POM-StudyGuide-e3

advertisement

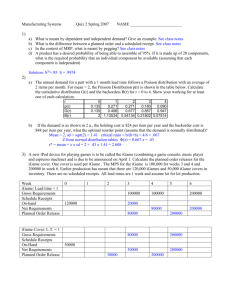

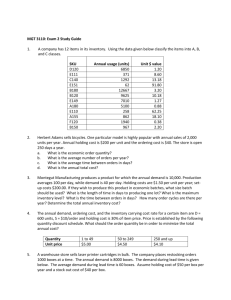

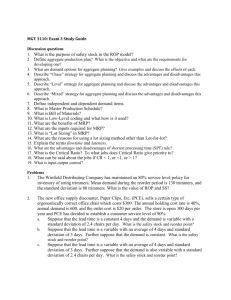

Exam 3 Study Guide 1. Leisure Travels, Inc. manufactures and sells Recreation Vehicles. The demand for the next four quarters is forecasted as 160, 180, 220, and 200. The labor required to produce one unit is 100 hours. Each worker works 8 hours per day for 65 days per quarter. Regular wages is $15 per hour and O.T. wages is $20 per hour. O.T. is limited to 20% regular hours. Limited subcontracting is available at the rate of $2500 per unit. Holding cost per unit per quarter is $100. Cost of hiring a worker is $350 and firing worker will cost $500. The company currently has 30 employees. a. Determine the production rate per worker per day and per quarter. b. Determine the regular time wage per worker per day and per quarter. c. Determine the O.T. cost per unit. d. Develop a “Chase” plan and the corresponding cost summary. Round up workers needed. e. Develop a “Level” plan and the corresponding cost summary. f. Develop a “Mixed” plan with a constant work force of 31 workers, but produce only what the net demand is each month, i.e. not accumulate any inventory in excess of the safety stock. If regular time capacity is not sufficient, use O.T. production first and use subcontracting only of O.T. capacity is not enough to make up the shortage. Round to 2 decimal places. 2. Consider the following Solver model for an aggregate planning problem given in the next page. a. What is the Solver Target cell? b. What are the Solver changing cells? c. What are the Solver constraints? d. What options of Solver must be checked? e. Determine the excel formula for the following cells: B17 B18 B19 B22 E22 B23 C26 D26 E26 B29 C29 F29 G29 H29 G33 B35 B36 B37 B38 B39 B40 B41 3. A concert organizing company wishes to study the effect of discount pricing on net revenue generated. Currently the company charges uniform fee of $100 per ticket and has averaged 500 tickets sold. The company is considering a three tier pricing structure, (a) a deeply discounted $70 per ticket if purchased at least 1 month in advance, (b) $90 per ticket if purchase at least a week in advance and $120 at the box office on the day of the event. The company has estimated a demand of 300 tickets sold at least a month in advance, 200 at least a week in advance and 100 on the day of the event. The company estimates the variable cost to be $3 per ticket under all the three prices. Using the yield revenue approach determine what the effect of the proposed price structure will be on net revenue. 4. A Bill of Materials is desired for a bracket (A) that is made up of a base (B), two springs (C) and four clamps (D). The base is assembled from one clamp (D) and two housings (E). Each clamp has one handle (F) and one casting (G). Each housing has two bearings (H) and one shaft (I). a. Develop a product structure tree. b. The lead time for the parts are given below. Develop a time-phased product structure. c. The available inventory for each part is given in the table below. Determine the net requirement quantities of all parts required to assemble 50 units of bracket A. Item A B C D E F G H I 5. Lead time 1 3 2 4 On-hand 100 30 0 0 Scheduled receipts 50 in week 1 20 in week 1, 30 in week 2 50 