GET IT! - Cal EITC 4 me

advertisement

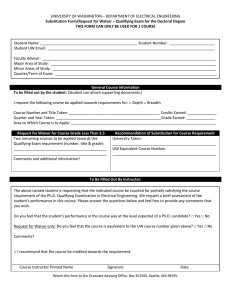

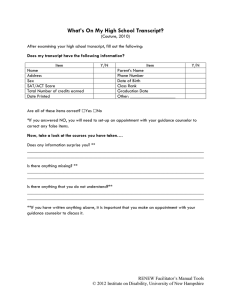

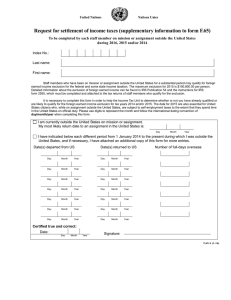

What would you do with an extra $6,000? It’s money for your family. Get ahead on household bills Pay your rent Start a savings account Buy new clothes for the kids Stock the pantry Pay for health care Other ________ For more information, go to CalEITC4Me.org It’s money for you. IT’S YOUR MONEY GET IT! EARNED INCOME TAX CREDIT Know it! You may qualify for a cash back tax credit! Did you know there’s a new California tax credit for working families? It’s called the California Earned Income Tax Credit (CalEITC) and it’s modeled after a federal credit that also gives back money to working families. With the combined credits, you can get up to $6,000. That’s money you can use for rent, utilities, groceries, and other important expenses. For more information, go to CalEITC4Me.org The Earn it! Get it! The amount of the cash back tax credit depends on your income and your family size. To get your cash back tax credit, simply file your 2015 state and federal tax returns. We’ll even help you file! To qualify for at least one of the two cash back credits, your 2015 wages must be less than $54,000. The number of “qualifying children” you support also impacts your credit amount. Don’t pay to have your taxes prepared when you can visit one of the local tax assistance sites and have them prepared for free while you wait! Visit CalEITC4Me.org where you can: • Get more information about “qualifying child” requirements. • Use the credit calculator to find out how much your “cash back” tax credits are worth! Friendly IRS certified volunteers at more than 1,000 tax preparation sites across California are available to help you file your taxes in person. Visit CalEITC4Me.org to find out about free tax assistance near you that will help you get your cash back tax credit. CALIFORNIA EARNED INCOME TAX CREDIT CalEITC4Me.org What would you do with an extra $6,000?