3110-StudyGuide

advertisement

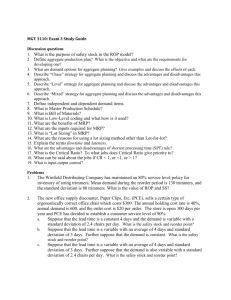

MGT 3110: Exam 2 Study Guide 1. A company has 12 items in its inventory. Using the data given below classify the items into A, B, and C classes. SKU D120 E111 C140 E151 B180 B120 E149 A180 E110 A155 F120 B150 Annual usage (units) 6850 371 1292 62 12667 9625 7010 5100 258 862 1940 967 Unit $ value 1.20 8.60 13.18 91.80 3.20 10.18 1.27 0.88 62.25 18.10 0.38 2.20 2. Herbert Adams sells bicycles. One particular model is highly popular with annual sales of 2,000 units per year. Annual holding cost is $200 per unit and the ordering cost is $40. The store is open 250 days a year. a. What is the economic order quantity? b. What is the average number of orders per year? c. What is the average time between orders in days? d. What is the annual total cost? 3. Montegut Manufacturing produces a product for which the annual demand is 10,000. Production averages 100 per day, while demand is 40 per day. Holding costs are $1.50 per unit per year; setup costs $200.00. If they wish to produce this product in economic batches, what size batch should be used? What is the length of time in days to producing one lot? What is the maximum inventory level? What is the time between orders in days? How many order cycles are there per year? Determine the total annual inventory cost? 4. The annual demand, ordering cost, and the inventory carrying cost rate for a certain item are D = 600 units, S = $10/order and holding cost is 30% of item price. Price is established by the following quantity discount schedule. What should the order quantity be in order to minimize the total annual cost? Quantity Unit price 5. 1 to 49 $5.00 50 to 249 $4.50 250 and up $4.10 A warehouse store sells laser printer cartridges in bulk. The company places restocking orders 1000 boxes at a time. The annual demand is 8000 boxes. The demand during lead time is given below. The average demand during lead time is 60 boxes. Assume holding cost of $50 per box per year and a stock out cost of $40 per box. Demand during lead time Probability 40 0.1 50 0.2 60 0.2 70 0.2 80 0.2 90 0.1 Determine the least cost safety stock and the corresponding ROP. 6. The Winfield Distributing Company has maintained an 80% service level policy for inventory of string trimmers. Mean demand during the reorder period is 130 trimmers, and the standard deviation is 80 trimmers. What is the value of ROP and SS? 7. The new office supply discounter, Paper Clips, Etc. (PCE), sells a certain type of ergonomically correct office chair which costs $300. The annual holding cost rate is 40%, annual demand is 600, and the order cost is $20 per order. The store is open 300 days per year and PCE has decided to establish a customer service level of 90%. a. Suppose that the lead time is a constant 4 days and the demand is variable with a standard deviation of 2.4 chairs per day. What is the safety stock and reorder point? b. Suppose that the lead time is a variable with an average of 4 days and standard deviation of 3 days. Further suppose that the demand is constant. What is the safety stock and reorder point? c. Suppose that the lead time is a variable with an average of 4 days and standard deviation of 3 days. Further suppose that the demand is also variable with a standard deviation of 2.4 chairs per day. What is the safety stock and reorder point? 