10-1

10

REPORTING AND

ANALYZING LIABILITIES

10-2

Financial Accounting, Sixth Edition

Study Objectives

10-3

1.

Explain a current liability and identify the major types of current

liabilities.

2.

Describe the accounting for notes payable.

3.

Explain the accounting for other current liabilities.

4.

Identify the types of bonds.

5.

Prepare the entries for the issuance of bonds and interest

expense.

6.

Describe the entries when bonds are redeemed.

7.

Identify the requirements for the financial statement presentation

and analysis of liabilities.

Reporting and Analyzing Liabilities

Current

Liabilities

What is a

current

liability?

Notes payable

Sales taxes

payable

Unearned

revenues

Current

maturities of

long-term debt

Payroll and

payroll taxes

payable

10-4

Bonds: LongTerm

Liabilities

Accounting

for Bond

Issues

Accounting

for Bond

Retirements

Types of

bonds

Issuing

procedures

Determining

the market

value of bonds

Issuing bonds

at face value

Discount or

premium on

bonds

Issuing bonds

at a discount

Issuing bonds

at a premium

Redeeming

bonds at

maturity

Redeeming

bonds before

maturity

Financial

Statement

Presentation

and Analysis

Balance sheet

presentation

Analysis

Off-balancesheet financing

Current Liabilities

What is a Current Liability?

Two key features:

1. Company expects to pay the debt from existing current

assets or through the creation of other current

liabilities.

2. Company will pay the debt within one year or the

operating cycle, whichever is longer.

Current liabilities include notes payable, accounts payable, unearned

revenues, and accrued liabilities such as taxes, salaries and wages, and

interest payable.

10-5

SO 1 Explain a current liability and identify the

major types of current liabilities.

Current Liabilities

Question

To be classified as a current liability, a debt must be

expected to be paid:

a. out of existing current assets.

b. by creating other current liabilities.

c. within 2 years.

d. both (a) and (b).

10-6

SO 1 Explain a current liability, and identify the

major types of current liabilities.

Current Liabilities

Notes Payable

10-7

Written promissory note.

Require the borrower to pay interest.

Those due within one year of the balance sheet date

are usually classified as current liabilities.

SO 2 Describe the accounting for notes payable.

Current Liabilities

Illustration: First National Bank agrees to lend $100,000 on

September 1, 2012, if Cole Williams Co. signs a $100,000,

12%, four-month note maturing on January 1. When a

company issues an interest-bearing note, the amount of

assets it receives generally equals the note’s face value.

Sept. 1

Cash

100,000

Notes payable

10-8

100,000

SO 2 Describe the accounting for notes payable.

Current Liabilities

Illustration: If Cole Williams Co. prepares financial statements

annually, it makes an adjusting entry at December 31 to

recognize interest.

Dec. 31

Interest expense

Interest payable

4,000 *

4,000

* $100,000 x 12% x 4/12 = 4,000

10-9

SO 2 Describe the accounting for notes payable.

Current Liabilities

Illustration: At maturity (January 1), Cole Williams Co. must

pay the face value of the note plus interest. It records payment

as follows.

Jan. 1

Notes payable

Interest payable

Cash

10-10

100,000

4,000

104,000

SO 2 Describe the accounting for notes payable.

Current Liabilities

Sales Tax Payable

10-11

Sales taxes are expressed as a stated percentage of

the sales price.

Retailer collects tax from the customer.

Retailer remits the collections to the state’s

department of revenue.

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Illustration: The March 25 cash register readings for Cooley

Grocery show sales of $10,000 and sales taxes of $600 (sales

tax rate of 6%), the journal entry is:

Mar. 25

Cash

10,600

Sales revenue

Sales tax payable

10-12

10,000

600

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Sometimes companies do not ring up sales taxes separately

on the cash register.

Illustration: Cooley Grocery rings up total receipts of $10,600.

