Home Depot Group 2

advertisement

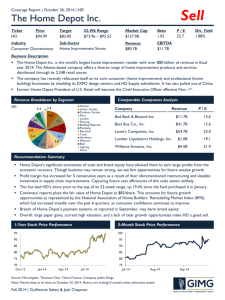

HOME DEPOT GROUP 2 ◘ ◘ ◘ ◘ ◘ Dillon Shepley Jayson Brayall Jeff Austin Jeff Taylor Benjamin Howard I. CURRENT SITUATION DILLON SHEPLEY A. Current Performance The company continued to expand and topped many company records in 2005 including earnings per share, operating margin and net earnings records. They retained the spot as the world’s largest home improvement retailer and the second largest retailer in the United States behind Wal-Mart. • • • • • • • Opened more than 900 stores from 2000-2005 Sales increased from $45.7 billion in 2000 to $81.5 billion in 2005 Earnings per share more than doubled in the same time Employed 345,000 associates Average sales per customer ticket reached 57.98, an all-time high 1,832 Home Depot stores Went from 0 to number 3 in the core appliance market share I. CURRENT SITUATION DILLON SHEPLEY B. Strategic Posture 1. Mission: • The Board of Directors (the "Board") of The Home Depot, Inc. (the "Company") is committed to maximizing long term shareholder value while supporting management in the business and operations of the Company, observing the highest ethical standards and adhering to the laws of the jurisdictions within which the Company operates. • Strong Business Code of Conduct and Ethics I. CURRENT SITUATION DILLON SHEPLEY B. Strategic Posture 2. Objectives • Enhancing the Core, extending the business and expanding the market. • Maintain and grow its leadership position in the home improvement retail worldwide. • Become the nation’s largest diversified wholesale distributor • Become number one in services • Become the largest home improvement retailer in both Canada and Mexico. • Increase direct-to-consumer channels • Compounded annual sales growth of 9%-12% • Compounded earnings per share growth of 10%-14% • Open 400-500 new stores • Increase operation margin • Have a cumulative operating cash flow of $50 billion • Cumulative capital expenditures of $17-20 billion • Grow Home Depot Supply sales • Increase efficiency • Increase number of customers applying for credit I. CURRENT SITUATION DILLON SHEPLEY B. Strategic Posture 3. Strategies • Introduced self checkout, Back End Automation and Re-engineering and centralized automated replenishment. • Acquired 21 companies • Remain prepared for weather phenomenon such as hurricane Katrina. •Served both the Do-It-Yourself (DIY) and Do-It-For-Me (DIFM) customer. • Better serve the professional customer. • Modernize the stores while updating their product lines. • Expand into multiple channels. • Expand into new markets. • Use technology to increase efficiency examples in clued computerized point of sale system, electronic bar code scanning system, and a UNIX server. • Become Sustainable. • Differentiate itself from its competitors through customer service. • Employ only highly qualified and helpful employees. • Demonstrate methods and techniques of performing a job safely and efficiently to the customer. • Offered credit programs and reduced charge card approval process time. I. CURRENT SITUATION DILLON SHEPLEY B. Strategic Posture 4. Policies Main policies • • • • • Improve everything we touch Superb Service Be a good corporate citizen Behave Ethically Act with integrity After Bob Nadelli • Centralized management • Organize the company • Emphasis on military efficiency • Hire veterans • Disciplined manager corps Prior to Bob Nardelli in December of 2005 • Decentralized management and decision making. • Entrepreneurial innovation and risk taking. • High levels of employee commitment and enthusiasm. • Bond with customers and the communities • Orange-blooded culture which emphasized individuality, informality, nonconformity, growth and pride. II. STRATEGIC MANAGERS JAYSON BRAYALL A. Board of Directors • • • • • • Robert Nardelli John L. Clendenin Gregory D. Brenneman Claudio X. Gonzalez David H. Batchelder Kenneth G. Langone • • • • • • • Angelo R. Mozilo Thomas J. Ridge Laban P. Jackson, Jr. Lawrence R. Johnston Helen P. Johnson – Leipold Bonnie G. Hill Milledge A. Hart II. STRATEGIC MANAGERS JAYSON BRAYALL A. Board of Directors (continued) • • • Majority of directors on the board Nardelli taking advantage of Home