11.72Mb

advertisement

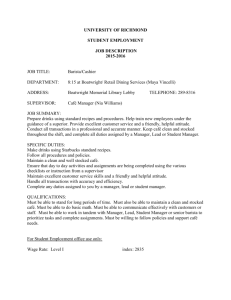

Poultry and Poultry Products Presented by Patarica Chongcharoen 20048351 Kulthida Trongnipatt Peter John Henry Amanda Field Vikram Sharma 20549229 19763549 20022042 19558627 1 Agenda • Industry Overview • • • • Environmental Analysis : PEST Threats & opportunities Company profile : Lenard’s New Product Development Proposal - Idea generation and screening - Concept testing - Business analysis - Product testing - Launched strategy and Marketing plan • Q &A 2 Industry overview Global Poultry Market • 81 million tones in 2006 (3% increase over 2005) • Major exporters – Brazil, USA., EU25, and China • Major importers – Japan, Russia, Germany, and Hong Kong • Market growth – increasing demand of Western country for consume highprotein and low-carbohydrate products • Market drivers – income and population growth, demographic change, urbanization and healthier lifestyle changes. Ovine Meat, 5.20% Pig Meat, 41.60% Bovine Meat , 25.70% Poultry Meat, 32.50% 3 Industry overview Australian Poultry Market • • • • Revenue value at A$ 1.3 billion in 2005 773.7 million kiloton in 2005 (5.4% increase over 2004) Expecting to increase over 39 kg. per person in 2008 Generated 120,000 jobs employed 40,000 people for workforce 40 39.8 37.7 36.8 35 36.2 Beef & Veal Pig 32.8 30 25.7 25 20 22.1 19.4 18.8 15 12.5 21.8 12.5 10 1995 2005 2007 Lamb & Mutton Chicken Meat 4 Industry overview Australian Poultry Market 800 • Most of poultry products are consumed domestically; exporting, less than 3% 750 • Market drivers – high prices of substitute meats – increasing of health awareness – switching from red meat to poultry products. 650 773.7 733.9 708.7 700 692.3 631.4 600 550 500 2001 2002 2003 2004 Poultry consumption 2005 5 Industry overview Bargaining power of suppliers is Low Supplier Power Rivalry among existing competitors is Medium to High. Barriers To Entry Industry Completion Threat of Substitute Threat of substitutes is Medium. Barriers to entry of new entrants are High. Buyer Power Bargaining power of buyer is High 6 Environmental Analysis (PEST) Political and law • Food regulations under Australia New Zealand Food Standards Authority (ie. HACCP regulations) • Occupational Health and Safety (OHS) legislation • The Australian Organic Standard (AOS) 7 Environmental Analysis (PEST) Economic • Australian economy is continuing to increase • Income per household – increased from approximately A$ 50,000 in 2000 up to A$ 60,000 in 2015 • Expecting the growth of per capita GDP from 2.7% to 3.2% between 2005 and 2010 8 Environmental Analysis (PEST) Socio-cultural • Increasing of health and wellness trend (Obesity – health concerns) • Demographic changes – aging people • Growing of organic products • Positive perception in poultry products as a healthier option • Changing consumer lifestyle (busier lifestyle) - ready meals, chilled food and better-for-you products 9 Environmental Analysis (PEST) Technological Trends • New processing methods • Air-Chilled chicken process to keep the chicken fresh • Food Safety • Packaging Methods and materials • Waste management 10 Industry threats • Disease (Avian Influenza - bird flu) • All chickens on affected farms will need to be destroyed • Limited water resources (drought) • Rise in consumer demand for healthy food (organic products) • Aging population (less fast food) 11 Industry opportunities • New export markets • Developing and growing markets • Healthier food • Free range products • Organic products • Australia’s fast food market is growing • Busier lifestyle, more demand for convenience food products 12 Mega Trends Convenience: Taste & Indulgence: Eat on the go Dinner time convenience Buying small portions Snack food Premium foods Authentic regional tastes Great Flavour & taste Healthy Food: Ethical: Trendy: High nutrient value “Free from” foods Low pathogen High energy foods Organic Foods Sustainable Fair Trade Café dinning Espresso Coffee 13 Lenard’s The Best Fresh Chicken Company Overview • • • • • • • • Leading food retailer distributing poultry and poultry products Revenue FY06/07 $145 million, growth of 3.35% on prior year results 190 retail outlets throughout Australia, 39 in New Zealand Store-within-a-store operations +13 million chickens sold per year, all supplied from local producers Employs approximately 2000 staff Serves in excess of 10 million customers per year Awarded from National Retail Association 14 Lenard’s Strengths & Weaknesses • Strengths – Strong brand – Extensive poultry-related product offering • Raw • prepared • easyliving range – Stock sourced from local producers – GM free products – High quality control of suppliers – Tight internal policies and procedures • Weaknesses – Global Grain Shortage – Avian Influenza – Limited to single product category – Absence of free range or organic varieties – Direct competitors are the big supermarket chains • Coles • Woolworths • Safeway – Negative consumer perception re: food poisoning 15 Lenard’s Supplier Bartter Enterprises Pty Limited • Owner of the Steggles brand • Australia's second largest poultry producer • Distribute fresh and frozen, whole and portioned chicken and turkey products nationally. • One of the top three producers of chicken in Australia. • Steggles chickens are processed in accordance with Commonwealth and State regulations. • Steggles chickens are raised in large purpose-built chicken sheds and are able to roam through the whole shed with easy access to food and water. 16 Idea generation and screening Source of ideas • Primary data - Customers - Potential retailers - End users - Competitors - Suppliers - Research and Development team (Brainstorming) • Secondary data - Collect from previous research (Industry data, Environmental trends, customer needs) 17 Idea generation – Key finding Increasing requirement for convenience food Increasing consumption of poultry products More demand for healthy products Slow growth of red meat industry New technolog y in processin g 18 Ideas generated 1. 2. 3. 4. 5. 6. 7. 8. 9. Calcium enriched chicken Different colour yolks Featherless chickens Boneless chickens Lenard’s Chicken Café Free range chicken products Organic chicken range Vertically integrate by acquiring chicken farm Lenard’s Organic Chicken Café 19 Screening Map – for top 3 ideas Sale Potential 10 Utilizing existing resources 5 Leverage of existing brand 0 Long term profitability Does it address a mega-trend? Consumer innovativeness Organic Chicken Bar Chicken Café Organic Chicken Café 20 Idea screening VS Roger’s five factors Roger’s 5 factors Idea Organic generated chicken bar Organic chicken cafe Lenard’s café Relative Advantage Complexity Compatibility Communicability Trialability 21 Concept Testing Concept A: Organic Chicken Concept B: Lenard’s Chicken Café Concept C: Lenard’s Organic Chicken Café 22 Concept A Organic Chicken Range Overview • New organic section within store • Strategy, new product range innovation • Product range extension – new organic chicken range • Gap: fills needs of organic healthy customers • In house products offered to customers, thus establishing close contacts • Product Testing • Laboratory testing • New supply channel required for organic products • Niche market - Increase in cost, good margins 23 Concept B Lenard’s Café Overview • Use mega trend of Cafés to attract more customers and leverage sale of current product • Business model based on McDonald McCafe experience within the Australian market • Strategy, use Café to PUSH product via new in-house channel • In house food preparation facilities are available 24 Concept C Organic Chicken Café Overview • Combination of Concept A&B to maximise the benefits of the current mega trend Café and Organic healthier chickens • Proposal possibility too Niche • Possible 3 Stage roll out of concepts; Lenard’s Café - Stage I Organic products range - Stage II Lenard’s Organic Café - Stage III 25 Franchisee Requirements Lenard’s Café Franchisee will have: • To share the expenses which will add value for the franchisee • To have some insight and understanding about the operations of Café • To accept the training given by the franchisor • Agree to catchment areas • Two options: Deli only or Deli plus Café Franchisor will have: • To evaluate the space for setting up in house cafes in already existing stores. • To evaluate the location with high traffic of customers in shopping centres for the pilot program. • To conduct a needs analysis in regards to the material required e.g Coffee Machines, Equipment, Staff, etc 26 • To establish a menu for the cafe Concept Testing: Intended market profile New Organic Chicken Range New Lenard’s Chicken Café Current Buying Patterns •Fast growth (20%) market •Price of organic chicken falling due to better economies of scale •Café culture is a current MEGA trend, very popular Existing Segment •Working class •Families/ busy mums •Baby boomers (45-60) •Middle to Upper Income •All ages Customer view of available products •Healthy convenient choice •Social activity •Both healthy and trendy 27 Concept Testing: Purchase intentions and product positioning New Organic Chicken Range New Lenard’s Chicken Café Trial and