AASA Pulse: Supplier KPI Benchmarks 2013

advertisement

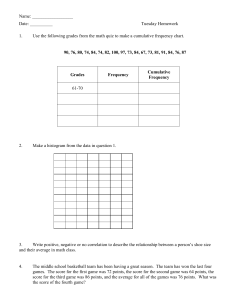

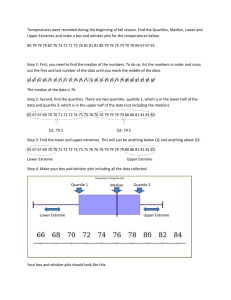

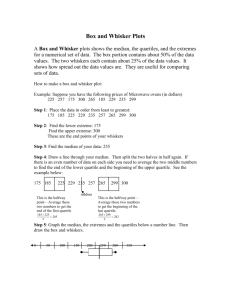

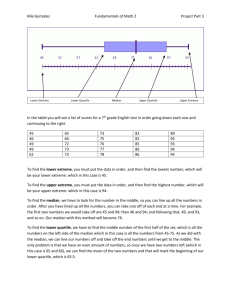

AASA Pulse: Supplier KPI Benchmarks 2013 2013 AASA Pulse: Supplier KPI Benchmarks 1 Contents Page Executive Summary 3 How to Use this Study 8 Returns 11 Fill Rates 18 Financial 34 Operations 44 Marketing and Forecasting 51 Results Segmented by Company Size 61 Results Segmented by Product Category 71 Appendix A: Profile of Respondents and Full Responses to Selected Question 81 Appendix B: Methodology 87 2013 AASA Pulse: Supplier KPI Benchmarks 2 Executive Summary 2013 AASA Pulse: Supplier KPI Benchmarks 3 Executive Summary (1/4) Metric Returns Fill Rates Key Findings Page 85% of respondents indicate that 2.5% or less of warranty returns are related to actual quality issues 14 Stock adjustment rose again to worrisome levels, raising concern about this practice across the industry 15 Differentiation through high fill rates is becoming more difficult as 74% of respondents had 94% or better fill rate by unit volume 19 75% had order turnaround of three days or less 25 Although on average only a small amount of business is done through vendor direct programs, this activity has been increasing steadily for the past 3 years; in addition, 26% of respondents had 10% or more of their sales through vendor direction 26-27 2013 AASA Pulse: Supplier KPI Benchmarks 4 Executive Summary (2/4) Metric Key Findings Page Financial Price changes decreased, though gross margin mean and median were able to hold steady 35, 41 31 e-Tailing Respondents estimate that on average 3.4% of their sales ultimately are sold by channel partners through e-tailing Payment terms with retailers averaged 177 days for respondents in 2012, with 24% at average terms of 291 – 360 days 36 Payment terms with WDs/Distributors average was much less than retailers, averaging 86 days with 2/3 of respondents reporting terms between 46 to 90 days 37 Payment Terms 2013 AASA Pulse: Supplier KPI Benchmarks 5 Executive Summary (3/4) Metric Operations Marketing Forecasting Key Findings Page The percent of sales manufactured in-house increased slightly to an average of 63.6% in 2012, though there are widely divergent models on this point 45 Manufacturing in low cost countries averaged 36% for 2012, up 10 percentage points from 2011 47 Average days on hand of inventory reported by respondents was 63 days 48 Overall marketing spend as a percent of revenue averaged 3% for 2012 52 Customer specific marketing spend on average was typically the highest area of marketing spend 53 90% of respondents reported access to POS and forecasting data from channel partners; however only 34% use it “Always” or “Frequently” 57 For most of respondents POS data is very useful; however, a subset finds limited value in the data 59-60 2013 AASA Pulse: Supplier KPI Benchmarks 6 Executive Summary (4/4) Metric Results Segmented by Company Size Results Segmented by Product Category Key Findings Page For larger firms there is a more significant portion of their business done via vendor direct 65 Smaller sized firms have played the largest part in the e-tailing space 66 Larger firms experienced the greatest price increase from 2011 67 Chemicals had the highest fill rates. The other product segments were slightly below Chemicals, but still all roughly achieved the target 95% fill rate. 74 Respondents estimate that e-tailing penetration is the highest in the under car product segment. Companies active in under car also participate the most in the vendor direct programs. 76 Chemicals sell the most directly through e-tailing 76 Engine and General maintenance have the longest payment terms 78 2013 AASA Pulse: Supplier KPI Benchmarks 7 How to Use this Study 2013 AASA Pulse: Supplier KPI Benchmarks 8 How to Use this Study Results can be an invaluable resource in your business planning What is the AASA Pulse? • • • • • • • A benchmarking survey conducted on an annual basis Available exclusively to AASA members Covers such key benchmarks as returns, payment terms, order metrics and key financial metrics Developed with the assistance and input of the AASA Marketing Executives Council (MEC) Analysis specifically targeted at aftermarket manufacturers. It is the only research of its kind available The AASA Pulse is absolutely anonymous and answers are kept strictly confidential Detailed results are shared only with survey participants 2013 AASA Pulse: Supplier KPI Benchmarks What to use the data for: • Use the AASA Pulse as a vital tool to assist you in your business and strategic planning – • • The data can help you determine what you should target for improvement And help identify where you are a benchmark – • Allows you to benchmark against industry standards and best practices And therefore allow you to focus your improvement on other areas and metrics Industry benchmarks to help in discussions with your Board and investors 9 Understanding Box Plots Box plots are used throughout the report; please use the following chart to reach a better understanding of how to read and interpret a box plot 25% Range of responses 4th Quartile 20% 3rd Quartile or Upper Quartile 15% Average or mean of responses The line between the blue boxes is the median or the midpoint of all the responses. 