Tax Issues slideshow - Bradley Kirschner CPA

advertisement

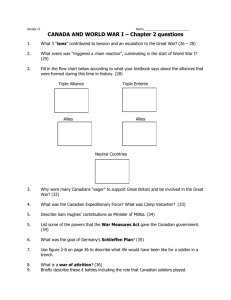

US Income Tax Issues for Expatriate Canadians Americans that have lived in Canada Relocations to the USA Bradley Kirschner, TEP, CA, CPA Certified Public Accountant since 1972 Society of Trust and Estate Practitioners Ten years trust tax banking experience Individual tax practice for 25 years Chartered Accountant in British Columbia since 2004 Topics to be Covered Residence for Tax Purposes The Canada – US Income Tax Treaty Comparison of Individual Income Tax Systems Leaving Canada First year in the US Common Compliance Issues RRSP/RRIF Non-US Bank and Financial Accounts Controlled Foreign Corporations Mutual Funds Tax Free Savings Accounts Registered Education Savings Plans Records to maintain Using Grandma’s Canadian Address Canadian Rental Property Residence Immigration – Visa holders are non-residents Income Tax – Residence is a mechanical 183 day test Resident – tax on worldwide income plus disclosure Non-Resident – tax on US source income only Canada – US Income Tax Treaty Will normally override the law in both countries Last amended in 2007 Article IV contains tie-breaking provisions for determining residency Permanent Home Centre of vital interests Habitual abode Citizenship Competent authority Comparison of Individual Income Tax Systems Canada US Individual Returns for each spouse Potential Joint Returns Income from all sources Less limited deductions Income from all sources Less limited deductions Taxable Income Adjusted Gross Income Less itemized or Standard Deduction Excess medical Taxes Interest Charitable Contributions Miscellaneous deductions Less Personal Exemptions Taxable Income Taxable Income Canada US Federal Tax Less Credits Personal Medical Charitable Contributions Less Foreign Tax Credit Federal Tax Provincial Tax (except Quebec) Less Credits Personal Medical Charitable Contributions Less Foreign Tax Credit (State taxes administered by each State) Less Foreign Tax Credit Net Provencal Tax Net Tax before payments Net Tax before payments Leaving Canada Canada taxes worldwide income earned while a resident plus Canadian sources. Departure Tax – deemed to have sold all property at FMV (Except Canadian Real Estate) RRSP accounts remain untaxed until distribution Non-business Canadian Income subject to withholding First Year in the United States Non-Resident (Does not meet the 183 day test) Only US source income subject to tax No joint return with spouse No Standard Deduction Limited Itemized Deductions Income Taxes Charitable Contributions Miscellaneous Deductions Resident Dual Status Year US source income prior to residence subject to tax Worldwide income after residency starting date subject to tax No joint return with spouse No Standard Deduction All Itemized Deductions available Election for Married Couples Treated as full-year residents Worldwide income for the year subject to tax File a joint return Standard deduction available Double taxation relief Foreign Earned Income Exclusion Foreign Tax Credit Election to be Treated as a Resident Must meet the 183 day test in year two Resident from the residency starting date in year one Why? Tax on worldwide income All itemized deductions are available Joint return election if married RRSP/RRIF Canada will withhold tax at distribution Not a US qualified plan Income taxed today in the US Income taxed upon distribution by Canada (Double Taxation) Election under the Treaty to defer tax until distribution Must File Form 8891 Non-US Bank and Financial Accounts Must file the FBAR – Form TD F 90-22.1 if the total of the maximum values of all accounts is $10,000 US or more Includes Bank Accounts, RRSP, Securities, Mutual Funds If the total of the maximum values of all accounts (expanded definition) exceeds the threshold, must file Form 8938, Statement of Specified Financial Assets. Significant Penalties come with each form. Controlled Foreign Corporation Generally 10% or more ownership, but complex tests to determine who must file. Reporting of the financial information of the foreign corporation. May result in the current US taxation of the Shareholder’s share of certain foreign income. This is similar in concept to the Canadian taxation of Foreign Accrual Property Income (FAPI) Canadian Mutual Funds Reportable on the FBAR form. May be a Passive Foreign Investment Company (PFIC). Costly in terms of current taxation & compliance. If a PFIC, must prepare Form 8621- Return by a Shareholder of a Passive Foreign Investment Company Applies to taxable accounts—not RRSP. Don’t hold Canadian Mutual Funds Tax Free Savings Accounts Registered Education Savings Plans Both are currently taxable in the US US Reporting Requirements Form 3520-A - Annual Information Return of Foreign Trust with a US Owner Form 3520 – Annual Return to Report Transactions with Foreign Trust and Receipt of Certain Foreign Gifts Records to Maintain Assets subject to the Canadian Exit Tax (deemed sale at Fair Market Value) have a US tax basis of FMV at date of immigration. You should maintain a record of those values. RRSP/RRIF distributions will taxed by the US as an annuity—you should maintain a record of your investment in the account and the value at the time of immigration. Using Grandma’s Canadian Address Jeopardize non-resident status Payment of Canadian taxes on income Securities Law Issues Canadian Rental Property Withholding required at 25% of gross rents. Can file a Section 216 Return and pay tax on the net rental income. Can file a form NR6 and have withholding on estimated net rental income. Must file a Section 216 Return Long-term implications of claiming Capital Cost Allowance (Depreciation). Bradley Kirschner, TEP, CA, CPA 180 Nickerson Street, Suite 301 Seattle, WA 98109-1631 (206)378-1886 brad@bwkcpa.com www.bwkcpa.com