Because the amount received from the sale is equal to the

sales price 100% plus 6% of sales, (sales tax rate of 6%), the

journal entry is:

Mar. 25

Cash

10,600

Sales revenue

Sales tax payable

10,000

*

600

* $10,600 / 1.06 = 10,000

10-13

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Unearned Revenue

Revenues that are received before the company delivers

goods or provides services.

1. Company debits Cash, and credits

a current liability account

(unearned revenue).

2. When the company earns the

revenue, it debits the Unearned

Revenue account, and credits a

revenue account.

10-14

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Illustration: Superior University sells 10,000 season football

tickets at $50 each for its five-game home schedule. The entry

for the sales of season tickets is:

Aug. 6

Cash

500,000

Unearned ticket revenue

500,000

As each game is completed, Superior records the earning of

revenue.

Sept. 7

Unearned ticket revenue

Ticket revenue

10-15

100,000

100,000

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Current Maturities of Long-Term Debt

Portion of long-term debt that comes due in the

current year.

No adjusting entry required.

Illustration: Wendy Construction issues a five-year, interest-bearing

$25,000 note on January 1, 2011. This note specifies that each January

1, starting January 1, 2012, Wendy should pay $5,000 of the note. When

the company prepares financial statements on December 31, 2011,

$5,000

1. What amount should be reported as a current liability? _________

$20,000

2. What amount should be reported as a long-term liability? _______

10-16

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Payroll and Payroll Taxes Payable

The term “payroll” pertains to both:

Salaries - managerial, administrative, and sales

personnel (monthly or yearly rate).

Wages - store clerks, factory employees, and manual

laborers (rate per hour).

Determining the payroll involves computing three amounts: (1)

gross earnings, (2) payroll deductions, and (3) net pay.

10-17

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Illustration: Assume Cargo Corporation records its payroll for

the week of March 7 as follows:

Mar. 7

Salaries and wages expense

100,000

FICA tax payable

7,650

Federal tax payable

21,864

State tax payable

Salaries and wages payable

2,922

67,564

Record the payment of this payroll on March 7.

Mar. 7

Salaries and wages payable

Cash

10-18

67,564

67,564

SO 3

Current Liabilities

Payroll tax expense results from three taxes that

governmental agencies levy on employers.

These taxes are:

10-19

FICA tax

Federal unemployment tax

State unemployment tax

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Illustration: Based on Cargo Corp.’s $100,000 payroll,

the company would record the employer’s expense and

liability for these payroll taxes as follows.

Payroll tax expense

13,850

FICA tax payable

State unemployment tax payable

Federal unemployment tax payable

10-20

7,650

800

5,400

SO 3 Explain the accounting for other current liabilities.

Current Liabilities

Question

Employer payroll taxes do not include:

a. Federal unemployment taxes.

b. State unemployment taxes.

c. Federal income taxes.

d. FICA taxes.

10-21

SO 3 Explain the accounting for other current liabilities.

10-22

Bond: Long-Term Liabilities

Bonds are a form of interest-bearing notes payable

issued by corporations, universities, and governmental

agencies.

Sold in small denominations (usually $1,000 or

multiples of $1,000).

10-23

SO 4 Identify the types of bonds.

Bond: Long-Term Liabilities

Types of Bonds

10-24

Secured

Unsecured

Convertible

Callable

SO 4 Identify the types of bonds.

10-25

Bond: Long-Term Liabilities

Issuing Procedures

Bond certificate

Issued to the investor.

Provides name of the company issuing bonds, face

value, maturity date, and contractual (stated)

interest rate.

10-26

Face value - principal due at the maturity.

Maturity date - date final payment is due.

Contractual interest rate – rate to determine cash

interest paid, generally semiannually.

SO 4 Identify the types of bonds.

Bond: Long-Term Liabilities

Illustration 10-3

10-27

SO 4

Bond: Long-Term Liabilities

Determining the Market Value of Bonds

Market value is a function of the three factors that determine

present value:

1. the dollar amounts to be received,

2. the length of time until the amounts are received, and

3. the market rate of interest.

