Saratoga

advertisement

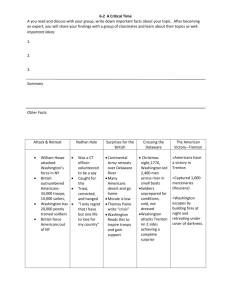

“Building a Leadership Legacy” North Carolina Healthcare Human Resource Assoc ROI of Human Capital Saratoga Agenda – – – – Over view of Saratoga Institute Current Workplace Trends ROI of Human Capital What Employer of Choice Companies are Doing Saratoga Saratoga Institute Helping clients improve profitability and productivity through the strategic application of human capital intelligence Saratoga Saratoga Institute Who Are We? – Founded in 1977 by Dr. Jac Fitz-enz – Based on over twenty years experience in human capital research – Data and interviews from over 900 companies in 19 industries – Over 1 million data elements from potential, current and past employees – Relies on continuing academic research and studies Saratoga Saratoga Worldwide 10 affiliates reaching clients in 25 countries Belgium - France - Germany - Italy - Netherlands Portugal - Spain - Sweden - Switzerland Canada U.K. SI Mexico Guatemala Venezuela Malaysia Singapore Brazil Indonesia Chile Uruguay Argentina South Africa Hong Kong Philippines Micronesia Australia Australia New Zealand What We Do – Publisher of the world’s largest database of human capital intelligence – Experts in Employee Commitment Surveys and Consulting – Thought leaders in the human capital industry – Design and implement Human Capital programs Saratoga The Big Picture Current Workplace Trends The People Problem 100 80 60 40 20 0 20 40 60 GDP +96% BIRTHS -33% 1965 1998 Saratoga The Trends Escalating Costs Cost/Hire -exempt Time to Start Voluntary Sep 1-3 yrs Training Invest Factor 1997 2228 6481 58 26% 441 2000 3072 8932 78 30% 495 2002 3655 10,581 92 33% 549 *Data based on research from Saratoga Institute Saratoga 2005 4529 13,054 113 38% 630 Current Workforce Trends – Unemployment is low: - Latest is 4.1%* - Range of 3.9 to 4.1 since October, 1999 – Turnover is high: - Median Separation Rate for all industries is 16.5%** – Absenteeism is high: - The rate of absenteeism has increased by more than 14% since 1996*** - On average, absenteeism costs $603 per employee Sources * U.S. Department of Labor ** Saratoga Institute, Human Capital Benchmarking Report 2000 *** CCH Inc. Unscheduled Absence Survey, 1996 Saratoga Hospitals / Healthcare Industry Current Status Voluntary Separations by Length of Service 0 -1 year 32.9% 1+ - 3 years 29.2% 3+ - 5 years 11.1% 5+ - 10 years 12.0% 10+ years 12.3% Turnover in early time frames leads to increased staffing and training costs Source: Saratoga Institute 2000 Benchmark Data Saratoga Hospitals / Healthcare Industry Current Status Add Rate: Number of new jobs added last year National Median Highest 6.4% 21.7% (services industry) Lowest 1.4% (chemicals/petroleum industry) Hospitals/Healthcare 2.9% Industry in slow growth period Source: Saratoga Institute 2000 Benchmark Data Saratoga Hospitals / Healthcare Industry Current Status Replacement Rate: Number of jobs needing replacement hires last year National Median 13.8% Highest 22.7% (services industry) Lowest 4.7% (manufacturing industry) Hospitals/Healthcare 21.7% Industry has very high turnover Source: Saratoga Institute 2000 Benchmark Data Saratoga Current Workforce Trends Changing Demographics Generation 1996 2000 2005 Pre-Baby Boom (Born before 1946) 26% 15% 6% Baby Boom (1946-64) 50% 50% 50% Generation X (1964-) 24% 35% 44% -Key talent aging -Median age increased from 28 in 1970 to 35 today to 40 by 2010 -2001 Baby Boomers become eligible for early retirement -6.5 million will turn 55 by 2002 -15% decline in 35-44 year olds over the next 15 years Despite the tight labor market, only 65% of the companies today actively recruit older workers to fill their vacancies Saratoga Current Workforce Trends Changing Demographics – 75% of the jobs of the future will be knowledge based jobs – and yet... – 75% of current workforce (age 25 to 34) have not completed college – 70% of workforce will not be college graduates in the next decade – 21% of the current adult population has only basic literacy skills – 75% of workers will need retraining within the decade Training Invest Factor 1997 2000 2002 2005 $441 $495 $549 $630 Saratoga Today’s Organization Struggling with Employee Commitment – Profound Organizational Upheaval – – – – – Uncertainty Lack of A Clear Corporate Vision