8. An oyster bar buys fresh oysters for $3 per pound and sells them for $10 per pound. Unsold oyster at the end of the day is sold to a grocery store for $1.20 per pound. Determine the pounds of oysters that must be ordered each day if the daily demand follows normal distribution with mean of 150 pounds and standard deviation of 12 pounds. 9. Leisure Travels, Inc. manufactures and sells Recreation Vehicles. The demand for the next four quarters is forecasted as 160, 180, 220, and 200. The labor required to produce one unit is 100 hours. Each worker works 8 hours per day for 65 days per quarter. Regular wages is $15 per hour and O.T. wages is $20 per hour. O.T. is limited to 20% regular hours. Limited subcontracting is available at the rate of $2500 per unit. Holding cost per unit per quarter is $100. Cost of hiring a worker is $350 and firing worker will cost $500. The company currently has 30 employees. a. Determine the production rate per worker per day and per quarter. b. Determine the regular time wage per worker per day and per quarter. c. Determine the O.T. cost per unit. d. Develop a “Chase” plan and the corresponding cost summary. Round up workers needed. e. Develop a “Level” plan and the corresponding cost summary. f. Develop a “Mixed” plan with a constant work force of 31 workers, but produce only what the net demand is each month, i.e. not accumulate any inventory in excess of the safety stock. If regular time capacity is not sufficient, use O.T. production first and use subcontracting only of O.T. capacity is not enough to make up the shortage. Round to 2 decimal places. 10. e. Consider the following Solver model for an aggregate planning problem given in the next page. a. What is the Solver Target cell? b. What are the Solver changing cells? c. What are the Solver constraints? d. What options of Solver must be checked? Determine the excel formula for the following cells: B17 B18 B19 F29 G29 H29 B22 E22 B23 C26 D26 E26 B29 C29 G33 B35 B36 B37 B38 B39 B40 B41 11. A concert organizing company wishes to study the effect of discount pricing on net revenue generated. Currently the company charges uniform fee of $100 per ticket and has averaged 500 tickets sold. The company is considering a three tier pricing structure, (a) a deeply discounted $70 per ticket if purchased at least 1 month in advance, (b) $90 per ticket if purchase at least a week in advance and $120 at the box office on the day of the event. The company has estimated a demand of 300 tickets sold at least a month in advance, 200 at least a week in advance and 100 on the day of the event. The company estimates the variable cost to be $3 per ticket under all the three prices. Using the yield revenue approach determine what the effect of the proposed price structure will be on net revenue. 12. A Bill of Materials is desired for a bracket (A) that is made up of a base (B), two springs (C) and four clamps (D). The base is assembled from one clamp (D) and two housings (E). Each clamp has one handle (F) and one casting (G). Each housing has two bearings (H) and one shaft (I). a. Develop a product structure tree. b. The lead time for the parts are given below. Develop a time-phased product structure. c. The available inventory for each part is given in the table below. Determine the net requirement quantities of all parts required to assemble 50 units of bracket A. Item A B C D E F G H I 13. Lead