3110-StudyGuide

advertisement

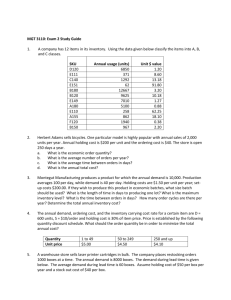

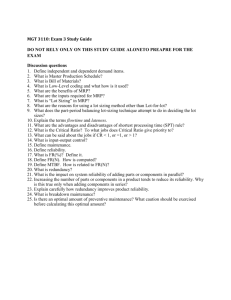

MGT 3110: Exam 3 Study Guide Discussion questions 1. What is the purpose of safety stock in the ROP model? 2. Define aggregate production plan? What is the objective and what are the requirements for developing one? 3. What are demand options for aggregate planning? Give examples and discuss the effects of each. 4. Describe “Chase” strategy for aggregate planning and discuss the advantages and disadvantages this approach. 5. Describe “Level” strategy for aggregate planning and discuss the advantages and disadvantages this approach. 6. Describe “Mixed” strategy for aggregate planning and discuss the advantages and disadvantages this approach. 7. Define independent and dependent demand items. 8. What is Master Production Schedule? 9. What is Bill of Materials? 10. What is Low-Level coding and what how is it used? 11. What are the benefits of MRP? 12. What are the inputs required for MRP? 13. What is “Lot Sizing” in MRP? 14. What are the reasons for using a lot sizing method other than Lot-for-lot? 15. Explain the terms flowtime and lateness. 16. 17. 18. 19. What are the advantages and disadvantages of shortest processing time (SPT) rule? What is the Critical Ratio? To what jobs does Critical Ratio give priority to? What can be said about the jobs if CR < 1, or =1, or > 1? What is input-output control? Problems 1. The Winfield Distributing Company has maintained an 80% service level policy for inventory of string trimmers. Mean demand during the reorder period is 130 trimmers, and the standard deviation is 80 trimmers. What is the value of ROP and SS? 2. The new office supply discounter, Paper Clips, Etc. (PCE), sells a certain type of ergonomically correct office chair which costs $300. The annual holding cost rate is 40%, annual demand is 600, and the order cost is $20 per order. The store is open 300 days per year and PCE has decided to establish a customer service level of 90%. a. Suppose that the lead time is a constant 4 days and the demand is variable with a standard deviation of 2.4 chairs per day. What is the safety stock and reorder point? b. Suppose that the lead time is a variable with an average of 4 days and standard deviation of 3 days. Further suppose that the demand is constant. What is the safety stock and reorder point? c. Suppose that the lead time is a variable with an average of 4 days and standard deviation of 3 days. Further suppose that the demand is also variable with a standard deviation of 2.4 chairs per day. What is the safety stock and reorder point? 3. A warehouse store sells laser printer cartridges in bulk. The company places restocking orders 1000 boxes at a time. The annual demand is 7000 boxes. The demand during lead time is given below. The average demand during lead time is 60 boxes. Assume holding cost of $5 per box per year and a stock out cost of $50 per box. Demand during lead time 40 50 60 70 80 90 Probability 0.1 0.2 0.2 0.2 0.2 0.1 Determine the least cost safety stock and the corresponding ROP. 4. An oyster bar buys fresh oysters for $3 per pound and sells them for $10 per pound. Unsold oyster at the end of the day is sold to a grocery store for $1.20 per pound. The daily demand is estimated to be 150 pounds with a standard deviation of 12 pounds. How many pounds of oysters must be ordered each day? 5. Leisure Travels, Inc. manufactures and sells Recreation Vehicles. The demand for the next four quarters is forecasted as 160, 180, 220, and 200. The labor required to produce one unit is 100 hours. Each worker works 8 hours per day for 65 days per quarter. Regular wages is $15 per hour and O.T. wages is $20 per hour. O.T. is limited to 20% regular hours. Limited