Depot’s publically traded stock. During the 2006 AN meeting, the Board was strongly accused of lacking independence and indeed did not participate in person. II. STRATEGIC MANAGERS JAYSON BRAYALL B. Top Management 1. The case and the 2006 Annual Report list the following as the managers of Home Depot. The majority had greater than three years with the corporation. • Management experience came from diverse external backgrounds • The internal experience base has been selected from medium to long term managers • Top management’s has established a strategic approach to corporate management. • Nardelli was empowered to bring on like minded upper level managers to match his vision. • Home Depot’s future as the industry leader was openly questioned • No information revealed the amount of executive stock held, with the exception of Nardelli. • During FY 2006, six uncertified, class actions were filed • The company has longed been known for its good corporate citizenship. II. STRATEGIC MANAGERS JAYSON BRAYALL B. Top Management 2. The annual report identifies the following as management for Home Depot. It also lists a separate listing of what it calls the Home Depot Leaders. • Roger W. Adams • Francis S. Blake • Timothy M. Crow • Joseph J. DeAngelo • Robert P. DeRodes • Marvin R. Ellison • Craig A. Menear • Bruce A. Merino • Paul Raines • Ricardo Salvidar • James C. Snyder, Jr. • Carol B. Tom’e • Annette M. Verschuren II. STRATEGIC MANAGERS JAYSON BRAYALL B. Top Management 3. The following is an additional listing taken from the Annual Report but not clarified in the text • Ms. Diane S. Dayhoff • Mr. Brad Shaw No historical or biographical information was published EXHIBIT #5 JAYSON BRAYALL Exhibit #5A 2007 2006 2005 Net Earnings Reconciliation of Net Earnings to Net Cash Provided by Op Activities: 5,761 5,838 5,001 Depreciation and Amortization Impairment Related to Disposition of EXPO Real Estate Stock-Based Compensation Expense Changes in Assets and Liabilities, net of the effects of acquisitions: 1,886 0 297 1,579 78 175 1,319 0 125 96 (358) (266) Increase in Merchandise Inventories (563) (971) (849) (Increase) Decrease in Other Current Assets Increase in Accounts Payable and Accrued Liabilities (225) 531 16 148 29 645 (Decrease) Increase in Deferred Revenue (123) 209 263 (Decrease) Increase in Income Taxes Payable (172) 175 2 Increase (Decrease) in Deferred Income Taxes (Decrease) Increase in Other Long-Term Liabilities 46 (51) (609) 151 319 119 7,661 6,620 6,632 FY Ends each January(amounts in $M) CASH FLOWS FROM OPERATING ACTIVITIES: Decrease (Increase) in Receivables, net Net Cash Provided by Operating Activities III. EXTERNAL ENVIRONMENT JEFF AUSTIN A. Natural Physical Environment: Sustainability Issues • The elimination of unnecessary packaging, along with recycling, has helped Home Depot in their bid for sustainability. They have also worked with training employees and customers to educate them on the importance of conservation and resource efficiency as well minimizing environmental health issues and safety risk associated with them. They are definitely trying to be a leader on the forefront when dealing with sustainability. • The reaction to Hurricane Katrina’s devastation shows how the natural environment could affect Home Depot business and it’s relation with the local community in particular. This is just one example from the text. Imagine if a tornado ripped through a town or a volcanic eruption disturbed Seattle area as it did in 1980. Home Depot would be affected by any of these natural disasters. III. EXTERNAL ENVIRONMENT JEFF AUSTIN B. Societal Environment a) Economic • Economic models established by company helps determine direction of industry (O) • Near record level in home ownership increases demand for DIY projects (O) • Expansion into Canada & Mexico offers new stakeholders/consumers (O) • Sales changed seasonally, winter being a low-growth quarter (T) III. EXTERNAL ENVIRONMENT JEFF AUSTIN B. Societal Environment b) Technological • Installation of self checkout kiosk decrease time in store and minimize person to person contact (T) • Internet became another channel for consumers to purchase products (O) • Addition of point-of-sale system, electronic bar