time 1 2 3 2 1 2 1 1 2 Available 5 5 10 20 50 150 50 5 0 A product (A) consists of a base (B) and a casting (C). The base consists of a plate (P) and three fasteners (F). The lead time, current on-hand inventory and scheduled receipts are given below. All components are lot for lot. The MPS requires start of production of 100 units of product A in week 4 and 150 in week 6. Produce the MRP for the upcoming six weeks. Produce a list of all planned order releases. Part B C P F 14. Lead time 1 3 2 4 Scheduled receipts 50 in week 1 20 in week 1, 30 in week 2 50 in week 1 30 in week 1, 40 in week 3 For the following item the inventory holding cost is $0.80 per week and the setup cost is $300. Determine the lot sizes and total cost for this item under (i) Lot-for-Lot, (ii) EOQ, and (iii) POQ methods. Item Week: Gross requirement Scheduled receipts Projected on-hand 100 Net Requirement Planned receipts Planned order releases 15. On-hand 100 30 0 0 LT = 1 100 1 2 250 3 200 4 150 5 250 6 200 7 200 8 150 Consider the following planned and actual hours of input and output. Week ending Planned input Actual input Planned output Actual output 1 500 700 650 600 2 800 700 650 700 3 700 700 650 800 4 600 800 650 700 5 600 600 650 650 6 800 500 700 500 Prepare the Input/Output Control chart for this workstation. Assume an initial actual backlog of 120 hours and zero for the two cumulative deviations. 16. The following jobs are waiting to be processed on day 50 Job Production days needed Date job due A 30 90 B 20 215 C 40 175 D 35 180 Sequence the jobs in the order of SPT, EDD, and Critical Ratio, and compute (i) Average flow time, (ii) Average lateness, (iii) Average number of jobs in the system, and (iv) Utilization, for each of the three schedule of jobs. 17. An antique restoration operation uses a two-step sequence that all jobs in a certain category follow. For the group of jobs listed. a. Find the sequence that will minimize total completion time. b. Determine the amount of idle time for workstation 102. c. What jobs are candidates for splitting‘? Why? If they were split, how much would idle time and makespan time be reduced? Assume the very first job can be split 50% and the remaining jobs can be spit 60%. JOB TIMES (minutes) Workstation 101 Workstation 102 A 27 45 B 18 33 C 70 30 D 26 24 E 15 10 Answers 1. No. SKU 1 B120 2 B180 3 C140 4 E110 5 A155 6 E149 7 D120 8 E151 9 A180 10 E111 11 B150 12 F120 Annual usage (units) Unit $ value 9625 10.18 12667 3.20 1292 13.18 258 62.25 862 18.10 7010 1.27 6850 1.20 62 91.80 5100 0.88 371 8.60 967 2.20 1940 0.38 Annual Dollar volume 97,982.50 40,534.40 17,028.56 16,060.50 15,602.20 8,902.70 8,220.00 5,691.60 4,488.00 3,190.60 2,127.40 737.20 220565.66 2. D = 2000, No. of days = 250, H = $200, S = $40 a. EOQ = Dollar % 44.4% 18.4% 7.7% 7.3% 7.1% 4.0% 3.7% 2.6% 2.0% 1.4% 1.0% 0.3% 100% Cum. % for $ 44.4% 62.8% 70.5% 77.8% 84.9% 88.9% 92.6% 95.2% 97.3% 98.7% 99.7% 100.0% 2(2000)40 28 200 b. N = D/Q = 2000/28 = 71.4 c. d = D/No. of days per year = 2000/250 = 8, T = Q/d = 28/8 = 3.5 days d. Annual total cost = (D/Q)S + (Q/2)H = (2000/28)40 + (28/2)200 = $5,657 3. D = 10,000, H = $1.50, S = $200, p = 100/day, d = 40/day EPQ = √ 2𝐷𝑆 𝑑 𝑝 𝐻(1− ) 2(10000)200 =√ 1.50(1− 40 ) 100 = 2108 Production time = Q/p = 2108/100 = 21.08 days Imax = (Q/p)(p - d) = (2108/100)(100 - 40) = 1264.80 Average number of orders per year = D/Q = 