100% of responses 10% 75% 2nd Quartile or Lower Quartile 50% 25% 5% 1st Quartile 0% Lower Quartile Upper Quartile Mean Source: 2013 AASA Pulse: KPI Benchmarks Survey 2013 AASA Pulse: Supplier KPI Benchmarks 10 Returns 2013 AASA Pulse: Supplier KPI Benchmarks 11 Warranty Returns (1/2) While warranty made up 1% or less of sales for 47% of respondents , 38% had 1-5% of sales as warranty and 15% had greater than 5% 15% 38% 47% 2013 AASA Pulse: Supplier KPI Benchmarks 12 Warranty Returns (2/2) While warranty returns averaged 2.6% of sales, the range of responses was very large Based on this feedback, the aftermarket has roughly $3.5 billion dollars of parts warranty returns a year. Note: at retail sales level Source: AASA/AAIA Joint Channel Forecast Model 2013 AASA Pulse: Supplier KPI Benchmarks 13 Warranty Returns and Quality Issues 85% of respondents indicate that 2.5% or less of returns are related to actual quality issues If the industry could reduce warranty returns by half, the industry could save ~$1.8 billion which would go straight to the bottom line of suppliers and channel partners. If the industry could reduce returns just to quality issues the industry would have $3.4 billion in addition profit. Source: AASA/AAIA Joint Channel Forecast Model 2013 AASA Pulse: Supplier KPI Benchmarks 14 Stock and Obsolescence Returns (1/2) Stock and obsolescence returns clustered around 2-3%, with a wide range of results 2013 AASA Pulse: Supplier KPI Benchmarks 15 Stock and Obsolescence Returns (2/2) Stock adjustment rose in 2012, raising concern about this practice across the industry Note: ~1 out of 10 respondents had >5% returns in this category In an era of “big data”, advanced analytics and supply chain integration, should the industry be experiencing this level of annual stock and obsolescence returns? 2013 AASA Pulse: Supplier KPI Benchmarks 16 Discrepancy Returns Average discrepancy return continues to decrease, with 56% experiencing 0.05% or less discrepancy returns 2013 AASA Pulse: Supplier KPI Benchmarks Year Average Discrepancy Return 2009 0.53% 2010 0.31% 2011 0.29% 2012 0.24% 17 Fill Rates 2013 AASA Pulse: Supplier KPI Benchmarks 18 Fill Rates by Unit Volume (1/2) Differentiation through high fill rates is becoming more difficult as 74% of respondents had 94% or better fill rate by unit volume 2013 AASA Pulse: Supplier KPI Benchmarks 19 Fill Rates by Unit Volume (2/2) Fill rate by unit volume continues to increase with both the mean and median of respondents falling above the desired target of 95% 2013 AASA Pulse: Supplier KPI Benchmarks 20 Fill Rate by Dollar Value (1/2) Fill rate by dollar value averaged 95.4% for respondents with 25% falling between 96.1% - 98% Mean = 95.4% 2013 AASA Pulse: Supplier KPI Benchmarks 21 Fill Rate by Dollar Value (2/2) Average fill rate by dollar value continue to increase from the low seen in 2010; the 95% fill rate goal in the industry is increasingly becoming standard 2013 AASA Pulse: Supplier KPI Benchmarks 22 Fill Rate by Line Item (1/2) Fill rate by line item averaged 94.9%, slightly below the typical 95% goal in the automotive aftermarket Mean = 94.9% 2013 AASA Pulse: Supplier KPI Benchmarks 23 Fill Rate by Line Item (2/2) Fill rate by line item also increased in 2012 capping a three year upward trend 2013 AASA Pulse: Supplier KPI Benchmarks 24 Order Turnaround Average order turnaround for respondents averaged slightly above 3 days, though 75% had order turnaround of three days or less Year Average Order Turnaround (in days) 2009 5.7 2010 2.0 2011 2.8 2012 3.2 75% 2013 AASA Pulse: Supplier KPI Benchmarks 25 Vendor Direct (1/2) Business models diverge: while 26% sell more than 10% through vendor direct, 39% report business through vendor direct programs is less than 1% 26% 39% 2013 AASA Pulse: Supplier KPI Benchmarks 26 Vendor Direct (2/2) Although on average only a small amount of business is done through vendor direct programs, this involvement has been increasing steadily for the past 3 years 2013 AASA Pulse: Supplier KPI Benchmarks 27 Overnight Shipping (1/2) The majority of respondents (59%) indicate that less than 1% of their business was done with