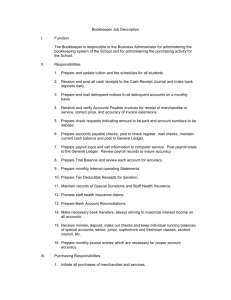

Accounting Policies Template

advertisement

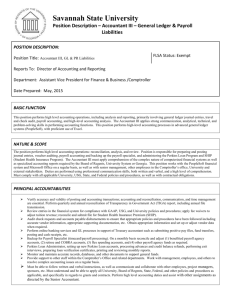

ORGANIZATION Accounting Policies and Procedures Manual Date of Adoption ACCOUNTING POLICIES AND PROCEDURES MANUAL INTRODUCTION ............................................................................................................................... 5 ACCOUNTING PROCEDURES ....................................................................................................... 5 INTERNAL CONTROLS .................................................................................................................. 5 REPORTING.................................................................................................................................. 5 ACCRUAL BASIS OF ACCOUNTING............................................................................................... 7 CHART OF ACCOUNTS ................................................................................................................. 8 PURCHASES AND ACCOUNTS PAYABLE ....................................................................................... 8 Purchases ................................................................................................................................ 8 Petty Cash ............................................................................................................................... 9 Small Minority-Owned and Women-Owned Businesses........................................................ 9 CASH DISBURSEMENTS ............................................................................................................... 9 Frequency of Processing ......................................................................................................... 9 Check Preparation ................................................................................................................ 10 Documentation ..................................................................................................................... 10 Check Signature .................................................................................................................... 11 Check Mailing........................................................................................................................ 11 Check Custody....................................................................................................................... 12 Invoice Cancellation .............................................................................................................. 12 Record Keeping ..................................................................................................................... 12 INVOICING ................................................................................................................................. 12 CASH MANAGEMENT AND INVESTMENTS................................................................................ 13 BANK RECONCILIATIONS ........................................................................................................... 13 CASH RECEIPTS .......................................................................................................................... 14 Check Receipts ...................................................................................................................... 14 Cash Receipts ........................................................................................................................ 14 Credit Cards .......................................................................................................................... 14 Deposits ................................................................................................................................ 15 2 Entry in General Ledger ........................................................................................................ 15 GENERAL LEDGER ...................................................................................................................... 15 PAYROLL .................................................................................................................................... 15 Hiring..................................................................................................................................... 15 W-4 and I-9 ........................................................................................................................... 15 Payroll Additions, Deletions, and Changes ........................................................................... 16 Pay Dates .............................................................................................................................. 16 Time Sheet Preparation ........................................................................................................ 16 Time Sheet Approval............................................................................................................. 16 Administrative Processing .................................................................................................... 17 Payroll Preparation ............................................................................................................... 17 Pay Upon Termination .......................................................................................................... 17 Withholding .......................................................................................................................... 18 BUSINESS EXPENSE REIMBURSEMENTS .................................................................................... 18 Travel Expenses .................................................................................................................... 18 EXPENSE ALLOCATIONS............................................................................................................. 