Presentation - International Insurance Society

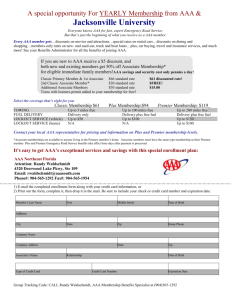

advertisement

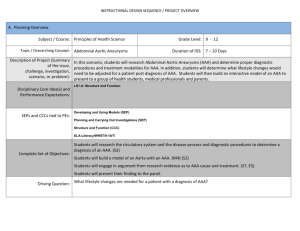

International Insurance Society, Inc. The Changing Insurance Landscape— What Survives? Howard W. Albert Chief Credit Officer, Assured Guaranty Ltd. Safe Harbor Disclosure • • Forward-looking statements are being made in this presentation. Actual results could differ materially from these statements. • Factors that could cause actual results to differ materially include, but are not limited to: For example, the Company’s forward looking statements, including its calculations of adjusted book value, PVP, net present value of estimated future installment premiums in force, total estimated net future premium earnings, and statements regarding capital losses, pricing, ratings, expenses and new business production could be affected by many events. - downgrades of financial strength ratings assigned by the major rating agencies to any of our insurance subsidiaries at any time, which has occurred in the past; downgrades of transactions we insure; our inability to execute our business strategy; reduction in the amount of reinsurance facultative cessions or portfolio opportunities available to us; contract cancellations; developments in the world’s financial capital markets that adversely affect our loss experience, the demand for our products, our access to capital, our unrealized (losses) gains on derivative financial instruments or our investment returns; more severe or frequent losses associated with our insurance products, or changes in our assumptions used to estimate loss reserves and realized (losses) gains on derivative financial instruments; changes in regulation or tax laws applicable to us, our subsidiaries or customers; governmental actions; natural catastrophes; the Company’s dependence on customers; decreased demand for our insurance or reinsurance products or increased competition in our markets; loss of key personnel; technological developments; the effects of mergers, acquisitions and divestitures; changes in accounting policies or practices; changes in the credit markets, segments thereof or general economic conditions, including the overall level of activity in the economy or particular sectors, interest rates, credit spreads and other factors; other risks and uncertainties that have not been identified at this time; and management’s response to these factors. • See the Company’s SEC filings and latest earnings press release and financial supplement, which are available on its website, for more information on factors that could affect its forward-looking statements. Do not place undue reliance on these forward-looking statements which are made as of June 10, 2009. Assured does not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. • This presentation references several non-GAAP financial measures. These non-GAAP financial measures are defined in the appendix of this presentation. In each case, if available, the most directly comparable GAAP financial measure is presented and a reconciliation of the non-GAAP financial measure and GAAP financial measure is provided. This presentation is consistent with how our management, analysts and investors evaluate our financial results and is comparable to estimates published by analysts in their research reports on us. Each of the non-GAAP financial measures is identified in this presentation as such. 2 Financial Guaranty Industry • The financial guaranty industry was founded in 1971 - • A financial guaranty provides interest and principal payment default protection to investors - 3 Financial guaranty is a specialized form of credit insurance Financial guarantors, also known as bond insurers, are monoline companies and are only permitted to engage in bond insurance business The bond insurer pays the investor in the event of default The bond insurer will pursue payment from the issuer through bankruptcy court or other means; the investor does not need to handle this The financial guaranty policy covers the life of the investment and is non-cancellable by the bond insurer Because the bond is insured, it receives the rating of the bond insurer which reduces the interest cost to the issuer The issuer of the bonds usually pays the premium U.S. Municipal Bond New Issuance: Credit Enhancement, 1980-2007 The industry initially only insured U.S. municipal bonds $ in Billions $450 400 350 AHERF bankruptcy 300 Orange County, CA bankruptcy 250 200 WPPSS default 150 100 50 0 1980 Bond Insurance 2.6% Letters of Credit 