overnight shipping, though the range of responses is wide 2013 AASA Pulse: Supplier KPI Benchmarks 28 Overnight Shipping (2/2) Surprisingly, median use of direct shipping has been declining though the average remains fairly high (2.5% of business) due to outliers who utilize a lot of overnight shipping 2013 AASA Pulse: Supplier KPI Benchmarks 29 e-Tailing Through Direct Sale Majority of respondents (76%) sell virtually nothing directly in the e-tailing channel, but that means 26% are selling direct online 1% or more of sales 10% sell 3% or more through direct e-tailing, indicating that the direct ecommerce sales model is being explored by some suppliers 2013 AASA Pulse: Supplier KPI Benchmarks 30 e-Tailing by Channel Partners Respondents estimate that on average 3.4% of their sales ultimately are sold through e-tailing Mean = 3.4% 2013 AASA Pulse: Supplier KPI Benchmarks 31 Drop Shipments and Cross Docking (1/2) Business requiring drop shipments/cross docking averaged 8.5% for 2012 Mean = 8.5% 2013 AASA Pulse: Supplier KPI Benchmarks 32 Drop Shipments and Cross Docking (2/2) In contrast to the previous three year decline, there was a significant spike in business done by drop shipments or cross docking in 2012 While median remains lower than 2009-2010, average has increased as drop ship/cross docking increased significantly among a subset of suppliers 2013 AASA Pulse: Supplier KPI Benchmarks 33 Financial 2013 AASA Pulse: Supplier KPI Benchmarks 34 Price Aftermarket price changes declined in 2012 versus 2011, averaging +1.8%; 56% of respondents increased prices while 18% saw declines 56% Year Average Aftermarket Price Change 2011 +2.4% 2012 +1.8% 18% 2013 AASA Pulse: Supplier KPI Benchmarks 35 Terms with Retailers Payment terms with retailers averaged 177 days for respondents in 2012; 24% had average terms of 291 – 360 days Mean = 177 2013 AASA Pulse: Supplier KPI Benchmarks 36 Terms with WDs/Distributors Payment terms with WDs/Distributors were much less than retailers, averaging 86 days with 2/3 of respondents reporting terms between 46 to 90 days Mean = 86 2013 AASA Pulse: Supplier KPI Benchmarks 37 SG&A expenses in 2012 General selling and sales administration (SG&A) expenses as a percent of aftermarket sales averaged 12% across respondents Mean = 12.0% 2013 AASA Pulse: Supplier KPI Benchmarks 38 SG&A expenses over time Average SG&A has crept up over the last 3 years, though the approximate quartile range of 6% to 15% has remained steady 2013 AASA Pulse: Supplier KPI Benchmarks 39 Gross Margin in 2012 Weighted average gross margin across all respondents was 32.6%; the range was large with 26% at 25% or lower GM and 29% above 40% GM 29% Mean = 32.6% 26% 2013 AASA Pulse: Supplier KPI Benchmarks 40 Gross Margin over time Weighted gross margin quartile range expanded and increased in 2012; mean increased slightly (31.7% to 32.6%) although the median remained on par with 2011 2013 AASA Pulse: Supplier KPI Benchmarks 41 Aftermarket Research and Development Spending in 2012 Respondent’s companies’ estimated average spend on R&D was 3% for 2012, although over a fifth spend less than 1% Mean = 3% 2013 AASA Pulse: Supplier KPI Benchmarks 42 Aftermarket Research and Development Spending over Time R&D spend continues to increase for aftermarket suppliers 2013 AASA Pulse: Supplier KPI Benchmarks 43 Operations 2013 AASA Pulse: Supplier KPI Benchmarks 44 In-House Manufacturing The percent of sales manufactured in-house increased to an average of 63.6% in 2012; nearly half of respondents manufacture more than 80% of their goods in-house 2013 AASA Pulse: Supplier KPI Benchmarks Year Average Percent of InHouse Sales 2011 55.1% 2012 63.6% 45 Manufacturing in the U.S. On average, respondents reported that 47% of aftermarket sales were manufactured in the US, about the same level as the previous year Year Average Percent of Sales Manufactured in US 2011 48% 2012 47% Will the reshoring US “manufacturing renaissance” be seen in the future in the aftermarket? 2013 AASA Pulse: Supplier KPI Benchmarks 46 Manufacturing in Low Cost Countries Manufacturing in low cost countries averaged 36% for 2012, up 10 percentage points from 2011 2013 AASA Pulse: Supplier KPI Benchmarks Year Average Percent of Sales Manufactured in Low Cost Countries 2011 26% 2012 36% 47 Inventory Days on Hand Average days on hand of inventory reported by respondents was 63 days, with nearly a third reporting “Greater than 90 days” Mean = 63 days 2013 AASA Pulse: Supplier KPI Benchmarks 48 Outbound Freight Costs 3.1 – 5% was the most common range for freight costs as a percent of SG&A 2013 AASA Pulse: Supplier KPI Benchmarks 49 Inventory Cost Inventory costs averaged 19% of cost of goods sold; inventory was 20% or more of COGS for 35% of respondents 35% Mean = 19% 2013 AASA Pulse: Supplier KPI Benchmarks 50 Marketing and Forecasting 2013 AASA Pulse: Supplier KPI Benchmarks 51 Marketing Spend Overall marketing spend as a percent of revenue averaged 3% for 2012, though 62% spent 3% or less Mean = 3% 62% 2013 AASA Pulse: Supplier KPI Benchmarks 52 Marketing Spend – Customer Specific Customer specific marketing spend on average was the highest area of marketing spend, with nearly 30% of the overall marketing budget Mean = 30% 2013 AASA Pulse: Supplier KPI Benchmarks 53 Marketing Spend – Advertising Over half of respondents reported marketing spend for advertising comprised less than 20% of their overall marketing budget; mean ad spending was 21% Mean = 21% 57% 2013 AASA Pulse: Supplier KPI Benchmarks 54 Marketing Spend – Trade Fairs Marketing spend for trade fairs averaged 21% of the overall budget for respondents Mean = 21% 2013 AASA Pulse: Supplier KPI Benchmarks 55 Marketing Spend – Other While the previous three categories comprise most marketing spend, 32% of respondents spend 20% or greater of their marketing budget on other promotional tools 32% Mean = 19% Note: Means of the four categories do not add up to 100 percent as not all respondents added up to 100 percent. 2013 AASA Pulse: Supplier KPI Benchmarks 56 POS and Forecasting Data 90% of respondents reported access to POS and forecasting data from channel partners; however only 34% use it “Always” or “Frequently” Are suppliers fully leveraging the data available to them? 2013 AASA Pulse: Supplier KPI Benchmarks 57 Value of POS data (1/3) Nearly two thirds of respondents report that the POS data is “Useful” or “Very useful” in improving their inventory levels and line fill 2013 AASA Pulse: Supplier KPI Benchmarks 58 Use of POS data (2/3) For most respondents, POS data is very useful; data is used as a benchmark for performance and forecasts guide suppliers in projecting growth Throughout your organization, how are you using POS/forecasting data provided by customers? “Guiding light in terms of true product performance in store… We leverage this in combination of our outbound shipments to truly understand demand so we can be responsive to customer needs as well as proactive if we see issues with our key accounts who provide this.” “Helps determine potential demand activity for upcoming periods. Provides a picture of the "health" of the market when consolidated with other customers' performance. Allows collaboration with customers on determining market strategies in given markets.” “To understand trends and to understand forecasting. To help plan for advertising budget.” “Inventory modeling - we just started it, but it is very valuable.” For full results, see Appendix 2013 AASA Pulse: Supplier KPI Benchmarks 59 Use of POS data (3/3) However, a subset of respondents finds limited value in POS data Throughout your organization, how are you using POS/forecasting data provided by customers? “Do not use.” “The forecast error is approximately 50% and this applies to our customers as well. (Therefore ½ of what was made does not sell through for that period, simultaneously ½ of the actual demand is made in an expedite mode or via the good fortune of having raw based on the “minimum buy quantities” required by the supply-chain.” “Rarely used” “Unfortunately, we do not have a lot of additional information provided to us at this time.” “Limited use” “We cannot as it is terribly inaccurate.” For full results, see Appendix 2013 AASA Pulse: Supplier KPI Benchmarks 60 Results Segmented by Company Size 2013 AASA Pulse: Supplier KPI Benchmarks 61 Methodology and How to Use Methodology • • • To obtain further insight into the data, we segmented results for select questions by the aftermarket revenue size of the respondent. We grouped respondents into three size segments: Annual US Aftermarket Revenue Number of Respondents <=$150 million 25 $151-$500 million 20 >$500 million 11 Note: Respondents who did not answer this question were not included in the company size segmentation 2013 AASA Pulse: Supplier KPI Benchmarks How to Use 1. This analysis can provide insight on advantages/disadvantages of size for different metrics. – In other words, are smaller or larger companies more efficient or effective on a given metric? 2. This analysis can also be used to benchmark your company against your closer peers in terms of relative size. – The issues and performance of smaller and larger companies can vary considerably; this analysis helps you understand better how your performance benchmarks against enterprises that are similar to you in scale. 