19 Personnel Allocation ............................................................................................................. 19 Non-Salary Expense Allocation ............................................................................................. 19 Expense Allocation Documentation ..................................................................................... 19 FINANCIAL REPORTS.................................................................................................................. 20 CAPITAL EQUIPMENT ................................................................................................................ 20 BUDGETING PROCESS ............................................................................................................... 20 MONTHLY CLOSE ....................................................................................................................... 21 TAX REPORTS............................................................................................................................. 21 Quarterly and Annual Payroll Reports/W-2’s/1099’s ........................................................... 21 Exempt Organization Returns ............................................................................................... 22 Annual Information Returns ................................................................................................. 22 3 4 INTRODUCTION These are the accounting policies and procedures of Organization. They are designed to be a reference to all employees of Organization in accomplishing our ongoing duties and to ensure uniform accounting practices. These policies will be revised as needed by the staff and approved by the Executive Director and Finance Committee of the Board of Directors. ACCOUNTING PROCEDURES The accounting procedures used by the organization shall conform to generally accepted accounting principles. This entails using the accrual method of accounting as described below. We shall also develop activity centers for each functional area including program, administration, shared costs and fundraising. INTERNAL CONTROLS Internal Controls are broadly defined as those processes designed to provide reasonable assurance regarding the achievement of specific objectives in accountability, effectiveness and efficiency of operations, reliability of financial reporting and compliance with applicable laws and regulations. Everyone in the organization has a role in internal controls. The systems described in this document and others are designed to minimize bureaucracy while maximizing the protection of our assets to help us achieve our mission. If a member of the staff becomes aware of problems in operations, noncompliance with internal control procedures or other policy violations or illegal actions, they should report it to the Executive Director or a member of the Board of Directors. REPORTING Monthly financial reports are made to the Board of Directors. These reports include current month and year-to-date financial statements along with a comparison of actual financial activity to budget and an explanation of significant variances. 5 In addition to internal reporting, the annual fiscal year-end financial statements are also audited by an independent Certified Public Accountant. 6 ACCRUAL BASIS OF ACCOUNTING The accrual basis of accounting is the method where revenue and expenses are recorded when they are incurred regardless of whether the cash has changed hands. The goal of the accrual method is to match revenues with expenses and eliminate the budget distortion of large advance payments, such as annual insurance premiums, etc. In doing so, this method gives a more accurate picture when actual expenses are compared with budgeted amounts. It also reduces the possibility of overlooking incurred but unpaid expenses when making budget projections. The accrual method policies are as follows: (1) Throughout the fiscal year, expenses are accrued into the month in which they are incurred provided that the accountant is notified of the expense no more than five working days after the close of the month in question; otherwise, the expense is counted as a current-month expense. This policy enables us to close each month and produce invoices for funders in a timely fashion. (2) At the close of the fiscal year, the five-working-day rule is not enforced. All expenses, which should be accrued into the fiscal year, are so accrued, in order to ensure that year-end financial statements reflect all expenses incurred during the fiscal year. (3) Revenue is always recorded in the month in which it was earned or pledged. Earned revenues are debited to accounts receivable and credited to revenue when the services are provided. When cash is received for these fees, it is credited to accounts receivable. Expenses incurred, paid for or not, are recorded in expense accounts. Those unpaid are credited to accounts payable. When a check is issued in payment, it is posted as a debit to accounts payable. Unrestricted grants and other contributions are recorded as revenue when they are awarded or pledged, regardless of when the cash payment is to be received and regardless of the time frame for the work covered by the grant. 