The Balance Sheet

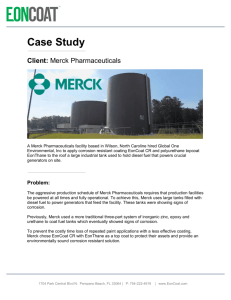

advertisement

Foundations of Business Introduction to Financial Reporting The Balance Sheet Financial Application Assignment Basic Elements of Financial Statements Assets = What a business owns Liabilities = What a business owes Equity = Owners’ economic position in the business Balance Sheet Equation Assets = (What a company owns) A = L Liabilities + Stockholders’ Equity + OE (Funds to purchase what a company owns) Balance Sheet What a Company owns A = Funds to purchase what a company owns = L + OE Champ Creemee Company Balance Sheet (as of 12/31/10) Cash Accounts Receivable Inventory $8,690 3,000 3,500 Current Assets 15,190 Equipment Total Assets 3,000 $18,190 Shows the company’s position on a fixed date; “snapshot” in time Accounts Payable Wages Payable Current Liabilities Notes Payable (L.T.) Total Liabilities Common Stock Retained Earnings Total Shareholders’ Equity Total Liab. & SH Equity $2,000 500 2,500 5,000 7,500 10,000 690 10,690 $18,190 How Transactions Impact Financial Statements Increase in something owned + Asset Increase in something owed + Liability Sale of Common stock + Common Stock Increase in Sales Increased Expenses associated with sales Increase in Net Income Pay dividend + Sales + Net Income + Expenses - Net Income + Retained Earnings - Retained Earnings Owners’ Equity Example: Owning a house with a mortgage Value of the house (= asset): - Mortgage (= liability): Owners’ Equity: $300,000 $200,000 $100,000 Assets - Liabilities (House) - (Mortgage) $300,000 - $200,000 Equity Equity $100,000 = = = The 30 Companies in the Dow Jones Industrial Average (DJIA) 3M Company (MMM) Alcoa Inc. (AA) Amer. Express (AXP) AT&T (T) Bank of America (BAC) Boeing (BA) Caterpillar Inc. (CAT) Chevron Corporation (CVX) Cisco Systems (CSCO) Coca-Cola (KO) Gen'l Electric (GE) Hewlett - Packard (HPQ) Home Depot (HD) JPMorgan Chase (JPM) Kraft Foods (KFT) DuPont (DD) Exxon Mobil Corp. (XOM) Intel (INTC) Int'l Business Mach. (IBM) McDonald's Corp. (MCD) Merck & Co. (MRK) Travelers (TRV) United Technologies (UTX) Johnson & Johnson (JNJ) Microsoft Corp. (MSFT) Pfizer, Inc. (PFE) Verizon Communic. (VZ) Wal-Mart Stores (WMT) Procter & Gamble (PG) Walt Disney (DIS) Spring 2011 The Dow Jones Industrial Average (The DJIA or the “Dow”) = Dow Jones Source: Google Finance The Dow vs. the S&P 500 (Standard & Poor’s 500) = Dow Jones Source: Google Finance = S&P 500 3 major market indexes the DJIA, S&P 500, NASDAQ =NASDAQ Source: Google Finance BP vs. Exxon Mobil vs. the S&P 500 Source: Google Finance Link to Financial Application Assignment A major company event—Jan. 13, 2011 Effect on company stock price? Merck clot drug seen unfit for stroke headline Top experimental drug found unfit for stroke patients * Vorapaxar acquired in Merck's buy of Schering-Plough * Dashed drug hopes pose challenge to new CEO * Merck shares drop 6.6 pct (Adds Merck drag on Dow, drug sales potential, stroke statistics) Date, source By Ransdell Pierson NEW YORK, Jan 13 (Reuters) - One of Merck & Co's (MRK) most important experimental drugs, blood clot preventer Vorapaxar, has been deemed inappropriate for patients who have suffered a stroke, dashing investor hopes and erasing nearly $8 billion from its market value. Vorapaxar, meant to prevent heart attacks and strokes or their recurrence, was considered a crown jewel in Merck's $41 billion acquisition in late 2009 of Schering-Plough Corp and deemed capable of generating annual sales of more than $3 billion. Jan. 13, 2011 Company announcement Comparison chart: The impact of a company event on the company’s stock price Event: Announcement by Merck of Vorapaxar’s ineffectiveness Effect of a company announcement on the company’s stock price MRK’s stock price underperforms the S&P500 slightly before the event but then experiences a sharp decline on the day of the event and continues to underperform the S&P 500 for the next 5 days. 104.00 102.00 100.00 98.00 96.00 94.00 92.00 90.00 INDEX VALUES Merck 88.00 INDEX VALUES S&P 500 86.00 84.00 Date of Announcement Creating an Index Base value 1 Base value 2 Index = new value / base value * 100 DATE S&P 500 ACTUAL VALUE (Close) S& P 500 INDEX VALUE (calculated) MERCK ACTUAL STOCK PRICE (Close) MERCK INDEX VALUE (calculated) 1/10/11 1269.75 100 $37.20 100 1/11/11 1274.48 1274.48 / 1269.75 x 100 = 100.37 $36.95 36.95 / 37.20 x 100 = 99.33 1/12/11 1285.96 1285.96 / 1269.75 x 100 = 101.28 $37.15 37.15 / 37.20 x 100 = 99.87 1/13/11 1283.76 1283.76 / 1269.75 x 100 = 101.10 $34.69 34.69 / 37.20 x 100 = 93.25 1/14/11 1293.24 1293.24 / 1269.75 x 100 = 101.85 $34.23 34.23 / 37.20 x 100 = 92.02 1/18/11 1295.02 1295.02 / 1269.75 x 100 =101.99 $33.87 33.87 / 37.20 x 100 = 91.05 1/19/11 1281.92 1281.92 / 1269.75 x 100 =100.96 $33.91 33.91 / 37.20 x 100 = 91.16 1/20/11 1280.26 1280.26 / 1269.75 x 100 =100.83 $34.05 34.05 / 37.20 x 100 = 91.53 1/21/11 1283.35 1283.35 / 1269.75 x 100 = 101.07 $33.90 33.90 / 37.20 x 100 = 91.13 Champ Creemee Company Inventory 2 gallons of ice cream cones napkins