Mergers and Acquisitions Activity Intense Competition for Talent Changes in Executive Management – – – Share holder value Impact of Unfilled Jobs Struggle to maintain work/life balance – Pressure to Deliver Results – Decreased Productivity – Apathy – High levels of turnover Saratoga Five Most Negative Gaps Concern Upper mgmt leadership skills GAP 2.32 Current bonus or add’l pay plans Earnings potential 2.26 2.12 Company stability Company loyalty to employees 2.16 2.12 Saratoga Current Workforce Trends Maintaining a competitive advantage means focusing on: - Recruitment - Retention - Becoming an “Employer of Choice” Saratoga ROI of Human Capital Saratoga’s Approach In A Knowledge Economy, The Primary Profit Lever is People Saratoga The Secondary Profit Lever Is Information -Hard and Soft Data -Employee Opinions -Saratoga Institute Human Capital Benchmarks Saratoga Information Is Power Without Objective Data, People Have Opinions With Objective Data, People Have Competitive Advantage Saratoga Importance Of Intangibles “...the factors most important to economic growth and societal wealth are intangible, such as intellectual capital, research and development, brand names and human capital.” Unseen Wealth: Report of the Brookings Task Force on Understanding Intangible Sources of Value Saratoga Measurement State Of The Art “81% stated their performance measurement system is not well aligned with corporate strategies”* * Cap Gemini Ernst & Young Center for Business Innovation - 2000 Saratoga Uses For Hard Data Communicate Performance Expectations See (vs. “feel”) & Understand Outcomes Compare to Standards / Benchmarks Identify Performance Gaps Support Resource Allocation Decisions Recognize & Reward Performance Saratoga Performance Analysis Unit Cost of Products & Services Cycle Time of Key Processes Volume of Output over Input Error or Defect Rates (Quality) Customer Satisfaction Scores Saratoga System Linkage Enterprise Goals Knowledge Management Business Unit PQS Objectives HC Management Acquire - Maintain - Develop - Retain Saratoga Human Capital Value Chain ENTERPRISE GOALS 1 Financial: Profit - EPS Position: Market Share Brand: Sign of Quality Reputation: Employer of Choice OPERATING OBJECTIVES 2 HUMAN CAPITAL MANAGEMENT Hire Pay Support Develop Retain Service: Customer Satisfaction Quality: Six Sigma Productivity: Unit Cost Cost Time Volume Quality Reaction 4 3 Saratoga Human Capital Value Case Study Organization Profile: – Multi-location healthcare provider with a workforce of 5,000. – Hospitals/Healthcare Organization Performance Metrics for X-ray technicians. – Waiting time for Drs. scheduling patient tests. – Number of patients scheduled. – Number of tests completed. – Number of tests that have to be redone. – Revenue generated per test. Saratoga Human Capital Value Case Study Human Resource Management: – Management responsible for recruiting and interviewing. – Criteria for hire may vary depending on urgency of need for X-ray technician staff. – Criteria for needed skills vary. – Division HR supports managers once candidates are identified. Provides screening support and assistance with hiring technicians: background checks, offer and processing of new hire paperwork. Saratoga Human Capital Value Case Study Current State – Time to start for X-ray technician is 90 days average. – Turnover for X-ray technicians with less than 2 years of service is 65%. – There are 200 open positions for X-ray technicians at this healthcare organization. Saratoga Human Capital Value Case Study Time to Start 90 Days Inconsistent Hiring Criteria X-Ray Technician Team Penalties for delays Fewer customers served Less revenue per test Missed Performanc e Goals Customer Delayed scheduling time Redone tests Missed Organization Performance Metrics Saratoga Cost of the Turnover Gap Using the Saratoga Data Cost Per Hire measures the average dollars spent on hiring costs per employee hired. Average Cost Per Hire for Hospital/Healthcare Industry $ 1,254 Multiply by 200 open positions with average time of 1 quarter to fill Results in turnover costs of at least $250,800 per quarter Extending Tenure Measurably Decreases Costs Cost Per Hire Source: Saratoga Institute 2000 Benchmark Data Saratoga Cost of the Turnover Gap Using the Saratoga Data Revenue Factor measures the dollars of revenue