subcontracting is available at the rate of $2500 per unit. Holding cost per unit per quarter is $100. Cost of hiring a worker is $350 and firing worker will cost $500. The company currently has 30 employees. a. b. c. d. e. f. 6. Determine the production rate per worker per day and per quarter. Determine the regular time wage per worker per day and per quarter. Determine the O.T. cost per unit. Develop a “Chase” plan and the corresponding cost summary. Develop a “Level” plan and the corresponding cost summary. Develop a “Mixed” plan with a constant work force of 31 workers, but produce only what the net demand is each month, i.e. not accumulate any inventory in excess of the safety stock. If regular time capacity is not sufficient, use O.T. production first and use subcontracting only of O.T. capacity is not enough to make up the shortage. Consider the following Solver model for an aggregate planning problem givebn in the next page. a. What is the Solver Target cell? b. What are the Solver changing cells? c. What are the Solver constraints? d. What options of Solver must be checked? e. Determine the excel formula for the following cells: B17 B18 B19 B22 E22 B23 C26 D26 E26 B29 C29 F29 G29 H29 G33 B35 B36 B37 B38 B39 B40 B41 7. A Bill of Materials is desired for a bracket (A) that is made up of a base (B), two springs (C) and four clamps (D). The base is assembled from one clamp (D) and two housings (E). Each clamp has one handle (F) and one casting (G). Each housing has two bearings (H) and one shaft (I). a. Develop a product structure tree. b. The lead time for the parts are given below. Develop a time-phased product structure. c. The available inventory for each part is given in the table below. Determine the net requirement quantities of all parts required to assemble 50 units of bracket A. Item A B C D E F G H I 8. 5 5 10 20 50 150 50 5 0 A product (A) consists of a base (B) and a casting (C). The base consists of a plate (P) and three fasteners (F). The lead time, current on-hand inventory and scheduled receipts are given below. All components are lot for lot. The MPS requires start of production of 100 units of product A in week 4 and 150 in week 6. Produce the MRP for the upcoming six weeks. Produce a list of all planned order releases. Part B C P F 9. Available Lead time 1 2 3 2 1 2 1 1 2 Lead time 1 3 2 4 On-hand 100 30 0 0 Scheduled receipts 50 in week 1 20 in week 1, 30 in week 2 50 in week 1 30 in week 1, 40 in week 3 For the following item the inventory holding cost is $0.80 per week and the setup cost is $300. Determine the lot sizes and total cost for this item under (i) Lot-for-Lot, (ii) EOQ, and (iii) PPB methods Item Week: Gross requirement Scheduled receipts Projected on-hand 100 Net Requirement Planned receipts Planned order releases LT = 1 100 1 2 250 3 200 4 150 5 250 6 200 7 200 8 150 10. Consider the following planned and actual hours of input and output. Week ending Planned input Actual input Planned output Actual output 1 2 3 4 5 6 7 8 500 700 650 600 800 700 650 700 700 700 650 800 600 800 650 700 600 600 650 650 800 500 700 500 700 500 700 600 800 800 700 800 Prepare the Input/Output Control chart for this workstation. Assume an initial actual backlog of 120 hours and zero for the two cumulative deviations. 11. The following jobs are waiting to be processed on day 250 Job A B C D E F Date Job received 215 220 225 240 245 250 Production days needed 30 20 40 50 20 35 Date job due 290 415 375 315 420 380 Sequence the jobs in the order of SPT, EDD, and Critical Ratio, and compute (i) Average flow time, (ii) Average lateness, (iii) Average no. of jobs in the system, and (iv) Utilization, for each of the three schedule of jobs. Answers to discussion questions 1. What is the purpose of safety stock in the ROP model? The purpose of safety stock is to decrease the probability of stock out during lead time of a replenishment order, which increases the probability of meeting demand, aka service level. 