in week 1 30 in week 1, 40 in week 3 For the following item the inventory holding cost is $0.80 per week and the setup cost is $300. Determine the lot sizes and total cost for this item under (i) Lot-for-Lot, (ii) EOQ, and (iii) POQ methods. Item Week: Gross requirement Scheduled receipts Projected on-hand 100 Net Requirement Planned receipts Planned order releases 7. Available 5 5 10 20 50 150 50 5 0 A product (A) consists of a base (B) and a casting (C). The base consists of a plate (P) and three fasteners (F). The lead time, current on-hand inventory and scheduled receipts are given below. All components are lot for lot. The MPS requires start of production of 100 units of product A in week 4 and 150 in week 6. Produce the MRP for the upcoming six weeks. Produce a list of all planned order releases. Part B C P F 6. Lead time 1 2 3 2 1 2 1 1 2 LT = 1 100 1 2 250 3 200 4 150 5 250 Consider the following planned and actual hours of input and output. 6 200 7 200 8 150 Week ending Planned input Actual input Planned output Actual output 1 500 700 650 600 2 800 700 650 700 3 700 700 650 800 4 600 800 650 700 5 600 600 650 650 6 800 500 700 500 Prepare the Input/Output Control chart for this workstation. Assume an initial actual backlog of 120 hours and zero for the two cumulative deviations. 8. The following jobs are waiting to be processed on day 50 Job Production days needed Date job due A 30 90 B 20 215 C 40 175 D 35 180 Sequence the jobs in the order of SPT, EDD, and Critical Ratio, and compute (i) Average flow time, (ii) Average lateness, (iii) Average number of jobs in the system, and (iv) Utilization, for each of the three schedule of jobs. 9. An antique restoration operation uses a two-step sequence that all jobs in a certain category follow. For the group of jobs listed. a. Find the sequence that will minimize total completion time. b. Determine the amount of idle time for workstation 102. c. What jobs are candidates for splitting‘? Why? If they were split, how much would idle time and makespan time be reduced? Assume the very first job can be split 50% and the remaining jobs can be spit 60%. JOB TIMES (minutes) Workstation 101 Workstation 102 A 27 45 B 18 33 C 70 30 D 26 24 E 15 10 Answers 1. Hiring cost/worker = 350 Worker hours/quarter = 520 Firing cost/worker = 500 Standard hours/unit = 100 RT Wage/hour = 15 Holding cost = 100 OT wage rate/hour = 20 Sub-contracting cost/unit = 2500 a. Production rate/worker/day = 8 hours per day/100 hours per unit = 0.08 per worker/day Production rate/worker/quarter = 0.08/worker/day x 65 days/quarter = 5.2/worker/ quarter b. Wage rate per worker per day = $15/hour x 8 hours/day = $120 Wage rate per worker per quarter = $15/hour x 8 hours/day x 65 days/quarter = $7800 c. OT cost/unit = $20/hour x 100 hours/unit = $2000 d. Chase plan Period Demand Production required 1 2 3 4 160 180 220 200 160–(0–0) = 160 180 220 200 Cost summary Regular wages O.T. cost = S.C. cost Hiring cost Firing cost Carrying cost Total cost Workers needed Workers needed (Rounded) 30 160/5.2=30.77 180/5.2=34.62 220/5.2=42.31 200/5.2=38.46 31 35 43 39 148 Hired Fired workers workers 1 4 8 0 13 148 workers-quarters x $7800 = 0 0 0 4 4 1,154,400 13 workers x $350 = 4 workers x $500 = 4,550 2,000 $1,160,950 e. Level Plan Sum of demand = 760 Average demand = 760/4 = 190 