A28

advertisement

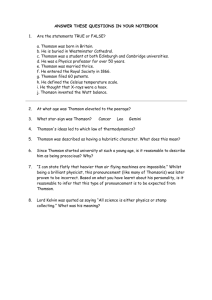

Twomey Jennings Anderson’s Business Law and the Legal Environment, Comprehensive 20e Anderson’s Business Law and the Legal Environment, Standard 20e Business Law: Principles for Today’s Commercial Environment 2e Chapter 28 Negotiable Instruments Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning Definitions • An instrument or piece of commercial paper is a transferable, written, signed promise or order to pay a specified sum of money. – An instrument is negotiable when it contains the terms required by the UCC. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 2 Definitions • The term party may refer to a natural person or to an entity, such as a corporation, an unincorporated enterprise, a government, or a bank account. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 3 Types of Negotiable Instruments and Parties • (1) Promissory Notes. • (2) Certificates of deposit is a promise to pay by a bank. • (3) Drafts (which includes checks) – In addition to ordinary checks, there are also cashier’s checks and teller’s checks. – A bank money order is a check even though it bears the words money order. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 4 Promissory Note March 31, 2004 Six months after date debtor undersigned hereby promise to pay to the order of Galactic Games, Inc, three thousand six hundred dollars with interest at the rate of 10.9%. This note is secured by the video arcade games purchased with its funds. In the event of default, all sums due hereunder may be collected. Debtor agrees to pay all costs of collection including, but not limited to, attorney fees, costs of repossession, and costs of litigation. John R. Haldehand Video Arcade Inc. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 5 Draft March 18, 1998 TO: Oriental Traders 1100 W. Clarendon Phoenix, AZ Pay to the order of Silly Putty, Inc. the sum of One thousand and no/100 dollars Accepted by: _______________ _______________ DATE: Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning Joe Guilden Silly Putty, Inc. 6 Parties to Instruments • Maker: original party on a note; promises to pay amount specified. • Drawer: party who creates a draft. • Drawee: party to whom a draft is addressed (i.e. bank or credit union). • Payee: party named on the face of the instrument to receive payment. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 7 Parties to Instruments • Drawee becomes the acceptor when it accepts responsibility to pay. • Accommodation party: one whose name is added to an instrument to strengthen its collectability. • Guarantor: promises to pay instrument under certain circumstances. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 8 Types of Instruments and Parties Notes Maker (Borrower) Payee Certificates of Deposit Maker (Bank) Payee Drawer (Seller) Draft Drawee (Buyer) Payee (Seller or Seller’s Bank) Drawer (Account Holder) Check Drawee (Bank) Payee Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 9 Requirements of Negotiability • The instrument must have: – A record (writing), – Authenticated (signed) by the maker or the drawer, • Agent, • Absence of Representative Capacity or Identification of Principal. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 10 Requirements of Negotiability • Instrument must (continued): – contain a promise or order: • of an unconditional nature, • to pay in money, • a sum certain, • on demand or at a definite time, • to order or bearer. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 11 Requirements of Negotiability • A check may be negotiable without being payable to order or bearer. • If an instrument is not negotiable, it is governed by contract law. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 12 Bearer vs. Order Paper “Pay to the bearer” “Pay to the order of John Jones or bearer” “Pay to John Jones or bearer” BEARER “Pay to cash” “Pay to the order of cash” “Pay to the order of Thomasina Jones” “Pay to John Jones, bearer” ORDER “Pay to Thomasina Jones” (check) “Pay to Thomasina Jones” (note) Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning NOT NEGOTIABLE 13 Factors not Affecting Negotiability • Ambiguous Language: –Words outrank figures. –Handwriting supercedes typed or printed terms. –Typewritten supercedes preprinted terms. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 14 Factors not Affecting Negotiability • Statute of Limitations – The UCC sets a three-year statute of limitations on most actions involving negotiable instruments. – The statute is six years for suits on certificates of deposit and accepted drafts. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 15