0.1% Other Enhancement 4.2% 1983 15.5% 6.6% 2.6% Bond Insurance 4 1986 16.2% 8.3% 2.4% 1989 24.7% 9.2% 3.6% Letters of Credit 1992 34.3% 3.4% 2.3% 1995 42.4% 7.1% 2.2% 1998 50.7% 4.3% 2.2% 2001 46.6% 4.7% 4.8% Other Credit Enhancement 2004 2007 54.2% 6.6% 2.3% 46.8% 4.8% 6.3% Uninsured Financial Guaranty History • In the 1980s, the industry diversified into credit enhancement in structured finance and international markets - - 5 In 1985, Financial Security Assurance, a company that Assured is in the process of acquiring, pioneered the use of financial guaranties for asset-backed securities such as mortgage and auto loan securitizations Expansion into the global markets, particularly for infrastructure transactions, began in the late 1980s Financial Guaranty Industry Par Written, 1991 - 2007 At year end 2007, industry total par insured was $2.2 trillion and net par written for the year was $630 billion $ in Billions $700 600 500 400 300 200 100 0 % of Total U.S. Public Finance U.S. Structured International 1991 84.6% 15.4% 0.0% 1993 1995 1997 1999 2001 2003 2005 2007 84.3% 15.7% 0.0% 64.2% 35.8% 0.0% 54.6% 37.5% 7.9% 48.2% 42.3% 9.6% 39.4% 45.1% 15.5% 54.2% 30.7% 15.0% 45.9% 40.0% 14.1% 38.1% 45.1% 16.8% US municipal 6 US structured finance International Financial Guaranty Industry: 2007 At year-end 2007, the seven primary companies were all rated triple-A by S&P, Moody’s and Fitch; Industry claims paying resources totaled $50.6 billion Company Claims Paying Resources Net Par Outstanding (Ranked by GAAP Equity) MBIA $3,656 $14,559 $678,661 AAA/Aaa/AAA 1973 Ambac 2,276 14,512 524,025 AAA/Aaa/AAA 1971 Assured Guaranty Ltd. 1,667 4,440 200,279 AAA/Aaa/AAA 1988 FSA1 1,558 6,739 426,342 AAA/Aaa/AAA 1985 FGIC 584 5,369 313,949 AAA/Aaa/AAA 1983 SCA 427 3,663 165,012 AAA/Aaa/AAA 1999 CIFG2 632 1,359 78,707 AAA/Aaa/AAA 2001 As of December 31, 2007, unless otherwise noted; $ in millions 1. Includes FSA’s Financial Products segment 2. As of March 31, 2007 7 Ratings GAAP Equity (S&P/Moody’s/Fitch) Year Founded And Then the World Changed • Beginning in late 2007 and continuing until now, certain obligations insured by many financial guarantors began to cause significant credit losses - • Standard & Poor’s, Moody’s and Fitch, which had previously rated all the primary companies triple-A, downgraded companies in 2008 due to rising loss expectations and diminished capital cushions - 8 Collateralized debt obligations of asset-backed securities (“CDOs of ABS”) Home equity lines of credit Closed-end second lien loans All companies that had CDOs of ABS were downgraded early in 2008, with downgrades continuing into 2009 Assured and FSA, the only companies that did not write CDOs of ABS, were downgraded by Moody’s in November 2008 due to Moody’s concerns about future industry demand Today, Assured is the only company active in the market today Decline in Industry New Business Production 2007 - Present Change in PVP1 $7.0 $6,177 $ in Billions 6.0 5.0 $5,020 4.0 3.0 2.0 $1,724 1.0 $243 0.0 2006 2007 Assured FGIC Ambac SCA 2008 MBIA CIFG (62.0)% versus 1Q-08 1Q-09 FSA 1. For an explanation of Assured’s PVP, a non-GAAP financial measure, and a reconciliation of PVP to gross written premiums, which is the most comparable GAAP term, please refer to the appendix on slide 16. Each company’s version of PVP may be different. Please refer to each companies operating supplement for a reconciliation of their version of PVP to gross written premiums. 9 Financial Guaranty Industry: 2009 In 2009, only two of the seven primary companies carry any triple-A ratings; Industry claims paying resources total $41.1 billion Company (Ranked by GAAP Equity) 1. FSA excluding FP GAAP Equity Ratings Net Par Insured (S&P/Moody’s/Fitch)1 $2,282 $7,357 $417,306 AAA/Aa3/AA+ 2. Assured Guaranty Ltd. 2,026 5,221 237,176 AAA/Aa2/AA 3. MBIA 1,640 13,565 769,400 BBB+/B3/NR 4. SCA2 710 NA 133,700 R/Ca/NR (645) 3,600 140,000 NR/NR/NR (3,978) 11,957 413,323 A/Ba3/NR NA NA NA BB/Ba3/NR 5. FGIC3 6. Ambac 7. CIFG As of March 31, 2009, unless otherwise noted; $ in millions NA – Not Available NR – Not Rated 1. Ratings as of May 12, 2009 2. From December 31, 2008, 10-K filing. 3. Estimated from December 31, 2008 GAAP and statutory filings. 