The process of finding the present value is

referred to as discounting the future amounts.

10-28

SO 4 Identify the types of bonds.

Bond: Long-Term Liabilities

Illustration: Assume that Acropolis Company on January 1,

2012, issues $100,000 of 9% bonds, due in five years, with

interest payable annually at year-end.

Illustration 10-4

Time diagram

depicting cash

flows

Illustration 10-5

Computing the

market price of

bonds

10-29

SO 4 Identify the types of bonds.

Accounting for Bond Issues

A corporation records bond transactions when it

issues or retires (buys back) bonds and

when bondholders convert bonds into common stock.

Bonds may be issued at

face value,

below face value (discount), or

above face value (premium).

Bond prices are quoted as a percentage of face value.

10-30

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Accounting for Bond Issues

Question

The rate of interest investors demand for loaning

funds to a corporation is the:

a. contractual interest rate.

b. face value rate.

c. market interest rate.

d. stated interest rate.

10-31

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Issuing Bonds at Face Value

Illustration: Devor Corporation issues 100, five-year, 10%,

$1,000 bonds dated January 1, 2012, at 100 (100% of face

value). The entry to record the sale is:

Jan. 1

Cash

100,000

Bonds payable

100,000

Prepare the entry Devor would make to accrue interest on

December 31.

Dec. 31

Interest expense

Interest payable

10-32

10,000

10,000

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Issuing Bonds at Face Value

Prepare the entry Devor would make to pay the interest on Jan.

1, 2013.

Jan. 1

Interest payable

Cash

10-33

10,000

10,000

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Accounting for Bond Issues

Assume Contractual Rate of 10%

10-34

Market Interest

Bonds Sold At

8%

Premium

10%

Face Value

12%

Discount

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Accounting for Bond Issues

Question

Karson Inc. issues 10-year bonds with a maturity value of

$200,000. If the bonds are issued at a premium, this

indicates that:

a. the contractual interest rate exceeds the market

interest rate.

b. the market interest rate exceeds the contractual

interest rate.

c. the contractual interest rate and the market interest

rate are the same.

d. no relationship exists between the two rates.

10-35

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Issuing Bonds at a Discount

Illustration: Assume that on January 1, 2012, Candlestick Inc.

sells $100,000, five-year, 10% bonds at 98 (98% of face value)

with interest payable on January 1. The entry to record the

issuance is:

Jan. 1

Cash

Discount on bonds payable

Bonds payable

98,000

2,000

100,000

Illustration 10-8

Computation of total cost of

borrowing—bonds issued at

discount

10-36

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Issuing Bonds at a Discount

Statement Presentation

Illustration 10-7

Statement presentation of

discount on bonds payable

10-37

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Issuing Bonds at a Discount

Question

Discount on Bonds Payable:

a. has a credit balance.

b. is a contra account.

c. is added to bonds payable on the balance sheet.

d. increases over the term of the bonds.

10-38

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Issuing Bonds at a Premium

Illustration: Assume that the Candlestick Inc. bonds previously

described sell at 102 rather than at 98. The entry to record the

sale is:

Jan. 1

Cash

Bonds payable

Premium on bonds payable

102,000

100,000

2,000

Illustration 10-12

Computation of total cost of

borrowing—bonds issued at

premium

10-39

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Issuing Bonds at a Premium

Statement Presentation

Illustration 10-11

Statement presentation of

premium on bonds payable

10-40

SO 5 Prepare the entries for the issuance of bonds and interest expense.

Accounting for Bond Retirements

Redeeming Bonds at Maturity

Candlestick records the redemption of its bonds at maturity as

follows:

Bonds payable

Cash

10-41

100,000

100,000

SO 6 Describe the entries when bonds are redeemed.

Accounting for Bond Retirements

Redeeming Bonds at Maturity

When a company retires bonds before maturity, it is

necessary to:

1. eliminate the carrying value of the bonds at the redemption

date;

2. record the cash paid; and

3. recognize the gain or loss on redemption.