7 Grants with restrictions – either time or programmatic – are recorded as Temporarily Restricted Revenue. These temporarily restricted grants are released from restriction when the funding restrictions are met. The entry for this recognition would include a debit to “Temporarily Restricted – Release from Restricted” and a credit to “Unrestricted – Release from Restricted.” CHART OF ACCOUNTS Attached is the Chart of Accounts in use by THE ORGANIZATION as of the date of this document. The chart is segregated into assets, liabilities, net assets, revenue, and expenses. Activity Centers are recorded as additional segments added to the accounts listed above. The Executive Director must approve additions to the Chart of Accounts. PURCHASES AND ACCOUNTS PAYABLE Purchases All purchases require the pre-approval of the Program Manager if in accordance with the budget or Executive Director. In his/her absence, the Executive Director delegates authority to approve purchases to the Associate Director. The following ways are approved for making purchases on behalf of the organization: Purchase Orders (if applicable) Expense reimbursements Corporate credit cards Check requests All purchases should have charge codes and be pre-approved by an authorized manager. If staff make purchases and pay out of their own pocket, they will be required to get approval before being reimbursed. All disbursements over $500 require the pre-approval of the Executive Director before placing the order. Purchases of more than $1500 also require the solicitation of three estimates. Purchase orders. (If applicable) Accounting distributes purchase order books to select authorized staff, keeping track of the slip number series. The PO slips should include the specific purchase items, prices, and grant it relates to before they are given to the Bookkeeper. On receipt of the invoice, the bookkeeper compares the invoice to the PO form and then authorizes payment. 8 Expense reimbursements. Staff must submit timely expense reimbursements and any necessary receipts with the reimbursement form. For grant related work, staff should provide the grant code and have a manager approve. For non-grant related work, staff should provide the program code and have the program manager approve. Corporate credit cards. Select authorized staff are issued corporate credit cards in their name because of the frequency and volume of their purchases. Staff are required to submit approved PO’s for the purchases. Check requests. When completing the Check Request form, the requesting staff member enters the reason for the check and account code on the form. The Director overseeing the grant or program should approve with his or her signature. Petty Cash Petty cash funds are maintained in the office by the Position. These funds are to be used for miscellaneous or unexpected purchases and the same approval procedures apply as mentioned above. Position is responsible for managing the petty cash funds and reconciling the remaining balances with the accountant on a monthly basis. Small Minority-Owned and Women-Owned Businesses It is the policy of Organization Name to place a fair share of purchases with small, minorityowned and/or women-owned business firms. In particular, we will: (1) solicit these firms whenever they are potential sources of products or services and (2) where feasible when it does not incur additional costs, divide total requirements into smaller needs that encourage participation by these firms. CASH DISBURSEMENTS Frequency of Processing Checks are processed weekly unless there are intervening holidays. Invoices submitted to Accounting by Tuesday will get processed & paid by Friday the same week. Supervisors must return approved and signed invoices to Accounts Payable in Accounting no later than 5 p.m. on Wednesday in order to include them within the same week’s check-run. 9 Checks can be prepared manually within one day, but this should be limited to emergency situations. Check Preparation The Executive Director or Finance Director determines which invoices are to be paid. To determine which approved invoices or expense reimbursements should be paid, the Executive Director or Finance Director reviews the accounts payable aging report, monthly cash flow projections, and an updated list of current receivables. In the event checks are needed for cash advances, the Executive Director must approve the check. To prepare checks, the accountant posts the expenses debiting the appropriate department and then prints the checks. No checks may be made payable to “Cash.” Documentation No checks are issued without an authorized Purchase Order, Expense Reimbursement Form or Check Request Form and supporting documentation. The following guidelines apply for documentation: For vendors, an invoice must be matched with an approved Purchase Order (and packing slip when available) on which the vendor’s name clearly appears, along with a description of the item(s) purchased and an explanation for why these items were purchased, if the relationship between the items and THE ORGANIZATION’S programs is not readily apparent. For subscriptions, a copy of the subscription card or renewal notice; For out-of-town travel expenses, receipts for lodging, airfare, and ground transportation—itineraries for the same are not adequate documentation; For local travel expenses, a mileage log, parking receipts, and bridge toll receipts. 10 For travel advance checks, an Expense Pre-Approval form with the reason for the advance, and For conferences, a copy of the registration form or program announcement. All expenses require appropriate approval as outlined in the “Purchases and Accounts Payable” section; all non-recurring expenses require pre-approval. For all of the above, original documents are required, photocopied materials are not acceptable documentation except on a case-by-case basis. Once prepared, checks are not to be held; only checks expected to be disbursed are selected and prepared. Check Signature THE ORGANIZATION endeavors to have all checks signed by at least one person other than the person who prepared the check. In no case is a check to be prepared and solely signed by the same person without a second person’s approval nor may a person be the sole signatory on a check to himself or herself. When presented for signature, supporting documents should be attached for the signer’s review. Only certain senior staff and Board Members are authorized to sign checks. The Executive Director, other positions, are the usual check signers. In absence of the above authorized staff signers, certain members of the Board of Directors may sign: the Chair, the Treasurer, the Secretary, and designated