2. Define aggregate production plan? What is the objective and what are the requirements for developing one? Aggregate production plan is a plan of overall production level, prepared over a rolling horizon of 12 to 18 monthly periods, or 4 to 6 quarterly periods. The objective is to minimize cost by adjusting production rates, labor levels, inventory levels, overtime work, subcontracting rates. The requirements for developing an aggregate production plan include: a logical overall unit for measuring sales and output a forecast of demand for the planning horizon in these aggregate terms standard hours to produce one unit of the product in these aggregate term cost data such as wages (regular time, overtime, and subcontracting), inventory carrying cost, and hiring/firing costs 3. What are demand options for aggregate planning? Give examples and discuss the effects of each. Demand options are techniques used to even out fluctuations in demand. Following are some examples. Back ordering during high- demand periods (Effective if substitute products are not available, but may result in loss of customer orders to competition and lost customer good will) Counter-seasonal product mix (effective in reducing huge ups and downs in demand , but may lead to products or services outside the company’s areas of expertise Economic incentives such as discounts (loss of profit) 4. Describe “Chase” strategy for aggregate planning and discuss the advantages and disadvantages this approach. Chase strategy matches output rates to demand forecast for each period by varying the workforce levels or vary production rate. Advantage: Very low inventories Disadvantage: Requires frequent hiring and firing of workers 5. Describe “Level” strategy for aggregate planning and discuss the advantages and disadvantages this approach. Level strategy uses uniform production rate. Fluctuations in demand is managed through accumulation of inventory during lean demand periods. Advantage: Stable production leads to better quality and productivity Disadvantage: High levels of inventory 6. Describe “Mixed” strategy for aggregate planning and discuss the advantages and disadvantages this approach. Mixed strategy maintains uniform production rate, but does not build inventory. Overtime and subcontracting is used to meet demand. Advantage: Stable production leads to better quality and productivity and low levels of inventory Disadvantage: Use of overtime and/or subcontracting may increase cost and may lead to quality related problems 7. Define independent and dependent demand items. Finished products whose demand is independent of production decisions are called “Independent demand” items. Items for which demand can be directly calculated from production decisions are called “Dependent demand” items. These are raw-materials and parts required for the production of the finished goods. 8. What is Master Production Schedule? Master Production Schedule specifies production quantities of each Independent Demand item for a planning horizon of 12 to 15 weeks. Total of MPS quantities must be in accordance with the aggregate production plan. 9. What is Bill of Materials? Bill of materials is structured list of components, ingredients, and materials needed to make an end product. Items needed to produce a given part are called components or “children”. The part into which the components go us called “Parent”. The BOM also gives the number of units of a child item needed to produce one unit of the parent item. 10. What is Low-Level coding and what how is it