repeat purchase •Customers looking for healthier food options •Trial organic range to existing products •Free sampling •Loyalty card (Club Lenard’s) •Mixed promotions – Coffee and Chicken meals Brand loyalty •Club Lenard’s •Established loyalty to use as leverage to enhance our new Café concept ‘gap’ analysis •Fits into Lenard’s product range to fill a gap in the organic chicken market •Brand extension 28 Concept Testing: Refinement and improvements New Organic Chicken Range Overall Specific features and attributes •Healthier food offering •No pesticides •Low wastage •No generic modified products •No antibiotics New Lenard’s Chicken Café •Café recipes and trial products to be posted on website and available on take home flyers •Extended loyalty card features 29 Concept Testing • 2 research approaches have been conducted • First Approach : Qualitative Research • Second Approach : Quantitative Research Research Approach Purpose Methodology Sample Size Qualitative research • Consumers’ reaction • Consumers’ purchasing behaviour • Focus groups • Projective technique • Working people (Age 25-45) • Baby boomers (Age 45-60) • Middle to upper level of household income Quantitative Research • Evaluating existing purchasing pattern • Supporting the results from focus group • Telephone Survey • Satisfy random sampling • Health conscious person (Age 25-60) • Middle to upper level of household income 30 Our new product : Lenard’s Café 31 Business Analysis Financial Year No. of Cafés Opened No. of Customers per annum Avg. Spend per Customer* Projected Sales Expenses Production Costs: Start Up: Materials & Labour Start Up: Tables, Cultery, China Start Up: Coffee Machines Start Up: Training, Misc, other On Going: Supplies On Going: Labour Marketing Costs Total Expenses Profit/Loss Allocation to Frachisee (40% of profit/loss) Profit Margin Break Even (years) Phase I 2008 5 56,420 14.00 789,880 Phase II 2009 25 338,520 14.42 4,881,458 Phase III 2010 50 902,720 14.85 13,407,739 19,079,077 17,171,170 20,986,985 50,000 10,000 25,000 25,000 25,000 330,000 50,000 500,000 15,000 125,000 125,000 125,000 1,980,000 250,000 500,000 25,000 250,000 250,000 250,000 3,300,000 1,250,000 1,050,000 50,000 400,000 400,000 400,000 5,610,000 1,550,000 945,000 45,000 360,000 360,000 360,000 5,049,000 1,395,000 1,155,000 55,000 440,000 440,000 440,000 6,171,000 1,705,000 515,000 3,120,000 5,825,000 9,460,000 8,514,000 10,406,000 274,880 109,952 1,761,458 704,583 7,582,739 3,033,096 9,619,077 3,847,631 8,657,170 3,462,868 10,580,985 4,232,394 34.80% 1.87 36.08% 1.77 56.55% 0.77 Total 80 1,297,660 50.42% 0.98 Sensitivity Analysis -10% +10% 72 88 1,167,894 1,427,426 50.42% 50.42% 0.98 0.98 * Adjusted Annually to reflect Inflation 32 Projected Marketing costs 1st year (5 Stores) 2nd year (+25 Stores) 3rd year (+50 stores) Marketing research $10,000 $ 35,000 $ 50,000 Product/Brand management • Loyalty program $ 10,000 $ 60,000 $120,000 $ 5,000 $ 15,000 $ 10,000 - $ 50,000 $ 50,000 $ 120,000 $ 85,000 $ 25,000 $30,000 $ 50,000 $ 500,000 $ 275,000 $ 50,000 Sales and Promotion • In-store promotion • Leaflet • Lenard’s website • TV • Magazine • Radio Total cost $ 50,000 Cost per store $ 10,000* $ 250,000 $ 10,000* $ 1,250,000 $ 2,500 33 Product testing Objective • To investigate target consumers’ perception towards their experience in Lenard’s Café • To identify the value gap between the café concept and the actual results for further improvement • To highlight main profitable products for focusing on the right target market and to maintain competitive advantage Methodology • Launching 5 Lenard’s Café in select locations 34 Product Testing Enjoyment Customer service Products Convenience 0% 10% 20% 30% 40% Product Testing Result • • • • Convenience: location, easy to order Customer Service: friendly and well-trained staff Products: wide range of products, fresh and healthy foods Enjoyment: spending time with their friends 35 Target market Who are our customers Geographic - Location Demographic - Gender and Age - Life-cycle Stage - Income level Psychological - Attitude and Belief - Personality - Lifestyle Behavioral - Decision role - Consumption occasion - User Status - Usage Rate - Rate of Adoption Why do customers buy - Physical benefit - Emotional benefit Where do customers buy - Retail Outlet Characteristics Urban area in Australia Male and Female, aged 25-45 years old and 45-60 years old Young Adult, Middle-aged Adult and Baby boomer Medium to High level Self-conscious, Image driven Outgoing, Trendy, Active, Enthusiastic Seeking for healthier products and information, Shopping, Eating out