small and micro-business assessment

advertisement

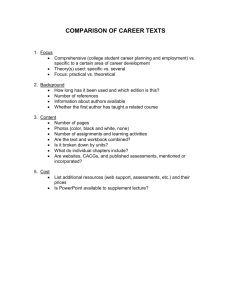

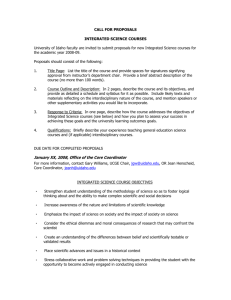

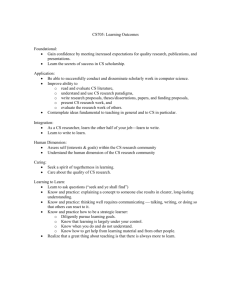

The UK Deregulation agenda – tackling the stock and flow of regulation Gordon Maddan Programme Manager - Business UK Government ambitions for business • To back British businesses: cutting red tape, lowering taxes on jobs and enterprise, getting young people into work, • boosting apprenticeships and investing in science and technology. • Britain will be the best place in Europe to innovate, patent new ideas and set up and expand a business. • Aim to be number one in Europe and in the top five worldwide in the World Bank’s Doing Business rankings by 2020 and to lead Europe in attracting foreign investment. • To deliver a further £10Bn of deregulation savings for business by 2020. • UK Principles of Regulation The Government will regulate to achieve its policy objectives only: (i) having demonstrated that satisfactory outcomes cannot be achieved by alternative, self-regulatory, or non-regulatory approaches (ii) where analysis of the costs and benefits demonstrates that the regulatory approach is superior by a clear margin to alternative, self-regulatory or non-regulatory approaches (iii) where the regulation and the enforcement framework can be implemented in a fashion which is demonstrably proportionate; accountable; consistent; transparent and targeted. There will be a general presumption that regulation should not impose costs and obligations on business, social enterprises, individuals and community groups unless a robust and compelling case has been made. The Government will adopt a One-in, Two-out approach • Stock and Flow of regulation •Change in policy making culture - regulation only when necessary – One in two out – Red Tape Challenge – Alternatives to regulation – Impact assessment – Growth duty Regulatory Delivery • Risk based, targeted, proportionate enforcement •Proactive compliance support • Change in culture – Competency – Consistency – Accountability - Alternatives to inspection Initiatives to date • One-in, One-out and then One-in, Two-out, the Government has delivered combined net annual savings to business of £1.19 billion per annum. • The Red Tape Challenge identified over 3,000 regulations to scrap or improve delivering annual savings of over £850 million to business. • Independent scrutiny of Impact Assessments by the Regulatory Policy Committee and approval requirement for all proposals through the Reducing Regulation Cabinet Committee has significantly improved the regulation making process • BRDO Primary Authority, Growth Duty and Regulators code, Competency frameworks and Better business for all initiatives have led to improvements in coordination of delivery, support and enforcement. • There has been a continuing fall in the number of businesses that see regulation as an obstacle to business success – from 62% in 2009 to 51% in 2014. Impact assessment process • • • • • • • Process set out in a ‘Better Regulation Framework Manual – Practical guidance for UK Government Officials Required for all regulatory proposals impacting on business costs Completed by Government department policy leads with support of Departmental Better Regulation Units Final impact assessment must be signed off by Departmental Minister and Permanent Secretary. Has to be scrutinised by Regulatory Policy Committee and assessed as ‘Fit for purpose’ before proposals can proceed to the Cabinet Reducing Regulation Committee. Red and amber rated assessments have to receive further work and be resubmitted for RPC approval Issued at same time as consultations and when final regulations and Acts are published. Impact assessment Impact assessments completed 2010 663 2011 491 2012 472 2013 415 2014 393 2015 238 (election year) Small and Micro Business Assessment Regulatory measures should only extend to small and microbusinesses where any disproportionate burden is fully mitigated • The small and micro-business assessment (SaMBA) is intended to ensure that all new regulatory proposals are designed and implemented so as to mitigate disproportionate burdens. The assumption is that there will be a legislative exemption for small and micro-businesses where a large part of the intended benefits of the measure can be achieved without including them. Small and Micro Business Assessment Mitigation approaches to be considered: • Full exemption (default option) • Partial exemption • Extended transition period • Temporary exemption: • Varying requirements by type and/or size of business: • Specific information campaigns or user guides, training and dedicated support for smaller businesses • Direct financial aid for smaller business • Opt-in and voluntary solutions Regulatory Policy committee Independent body with secretariat provide the government with external, independent scrutiny of new regulatory and deregulatory proposals. • reviewing evidence and analysis supporting new regulatory proposals, and checking them before proposals are agreed by ministers • ensuring the government’s estimates of costs and benefits to business as a result of regulation are accurate • looking at small and micro business assessments within impact assessments • settling disputes between non-economic regulators and businesses with reference to the new guidance on accountability for regulator impact • Where a new regulatory measure does not qualify for the fast track, its impact assessment must be assessed as “fit for purpose” by the Regulatory Policy Committee before clearance is sought from the Reducing Regulation sub-Committee. Reducing Regulation Committee • A Cabinet sub-committee established to take strategic oversight of the delivery of the Government’s regulatory framework. • Pre-Clearance required for all proposals before public consultation • Considers Government principles of Regulation, Impact assessment, RPC opinion on IA and meeting one in two out rules. Parliamentary scrutiny • Parliamentary Scrutiny Unit assists MP Select Committees in evaluation of Impact Assessments • Oral, Written parliamentary questions on Impact assessments increasingly prevalent. Making sure the business view is heard ‘You can’t regulate what you don’t understand’ • Business Reference Panel • Consultations • Expert Panels Business Reference Panel •Regulatory experts from 150+ Trade Associations, Business Representative Bodies and Individual businesses. • Link to those representing the views on regulation of over 2.0 million businesses • Meets as a full panel four times a year (BRDO update, discussions with external presenters, headline speaker, radar session, BRDO consultations). • Breaks into representatives of Small and Local, Large and Multisite, Food and other Manufacturing for discussion sessions. • Idea to broaden interest and understanding of regulatory delivery and actively engage participants in driving change. To get members to see the broader picture rather than issues as just affecting their own sector or business. • RPC, DH, FSA, CCP, CMA, TSI, CIEH, CFOA, EA, HSE, ASA have consulted panel Small and Local Food, Manufacturing, Services Large and Multisite Business Reference Panel Outputs • Better regulation Reports: – Age restricted products and services – From the Business end of the Telescope – Date coding of food – High Street regulation • Thought leadership: – – – – Extension of PA to Trade Associations Revision of the Regulators Code Growth duty Need for expert panels Expert panels • Bring together: – – – – Government policy leads Local Authority enforcers Self and Co-regulatory bodies Trade Association experts Aim to resolve problems quickly by getting the right people round the table. Examples Food Standards and Labelling, Age restricted products, Leisure and Entertainment. The UK Deregulation agenda – tackling the stock and flow of regulation Gordon Maddan Programme Manager - Business