used? A level code starting from zero at the top of the BOM tree and incremented by 1 going down each level of the BOM tree is assigned. Then, the lowest level at which an item appears is called Low-Level code. The MRP computations are processed one level at a time, starting from level zero. 11. What are the benefits of MRP? Better response to customer orders Faster response to market changes Improved utilization of facilities and labor Reduced inventory levels 12. What are the inputs required for MRP? Master Production Schedule Bill of Materials Inventory status 13. What is “Lot Sizing” in MRP? The process of combining net requirements into production lots is called lot sizing. 14. What are the reasons for using a lot sizing method other than Lot-for-lot? Lot-for-lot often requires too many lots that may not be economically justifiable Sometime lot-for-lot generates absurdly small lots 15. Explain the terms flowtime and lateness. Flow time is the length of time a job is in the system; lateness is completion time minus due date. 16. What are the advantages and disadvantages of shortest processing time (SPT) rule? SPT minimizes the average flow time, average lateness, and average number of jobs in the system. It maximizes the number of jobs completed at any point. The disadvantage is that long jobs are pushed back in the schedule. 17. What is the Critical Ratio? To what jobs does Critical Ratio give priority to? The Critical Ratio (CR) is an index number computed by diving the time until due date by the working time remaining. The CR gives priority to jobs that must be done to keep shipping on schedule. 18. What can be said about the jobs if CR < 1, or =1, or > 1? If CR < 1, then the job has fallen behind, the work remaining exceeds the time until due date. If CR = 1, then the job is on schedule, the work remaining exactly equals the time until due date. If CR > 1, then there is slack, the time until due date exceeds the work remaining. 19. What is input-output control? Input/output control keeps track of planned versus actual inputs and outputs, highlighting deviations and indicating bottlenecks using cumulative backlog. Answers to problems 1. 2. Given dL = 130, dLT = 80, and for 80% service level, Z = 0.84 ROP = 130 + 0.84 x 80 = 197.2, or round up to 198 for at least 80% service level d = D/No. of days per year = 600/300 = 2 per day, Z for 90% service level = 1.285 a. Given: L = 4 days Constant, d = 2.4 per day, therefore dLT = 2.4 √4 = 4.8 Safety stock = Z dLT = 1.285 x 4.8 = 6.2 or 7 (round up for at least 90% service level) ROP = dL + SS = (2 chairs/day * 4) + 7 = 15 b. Given: L = 4 days with L = 3 and demand is constant, dLT = 2 (3) = 6 Safety stock = Z dLT = 1.285 x 6 = 7.7 or 8 (round up for at least 90% service level) ROP = dL + SS = (2 chairs/day * 4) + 8 = 16 c. Given: L = 4 days with L = 3 , and d = 2.4 per day, therefore dLT = √4(2.4)2 + 22 32 = 7.684 Safety stock = Z dLT = 1.285 x 7.684 = 9.9 or 10 (round up for at least 90% service level) ROP = dL + SS = (2 chairs/day * 4) + 10 = 18 3. Number of orders per year = 7, H = $5, S = $50 Safety ROP stock Carrying cost Expected stock out 60 0 0 (10x.2 + 20x.2 + 30x.1) = 9 70 10 10 x $5 = $50 (10x.2 + 20x.1) = 4 80 20 20 x $5 = $100 (10x.1) = 1 90 30 30 x $5 = $150 0 Stock out cost/order Stock out cost/year Total cost 9 x $50 = $450 $3,150 $3,150 4 x $50 = $200 $1,400 $1,450 1 x $50 = $50 $350 $450 0 $0 $150 Least cost safety stock = 30, ROP = 90 4. Cs = Lost profit = Selling price per unit – Cost per unit = 10 – 3 = $7 Co = Cost/unit – salvage value/unit = 3 – 1.20 = $1.80 Optimum service level = 7/(7 + 1.80) = 0.795 = 79.5% From normal table, for 79.5% service level, Z = 0.83 Order quantity = + Z = 150 + 0.825 (12) = 159.9 or 160 5. Hiring cost/worker = Firing cost/worker = RT Wage/hour = OT wage rate/hour = Sub-contracting cost/unit = 350 500 15 20 2500 Worker hours/quarter = Standard hours/unit = Holding cost = 520 100 100 a. Production rate/worker/day = 8 hours per day/100 hours per unit = 0.08 per worker/day Production rate/worker/quarter = 0.08/worker/day x 65 days/quarter = 5.2/worker/ quarter b. Wage rate per worker per day = $15/hour x 8 hours/day = $120 Wage rate per worker per quarter = $15/hour x 8 hours/day x 65 days/quarter = $7800 c. OT cost/unit = $20/hour x 100 hours/unit = $2000 d. Chase plan Period Demand Production required Workers needed Workers needed (Rounded) 30 Hired workers Fired workers 1 2 3 4 160 180 220 200 Cost summary Regular wages O.T. cost = S.C. cost Hiring cost Firing cost Carrying cost Total cost 160–(0–0) = 160 180 220 200 160/5.2=30.77 180/5.2=34.62 220/5.2=42.31 200/5.2=38.46 31 35 43 39 148 148 workers-quarters x $7800 = 1 4 8 0 13 0 0 0 4 4 1,154,400 13 workers x $350 = 4 workers x $500 = 4,550 2,000 $1,160,950 d. Level Plan Sum of demand = 760 Average demand = 760/4 = 190 i.e. = production per quarter Period 1 2 3 4 Average demand = Cost summary Regular wages O.T. cost = S.C. cost Hiring cost Firing cost Carrying cost Total cost Demand RT Production 160 180 220 200 190 Workers needed/quarter = Workers rounded up = E.I. 0 30 40 10 0 80 190 190 190 190 760 36.54 37 37 workers x 4 quarters x $7800 = (37 workers – 30 workers) x $ 350 = 80 x $100 = 1,154,400 2,450 8,000 $1,164,850 f. Mixed plan Plan C No. of workers = 31 Production per quarter with 31 workers = 31 x 5.2 = 161.2 or 161 O.T. capacity/quarter = 161 x 20% = 32 Production Shortage Period Demand capacity RT Production 161 1 160 Min(160,161) =160 160 – 160=0 161 180-161=19 2 180 Min(180,161) =161 161 220-161=59 3 220 Min(220,161) =161 161 200-161=39 4 200 Min(200,161) =161 643 O.T Capacity 32 32 32 32 O.T. Production 0 Min(19,32)=19 Min(59,32)=32 Min(39,32)=32 83 S.C. 0 0 59-32=27 39-32=7 34 Cost summary Regular wages O.T. cost = S.C. cost Hiring cost Firing cost Carrying cost Total cost 31 workers x 4 quarters x $7800 = 83 units x $2000 34 units x $2500 = (31 – 30) x $350 = 967,200 166,000 85,000 350 $1,218,550 6. B17 B18 B19 B22 E22 B23 C26 D26 E26 B29 C29 B13/B11*B12 B13*B3*B12 B11*B4 E11 B22+C22-D22 E22 SUM(C22:C25) SUM(D22:D25) SUM(E22:E25) E12 E22*$B$17 F29 G29 E4 SUM(B29:E29)-F29 H29 C29*$B$14 G33 SUM(G29:G32) B35 E26*B18 B36 D33*B19 B37 B38 E33*B5 C26*B7 B39 B40 B41 D26*B8 G33*B6 SUM(B35:B40) a. B41 b. C22:D25, D29:E32 c. D29:D32 <= H29:H32 G29:G32 >= E13 C22:D25 = Integer (if needed) D29:E32 = Integer (if needed) d. Assume linear model Assume non-negative 7. A B C2 D1 F D4 E2 G H2 I F G F D G B H E I C A F D G 1 2 3 4 5 Lead time = 7 weeks Part A B C D E F G H I Gross 50 1 x A = 45 2 x A = 2 x 45 = 90 4 x A + 1 x B = 4 x 45 + 40 = 220 2 x B = 80 1 x D = 200 1 x D = 200 2 x E = 2 x 30 = 60 1 x E = 30 Available 5 5 10 20 50 150 50 5 0 Net 50 – 5 = 45 45 – 5 = 40 90 – 10 = 80 220 – 20 = 200 80 – 50 = 30 200 – 150 = 50 200 – 50 = 150 60 – 5 = 55 30 – 0 = 30 6 7 8. 1 2 3 MPS start for A Item B GR = Lead time = Week: Gross requirement Scheduled receipts Projected on-hand 100 Net requirement Planned receipts Planned order releases Item C Week: Gross requirement Scheduled receipts Projected on-hand 30 Net requirement Planned receipts Planned order releases Item P Week: Gross requirement Scheduled receipts Projected on-hand Net requirement Planned receipts Planned order releases Item F Week Gross requirement Scheduled receipts Projected on-hand Net requirement Planned receipts Planned order releases 4 100 0 0 5 6 150 1 1 0 50 100 2 0 3 0 4 100 5 0 6 150 150 150 150 50 0 0 0 0 0 0 0 0 0 100 50 100 100 0 4 100 5 0 6 150 0 0 150 80 20 20 0 0 0 0 150 150 0 Lead time = 3 