code, and a UNIX server assisted in efficient tracking a buyer trends (O) • A second technology center was opened in Mexico (O) • Overall upgrades to financial services in Mexico, call centers, and websites help advance sales and revenue tracking (T) c) Political/Legal • CEO are compensated up to 50% bonuses annually (T) • Managerial level employees receive at a minimum 25% incentive pay (T) • Floor workers and lower level employees receive no bonuses (T) III. EXTERNAL ENVIRONMENT JEFF AUSTIN B. Societal Environment d) Socio Cultural • • • • • Employees have opportunity for a cradle to the grave job (O) Train employees based on a bottom-to-top sequence (O) Informality among employees prior to Nardelli (T) Huge contributor during Hurricane Katrina relief (O) CommUnity Grants cleaned up play ground for children (O) Even though Home Depot has expanded outside the US borders, they still haven’t left North America. These factors have not been tested elsewhere. III. EXTERNAL ENVIRONMENT JEFF AUSTIN C. Task Environment • • • • • • Threat of new entrants – Low Bargaining powers of buyers – Medium Threat of substitute products or service – Low Bargaining power of suppliers – Medium Rivalry among competing firms – High Power of unions, government, special interest groups – Medium EXHIBIT #1 JEFF AUSTIN D. Summary of External Factors Weight Rating Weighted Score Record-level home sales 0.2 4 0.8 Addition of UNIX 0.05 2.8 0.14 Employee training 0.1 3.6 0.36 Katrina relief 0.15 3.2 0.48 Expansion across borders 0.1 2.5 0.25 Self-checkout kiosk 0.1 3 0.3 Employee compensation 0.15 4.5 0.675 Change in seasonal sales 0.05 2.8 0.14 Informality among employees` 0.1 2.5 0.25 Totals 1 External Factors Opportunities Threats 3.395 Comments IV. INTERNAL ENVIRONMENT: STRENGTHS AND WEAKNESSES JEFF TAYLOR A. Corporate Structure • Management consists of a 13 member leadership team. These 13 Executive Officers work together to successfully manage the company. • CEO Robert Nardelli is very involved in every managerial decision. He gives the final word on what percentage of full time and part time employees he wants and where he wants them. IV. INTERNAL ENVIRONMENT: STRENGTHS AND WEAKNESSES JEFF TAYLOR B. Corporate Culture • Home Depot emphasized an “orange-blooded culture” that emphasized individuality, informality, nonconformity, growth, and pride. This was promoted by to of the company founders, Bernard Marcus and Arthur Blank. • The senior executives recognize the amount of young people that work for the Home Depot and they want these employees to feel comfortable, relaxed, and secure in their positions. • When Bob Nardelli took over, he did away with the former concepts of this decentralized entrepreneurial venture. He brought a more rigid structure to his employees. • Staff strongly opposed the changes made by Nardelli and 98% of the top executives left the company. IV. INTERNAL ENVIRONMENT: STRENGTHS AND WEAKNESSES JEFF TAYLOR C. Corporate Resources 1. Marketing • Offer a wide array of high-quality goods at low prices, while offering help from knowledgeable and helpful employees. • They used sponsorships that were viewed by millions including: NASCAR, U.S. Olympics team, and ESPN College Gameday. • Offered service to three primary customer groups: DIY (Do IT Yourself) Customers, DIFM (Do It For Me) customers, and Professional Customers. IV. INTERNAL ENVIRONMENT: STRENGTHS AND WEAKNESSES JEFF TAYLOR C. Corporate Resources 2. Finance • In 2005 sales increased almost 100% from 2000 to reach $81.5 billion. • Since 2000 nearly $13 billion was returned to shareholders in the form of dividends and share repurchases. • Average ticket sale hit an all time high in 2005 reaching $57.98 per customer. • Common stock actually dropped by 30% since Nardelli took the company over. • Nardelli is amongst six other CEOs who Fortune magazine identified in an article entitled, “The Real CEO Pay Problem”. He had given himself pay and benefits exceeding $13 million in value annually. IV. INTERNAL ENVIRONMENT: STRENGTHS AND WEAKNESSES JEFF TAYLOR C. Corporate Resources 3. Research and Development • In 1990 Home Depot tested a new Store Productivity Improvement program designed to improve storage and merchandise replenishment on the floor. • They tested renovations that would enhance customer access, reduce customer shopping time, and streamline merchandise stocking and delivery. 