10000/2108 = 4.74 Time between orders = Q/d = 2108/40 = 52.7 days Cum. % for no. of items 8.3% 16.7% 25.0% 33.3% 41.7% 50.0% 58.3% 66.7% 75.0% 83.3% 91.7% 100.0% Class A A B B B B C C C C C C Annual holding cost = (Imax/2) x H = (1264.80/2) x 1.50 = $948.60 Annual setup cost = (D/Q) x S = (10000/2108) x 200 = $948 Total cost = 948.60 + 948 = $1,896.60 4. D = 600 Q S = 10 Price Holding cost 1 - 49 5.00 1.50 50 - 249 250 & above 4.50 1.35 4.10 1.23 Q 1 – 49 50 - 249 >= 250 EOQ = Holding cost = 30% Formula Q Candidate Q Formula Q > upper limit -89 not a candidate Formula Q is within range, = 94 Candidate Q = Formula Q Formula Q < lower limit, 99 Candidate Q = lower limit Price Candidate Q Ordering cost 5.00 4.50 94 63.83 4.10 250 24.00 250 @ P = $4.10 Holding cost 63.45 153.75 5. Number of orders per year = 8000/1000 = 8, H = $50, Cs = $40 Safety ROP stock Carrying cost Expected stock out 60 0 0 (10x.2 + 20x.2 + 30x.1) = 9 70 10 10 x $50 = $500 (10x.2 + 20x.1) = 4 80 20 20 x $50 = $1000 (10x.1) = 1 90 30 30 x $50 = $1500 0 94 250 Item cost Total cost 2700 2460 2827.28 2637.75 Stock out cost/year 9 x 8 x 40 = $2,880 4 x 8 x 40 = $1,280 1 x 8 x 40 = $320 $0 Least cost safety stock = 20, ROP = 80 6. Given dL = 130, dLT = 80, and for 80% service level, Z = 0.84 ROP = 130 + 0.84 x 80 = 197.2, or round up to 198 for at least 80% service level 7. d = D/No. of days per year = 600/300 = 2 per day, Z for 90% service level = 1.285 a. Given: L = 4 days Constant, d = 2.4 per day, therefore dLT = 2.4 √4 = 4.8 Safety stock = Z dLT = 1.285 x 4.8 = 6.2 or 7 (round up for at least 90% service level) ROP = dL + SS = (2 chairs/day * 4) + 7 = 15 b. Given: L = 4 days with L = 3 and demand is constant, dLT = 2 (3) = 6 Safety stock = Z dLT = 1.285 x 6 = 7.7 or 8 (round up for at least 90% service level) Total cost $2,880 $1,780 $1320 $1500 ROP = dL + SS = (2 chairs/day * 4) + 8 = 16 c. Given: L = 4 days with L = 3 , and d = 2.4 per day, therefore dLT = √4(2.4)2 + 22 32 = 7.684 Safety stock = Z dLT = 1.285 x 7.684 = 9.9 or 10 (round up for at least 90% service level) ROP = dL + SS = (2 chairs/day * 4) + 10 = 18 8. Cs = Lost profit = Selling price per unit – Cost per unit = 10 – 3 = $7 Co = Cost/unit – salvage value/unit = 3 – 1.20 = $1.80 Optimum service level = 7/(7 + 1.80) = 0.795 = 79.5% From normal table, for 79.5% service level, Z = 0.83 Stock = + Z = 150 + 0.825 (12) = 159.9 or 160 9. Hiring cost/worker = 350 Worker hours/quarter = 520 Firing cost/worker = 500 Standard hours/unit = 100 RT Wage/hour = 15 Holding cost = 100 OT wage rate/hour = 20 Sub-contracting cost/unit = 2500 a. Production rate/worker/day = 8 hours per day/100 hours per unit = 0.08 per worker/day Production rate/worker/quarter = 0.08/worker/day x 65 days/quarter = 5.2/worker/ quarter b. Wage rate per worker per day = $15/hour x 8 hours/day = $120 Wage rate per worker per quarter = $15/hour x 8 hours/day x 65 days/quarter = $7800 c. OT cost/unit = $20/hour x 100 hours/unit = $2000 d. Chase plan Period Demand Production required 1 2 3 4 160 180 220 200 160–(0–0) = 160 180 220 200 Cost summary Regular wages O.T. cost = S.C. cost Hiring cost Firing cost Carrying cost Total cost Workers needed Workers needed (Rounded) 30 160/5.2=30.77 180/5.2=34.62 220/5.2=42.31 200/5.2=38.46 31 35 43 39 148 148 workers-quarters x $7800 = 13 workers x $350 = 4 workers x $500 = Hired Fired workers workers 1 4 8 0 13 0 0 0 4 