62 Returns by Company Size Respondent Revenue Size Metric <=$150 M $151-500M >$500M 0% 0.5% 0.5% Median 0.5% 1.8% 1.1% Upper Quartile 3.5% 4.5% 3.1% Mean (Avg.) 1.9% 3.4% 2.5% Warranty Returns Lower Quartile Quality Issues as a percent of Warranty Returns Lower Quartile 1.3% 1.3% 1.3% Median 1.3% 1.3% 1.3% Upper Quartile 1.3% 1.3% 1.3% Mean (Avg.) 2.6% 3.1% 1.3% Stock Adjustment and Obsolescence Returns Lower Quartile 0.4% 1.5% 1.5% Median 1.5% 2.5% 1.5% Upper Quartile 4.5% 3.5% 2.5% Mean (Avg.) 2.4% 2.5% 2.4% 2013 AASA Pulse: Supplier KPI Benchmarks Mid-size firms had the largest warranty returns Majority of respondents, despite the size of the company, indicated a small amount of actual quality issues contributing to warranty returns Stock adjustments were relatively the same across company size 63 Fill Rates by Company Size Respondent Revenue Size Metric <=$150 M $151-500M >$500M Lower Quartile 95% 95% 95% Median 95% 95% 95% Upper Quartile 97% 97% 97% 95.4% 95.4% 95.3% Lower Quartile 95% 93% 91% Median 97% 96% 95% 98.5% 97% 98.5% 96% 95.4% 94.7% Lower Quartile 94% 93% 93% Median 95% 95% 93% Upper Quartile 98.5% 97.4% 95% Mean (Avg.) 95.6% 94.6% 93.8% Fill rate as a % of unit volume Mean (Avg.) Fill rate as a % of unit volume was consistent across firm size Fill rate as a % of dollar value Upper Quartile Mean (Avg.) Fill rate as a % of dollar value was highest for smaller firms Fill rate as a % of line items filled 2013 AASA Pulse: Supplier KPI Benchmarks Fill rate as a % of line items filled was lowest with larger firms 64 Shipping Metrics by Company Size Respondent Revenue Size Metric <=$150 M $151-500M >$500M 1.8 1.8 2 Median 2 2 2 Upper Quartile 4 4 3 2.7 2.7 2.5 Order turnaround (days) Lower Quartile Mean (Avg.) Vendor direct (% of business) Lower Quartile 0.1% 1.5% 0.1% Median 1.5% 4% 8.8% 3% 11.3% 13.8% 8.1% 8.2% 10.3% Upper Quartile Mean (Avg.) Order turnaround for larger firms is slightly lower For larger firms there is a more significant portion of their business done via vendor direct Overnight shipping (% of business) Lower Quartile 0.2% 0.2% 0.7% Median 0.2% 1% 1% Upper Quartile 1.7% 1.8% 1.3% Mean (Avg.) 2.1% 3.6% 1% 2013 AASA Pulse: Supplier KPI Benchmarks Medium sized firms have the most overnight shipping as a percent of their business 65 e-Tailing by Company Size Respondent Revenue Size Metric <=$150 M $151-500M >$500M Lower Quartile 0.2% 0.2% 0.2% Median 0.2% 0.2% 0.5% Upper Quartile 0.2% 0.2% 0.8% Mean (Avg.) 2.8% 0.2% 0.7% e-Tailing through Direct Sales Smaller sized firms have sold the most directly in the e-tailing space e-Tailing through Channel Partners Lower Quartile 1.2% 1.1% 1.6% Median 1.2% 2.2% 2.2% Upper Quartile 5.3% 4% 3.5% Mean (Avg.) 3.5% 3.8% 2.6% 2013 AASA Pulse: Supplier KPI Benchmarks 66 Financial Metrics by Company Size (1/2) Respondent Revenue Size Metric <=$150 M $151-500M >$500M 31.5% 24% 24.3% 34% 33% 27.5% Upper Quartile 32.5% 37.5% 37.4% Mean (Avg.) 34.4% 32.2% 29.8% No change -0.4% +0.5% Median +0.5% +0.5% +1.5% Upper Quartile +2.3% +1.9% +1.5% Mean (Avg.) +0.9% +0.4% +1.1% Lower Quartile 1.8% 0.1% 1.3% Median 2.5% 2.3% 1.8% Upper Quartile 4.5% 2.8% 2.3% 4% 2.3% 1.7% Gross Margin (Weight Average, Aftermarket) Lower Quartile Median Smaller firms had the highest gross margins Price Change Year-over-Year Lower Quartile Larger firms experienced the greatest price increase from 2011 R&D (Aftermarket, % Sales) Mean (Avg.) 2013 AASA Pulse: Supplier KPI Benchmarks Smaller firms spend the most on R&D as percent of sales 67 Financial Metrics by Company Size (2/2) Respondent Revenue Size Metric <=$150 M $151-500M >$500M SG&A (percent of aftermarket sales) Lower Quartile 4.5% 7% 8% Median 5.5% 11% 10% Upper Quartile 11.5% 15% 18% Mean (Avg.) 9.8% 12.1% 12.7% Payment Terms to Retailers (in days) Lower Quartile 68 158 68 Median 113 258 258 Upper Quartile 158 326 258 133.7 231.3 183.6 Lower Quartile 3.5 3.7 3.5 Median 9.5 5.5 4 Upper Quartile 11 11 5.5 Mean (Avg.) 7.7 6.9 5.5 Mean (Avg.) Smaller firms had the lowest SG&A Smaller firms had the smallest payment terms to retailers with large and medium firms having a median response of 258 days Inventory Turns 2013 AASA Pulse: Supplier KPI Benchmarks Smaller firms had the largest amount of inventory turns 68 Manufacturing Strategies by Company Size Respondent Revenue Size Metric <=$150 M $151-500M >$500M % of Sales Manufactured In-House Lower Quartile 22.5% 55% 55% Median 65% 75% 85% Upper Quartile 95% 90% 85% 57.6% 68.6% 66.7% 13.1% 15% 35% Median 40% 45% 55% Upper Quartile 95% 65% 85% 47.4% 43.2% 57.5% Mean (Avg.) Larger and medium sized firms manufacture nearly 2/3 of sales in-house on average % of Sales Manufactured in US Lower Quartile Mean (Avg.) Larger firms manufacture in the US more than small and medium firms % of Sales Manufactured in Low Cost Countries Lower Quartile 2.5% 11.3% 15% Median 25% 35% 25% Upper Quartile 55% 55% 55% 34.6% 35% 34.4% Mean (Avg.) 2013 AASA Pulse: Supplier KPI