4. Operations and Logistics • Service objectives were focused around the Do It Yourself idea. Management wanted the customers to feel confident in themselves to do the job through the guidance they receive from the employees. • They offer power tool and truck rentals, Do It Yourself plans, Do It For Me plans, Commercial customer sales, and skillful and knowledgeable employees at the customers disposal. IV. INTERNAL ENVIRONMENT: STRENGTHS AND WEAKNESSES JEFF TAYLOR C. Corporate Resources 5. Human Resources Management • As of January, 2006, Home Depot employed 345,000 people. 68% of these employees are full time and the rest are part time. • There are no unions, as the employee relations with the company are very good. • Company goal is to maintain employee turnover at no more than 20%. 6. Information Technology • Each store contains the typical point-of-sale system, bar code scanning system, and a UNIX server. • The charge card approval waiting time was recently reduced to less than 30 seconds to speed up customer check out time. • Home Depot continuously searches for updates to its information systems to accompany its growth and reduce its control costs. EXHIBIT # 2 JEFF TAYLOR EXHIBIT 2 Internal Factors Weight Rating Weighted Score Comments Skilled, happy employees 0.15 4.00 0.60 Want to help Involved senior management 0.10 3.00 0.30 Important Product selection 0.20 4.50 0.90 Wide variety Service options 0.15 3.50 0.53 DIY, DIFM Good advertising 0.15 3.40 0.51 Widely viewed New CEO management method 0.10 3.50 0.35 Original employees unhappy Employee Retention 0.05 2.00 0.10 High turnover rate Overpaid CEO (public issue) 0.10 3.00 0.30 Public is unhappy with this Strengths Weaknesses Total Scores 1.00 3.59 V. ANALYSIS OF STRATEGIC FACTORS BENJAMIN HOWARD A. Situational Analysis (SWOT) 1. Strengths • Rapid Deployment • Predictable and profitable growth Strongest balance sheet • Number 3 in the core appliance market share Secured 10% of the U.S. Market • Largest home improvement retailer Canada & Mexico • Served three primary customers Do-It-Yourself Do-It-For-Me Professional customers • Store Productivity Improvement (SPI) • Concern for Environment • “Recession proof” • No single supplier • Management and employee relations • Brand Awareness V. ANALYSIS OF STRATEGIC FACTORS BENJAMIN HOWARD A. Situational Analysis (SWOT) 2. Weaknesses • • • • Carpet Installation Didn’t inspire customer service Negative comparable store sale figure Product Recalls 3. Opportunities • • • • • • • • Introduce new products Maintain and grow leadership position Become the Nation’s largest diversified distributor Become number one in services Increasing direct-to-consumer channels New operational Initiatives Tremendous potential for future growth International Expansion V. ANALYSIS OF STRATEGIC FACTORS BENJAMIN HOWARD A. Situational Awareness (SWOT) 4. Threats • Reorganization Initiatives • Increase demand for power tools • Growth in online purchasing B. Review of Current Mission and Objectives Mission Statement • To provide the best customer experience in home improvement retail, the best place to work for our associates and the best place to invest Objective • Cannibalize • Attend to customer EXHIBIT #4 BENJAMIN HOWARD Liquidity Ratio Current (Current Assets/Current Liabilities) 2005 1.3 2006 1.18 Quick (current Assets-inventory/current liabilities) 0.401 0.306 Leverage Ratio Debt to Total Assets (Total Debt/Total Assets) Debt To Equity (Total Debt/Total Assets) Activity Ratios Inventory Turnover-sales (Net Sales/Inventory) Average collection (days) (Inventory/COGS divided by 365) Fixed Asset Turnover (Sales/Fixed Asset) Total Asset Turnover (sales/total asset) Profitability Ratios Gross Profit Margin (Sales-COGS/Net Sales) Net Operating Margin (Net Profit After taxes/Net Sales) Profit Margin on Sales 1-(COGS/Sales) 6.00% 1% 1.37% 8.08% 6.40% 75.7 76.8 1.87% 1.83% 33.50% 32.80% 10.70% 32.8 Return on Total Assets (Net Profit After Taxes/Total Assets) 12.00% 13.00% Return on Equity (Net Profit After taxes/Shareholder’s equity) 21.00% 20.00%