Case Study 2 - Internal Control Week 5: Case Study 2

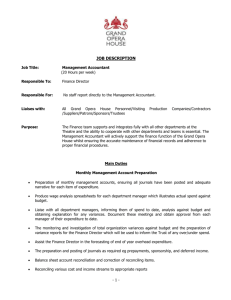

advertisement

Case Study 2 - Internal Control Week 5: Case Study 2 - Internal Control Acct Fin: Managerial Use,Anlys Case Study 2 - Internal Control 1. Inform the President of any new internal control requirements if the company decides to go public. (7 points) Answer – Based on facts given in the case, new internal control requirements that are needed for the company to go public are listed below a. b. c. d. Compliance with Sarbanes-Oxley Act Regulations Compliance with SEC, GAAP and IFRS procedures to record all transactions Internal audit on company financial and business processes and transactions Implementation of better security measures for data protection, identity protection and ensuring that company resources are not misused 2. Advise the President of what the company is doing right (they are doing some things well) and also recommend to the President whether or not they should buy the indelible ink machine. When you advise the President, please be sure to reference the applicable internal control principle that applies. (13 points) Answer – Some of the things that the company is doing well and should continue are listed below and in accordance with the Sarbanes-Oxley Act and GAAP regulations: a. Pre-numbered invoices are used for accounting b. Receiving checks and completing the monthly bank reconciliation c. Having an accountant who is able to manage the accounts and streamlining many of their processes d. Loyalty and trust with long term employees In terms of requirement for purchasing the indelible ink machine, I would suggest that the company should procure it. Having the indelible ink machine would help the company to process its checks much faster and track these payments that would help in better record of transactions. Also, the accountant’s time would be saved that he could then use better in improving other processes or services in the organization. The indelible check unit would definitely help automate the accounting department by making it more efficient, and also help the business as it grows and the number of transactions increases. e. Advise the President of what the company is doing wrong (they are definitely doing some things poorly). Please be sure to include the internal control principle that is being violated along with a recommendation for improvement. (20 points) Case Study 2 - Internal Control Answer – Some of the things that the company is doing wrong and which should be changed are listed below followed by recommendations for improvement 1. Accountant doing both treasurer and controller job – It is recommended that there is separation of duties to ensure both roles are performed effectively 2. Lack of control on computer access and not having user authentication – It is recommended that IT section monitors all computers and user activities 3. Not having user ID and password – It is recommended that the company have user ID and separate password for every user 4. No blocking harmful or restricted websites – It is recommended that the company implement software that automatically blocks harmful or inappropriate sites thus ensuring that people are not able to visit these sites using the office computers 5. Petty cash handled by multiple parties – It is recommended that the cash handled by only one person, and is therefore accountable. Also all transactions (cash in particular) to be entered into a financial software 6. Employee with a criminal background recruited - Background checks to be performed for new hires If these items are addressed in its entirety all the internal control issues will be addressed fully. The primary components of internal controls are the following: control environment, risk assessment, control activities, information and communication and monitoring. All business should provide individual security to each user, monitor the work of every user and restrict access to certain websites that are not productive to the work environment. The business should perform a thorough background check for all new hires. The human resources staff members should always be included with President and their accountant in every new hire interview. Employees having dual roles should be eliminated and more distribution of duties, separation of duties so that the accountant can focus on finance activities while other individuals focus on their expertise. All employees do not need to handle the cash; it should be designated personnel only. All transactions must be recorded in the automated management system. Checks must be secured at all times instead of weekends only. If the discrepancies above are addressed LJB Company can regulate their internal control measures to be a trustworthy company in case it decides to go public in future or even in case it remains private.