Benchmarks Medium firms manufacture in low cost countries slightly more than others 69 Marketing Spend by Company Size Respondent Revenue Size Metric <=$150 M $151-500M >$500M Marketing Spend – Advertising (% of overall marketing spend) Lower Quartile 5% 15% 5% Median 15% 25% 25% Upper Quartile 30% 35% 25% 18.5% 26.9% 21.7% Mean (Avg.) Medium firms spend the most on advertising as a marketing tool Marketing Spend – Trade Fairs (% of overall marketing spend) Lower Quartile 12.5% 5% 5% 20% 15% 5% Upper Quartile 27.5% 30% 25% Mean (Avg.) 24.2% 19% 18.3% Median Smaller firms tend to spend the most of their marketing budget on trade fairs Marketing Spend – Customer Specific (% of overall marketing spend) Lower Quartile 10% 20% 15% Median 25% 25% 25% Upper Quartile 45% 35% 40% 28.5% 30.3% 28.8% Mean (Avg.) 2013 AASA Pulse: Supplier KPI Benchmarks Customer specific spending is the same regardless of firm size 70 Results Segmented by Product Category 2013 AASA Pulse: Supplier KPI Benchmarks 71 Methodology and How to Use Methodology • • • To obtain further insight into the data, we segmented results for select questions by company product category. Respondents provided the key product categories they were active in: Annual US Aftermarket Revenue Number of Respondents Engine 29 Under Car 21 General Maintenance Parts 20 Chemicals / Paint / Lubricant 8 How to Use 1. This analysis can provide insight on strength / weakness of different product categories. – In other words, are different product segments more efficient or effective on a given metric? 2. This analysis can also be used to benchmark your company against your closer peers in terms of product segment. – The issues and performance of companies in different product segments can vary considerably; this analysis helps you understand better how your performance benchmarks against enterprises that are roughly similar to you in product category. Respondents were able to choose multiple product categories. Their responses were included in each applicable category. Therefore the number of responses in the sum of the categories noted above will exceed the total number of survey responses. 2013 AASA Pulse: Supplier KPI Benchmarks 72 Returns by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant Lower Quartile 0.5% 0.5% 0.5% - Median 2.5% 1.8% 1.8% 0% Upper Quartile 3.5% 3.8% 2.5% - Mean (Avg.) 2.7% 2.6% 2.9% 1% Warranty Returns Chemicals had the lowest median of warranty returns; engine the highest Quality Issues as Percent of Warranty Returns Lower Quartile 1.3% 1.3% 1.3% - Median 1.3% 1.3% 1.3% 1.3% Upper Quartile 1.3% 3.8% 1.3% - Mean (Avg.) 2.2% 4% 3.5% 1.8% Stock Adjustment and Obsolescence Returns Lower Quartile 1.8% 1.5% 1.5% - Median 2.5% 2.5% 2.5% 0.1% Upper Quartile 4.5% 3.5% 4% - Mean (Avg.) 3.1% 2.7% 3% 1% Amount of quality issues was the same regardless of product segment Chemicals had the lowest amount of stock adjustments for 2012; returns were similar for other categories Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks 73 Fill Rates by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant 93.5% 92.5% 93% - Median 95% 95% 95% 97% Upper Quartile 97% 97.3% 97% - 94.6% 94.7% 94.8% 96.5% Fill rate as a % of unit volume Lower Quartile Mean (Avg.) Fill rate as a % of dollar value Lower Quartile 93% 91% 93% - Median 95% 95% 95% 98.2% Upper Quartile 97% 97.3% 97% - 94.7% 94.2% 94.4% 97.7% Mean (Avg.) Fill rate as a % of line items filled Lower Quartile 93% 92.5% 93% - Median 95% 94% 95% 98.3% Upper Quartile 97% 95.5% 97.9% - 94.3% 93.8% 94.6% 95.9% Mean (Avg.) Chemicals had the highest fill rate for unit volume, dollar and line items filled. The other product segments were slightly below Chemicals, but still all roughly achieved the target 95% fill rate. Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks 74 Shipping Metrics by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant Order turnaround (days) Lower Quartile 2 1.8 2 - Median 2 2.5 2 3 Upper Quartile 3 3.3 3 - 2.6 3 2.4 3.1 Mean (Avg.) Order turnaround is lowest for engine and general maintenance parts; highest for Chemicals Vendor direct (% of business) Lower Quartile 0.5% 1.5% 0.5% - Median 2.5% 5% 1% 3% Upper Quartile 12.5% 12.5% 11.4% - 8% 9.2% 6.3% 26.9% Mean (Avg.) Under car participates the most in vendor direct programs Overnight shipping (% of business) Lower Quartile 0.7% 0.2% 0.3% - Median 1.2% 0.7% 1% 0.2% Upper Quartile 2.8% 1.9% 2.5% - Mean (Avg.) 4.5% 2.3% 5% 0.3% All product segments have very little business done via overnight shipping Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks 75 e-Tailing by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant e-Tailing through Direct Sales Lower Quartile 0.2% 0.2% 0.2% - Median 0.2% 0.2% 0.2% 1.2% Upper Quartile 0.7% 1.7% 1.2% - Mean (Avg.) 1.6% 1.8% 2.2% 1.2% e-Tailing through Channel Partners Lower Quartile 1.2% 2.2% 1.2% - Median 2.2% 3.5% 2.5% 1.2% Upper Quartile 3.5% 6% 4.3% - 4% 4.6% 4.2% 2.1% Mean (Avg.) Chemicals sell the most direct through e-tailing The under car product segment estimates e-tailing has the highest share of segment sales. Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks 76 Financial Metrics by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant R&D (Aftermarket, % Sales) Lower Quartile 0.7% 1.3% 1.3% - 2% 1.8% 2.3% 1.8% Upper Quartile 3.1% 2.8% 3.1% - Mean (Avg.) 3.2% 2.4% 3% 2.6% Median General Maintenance spends the most on aftermarket R&D as a percent of sales SG&A (percent of aftermarket sales) Lower Quartile 5.5% 7% 5.5% - Median 9.5% 10.8% 9.5% 9.5% Upper Quartile 15% 23% 17.3% - 11.8% 14% 12.9% 15.9% Mean (Avg.) Under Car has a slightly higher median SG&A compared to other segments Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks 77 Payment Terms by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant Payment Terms to Retailers (in days) Lower Quartile 158 68 113 - Median 258 158 258 113 Upper Quartile 326 258 326 - 221.7 161.7 201.8 149.9 Mean (Avg.) Engine and General Service have the longest payment terms of the product segments to retailers Payment Terms to WDs/Distributors (in days) Lower Quartile 68 68 68 - Median 68 68 68 68 Upper Quartile 113 68 68 - Mean (Avg.) 95.3 81.5 78.5 75.5 Payment terms to WDs/Distributors has the same median across segments, though engine has some outliers Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks 78 Manufacturing Strategies by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant % of Sales Manufactured In-House Lower Quartile 45% 22.5% 15% - Median 65% 65% 75% 75% Upper Quartile 85% 85% 85% - 62.3% 56.8% 52.6% 49.6% Mean (Avg.) % of Sales Manufactured in US Lower Quartile 25% 20% 25% - Median 35% 25% 45% 95% Upper Quartile 65% 60% 55% - 44.2% 41.1% 43.4% 83.6% Mean (Avg.) % of Sales Manufactured in Low Cost Countries Lower Quartile 15% 7.5% 15% - Median 35% 35% 35% 0.3% Upper Quartile 55% 50% 55% - 37.6% 33% 35% 11.9% Mean (Avg.) Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks General Maintenance and Chemicals manufacture the most in-house at median, though the story is the opposite at the mean; some players in these segments have high levels of outsourcing Chemicals manufacture significantly more in the US than other segments More than a third of parts (nonChemicals) manufacturing is in low cost countries 79 Marketing Spend by Product Segment Respondent by Product Segment Metric Engine Under Car General Maintenance Parts Chemicals / Paint / Lubricant Marketing Spend – Advertising (% of overall marketing spend) Lower Quartile 5% 5% 5% - Median 15% 15% 10% 45% Upper Quartile 25% 35% 25% - 20.2% 20.6% 15% 28.6% Mean (Avg.) Chemicals spend the most of their advertising budget on advertising (many players in this segment have branded products) Marketing Spend – Trade Fairs (% of overall marketing spend) Lower Quartile 5% 5% 5% - Median 15% 15% 15% 15% Upper Quartile 25% 25% 25% - 21.8% 17.9% 15.6% 16.4% Mean (Avg.) Marketing Spend – Customer Specific (% of overall marketing spend) Lower Quartile 15% 15% 25% - Median 25% 25% 35% 45% Upper Quartile 35% 45% 55% - 26.4% 32.1% 37.5% 42.1% Mean (Avg.) Spend on trade fairs is roughly the same across product segments Chemicals and maintenance parts spend more of their marketing spend on customer specific initiatives Note: Chemicals product category does not include the lower or upper quartile to ensure confidentiality of those respondents. 2013 AASA Pulse: Supplier KPI Benchmarks 80 Appendix A Profile of Respondents Full Responses to Selected Question 2013 AASA Pulse: Supplier KPI Benchmarks 81 Size of Respondents 2013 AASA Pulse: Supplier KPI Benchmarks 82 Number of Employees of Respondents 2013 AASA Pulse: Supplier KPI Benchmarks 83 Product Segments of Respondents Note: Total does not add up to 100% due to respondents ability to select multiple categories 2013 AASA Pulse: Supplier KPI Benchmarks 84 Throughout your organization, how are you using POS/forecasting data provided by customers? (1/2) “Compare POS data to trends” “Comparing customer generated forecasts to our own internal forecasts” “Component orders” “Demand planning, assortment recommendations, SKU sales and return trends” “Do not use.” “Forecasting. Inventory levels.” “Guiding light in terms of true product performance in store… We leverage this in combination of our outbound shipments to truly understand demand so we can be responsive to customer needs as well as proactive if we see issues with our key accounts who provide this.” “Helps determine potential demand activity for upcoming periods. Provides a picture of the "health" of the market when consolidated with other customers' performance. Allows collaboration with customers on determining market strategies in given markets.” “Identify specific regional / customer trends for new numbers.” “In our sales and operational planning process.” “Input into internal forecast systems” “Inventory modeling - we just started it, but it is very valuable.” 