i.e. = production per quarter Period Demand 1 2 3 4 160 180 220 200 No. of workers needed = 190/5.2 = 36.54 or 37 RT Production 190 190 190 190 E.I. 0 30 40 10 0 Cost summary Regular wages Hiring cost Firing cost Carrying cost Total cost 37 workers x 4 quarters x $7800 = (37 workers – 30 workers) x $ 350 = 1,154,400 2,450 8,000 $1,164,850 80 x $100 = f. Mixed Plan No. of workers = 31 Production per quarter with 31 workers = 31 x 5.2 = 161.2 O.T. capacity/quarter = 161.2 x 20% = 32.2 Period 1 2 3 4 Demand 160 180 220 200 Shortage 160 – 160=0 180-161.2=18.8 220-161.2=58.8 200-161.2=38.8 Cost summary Regular wages O.T. cost = S.C. cost Hiring cost Firing cost Carrying cost Total cost Production capacity 161.2 161.2 161.2 161.2 O.T Capacity 32.2 32.2 32.2 32.2 RT Production Min(160,161.2) =160 Min(180,161.2) =161.2 Min(220,161.2) =161.2 Min(200,161.2) =161.2 643.6 O.T. Production 0 Min(18.8,32.2) = 18.8 Min(58.8,32.2)=32.2 Min(38.8,32.2)=32.2 82.8 31 workers x 4 quarters x $7800 = 82.8 units x $2000 33.6 units x $2500 = (31 – 30) x $350 = S.C. 0 0 58.8 – 32.2=26.8 38.8 - 32.2=6.8 33.6 967,200 165,600 84,000 350 $1,217,150 2. B17 B18 B19 B22 E22 B23 C26 D26 (B13*B12)/B11 B13*B3*B12 B11*B4 E11 B22+C22-D22 E22 SUM(C22:C25) SUM(D22:D25) F29 G29 H29 G33 B35 B36 B37 B38 E4 SUM(B29:E29)-F29 C29*$B$14 SUM(G29:G32) E26*B18 D33*B19 E33*B5 C26*B7 a. B41 b. C22:D25, D29:E32 c. D29:D32 <= H29:H32 G29:G32 >= E13 C22:D25 = Integer (if needed) D29:E32 = Integer (if needed) d. Changing cells non-negative Simplex LP E26 B29 C29 B39 B40 B41 SUM(E22:E25) E12 E22*$B$17 D26*B8 G33*B6 SUM(B35:B40) 3. Current pricing: Price = $100 Demand = 500 Revenue = 500 x $100 = 50,000 Variable cost = $3 x 500 = 1500 Net revenue = 50,000 – 1,500 = $48,500 Proposed pricing: Price Demand Revenue 70 300 21000 90 200 18000 120 100 12000 Total revenue = 51000 Variable cost = $3 x 600 tickets sold = 1800 Net revenue = 51,000 – 1,800 = $49,200 4. (a) A B C2 (b). D4 E2 D1 F G H2 I F F D G B H G E I C A F D G 1 2 3 4 5 Lead time = 7 weeks (c) Part A B C D E F G H I Gross 50 1 x A = 45 2 x A = 2 x 45 = 90 4 x A + 1 x B = 4 x 45 + 40 = 220 2 x B = 80 1 x D = 200 1 x D = 200 2 x E = 2 x 30 = 60 1 x E = 30 Available 5 5 10 20 50 150 50 5 0 Net 50 – 5 = 45 45 – 5 = 40 90 – 10 = 80 220 – 20 = 200 80 – 50 = 30 200 – 150 = 50 200 – 50 = 150 60 – 5 = 55 30 – 0 = 30 6 7 5. 1 2 3 MPS start for A Item B GR = Week: Gross requirement Scheduled receipts Projected on-hand 100 Net requirement Planned receipts Planned order releases Item C Week: Gross requirement Scheduled receipts Projected on-hand 30 Net requirement Planned receipts Planned order releases Item P Week: Gross requirement Scheduled receipts Projected on-hand Net requirement Planned receipts Planned order releases Item F Week Gross requirement Scheduled receipts Projected on-hand Net requirement Planned receipts Planned order releases 0 0 Lead time = 3 0 2 0 4 100 5 6 150 4 100 5 0 6 150 1 1 0 50 100 150 150 150 50 0 0 0 0 0 0 0 0 0 100 50 100 100 0 4 100 5 0 6 150 0 0 150 80 20 20 0 0 0 0 150 150 0 Lead time = 3 0 4 0 5 100 6 0 50 50 50 0 0 1 0 20 30 2 0 30 50 0 20 0 0 Lead time = 3 0 80 2 0 3 2 1 0 50 0 50 50 50 0 0 0 0 0 50 0 0 0 0 1 0 30 0 Lead time = 2 3 0 0 40 30 30 4 0 5 300 6 0 70 0 0 230 0 0 0 0 70 230 230 0 Planned order releases: A has releases of 100 in week 4, 150 in week 7 B has a