4 1,154,400 4,550 2,000 $1,160,950 e. Level Plan Sum of demand = 760 Average demand = 760/4 = 190 i.e. = production per quarter Period Demand 1 2 3 4 160 180 220 200 RT Production E.I. 0 30 40 10 0 190 190 190 190 No. of workers needed = 190/5.2 = 36.54 or 37 Cost summary Regular wages 37 workers x 4 quarters x $7800 = Hiring cost (37 workers – 30 workers) x $ 350 = Firing cost Carrying cost 80 x $100 = Total cost 1,154,400 2,450 8,000 $1,164,850 f. Mixed Plan No. of workers = 31 Production per quarter with 31 workers = 31 x 5.2 = 161.2 O.T. capacity/quarter = 161.2 x 20% = 32.2 Period 1 2 3 4 Demand 160 180 220 200 Shortage 160 – 160=0 180-161.2=18.8 220-161.2=58.8 200-161.2=38.8 Cost summary Regular wages O.T. cost = S.C. cost Hiring cost Firing cost Carrying cost Total cost Production capacity 161.2 161.2 161.2 161.2 O.T Capacity 32.2 32.2 32.2 32.2 RT Production Min(160,161.2) =160 Min(180,161.2) =161.2 Min(220,161.2) =161.2 Min(200,161.2) =161.2 643.6 O.T. Production 0 Min(18.8,32.2) = 18.8 Min(58.8,32.2)=32.2 Min(38.8,32.2)=32.2 82.8 31 workers x 4 quarters x $7800 = 82.8 units x $2000 33.6 units x $2500 = (31 – 30) x $350 = S.C. 0 0 58.8 – 32.2=26.8 38.8 - 32.2=6.8 33.6 967,200 165,600 84,000 350 $1,217,150 10. B17 B18 B19 B22 E22 B23 C26 D26 E26 B29 C29 (B13*B12)/B11 B13*B3*B12 B11*B4 E11 B22+C22-D22 E22 SUM(C22:C25) SUM(D22:D25) SUM(E22:E25) E12 E22*$B$17 F29 G29 H29 G33 B35 B36 B37 B38 B39 B40 B41 E4 SUM(B29:E29)-F29 C29*$B$14 SUM(G29:G32) E26*B18 D33*B19 E33*B5 C26*B7 D26*B8 G33*B6 SUM(B35:B40) a. B41 b. C22:D25, D29:E32 c. D29:D32 <= H29:H32 G29:G32 >= E13 C22:D25 = Integer (if needed) D29:E32 = Integer (if needed) d. Changing cells non-negative Simplex LP 11. Current pricing: Price = $100 Demand = 500 Revenue = 500 x $100 = 50,000 Variable cost = $3 x 500 = 1500 Net revenue = 50,000 – 1,500 = $48,500 Proposed pricing: Price Demand Revenue 70 300 21000 90 200 18000 120 100 12000 Total revenue = 51000 Variable cost = $3 x 600 tickets sold = 1800 Net revenue = 51,000 – 1,800 = $49,200 12. (a) A B C2 D1 F D4 E2 G H2 I F G (b). F D G B H E I C A F D G 1 2 3 4 5 Lead time = 7 weeks (c) Part A B C D E F G H I Gross 50 1 x A = 45 2 x A = 2 x 45 = 90 4 x A + 1 x B = 4 x 45 + 40 = 220 2 x B = 80 1 x D = 200 1 x D = 200 2 x E = 2 x 30 = 60 1 x E = 30 Available 5 5 10 20 50 150 50 5 0 Net 50 – 5 = 45 45 – 5 = 40 90 – 10 = 80 220 – 20 = 200 80 – 50 = 30 200 – 150 = 50 200 – 50 = 150 60 – 5 = 55 30 – 0 = 30 6 7 13. 1 2 3 MPS start for A Item B GR = Week: Gross requirement Scheduled receipts Projected on-hand 100 Net requirement Planned receipts Planned order releases Item C Week: Gross requirement Scheduled receipts Projected on-hand 30 Net requirement Planned receipts Planned order releases Item P Week: Gross requirement Scheduled receipts Projected on-hand Net requirement Planned receipts Planned order releases Item F Week Gross requirement Scheduled receipts Projected on-hand Net requirement Planned receipts Planned order releases 0 0 Lead time = 3 0 2 0 4 100 5 6 150 4 100 5 0 6 150 1 1 0 50 100 150 150 150 50 0 0 0 0 0 0 0 0 0 100 50 100 100 0 4 100 5 0 6 150 0 0 150 80 20 20 0 0 0 0 150 150 0 Lead time = 3 0 4 0 5 100 6 0 50 50 50 0 0 1 0 20 30 2 0 30 50 0 20 0 0 Lead time = 3 0 80 2 0 3 2 1 0 50 0 50 50 50 0 0 0 0 0 50 0 0 0 0 1 0 30 0 Lead time = 2 3 0 0 40 30 30 4 0 5 300 6 0 70 0 0 230 0 0 0 0 70 230 230 0 Planned order releases: A has