2013 AASA Pulse: Supplier KPI Benchmarks “Limited to sales forecast. Not used consistently for supply chain activities.” “Limited use” “Logistics team is using POS data for one major customer to track new part sales at store level to adjust SKU level forecast and planning to improve fill rates an reduce inventory.” “Mainly used for SKUs on the front end of the sales trend to monitor the ramp up in sales, as well as large changes in trend with mature or declining SKUs.” “Our customers forecasts are vital to our production scheduling and inventory planning to insure high order fill and control inventory costs.” “POS data very useful. Customer forecasts not very accurate, used on exception basis. We review forecasts with the customer when there are large discrepancies to our internal forecast.” “Purchasing / Forecasting; Product Management; Customer Category Management” “Rarely used” “Sales & Operations budgets, PC&L, Supply chain” “Sales forecasting” 85 Throughout your organization, how are you using POS/forecasting data provided by customers? (2/2) “The forecast error is approximately 50% and this applies to our customers as well. (Therefore ½ of what was made does not sell through for that period, simultaneously ½ of the actual demand is made in an expedite mode or via the good fortune of having raw based on the “minimum buy quantities” required by the supply-chain.” “To confirm internal information” “To determine inventory levels” “To improve our fill-rate” “To optimize inventory and order fill” “To order long lead time items and establish inventory levels” “To understand trends and to understand forecasting. To help plan for advertising budget.” “Unfortunately, we do not have a lot of additional information provided to us at this time.” “Use the data to bounce up against current forecast by customer to look for flyers/numbers that are trending significantly upward or downward.” “Used in product rationalization and forecasting” “Used in SIOP process.” 2013 AASA Pulse: Supplier KPI Benchmarks “Using both historical POS with running POS provides much more accurate forecasting capabilities. Comparing both also helps to identify growing and declining trends of specific parts or categories.” “Using it to predict future sales trends; assessing individual customers' share gains/losses.” “We cannot as it is terribly inaccurate.” “We have a dedicated analyst that uses the information to coordinate inventory plans.” “We try to understand customer forecast values and compare to our historic and forecast data to optimize materials management” 86 Appendix B Methodology 2013 AASA Pulse: Supplier KPI Benchmarks 87 AASA Pulse methodology notes • The AASA Supplier Pulse report is an annual benchmarking survey covering key automotive aftermarket supplier performance indicators (KPIs). • The purpose of the Pulse is to provide members with general information on high-level benchmarking of sector performance. The information and opinions contained in this report are for general information purposes only. • Participation is only available to AASA supplier members. Full reports are provided only to survey participants and AASA Board members. • Surveys are sent to senior executives and member representatives at all AASA members. There were 60 responses to this year’s survey. • The survey covers 2012 data (calendar or fiscal year, depending on respondent). Answers were provided by respondents based on actual data if available or best estimates. Most questions were multiple choice, so numbers used in the report represent the midpoint of a selected multiple choice answer. • The survey is anonymous and answers are kept strictly confidential. Therefore, only aggregated results will be reported and individual responses will not be released and will be destroyed after results are compiled. 2013 AASA Pulse: Supplier KPI Benchmarks 88 Contact Information Paul McCarthy Vice President Industry Analysis, Planning and Member Services Office: +1 919.406.8812 | Mobile: +1 248.914.2567 Email: pmccarthy@aasa.mema.org Bailey L. W. Overman Analyst/Coordinator Industry Analysis and Member Services Office: +1 919.406.8823 Email: boverman@aasa.mema.org AASA | Automotive Aftermarket Suppliers Association 10 Laboratory Drive | Research Triangle Park | NC | 27709 | USA www.aftermarketsuppliers.org 2013 AASA Pulse: Supplier KPI Benchmarks 89