Enabling Students to Compare Theories in Media Stories about the

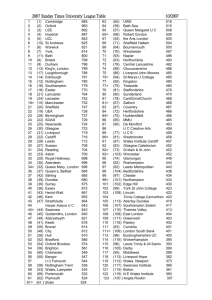

advertisement

Developments in Economics Education Enabling Students to Compare Theories In Media Stories about the Economy or journal articles or textbooks I. David Wheat Associate Professor of System Dynamics University of Bergen, Norway Adjunct Associate Professor of Economics Virginia Western Community College, U.S.A. Cardiff September 10, 2009 1 D. Wheat, DEE Conference Cardiff, Wales, Sep 10, 2009 Challenge: Representing Causal Structures A challenge for students: representing a discipline's causal structures … hypotheses and theories … how and why things happen the way they do Even verbatim notes do not guarantee comprehension of hypotheses and theories. Students may merely memorize and repeat. What’s missing: a translation technique that structures information in a way that is – … faithful to the theory in the textbook, article, or news media – … yet comprehensible to the student. D. Wheat, DEE Conference 2 Cardiff, Wales, Sep 10, 2009 What is the Feedback Method? • 2007 DEE Conference: MacroLab Workshop – students use a simulation model of U.S. economy – students see structure represented in two formats: • stock & flow diagram • feedback loop diagrams – students examine behavior via interactive learning environment – enables even first-year students to study dynamics • Today: Feedback Method of Theory Representation 1. converts a theory (narrative text or equations) into causal links & loops 2. formulates the stock and flow structure of the theory 3. simulates the translated model 4. tests the theory’s predictive claims provides a “structured pattern” to facilitate understanding & comparison D. Wheat, DEE Conference 3 Cardiff, Wales, Sep 10, 2009 Example from 18th Century Economics Richard Cantillon • Essai Sur la Nature du Commerce en General (1755) • described the economic system as self-adjusting Cantillon’s wage model: • higher wages encourage larger families • larger families increase the labor supply • larger labor supply reduces wages wages + wages + family size + labor supply _ wages _ delays C family size labor supply || + D. Wheat, DEE Conference 4 Cardiff, Wales, Sep 10, 2009 Example from 19th Century Economics When there is a general impression that the price of some commodity is likely to rise, from an extra demand, a short crop, obstructions to importation, or any other cause, there is a disposition among dealers to increase their stocks, in order to profit by the expected rise. This disposition tends in itself to produce the effect which it looks forward to, a rise of price; and if the rise is considerable and progressive, other speculators are attracted...[resulting] in a further advance [in price]. John Stuart Mill (Principles of Political Economy, 1848) D. Wheat, DEE Conference 5 Cardiff, Wales, Sep 10, 2009 Mill’s Speculative Demand Model When there is a general impression that the price of some commodity is likely to rise, from an extra demand, a short crop, obstructions to importation, or any other cause, there is a disposition among dealers to increase their stocks, in order to profit by the expected rise. This disposition tends in itself to produce the effect which it looks forward to, a rise of price; and if the rise is considerable and progressive, other speculators are attracted...[resulting] in a further advance [in price]. Variables: (1) expectation of rising prices expectation of rising prices + (2) speculative demand speculative demand + price + (3) price expectation of rising prices D. Wheat, DEE Conference 6 Cardiff, Wales, Sep 10, 2009 Three Theories of the Housing Price Bubble “There Is No Housing Bubble in the USA: Housing Activity Will Remain at High Levels in 2005 and Beyond” J. Smith (2005) “The 1998-2005 Housing 'Bubble' and the Current Correction: What's Different this Time?” Wheaton and Nechayev (2007) “From Bubble to Depression?” Gjerstad and V. Smith (2009) D. Wheat, DEE Conference 7 Cardiff, Wales, Sep 10, 2009 Model 1 “There Is No Housing Bubble in the USA: Housing Activity Will Remain at High Levels in 2005 and Beyond” D. Wheat, DEE Conference 8 Cardiff, Wales, Sep 10, 2009 Model 2 “The 1998-2005 Housing 'Bubble' and the Current Correction: What's Different this Time?” D. Wheat, DEE Conference 9 Cardiff, Wales, Sep 10, 2009 Model 3 “From Bubble to Depression?” D. Wheat, DEE Conference 10 Cardiff, Wales, Sep 10, 2009 Comparing the Three Price-Bubble Theories* There Is No Housing Bubble … The Housing Bubble … What’s Different this Time? Bubble to Depression? *adapted from Wheat (2009), “Empowering Students to Compare Ways Economists Think: The Case of the Housing Bubble,” International Journal of Pluralism and Economics Education. D. Wheat, DEE Conference 11 Cardiff, Wales, Sep 10, 2009 Summary Conclusions End product of a Feedback Method of mapping: • a set of causal links (and maybe a loop) representing how an economic process is believed to work • evidence of student-constructed understanding • facilitates comparison of economists’ theories Resulting “feedback map”--whether accurate or not-provides a forum for discussion that can …correct student misconceptions …facilitate better instructor explanations …enhance learning about dynamic processes in economics A commitment to pluralism in economics education requires a corresponding commitment to empower students to compare economists’ mental models. D. Wheat, DEE Conference 12 Cardiff, Wales, Sep 10, 2009 Thank you. Stay in touch. david.wheat@uib.no +47-55-58-3081 D. Wheat, DEE Conference Cardiff, Wales, Sep 10, 2009 D. Wheat, DEE Conference 14 Cardiff, Wales, Sep 10, 2009 Feedback Loop Diagram of Sachs’ “Poverty Trap Model” + C population + + + official development assistance Adapted from Jeffrey Sachs’ The End of Poverty: Economic Possibilities for our Time (2005) D. Wheat, DEE Conference 15 Cardiff, Wales, Sep 10, 2009 Stock-and-Flow Diagram of Sachs’ “Poverty Trap Model” R1 C R2 D. Wheat, DEE Conference 16 Cardiff, Wales, Sep 10, 2009 Simulation Results ODA = $100/year/person for 10 years ODA = 0 simulation 2 reference mode Income per capita simulation 1 ODA = $100/year/person for 15 years simulation 3 Income per capita reference mode Income per capita reference mode ODA = $100/year/person for 18 years simulation 4 Income per capita reference mode D. Wheat, DEE Conference Cardiff, Wales, Sep 10, 2009 Summary • The Feedback Method Model reproduces the reference mode. • If the ODA policy is $100/year/person, it takes 18 years to produce sustainable growth in the Sachs model. • The Sachs model has several limitations, including: – It ignores all counteracting loops except one (capital depreciation) – It has no dynamic history. It ignores the development of the poverty trap. – It assumes investment responds only to saving; i.e., “expected profits” from investment do not affect investment D. Wheat, DEE Conference 18 Cardiff, Wales, Sep 10, 2009