The carrying value of the bonds is the face value of the bonds less

unamortized bond discount or plus unamortized bond premium at the

redemption date.

10-42

SO 6 Describe the entries when bonds are redeemed.

Accounting for Bond Retirements

Question

When bonds are redeemed before maturity, the gain or loss

on redemption is the difference between the cash paid and

the:

a. carrying value of the bonds.

b. face value of the bonds.

c. original selling price of the bonds.

d. maturity value of the bonds.

10-43

SO 6 Describe the entries when bonds are redeemed.

Accounting for Bond Retirements

Illustration: Assume at the end of the fourth period, Candlestick

Inc., having sold its bonds at a premium, retires the bonds at 103

after paying the annual interest. Assume that the carrying value of

the bonds at the redemption date is $100,400 (principal $100,000

and premium $400). Candlestick records the redemption at the end

of the fourth interest period (January 1, 2016) as:

Bonds payable

100,000

Premium on bonds payable

Loss on bond redemption

Cash

10-44

400

2,600

103,000

SO 6 Describe the entries when bonds are redeemed.

Accounting for Bond Retirements

Question

When bonds are converted into common stock:

a. a gain or loss is recognized.

b. the carrying value of the bonds is transferred to paidin capital accounts.

c. the market price of the stock is considered in the

entry.

d. the market price of the bonds is transferred to paid-in

capital.

10-45

SO 6 Describe the entries when bonds are redeemed.

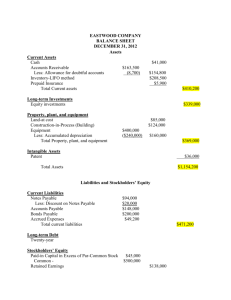

Financial Statement Analysis and Presentation

Balance Sheet Presentation

Illustration 10-15

10-46

SO 7

Financial Statement Analysis and Presentation

Analysis

Illustration 10-16

10-47

SO 7

Financial Statement Analysis and Presentation

Liquidity

Illustration 10-17

Liquidity ratios measure the short-term ability of a company to pay

its maturing obligations and to meet unexpected needs for cash.

10-48

SO 7 Identify the requirements for the financial statement

presentation and analysis of liabilities.

Financial Statement Analysis and Presentation

Solvency

10-49

Solvency ratios measure the ability of a company to survive over a

long period of time.

SO 7

10-50

Financial Statement Analysis and Presentation

Off-Balance-Sheet Financing

10-51

Contingencies

Leasing

►

Operating lease

►

Capital lease

SO 7 Identify the requirements for the financial statement

presentation and analysis of liabilities.

10-52

Straight-Line

Amortization

appendix 10A

Amortizing Bond Discount

To follow the matching principle, companies allocate bond

discount to expense in each period in which the bonds are

outstanding.

Illustration 10A-1

10-53

SO 8 Apply the straight-line method of amortizing

bond discount and bond premium.

Straight-Line

Amortization

appendix 10A

Amortizing Bond Discount

Illustration: Candlestick, Inc., sold $100,000, five-year, 10%

bonds on January 1, 2012, for $98,000 (discount of $2,000).

Interest is payable on January 1 of each year. Prepare the

entry to accrue interest at Dec. 31, 2012.

Dec. 31

Interest expense

Discount on bonds payable

Interest payable

10-54

10,400

400

10,000

SO 8 Apply the straight-line method of amortizing

bond discount and bond premium.

Straight-Line

Amortization

appendix 10A

Amortizing Bond Discount

Illustration 10A-2

10-55

SO 8 Apply the straight-line method of amortizing

bond discount and bond premium.

Straight-Line

Amortization

appendix 10A

Amortizing Bond Premium

Illustration: Candlestick, Inc., sold $100,000, five-year, 10%

bonds on January 1, 2012, for $102,000 (premium of

$2,000). Interest is payable on January 1 of each year.

Prepare the entry to accrue interest at Dec. 31, 2012.