generated per FTE annually (productivity measure) Median Revenue Factor for Hospital/Healthcare Industry $ 102,438 Divided by 4 = revenue per FTE per quarter $ 25,609 Multiply by 200 open positions with average time of 1 quarter to fill Results in revenue loss of $5,121,800 per quarter Reducing Time to Start Can Increase Revenue Revenue Factor Source: Saratoga Institute 2000 Benchmark Data Saratoga Human Capital Data Management Workforce Planning Acquisition Retention Support Development Evaluate the Effect Saratoga Human Resource Data Points Staffing Developing Retaining Cost Cost / Hire Cost / Trainee Cost / Turnover Time Time to Fill Cost/Trainee Hr Turnover by LOS No. Hired No. Trained Turnover Rate Quantity Quality Hire Rating Skills Attained Readiness Reaction Mgr Satisfac. Trainee Response Turnover Reason Saratoga Human Capital Management Scorecard Acquisition Cost per Hire Time to Fill Jobs No. & Quality of Hires Maintenance Average Pay Benefits / Payroll Process Costs Retention Voluntary Separations Separation by LOS Cost of Separations Development Training Cost / Payroll Training Hours / EE Training ROI Job Satisfaction Employee Morale Saratoga Effects On Operational Processes Process Recruiting Change Time to fill shortened by implementing new staffing program Impact Value Fill 14 days faster, meet Scheduling Demands Patient Satis. Higher Rev / day = $XXX Increase Cust Sat/Dr. Satis Quality rating increases = $XXX Saratoga Operations Data Points Service Quality Productivity Cost Cost / Contact Redo Cost Cost per Serv Time Time to RespondRecall Rate Time to Treat Volume Calls Handled Rework Rate Errors Misinformation Misdiagn Rate Human Patient Satisfaction Patients Trted % Misstrd Turnover Rate Srvc / Worker Saratoga Human Capital Corporate Scorecard Financial Human Revenue / FTE Accession Percent Human Capital Cost Contingent Percent Human Capital ROI Professional Ratio Human Capital Value Added Supervisory Ratio Separation Percent Human EVA Saratoga “If you don’t measure your results, you’re only practicing.” Robert Galvin Retired Chairman Motorola Saratoga Human Capital Value HCROI: Revenue $1,000,000 Expense 800,000 Pay/Benefits 500,000 Nonhuman 300,000 Adjusted Profit 700,000 Divided by Pay & Ben 500,000 HCROI Ratio = $1.00 : $1.40 *Return on investment on $ spent on people Saratoga Company Profile Report KPI SamCo Results Revenue/FTE $125,000 Expense/FTE HCROI Ttl Comp / Exp Ttl Lbr Cost / Exp Mgt Ratio Competitor Industry Results Mean $120,000 $110,000 110,000 95,000 90,000 $1 : 1.43 $1 : 1.86 $1 : 1.58 30% 32% 5.50 - 1 26% 31% 33% 38% 8.37 - 1 8.08 – 1 Saratoga Hire / Retention Report KPI SamCo Results Hire Rate Add (Grow) Replace 17.1% 2.8 14.3 CPH - EX Fill Time - EX T/O - EX Training Comp HR Investment $8,573 38 7.5% 1.12% 0.39% Competitor Industry Results Mean 11.6% 5.5 6.1 18.4% 8.3 10.1 $9,847 68 $9,010 65 3.6% 6.6% 1.45% 0.85% 1.86% 0.68% Less time and $ spent on Human Capital side of the org. Saratoga Best Practices: Critical Elements Keys to Winning and Keeping Talent • Develop retention strategies • Develop talent Instill Talent Mindset Improved Financial Performance: • Recruit talent continuously • Build high-performance culture • Create “extreme” employee value proposition Top Talent Firms 1.7 times greater RSE than Mid Talent Firms Adapted from McKinsey’s War For Talent 2000 Saratoga Employee Dissatisfaction Voluntary Terminations* Compensation Supervision 16% Opportunity Leadership 12% 19% 12% * 14,180 interviews from 50 companies in 2000 Saratoga Benchmark Database Revenue & Expense Headcount & FTEs HR Department Cost & FTE Ratio Compensation Cost Management Benefits Cost Management Staffing Costs - Time - Volume Separation Rates & Costs Training Costs & Volume Employee Values & Needs Industry Size Region Growth Saratoga What Successful Organizations Are Doing – Retain Key Talent - Attract, Assimilate, Develop – Effectively Manage Workforce Costs – Distinguish Between Core and Non-Core Capabilities – Measure the Impact of Human Capital – Implement Efficient Technology Solutions – Foster High Levels of Employee Commitment Saratoga Saratoga’s Value Proposition Assessment Executio n Strategy Intelligence Information Data Time Saratoga If you measure it, you can understand it. If you understand it, you can improve it. Saratoga