releases of 100 in week 4, 150 in week 7 B has a release of 100 in week 5 C has releases of 20 in week 1, 150 in week 3 P has a release of 50 in week 3 F has a release of 230 in week 1 0 0 4 0 0 14. (i) L-4-L Item Week: Gross requirement Scheduled receipts Projected on-hand Net Requirement Planned receipts Planned order releases 100 No. of setup = Carrying cost = Setup cost = 7 x $300 = Total cost = LT = 1 100 1 2 250 3 200 4 150 5 250 6 200 7 200 8 150 100 0 0 250 0 250 250 200 0 200 200 150 0 150 150 250 0 250 250 200 0 200 200 200 0 200 200 150 0 150 150 0 5 250 0 150 100 375 0 6 200 0 275 0 0 375 7 200 0 75 125 375 0 8 150 0 250 0 0 0 7 0 2100 2100 (ii) EOQ: Total demand for 8 weeks = 1500, d = 1500/8 = 187.5 H = $0.80/week S = 300 2(187.5)300 0.8 Q= √ Item Week: Gross requirement Scheduled receipts Projected on-hand Net Requirement Planned receipts Planned order releases = 375 100 LT = 1 100 0 100 0 0 375 1 2 250 0 0 250 375 375 3 200 0 125 75 375 0 4 150 0 300 0 0 375 Setup cost per week = (d/Q) S = (187.5/375) x 300 = Holding cost per week = (Q/2)H per week = (375/2) x 0.80 = Total cost per week= 150 + 150 = Cost for 8 weeks = Total cost per week x 8 weeks = 300 x 8 = (iii) POQ No. of periods = EOQ/d = 375/187.5 = 2 weeks Item LT = 1 Week: 1 2 Gross requirement 100 250 Scheduled receipts 0 0 Projected on-hand 100 100 0 Net Requirement 0 250 Planned receipts 0 450 3 200 0 200 0 0 4 150 0 0 150 400 150 150 300 2400 5 250 0 250 0 0 6 200 0 0 200 400 7 200 0 200 0 0 8 150 0 0 150 150 Planned order releases 450 No. of setup = Setup cost = 4 x $300 = Sum of ending inventory Carrying cost = 650 x 0.8 = Total cost = #15. Week ending Planned input Actual input Cumulative deviation Planned output Actual output Cumulative deviation Backlog 400 400 150 4 1200 650 520 1720 120 1 500 700 200 650 600 -50 220 2 800 700 100 650 700 0 220 3 700 700 100 650 800 150 120 4 600 800 300 650 700 200 220 5 600 600 300 650 650 200 170 6 800 500 0 700 500 0 170 #16. SPT Processing time (Days) 20 30 35 40 125 Job B A D C Average flow time = Average lateness = Average WIP = Utilization = Days till due date 165 40 130 125 Completion time (Flowtime) 20 50 85 125 280 Lateness 0 10 0 0 10 70 2.5 2.240 44.6% EDD Job A C D B Processing time (Days) 30 40 35 20 125 Days till due date 40 125 130 165 Average flow time = Average lateness = Average no. of jobs in the system = Utilization = 82.5 0 2.640 37.9% Completion time (Flowtime) 30 70 105 125 330 Lateness 0 0 0 0 0 CR Job A B C D Processing time 30 20 40 35 Processing time (Days) 30 40 35 20 125 Job A C D B Date job due 90 215 175 180 Days till due date 40 125 130 165 Average flow time = Average lateness = Average no. of jobs in the system = Utilization = Due date 40 165 125 130 CR 1.333333 8.25 3.125 3.714286 Completion time (Flowtime) 30 70 105 125 330 Lateness 0 0 0 0 0 82.5 0 2.640 37.9% #17. JOB TIMES (minutes) A 27 45 Workstation 101 Workstation 102 Job B A C D E B 18 33 a. Schedule: B – A – C – D – E Workstation 101 Processing time Finish time 18 18 27 45 70 115 26 141 15 156 C 70 30 D 26 24 E 15 10 Workstation 102 Processing time Start time Finish time 33 18 51 45 51 96 30 115 145 24 145 169 10 169 179 Idle time 18 0 19 0 0 37 b. Total idle time for workstation 102 is 37 minutes B A C 18 45 Idle B 20 A Idle 51 30 40 E 115 18 10 D 50 96 60 70 80 90 100 141 D C 115 110 156 120 145 130 140 150 160 E 169 179 170 180