members of the Finance Committee who are duly authorized on the bank’s check signing card. Checks for sums of $10,000 to $35,000 require two staff signatures. For checks over $35,000, one staff and one board member must co-sign the check. Check Mailing 11 After the signatures have been obtained, the accountant prepares the checks and distributes them in person or mails them. Check Custody Unused checks are kept in a locked cabinet with access limited to the Accounting Department. Invoice Cancellation After payment, all invoices, vouchers and other supporting documents are cancelled with a PAID stamp. The check number and the payment date are recorded on the Check Request form. Record Keeping The accountant retains all original records (check requests, invoices, other documentation) for vendor files. A duplicate copy of each check is filed in numerical order separate from the vendor files. All records must be kept a minimum of three years. INVOICING Staff and independent consultants must submit expense reimbursements and invoices by the end of the 5th working day of the month following the close. Reimbursable expenses must be within the guidelines published. On a monthly or quarterly basis as determined by the funding source, the Finance Manager prepares invoices for all funding sources that provide funds on a reimbursement basis. The Finance Manager prepares these invoices in the format required by the funder using general ledger reports provided by the bookkeeper. If an expense recorded on the general ledger is not allowed by the funding source as determined during invoice preparation, the Finance Manager prepares a journal entry to correct the allocation of the expense in question. Once prepared, invoices are forwarded to the Executive Director for signature. Copies of all invoices are kept on file by the Finance Manager. 12 CASH MANAGEMENT AND INVESTMENTS The Finance Manager works with the accountant to manage the bank accounts and transfer funds when necessary to ensure that adequate cash is available. Cash that is not needed immediately is invested in short-term certificates of deposit generally maturing in 60 to 120 days. An effort is made to invest in CD amounts up to $100,000 and distribute these investments across more than one bank in order to have the CDs be FDIC insured. BANK RECONCILIATIONS Bank reconciliation procedures include: Receipt of unopened bank statement and cancelled checks by the accountant. After reviewing these materials and initialing the statement, the accountant prepares the bank reconciliation. Comparison of cancelled checks with disbursement journals as to amount, date and payee. Examination of cancelled checks for authorized signatures. Examination of cancelled checks for irregular endorsements. Examination of cancelled checks for alteration. Comparison of date and amount of deposit on bank statements to cash receipts journal. Investigation of interbank transfer to determine that both sides of the transaction have been recorded. Review and approval of the bank reconciliation by the Associate Director. The accountant files all cancelled checks in numerical order. Voided checks are filed with cancelled checks. 13 CASH RECEIPTS Check Receipts The mail is opened daily by the Receptionist who then provides all checks to the Finance Manager or other person (not the accountant). The checks are then entered into a check log which also includes a listing of any non-cash gifts received. Two additional copies of the check log, along with photocopies of all checks and transmittal letter are provided to the accountant. Once the accountant prepares the deposit, she attaches a copy of the deposit slip to one copy of the check log with attachments, and forwards these documents to Development. The Development Director generates a donor acknowledgement letter. The accountant retains the other copy of the check log, deposit slip, and attachments. Copies of all funder grant checks are also provided to the Finance Manager who maintains an Excel log of funder amount, and date of receipt. Any check returned by the bank is forwarded to the accountant who records the transaction. The accountant investigates and pursues collection, if appropriate. Any bank advices for debits, credits, and uncollectible checks are received by the accountant. Cash Receipts A book of blank receipts for cash is kept by the Receptionist. When cash is received, receipts are completed in duplicate and a copy of the receipt is given to the payer. The payer and the organization representative who is receiving the cash both count the cash to ensure that the receipt total matches the total cash. The cash is then forwarded to the Receptionist for inclusion on that day’s deposit log, and a copy of the receipt is attached to the deposit log. Credit Cards THE ORGANIZATION accepts payments with Visa, MasterCard and American Express. Online credit card payments can be made through our secure online payment gateway. Payments are deposited within one business day directly into our checking account. 14 Deposits The accountant deposits all cash and checks within two working days of their receipt. The bookkeeper obtains a deposit receipt from the bank for all deposits. Entry in General Ledger The accountant enters the cash and check receipts into the general ledger, thereby automatically updating the checking account balance. GENERAL LEDGER The general ledger is automated and maintained at THE ORGANIZATION. All input and balancing is the responsibility of the accountant with final approval by the Finance Manager. The Finance Manager reviews the general ledger on a monthly basis and analyzes variances between budget and actual amounts. He or she presents the analysis to the Executive Director and the Finance Committee of the Board of Directors. PAYROLL Hiring The Executive Director approves all new hire offer letters and helps the new employee complete all necessary paperwork for payroll, regulatory compliance, and benefits. The