Decider Every day Current purchasers and non-purchasers in healthy food Medium to heavy users Medium to fast Health conscious , nutrition seeking Feel more confident, gain self-appreciation Shopping center and high-traffic areas 36 Key competitors • Direct competitors – Supermarkets – Independent retailers & Butcher shops • Indirect competitors - Leading fast food outlets such as: Subway, Pizza Hut, McDonald, Red Rooster, Nando’s, KFC Independent café 37 Positioning – Perceptual map High price “ Position as a premium brand with healthy food” Mc Café Unhealthy product Healthy product Salad Bar Standard Product Low price 38 Marketing objective • To achieve a profit from “Lenard’s Café” of $9.6 mn by the end of phase III • To create relative brand awareness of “Lenard’s Café” by 20% of customers for the end of phase III 39 Commercialization • Roll-out strategy • Test marketing: 5 initial stores • Pull Strategy • Relationship Management – Customer – Franchisee 40 Launch Strategy & Marketing Roll-out Plan Phase 1 Test Market Open 5 stores 1 years Phase 2 Expansion 25 additional stores 2 years Phase 3 Ramp Up 50 stores Australia Wide 3 years Total 80 stores Feedback will be conducted between each phase to ensure the optimal strategy and marketing mix is achieved. 41 Marketing Strategy: Product strategy • Introduce “Lenard’s Café” as a new concept • Create brand positioning of Lenard’s Café as a premium brand of café by providing a high quality product and superior service 42 Marketing Strategy : Pricing strategy • Use skimming pricing to create consumer’s perception in “Lenard’s Café” as the premium quality position in the market and boost profit margins Distribution strategy • Launch “Lenard’s Café” in high traffic locations, especially shopping centre • Use the existing franchise store for adding the new store concept to expand its café throughout Australia 43 Marketing Strategy : Promotion and communication strategy • Use below-the-line in the first year to reach prospect customers - In-store media, Leaflet, Coupon • Use above-the-line in the second & third year to reach mass market - TV, Radio, Magazine and Internet • Apply customer loyalty program to create a long-term relationship with customers by creating “Lenard’s Card” to offer special promotion 44 Marketing Strategy : People strategy • Recruit energetic and friendly staff to provide a good service quality • Recruit experienced NED and staff to aid in the roll-out strategy • Create training program for franchisees and employees to learn about a new concept (Café) to deliver customers with a good service • Launch incentive and reward program to encourage employees performance 45 Marketing Strategy : Physical assets • Create a service environment by the use of store decoration, staff uniform in line with Lenard’s logo and use red color as a main color in store Process management • Products will be recommended by staffs in order to offer the right product to the right customer • Orders will be retrieved through front-line staffs for preparing products to each customer • Ask customer feedback with warm and friendly to gain customer’s insights for improving the product and service 46 Exit and Repositioning Strategy End of Phase I • If phase I unsuccessful, pull plug on Phase II and III End of Phase II • If other aggressive entrants in market, may have to bring forward phase III of launch 47 Summary Critical Success Factors • Loyal customer base – brand leverage • Strong retail and supplier relationship • Knowledge of the poultry industry • Leverage of existing product lines • Utilizing current mega trends to our advantage • Existing economies of scale within the poultry products industry 48 Questions? Thank you 30 Friday 49 Reference List • Lenard’s (2007), viewed 23rd November, 2007 www.lenards.com.au • Australian chicken meat federation INC. (2007), viewed 24th November, 2007 www.poultrycrc.com.au • R&D Plan for the Chicken meat Program 2004-2009 (2007), viewed 21st November, 2007 www.rirdc.gov.au/pub/chick5yr.htm • Poultry Outlook Report – October 2004 (2007), viewed 21st November, 2007 www.thepoultrysite.com/articles/239/poultry-outlook-report-october-2004 • Poultry Meat (2007), viewed 22nd November, 2007 www.bareconomics.com/interactive/ac_mar07/htm/meat.htm • Laux, M. (2007), Organic Poultry, viewed 22nd November, 2007 www.agmic.org/agmrc/commoditty/livestock/poultry+organic.htm • The industry in brief (2007), viewed 22nd November, 2007 www.poultrycrc.com • Agricultural Economics of Australia and New Zealand (2007), viewed 22nd November, 2007 www.abreconomics.com/interactive/aus 50