The Effects of SAS No. 115

advertisement

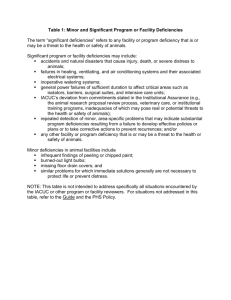

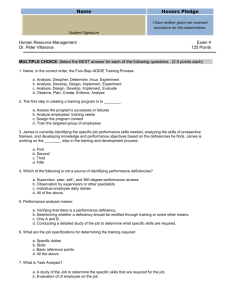

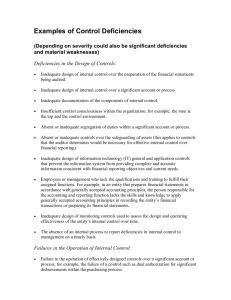

The Effects of SAS No. 115 Presented by YOUR NAME THE DATE Objectives • For you to gain an understanding of a new audit standard affecting your audit engagement and the specific impacts and potential outcomes that result from this standard Why A New Standard? • As with SAS No. 112, the accounting profession believes the new SAS No. 115 may: – Heighten your awareness, as a business owner or someone charged with organizational governance, of internal control over financial reporting – Better enable you to assess your internal control needs and determine the costs and benefits of implementing any new controls to help minimize the risks of financial statement misstatements, including fraud What is SAS No. 115? • Statement on Auditing Standards (SAS) No. 115, Communication of Internal Control Related Matters Identified in an Audit – Supersedes SAS No. 112 by the same name – Provides new definitions of the terms material weaknesses and significant deficiencies – Provides guidance as to how to evaluate whether a deficiency in internal controls is a significant deficiency or materials weakness Components of SAS No. 115 • As with SAS No. 112, as your auditor we must evaluate identified control deficiencies – Then determine whether those deficiencies, individually or in combination, are significant deficiencies or material weaknesses Components of SAS No. 115 • We must communicate, in writing, significant deficiencies and material weaknesses to management and those charged with governance – This communication includes significant deficiencies and material weaknesses identified and communicated to management and those charged with governance in prior audits but not yet remediated Definitions • Deficiency in Internal Control - A deficiency in internal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent or detect misstatements on a timely basis: – A deficiency in design exists when (a) a control necessary to meet the control objective is missing or (b) an existing control is not properly designed so that, even if it operates as designed, the control objective would not be met – A deficiency in operation exists when (a) a properly designed control does not operate as designed or (b) when the person performing the control does not possess the necessary authority or competence to perform the control effectively Definitions • Material Weakness - A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity's financial statements will not be prevented, or detected and corrected on a timely basis Definitions • Significant Deficiency A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance Examples of Control Deficiencies • Examples of circumstances that may be control deficiencies, significant deficiencies, or material weaknesses include: – Inadequate design of internal control over the preparation of the financial statements being audited – Employees or management who lack the qualifications and training to fulfill their assigned functions Examples of Control Deficiencies – Inadequate design of information technology (IT) general and application controls – Inadequate documentation of the components of internal control – Inadequate design of monitoring controls that assess the design and operating effectiveness of the entity’s internal control over time – Inadequate design of internal control over a significant account or process Examples of Control Deficiencies – Insufficient control consciousness within the organization, for example, the tone at the top and the control environment – Absent or inadequate segregation of duties within a significant account or process – Absent or inadequate controls over the safeguarding of assets • This applies to controls that the auditor determines would be necessary for effective internal control over financial reporting An Illustrative Example - #1 • You have requested that we perform the functions necessary to prepare your financial statements since you do not have the resources with the adequate knowledge to prepare your organization’s financial statements according to generally accepted accounting principles An Illustrative Example - #2 • Your controller asks the auditor to calculate the year-end depreciation adjustment and gain or loss on sale adjustment – The adjustment is a material adjustment – The controller does not have the skill to determine the adjustment An Illustrative Example - #3 • Your bookkeeper, who maintains the company’s general ledger, is unable to record the investments and related investment activity because he does not understand the broker’s statement Evaluating the Illustrations • These illustrations may be control deficiencies • We will then determine whether they are a significant deficiency or a material weakness based upon: – The magnitude of the potential misstatement resulting from the deficiency or deficiencies; and – Whether there is a reasonable possibility that the entity’s controls will fail to prevent, or detect and correct a misstatement • These are only some of the many examples of potential control deficiencies and are intended to be for illustrative purposes only and not comprehensive or specific to your audit Communicating Deficiencies • Our consideration of internal control during your audit is not designed to identify all deficiencies in internal control that might be significant deficiencies or material weaknesses – We are only required to communicate in writing those control deficiencies we identify during the audit and determine to be significant deficiencies or material weaknesses, including those that have been previously communicated, whether verbally or in writing, that are not yet remedied Evaluating Options • As a result of your audit, you may wish to have us help you: – Educate your management team and those charged with governance on internal controls as it relates to your organization’s financial reporting – Help you understand the costs and benefits of implementing appropriate controls – Assist in testing current controls or developing and implementing appropriate controls Engagement Scope and Fees • Because we were already communicating in writing those control deficiencies we identified during the audit and determined to be significant deficiencies or material weaknesses, we do not expect any material changes in audit fees this year • However, if there are new control deficiencies or other issues that arise that affect the scope of the audit, we will communicate this to you as we become aware of them Next Steps • We will complete and deliver the audit engagement letter to you • You can determine if there are issues you’d like to discuss or questions you’d like to have us address • We look forward to working with you and your team on your audit! Contact Us At Anytime! • Feel free to contact us with any questions or assistance you need related to your audit at: – Audit Partner/Engagement Contact Name – Audit Partner/Engagement Contact Phone Number – Audit Partner/Engagement Contact Email Address