accountant is informed of any new hire by receipt of the Employment Information Form, W-4 and I-9. The accountant then adds the employee to the payroll, arranges for payroll taxes, etc. W-4 and I-9 A new employee must submit forms W-4 and I-9 before starting work. If the employee claims to be exempt or to have fourteen or more exemptions, a copy of the W-4 is sent to the Internal Revenue Service in accordance with tax laws. Form W-4 should be completed annually and is required whenever a change in exemption status is made. 15 Payroll Additions, Deletions, and Changes An Employment Information Form or memo signed by the Executive Director is required before any names can be added or deleted from the payroll or when wages or salary are changed. Pay Dates THE ORGANIZATION has semi-monthly pay periods which end on the 15th and last day of the month. Checks are distributed four days after the end of the pay period, unless it falls on a weekend, when checks are distributed the Friday before. Time Sheet Preparation Time sheets should be submitted online by both salaried and hourly employees according to the schedule of semi-monthly due dates published and given to all staff. Employees should enter actual time worked in each period then print out and submit one copy to Accounting and another signed copy to their supervisor. If the employee is absent and did not sign the time sheet, the Accountant may process the time sheet. However, the employee must sign the time sheet as soon as he/she returns to work. Time Sheet Approval It is each supervisor’s responsibility to review the employee time sheets to ensure that they are correct. Supervisors should confirm the amount of time charged to grants, overtime, vacation, holiday or leave without pay during the period being reviewed. The hours charged against a grant and the code should be approved by the program manager. Vacation time should agree with the amount of time off requested in the Vacation Request Form. The respective supervisor must sign the time sheet as confirmation that the information is correct or request corrections and have another signed copy submitted to Accounting. The Accountant must also check the vacation totals on the master list that the organization receives from the payroll company. It indicates the amount of time each employee has accrued. If an employee does not have appropriate time accrued, they are not paid for the stated time off or the staff must agree to have the time debited from future accrued time. 16 Any overtime must have been pre-approved in writing by the supervisor overseeing the staff member’s work. Administrative Processing If a time sheet is not completed correctly, the supervisor corrects the errors. Payroll checks cannot be processed without the time sheet. Payroll Preparation Approved, completed time sheets are reviewed by the accountant for adequacy of approvals, clerical accuracy, and alterations before being called into the payroll service. Changes of pay or withholding are approved by the Executive Director and updated by the accountant. Input is prepared on a ledger provided by the payroll service and saved in the payroll binder after being called in. The accountant reconciles batch total against number reported to payroll service. Pay (net payroll) is entered into the check register and reconciled to gross payroll through a general journal entry into the General Ledger. Signed pay checks are given out by the accountant. Employees may elect to have direct deposit service, receive the check in-person in the office, or picked up. If an employee is ill or unavailable to pick up his/her check and would like someone to pick it up for him/her, the employee must call the Executive Director or Finance Manager and give the name of the person who is picking up the check. The person picking up the check must have a letter of authorization from the employee in order to pick up the check and must show acceptable identification. Pay Upon Termination An employee who terminates receives his/her final paycheck at the close of business the same day as termination. If the terminating employee is not at work, he/she can pick up the check between the hours of 9:00 am and 5:00 pm. Monday through Friday in the office, or have it mailed to another location upon written request. 17 Withholding Other than the standard withholding of Federal and State income tax, social security (F.I.C.A.) and disability insurance (S.D.I.), all withholdings, for example for commuter checks or benefits, must be authorized in writing by the employee. The only exceptions are garnishments as ordered by appropriate government agencies and any employee share of medical insurance premiums, as described in the Employee Manual. The payroll service is responsible for timely deposit of payroll taxes so as to avoid incurring penalties. BUSINESS EXPENSE REIMBURSEMENTS Employees are not reimbursed for expenses unless they submit an Expense Reimbursement Form. These forms are available from the accountant and the cost center’s Department Director should sign completed forms. Each expense should include the cost center and complete grant code. Requests for reimbursement for all routine expenses should be turned in within 5 working days of the following month after the expense was incurred, and all original receipts should be attached. Travel Expenses Reimbursement for travel expenses should be requested within 5 working days of the following month after the expense was incurred, and should be accompanied by receipts for all air travel, lodging, car expenses, ground transportation, and all reimbursable items over $5. Travel expenses are reimbursed to employees under the following guidelines: Air travel should be at the lowest available rate. Ground transportation to/from airports is reimbursed if the employee uses shuttle services or a similar method of transport. Auto rental expenses or taxicab fares in the destination city are reimbursed only if public