release of 100 in week 5 C has releases of 20 in week 1, 150 in week 3 P has a release of 50 in week 3 F has a release of 230 in week 1 0 0 4 0 0 6. (i) L-4-L Item Week: Gross requirement Scheduled receipts Projected on-hand Net Requirement Planned receipts Planned order releases 100 No. of setup = Carrying cost = Setup cost = 7 x $300 = Total cost = LT = 1 100 1 2 250 3 200 4 150 5 250 6 200 7 200 8 150 100 0 0 250 0 250 250 200 0 200 200 150 0 150 150 250 0 250 250 200 0 200 200 200 0 200 200 150 0 150 150 0 4 150 0 300 0 0 375 5 250 0 150 100 375 0 6 200 0 275 0 0 375 7 200 0 75 125 375 0 8 150 0 250 0 0 0 7 0 2100 2100 (ii) EOQ: Total demand for 8 weeks = 1500, d = 1500/8 = 187.5 H = $0.80/week S = 300 2(187.5)300 0.8 Q= √ = 375 Item Week: Gross requirement Scheduled receipts Projected on-hand Net Requirement Planned receipts Planned order releases 100 LT = 1 100 0 100 0 0 375 1 2 250 0 0 250 375 375 3 200 0 125 75 375 0 Setup cost per week = (d/Q) S = (187.5/375) x 300 = Holding cost per week = (Q/2)H per week = (375/2) x 0.80 = Total cost per week= 150 + 150 = Cost for 8 weeks = Total cost per week x 8 weeks = 300 x 8 = (iii) POQ No. of periods = EOQ/d = 375/187.5 = 2 weeks Item LT = 1 Week: 1 2 Gross requirement 100 250 Scheduled receipts 0 0 Projected onhand 100 100 0 Net Requirement 0 250 150 150 300 2400 3 200 0 4 150 0 5 250 0 6 200 0 7 200 0 8 150 0 200 0 0 150 250 0 0 200 200 0 0 150 Planned receipts Planned order releases 0 450 No. of setup = Setup cost = 4 x $300 = Sum of ending inventory Carrying cost = 650 x 0.8 = Total cost = #7. Week ending Planned input Actual input Cumulative deviation Planned output Actual output Cumulative deviation Backlog 450 0 400 400 0 400 400 0 150 150 4 1200 650 520 1720 120 1 500 700 200 650 600 -50 220 2 800 700 100 650 700 0 220 3 700 700 100 650 800 150 120 4 600 800 300 650 700 200 220 5 600 600 300 650 650 200 170 6 800 500 0 700 500 0 170 #8. SPT Processing time (Days) 20 30 35 40 125 Job B A D C Average flow time = Average lateness = Average WIP = Utilization = Days till due date 165 40 130 125 Completion time (Flowtime) 20 50 85 125 280 Lateness 0 10 0 0 10 70 2.5 2.240 44.6% EDD Job A C D B Processing time (Days) 30 40 35 20 125 Days till due date 40 125 130 165 Average flow time = Average lateness = Average no. of jobs in the system = Utilization = 82.5 0 2.640 37.9% Completion time (Flowtime) 30 70 105 125 330 Lateness 0 0 0 0 0 CR Job A B C D Processing time 30 20 40 35 Processing time (Days) 30 40 35 20 125 Job A C D B Date job due 90 215 175 180 Days till due date 40 125 130 165 Average flow time = Average lateness = Average no. of jobs in the system = Utilization = Due date 40 165 125 130 CR 1.333333 8.25 3.125 3.714286 Completion time (Flowtime) 30 70 105 125 330 Lateness 0 0 0 0 0 82.5 0 2.640 37.9% #9. JOB TIMES (minutes) A 27 45 Workstation 101 Workstation 102 a. Schedule: B – A – C – D – E Workstation 101 Job Processing time Finish time B 18 18 A 27 45 C 70 115 D 26 141 E 15 156 B 18 33 C 70 30 D 26 24 E 15 10 Workstation 102 Processing time Start time Finish time 33 18 51 45 51 96 30 115 145 24 145 169 10 169 179 Idle time 18 0 19 0 0 37 b. Total idle time for workstation 102 is 37 minutes B A C 18 45 Idle 20 A Idle 51 30 40 50 E 115 B 18 10 D 96 60 70 80 90 100 141 D C 115 110 156 120 145 130 140 150 160 E 169 179 170 180