0 4 0 5 100 6 0 50 50 50 0 0 1 0 20 30 2 0 30 50 0 20 0 0 Lead time = 3 0 80 2 0 3 2 1 0 50 0 50 50 50 0 0 0 0 0 50 0 0 0 0 1 0 30 0 Lead time = 2 3 0 0 40 30 30 4 0 5 300 6 0 70 0 0 230 0 0 0 0 70 230 230 0 Planned order releases: A has releases of 100 in week 4, 150 in week 7 B has a release of 100 in week 5 C has releases of 20 in week 1, 150 in week 3 P has a release of 50 in week 3 F has a release of 230 in week 1 0 0 4 0 0 9. (i) L-4-L Item Week: Gross requirement Scheduled receipts Projected on-hand Net Requirement Planned receipts Planned order releases 100 No. of setup = Carrying cost = Setup cost = 7 x $300 = Total cost = LT = 1 100 1 2 250 3 200 4 150 5 250 6 200 7 200 8 150 100 0 0 250 0 250 250 200 0 200 200 150 0 150 150 250 0 250 250 200 0 200 200 200 0 200 200 150 0 150 150 0 5 250 0 150 100 375 0 6 200 0 275 0 0 375 7 200 0 75 125 375 0 8 150 0 250 0 0 0 7 200 0 0 200 350 8 150 0 150 7 0 2100 2100 (ii) EOQ: Total demand for 8 weeks = 1500, d = 1500/8 = 187.5 H = $0.80/week S = 300 2(187.5)300 Q= √ 0.8 = 375 Item Week: Gross requirement Scheduled receipts Projected on-hand Net Requirement Planned receipts Planned order releases 100 LT = 1 100 0 100 0 0 375 1 2 250 0 0 250 375 375 3 200 0 125 75 375 0 4 150 0 300 0 0 375 Setup cost per week = (d/Q) S = (187.5/375) x 300 = Holding cost per week = (Q/2)H per week = (375/2) x 0.80 = Total cost per week= 150 + 150 = Cost for 8 weeks = Total cost per week x 8 weeks = 300 x 8 = 150 150 300 2400 (iii) PPB EPP = 300/0.80 = 375 Item Week: Gross requirement Scheduled receipts Projected on-hand Net Requirement Planned receipts 100 LT = 1 100 0 100 0 0 1 2 250 0 0 250 600 3 200 0 350 4 150 0 150 5 250 0 0 250 450 6 200 0 200 Planned order releases Periods combined Quantities combined 600 450 Periods brought forward for the last quantity New Partperiods 350 Total combined partperiods Lot #1 with planned receipt in week #2 2 250 0 0 2, 3 250 + 200 = 450 1 200x1 = 200 2, 3, 4 450 + 150 = 600 2 150 x 2 = 300 0 200 200 + 300 = 500 (500 is closer to EPP of 375) Lot #2 with planned receipt in week #5 5 250 0 0 0 5, 6 250 + 200 = 450 1 200 x 1 = 200 200 (200 is closer to EPP of 375) 5, 6, 7 450 + 200 = 650 2 200 x 2 = 400 200 + 400 = 600 Lot #1 with planned receipt in week #2 7 200 0 0 7, 8 200 + 150 = 350 1 1x 150 = 150 0 150 Summary: Lot # Planned order release in Week Weeks covered Lot size Lot PP 1 Week 1 2, 3, 4 600 500 2 Week 4 5, 6 450 200 3 Week 6 7, 8 350 150 850 Total cost = 3 Setups x 300 + 850 x 0.8 = $1,580 #10. Week ending Planned input Actual input Cumulative deviation Planned output Actual output Cumulative deviation Backlog 120 1 2 3 4 5 6 7 8 500 700 200 650 600 -50 220 800 700 100 650 700 0 220 700 700 100 650 800 150 120 600 800 300 650 700 200 220 600 600 300 650 650 200 170 800 500 0 700 500 0 170 700 500 -200 700 600 -100 70 800 800 -200 700 800 0 70 #11. SPT Processing time (Days) 20 20 30 35 40 50 Job B E A F C D Days till due date 165 170 40 130 125 65 Completion time (Flowtime) 20 40 70 105 145 195 Lateness 0 0 30 0 20 130 575 180 195 Average flow time = Average lateness = Average WIP = Utilization = 95.833 30 2.949 0.339 EDD Job A D C F B E Processing time (Days) 30 50 40 35 20 20 195 Days till due date 40 65 125 130 165 170 Average flow time = Average lateness = Average no. of jobs in the system = Utilization = Completion time (Flowtime) 30 80 120 155 175 195 755 Lateness 0 15 0 25 10 25 75 125.83 12.50 3.87 0.26 CR Job D A C F Processing time (Days) 50 30 40 35 Days till due date 65 40 125 130 Completion time (Flowtime) 50 80 120 155 Lateness 0 40 0 25 CR 1.30 1.33 3.13 3.71 B E 20 20 195 Average flow time = Average lateness = Average no. of jobs in the system = Utilization = 165 170 129.17 16.67 3.97 0.25 175 195 775 10 25 100 8.25 8.50