Dec. 31

Interest expense

Premium on bonds payable

Interest payable

10-56

9,600

400

10,000

SO 8 Apply the straight-line method of amortizing

bond discount and bond premium.

Straight-Line

Amortization

appendix 10A

Amortizing Bond Premium

Illustration 10A-4

10-57

SO 8 Apply the straight-line method of amortizing

bond discount and bond premium.

appendix 10B

Effective Interest

Amortization

Under the effective-interest method, the amortization of the

discount or premium results in interest expense equal to a

constant percentage of the carrying value.

Required steps:

1. Compute the bond interest expense.

2. Compute the bond interest paid or accrued.

3. Compute the amortization amount.

Illustration 10B-1

10-58

Effective Interest

Amortization

appendix 10B

Amortizing Bond Discount

Illustration: Candlestick, Inc., sold $100,000, five-year, 10%

bonds on January 1, 2012, for $98,000. The effective-interest

rate is 10.53% and interest is payable on Jan. 1 of each year.

Prepare the bond discount amortization schedule.

10-59

SO 9 Apply the effective-interest method of amortizing

bond discount and bond premium.

Effective Interest

Amortization

appendix 10B

Amortizing Bond Discount

Illustration 10B-2

10-60

SO 9 Apply the effective-interest method of amortizing

bond discount and bond premium.

Effective Interest

Amortization

appendix 10B

Amortizing Bond Discount

Illustration: Candlestick, Inc. records the accrual of interest

and amortization of bond discount on Dec. 31, as follows:

Dec. 31

Interest expense

Discount on bonds payable

Interest payable

10-61

10,319

319

10,000

SO 9 Apply the effective-interest method of amortizing

bond discount and bond premium.

Effective Interest

Amortization

appendix 10B

Amortizing Bond Premium

Illustration: Candlestick, Inc., sold $100,000, five-year, 10%

bonds on January 1, 2012, for $102,000. The effective-interest

rate is 9.48% and interest is payable on Jan. 1 of each year.

Prepare the bond premium amortization schedule.

10-62

SO 9 Apply the effective-interest method of amortizing

bond discount and bond premium.

Effective Interest

Amortization

appendix 10B

Amortizing Bond Premium

Illustration 10B-4

10-63

SO 9 Apply the effective-interest method of amortizing

bond discount and bond premium.

Effective Interest

Amortization

appendix 10B

Amortizing Bond Premium

Illustration: Candlestick, Inc. records the accrual of

interest and amortization of premium discount on Dec. 31,

as follows:

Dec. 31

Interest expense

Premium on bonds payable

Interest payable

10-64

9,670

330

10,000

SO 9 Apply the effective-interest method of amortizing

bond discount and bond premium.

appendix 10C

Long-Term

Notes Payable

Long-Term Notes Payable

May be secured by a mortgage that pledges title to specific

assets as security for a loan.

Typically, the terms require the borrower to make installment

payments over the term of the loan. Each payment consists

of

1. interest on the unpaid balance of the loan and

2. a reduction of loan principal.

10-65

Companies initially record mortgage notes payable at face

value.

SO 10 Describe the accounting for long-term notes payable.

appendix 10C

Long-Term

Notes Payable

Illustration: Porter Technology Inc. issues a $500,000, 12%,

20-year mortgage note on December 31, 2012. The terms

provide for semiannual installment payments of $33,231.

Illustration 10C-1

10-66

SO 10 Describe the accounting for long-term notes payable.

appendix 10C

Long-Term

Notes Payable

Illustration: Porter Technology records the mortgage loan and

first installment payment as follows:

Dec. 31

Cash

500,000

Mortgage payable

Jun. 30

Interest expense

Mortgage payable

Cash

10-67

500,000

30,000

3,231

33,231

SO 10 Describe the accounting for long-term notes payable.

appendix 10C

Long-Term

Notes Payable

Question

Each payment on a mortgage note payable consists of:

a. interest on the original balance of the loan.

b. reduction of loan principal only.

c. interest on the original balance of the loan and

reduction of loan principal.

d. interest on the unpaid balance of the loan and

reduction of loan principal.

