 DECLARATION: This is to be done by the property owner or a responsible representative and should include Name, Signature and Date DT 0117 ver 1.0