transportation is inadequate or unavailable in the destination city. 18 Lodging expenses should not exceed IRS-approved rates for the destination city, unless the employee can demonstrate a compelling reason for incurring more expensive lodging. Local Travel: Business use of an employee’s automobile is reimbursed at the prevailing IRS rate per mile; bridge tolls and parking expenses are reimbursed, at prevailing rates, for employees attending meetings that require them to use their car. Please see the “Cash Disbursements” section for a description of the kind of documentation required for various types of expenses. EXPENSE ALLOCATIONS Personnel Allocation Personnel expenses at THE ORGANIZATION are spread among departments according to how much of each position’s time is spent on that department’s work. Personnel are allocated to specific funding sources that support a given department based on agreements negotiated with those funding sources. Non-Salary Expense Allocation Many non-salary expenses are spread according to a shared cost method. Under the shared cost system, the number of full-time equivalents (FTEs) charged to a departmental-funding source combination in a given month is divided by total agency FTE’s for that month, via an allocation spread sheet prepared by the Finance Manager. The resulting percentage is applied to those costs that are shared throughout the agency, via the same allocation spread sheet. In those cases where a specific funding source has categorically disallowed a type of expense that is usually spread according to shared cost, the portion of the expense that would have been allocated to the funding source is charged instead to the Unrestricted Fund. All other non-salary expenses are charged out directly to departments and/or funding sources based on a determination as to which department and/or funding source was responsible for incurring the expense. Expense Allocation Documentation The Finance Manager prepares a monthly spreadsheet, which spreads all expenses among departments and funds according to the allocation scheme summarized above. The accountant records the necessary journal entries to enter all data into the General Ledger. He or she provides monthly reports on all funding sources to the Finance Manager. The Finance Manager 19 reviews the allocations as posted, and informs the accountant of any corrections that need to be made. The accountant makes these corrections in the form of journal entries. FINANCIAL REPORTS The Finance Manager and the accountant prepare all financial reports required by the government and granting agencies and the Board. They prepare monthly financial statements comparing actual income and expense to budgeted amounts, trial balance, balance sheet and income and expense statements. CAPITAL EQUIPMENT Any single or group of items totaling $500 or more should be capitalized into a fixed asset account. Any item or items less than $500 should be recorded in the appropriate expense account. All items with a life span of less than one year go to the appropriate expense account. Depreciation is recorded at least annually. Depreciation is computed using the straight-line method over the estimated useful lives of the related assets in accordance with funding agency requirements. On an annual basis, a physical inventory is taken by the receptionist and reconciled to the manual records by the Accountant. These manual records include a description of the equipment’s serial number, date of purchase, and cost/fair market value. BUDGETING PROCESS The agency budget is prepared annually for all departments. The budget is prepared by the Executive Director in conjunction with the Finance Manager and the Finance Committee. The budget is to be approved by the Board of Directors prior to July 1st of each year. The budget is revised during the year only if approved by the Board of Directors. The Finance Manager will prepare worksheets for the managers including staff allocations, development projections by funder and department, and P&L’s by department. 20 MONTHLY CLOSE In performing the monthly close, the accountant reconciles balance sheet items to their subsidiary ledgers as follows: Reconciles the accounts payable aging balances to the general ledger accounts payable balance. Reconciles the contracts receivable spreadsheet to the general ledger contracts receivable balance. Reconciles the bank statement to the general ledger bank balance. Reconciles pre-paid, other asset account and a liability accounts to the appropriate subsidiary ledgers. Prints monthly and year-to-date financial statements and a monthly general ledger. TAX REPORTS The Finance Manager will see that all required Federal, State, County, and City reports are filed on time with the proper governmental agency. Quarterly and Annual Payroll Reports/W-2’s/1099’s Quarterly Federal and State payroll reports (Forms 941 and DE3) are prepared and filed by the Payroll Tax Management (PTM) in conjunction with the payroll service. Annual payroll reports and W-2’s are prepared by the payroll service. The W-2 statements are issued to the employees prior to January 31st of the following year for the prior calendar year. 21 Exempt Organization Returns The annual Return of Organization Exempt from Income Tax must be filed with both the Internal Revenue Service and the State Regulatory Agency. The Internal Revenue Service uses Form 990. Forms are prepared by the auditor from the information in the financial statements. Annual Information Returns Annual Information Returns must be filed with the Federal and State governments on or before February 28th of the following year for the prior calendar year. Form 1099-MISC should also be filed for any non-corporate entity or individual to whom the agency paid $600 or more for services during the calendar year and who is not considered to be an employee. Forms 1099 must be given to the recipient by January 31st of the following year for the prior calendar year. 22