10 Claims Paying Resources Decline in Municipal Bond Insurance 2007 - Present Change in Credit Enhancement $ in Billions $500 450 400 350 300 250 200 150 100 50 0 $429.9 $391.9 $119.7 2007 11 2008 YTD 4/30/09 Bond Insurance Letters of Credit Other Credit Enhancement Uninsured (12.6)% versus YTD 4/08 Financial Guaranty Industry—What Survives? • The industry’s operating model has been proven - - • The industry is stabilizing and new entrants are emerging - - 12 Unlike banks, financial guaranty companies are not dependent on liquidity and market access Despite major claims losses, only one company has not made their claims payments • Principal and interest are only paid when due • Limited accelerations due to downgrades All companies are considered to be “solvent” by the regulators, although most are not writing new business Some existing companies have formed new public finance only companies • MBIA: National Guarantee • Ambac: Everspan Guaranty New competitors have also emerged • Berkshire Hathaway Assurance There is talk of other new entrants • Municipal Investors Assurance Corp. (Macquarie/Citadel) • National League of Cities Financial Guaranty Industry—What Survives? Municipal Market • There is a strong and abiding need for financial guaranty insurance - • Investors have adapted to double-A level guarantees - 13 The U.S. municipal market has several structural features that generate demand for our product • Large retail investor base that tends to have undiversified investments because of single-state focus (NY investors buy NY bonds for tax benefit; don’t normally buy California bonds) • Large number of issuers (50,000+) with limited financial disclosures • Wide variety of credit structures and revenue sources that may or may not benefit from full governmental support • Healthcare facilities • Municipal utilities • Special purpose facilities: convention centers, stadiums Assured, which has been split rated since November 2008, has provided guarantees on more than 10% of the entire U.S. municipal new issue market through May 30, 2009 Almost no banks or insurance companies, potential competitors to financial guaranty, are rated AAA Bank letters of credit are an imperfect substitute for bond insurance Financial Guaranty Industry—What Survives? Asset-Backed and Global Markets • • • Asset-backed issuance will stabilize and grow - Securitization is the most cost effective form of financing for consumer and small commercial loans receivables - Some types of transactions are unlikely to come back (CDOs of ABS) Infrastructure - Infrastructure investment is a key component of the economic stimulus package - Repair and expansion of existing infrastructure is necessary Global ABS - 14 Issuance expected to rebuild after maturation of ABS liquidity market facilities like the TALF Appendix Appendix Explanation of Non-GAAP Financial Measures Present value of financial guaranty and credit derivative gross written premiums, or PVP, which is a non-GAAP financial measure, is defined as gross upfront and installment premiums received and the present value of gross estimated future installment premiums, on insurance and credit derivative contracts written in the current period, discounted at 6% per year. Management believes that PVP is a useful measure for management, investors and analysts because it permits the evaluation of the value of new business production for Assured by taking into account the value of estimated future installment premiums on all new contracts underwritten in a reporting period, whether in insurance or credit derivative contract form, which GAAP gross premiums written and the net credit derivative premiums received and receivable portion of net realized gains and other settlement on credit derivatives (“credit derivative revenues”) does not adequately measure. Management discounts estimated future installment premiums on insurance contracts for PVP at 6% per year, while under FAS 163 these amounts are discounted at a risk free rate. Additionally, under FAS 163 management records future installment premiums on financial guaranty insurance contracts covering non-homogeneous pools of assets based on the contractual term of the contract whereas for PVP management only records its estimate of the future installment premiums that it expects to receive based on the contractual terms of the transaction. Actual future net earned or written premiums and credit derivative revenues may differ from PVP due to factors such as prepayments, amortizations, refundings, contract terminations or defaults that may or may not be influenced by market interest rates, refinancing or refunding activity, prepayment speeds, policy changes or terminations, credit defaults, or other factors that management cannot control or predict. This measure should not be viewed as a substitute for gross written premiums determined in accordance with GAAP. 16