Internal Controls - Mississippi Annual Conference

advertisement

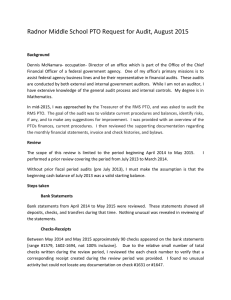

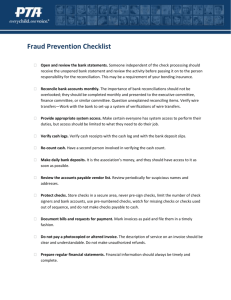

Internal Controls Mississippi Conference UMC David Stotts, CPA Treasurer/Director of Financial Administration 2008 Discipline 258 4 c The committee on finance shall establish written financial polices to document the internal controls of the local church. The written financial policies should be reviewed for adequacy and effectiveness annually by the committee on finance and submitted as a report to the charge conference annually. Key Point Church leaders have a special fiduciary obligation to make sure that all church assets are protected and used properly. 15% of all churches are victimized by unscrupulous employees or members. 5250 UM churches in the US 167 UM churches in Mississippi General Objectives Safeguard Assets Reliability and accuracy of financial records Compliance with managerial policies General Objectives Provide Accurate recording Reliable reports for effective planning and budgeting Efficiency of current operations Unreliable Financial Records and Misappropriated Funds Result From Separation of duties Establish a Crisp Organization Structure Recruitment of qualified personnel Adopted and written accounting procedures manual Monitoring of accounting work Arena of trust Separation of Duties Authorization of transactions Recording of transactions Custody of assets Internal Controls Must Be BeneficialFinancially and Emotionally Remove temptation for misappropriation Prevent a cloud of suspicion Save time and expense in record reconstruction Improve error detection Reduce confrontations Reduce board division Reduce chance of losses Reduce embarrassment and negative media Internal Controls Organization Chart Accounting procedure manual Separation of duties Safe guard of assets Safe guard accounting records Internal audit committee Annual Audit Personnel screening Bonding Cash Receipts Use offering envelopes Use checks-not cash Receipts counted by 2 people Secure area for counting Verify envelope amounts Restrictive endorsements Cash Receipts (Continued) Deposit Daily Deposit in tact Use of lock box Reports-Financial Secretary, Treasurer, internal audit Mail/Drop off-not by one maintaining accounting records Never cash checks payable to church Cash Receipts (Continued) Never cash checks out of deposit Maintain contribution records Periodic notices to members Maintain copies of notices sent to members Account for any differences to internal audit committee Cash Disbursements Requisition slips-indicate budget line item Prenumbered purchase orders Approval of invoices Foot and verify invoices Check authorization form Pre-numbered checks Machine prepared checks Cash Disbursements-continued Signers inspect supporting documents 2 signatures Supporting documentation canceled when paid Retain void checks Never make checks to “Cash” Safeguard blank checks Cash Disbursements-continued Expenses in correct period Petty cash for minor disbursements Vouch petty cash expenditures Are transfers between bank accounts authorized Reconciliation Bank accounts not reconciled by person involved in writing checks Surprise audit of Petty Cash Reconcile books to Financial Statements Other Assets Lock box for valuables 2 signatures to get into lock box Inventory of securities, valuables, equipment, noncash assets Insurance adequacy Resources The Church Guide to Internal Controls by Richard J. Vargo GCFA website Conference website Mississippi-umc.org Conference wide Risk Managers gcfa.org Phil Hinton Gallagher 601-956-5810 David Stotts, CPA-Conference Treasurer 601-354-0515 david@mississippi-umc.org