10-68

SO 10 Describe the accounting for long-term notes payable.

Key Points

10-69

The basic definition of a liability under GAAP and IFRS is very

similar. In a more technical way, liabilities are defined by the

IASB as a present obligation of the entity arising from past

events, the settlement of which is expected to result in an

outflow from the entity of resources embodying economic

benefits.

IFRS requires that companies classify liabilities as current or

non-current on the face of the statement of financial position

(balance sheet), except in industries where a presentation

based on liquidity would be considered to provide more useful

information (such as financial institutions).

Key Points

10-70

Under IFRS, liabilities are classified as current if they are

expected to be paid within 12 months.

Similar to GAAP, items are normally reported in order of

liquidity. Companies sometimes show liabilities before assets.

Also, they will sometimes show non-current (long-term)

liabilities before current liabilities.

Under both GAAP and IFRS, preferred stock that is required to

be redeemed at a specific point in time in the future must be

reported as debt, rather than being presented as either equity

or in a “mezzanine” area between debt and equity.

Key Points

10-71

Under IFRS, companies sometimes will net current liabilities

against current assets to show working capital on the face of

the statement of financial position.

IFRS requires use of the effective-interest method for

amortization of bond discounts and premiums. GAAP allows

use of the straight-line method where the difference is not

material. Under IFRS, companies do not use a premium or

discount account but instead show the bond at its net amount.

Unlike GAAP, IFRS splits the proceeds from the convertible

bond between an equity component and a debt component. The

equity conversion rights are reported in equity.

Key Points

10-72

The IFRS leasing standard is IAS 17. Both Boards share the

same objective of recording leases by lessees and lessors

according to their economic substance—that is, according to

the definitions of assets and liabilities. However, GAAP for

leases is much more “rules-based,” with specific bright-line

criteria (such as the “90% of fair value” test) to determine if a

lease arrangement transfers the risks and rewards of

ownership; IFRS is more conceptual in its provisions. Rather

than a 90% cut-off, it asks whether the agreement transfers

substantially all of the risks and rewards associated with

ownership.

Key Points

10-73

Under GAAP, some contingent liabilities are recorded in the

financial statements, others are disclosed, and in some cases

no disclosure is required. Unlike GAAP, IFRS reserves the use

of the term contingent liability to refer only to possible

obligations that are not recognized in the financial statements

but may be disclosed if certain criteria are met.

For those items that GAAP would treat as recordable

contingent liabilities, IFRS instead uses the term provisions.

Provisions are defined as liabilities of uncertain timing or

amount. Examples of provisions would be provisions for

warranties, employee vacation pay, or anticipated losses.

Looking into the Future

The FASB and IASB are currently involved in two projects. One

project is investigating approaches to differentiate between debt

and equity instruments. The other project, the elements phase of

the conceptual framework project, will evaluate the definitions of

the fundamental building blocks of accounting. The results of

these projects could change the classification of many debt and

equity securities. In addition to these projects, the FASB and IASB

have also identified leasing as one of the most problematic areas

of accounting. A joint project will initially focus primarily on lessee

accounting.

10-74

Which of the following is false?

a) Under IFRS, current liabilities must always be

presented before non-current liabilities.

b) Under IFRS, an item is a current liability if it will be paid

within the next 12 months.

c) Under IFRS, current liabilities are shown in order of

liquidity.

d) Under IFRS, a liability is only recognized if it is a

present obligation.

10-75

Under IFRS, a contingent liability is:

a) disclosed in the notes if certain criteria are met.

b) reported on the face of the financial statements if

certain criteria are met.

c) the same as a provision.

d) not covered by IFRS.

10-76

The joint projects of the FASB and IASB could potentially:

a) change the definition of liabilities.

b) change the definition of equity.

c) change the definition of assets.

d) All of the above.

10-77

Copyright

“Copyright © 2011 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility for

errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.”

10-78