Complexities of board dynamics of non profit organisations and the

advertisement

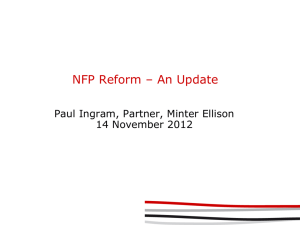

Presenter: Adele Johns Executive Officer: Community Compass Inc. Research student: International Graduate School of Business, University South Australia Director: Adssi Home Living Australia Acknowledgement to country Introductions background, purpose, outcomes Non profit sector in Australia is worth at least $70 billion It is Australia’s principal employer with more than 600,000 employees It is reported that charities employ about 7% of the workforce and account for 5% of gross domestic product – making the sector equivalent in size to agriculture Not for Profit Productivity Commission Report 2010 – Peter Fitzgerald. Of the 59,000 non profits that are employers the CEO/Manager position works under the governance structure of a board. Requires Executive positions to be held by the board, the financial executive position known as the Treasurer. All board members have a legal fiduciary responsibility Australian Charities & Nonprofit Commission: “Governance is the process, activities and relationships that make sure your organisation is effectively and properly run.” Governance for Good: The ACNC’s Guide for charity board members. www.acnc.gov.au/ACNC/manage/tools/ACNC/edu/tools Strategic planning – big picture thinking Setting the Vision Setting the objectives to meet the key purpose of the organisations existence Ensuring sustainability and viability – ability to meet all pecuniary liabilities Certify compliance and accountability matters of the organisation are adhered to Maintain effective record keeping and monitoring of organisational objectives Audit requirements dependent on level of income received. Australian Taxation obligations – Goods and Services tax, Withholding taxes Fringe benefits tax Funders requirements – philanthropic or Government funds, State and Federal The purpose of this research is to highlight the complexities of board dynamics and engagement of financial management providing an insight as to ‘how’ boards are currently engaging in financial management practices and alternate models. To identify if Boards of non profit organisations are insufficiently engaged with sound financial management practices. To observe Board members (lack) confidence in asking appropriate questions regarding financial matters. Determine the level of understanding of financial reports. My observation is, the member of the board responsible for financial matters, usually called the Treasurer, presents a report which is only given moments of ‘air-time’, before the agenda is quickly whisked along to matters of general business. The treasurers report and financial statements are either inappropriately set out, condensing financial data to meaningless reports/spreadsheets, rather than formal financial statements. This could be the result of lack of interpretation and understanding of accounting standards and formats but there are a range of other issues including the capability of the board to deal with financial issues. This research provides the opportunity to delve deeper into the complex nature of board, unveiling boardroom capacity in financial management matters Observation of member participation in their engagement with financial data, report layouts and time allocated for exploring the financial performance and position Recognise the human dynamics at play with the theoretical perspective of Ralph Stacey.- Stacey, R. and Griffin, D., (2005). “Complexity and the Experience of Managing in Public Sector Organisations”. London, Routledge. How could non profit boards improve engagement in financial management? Subsidiary questions… What issues/complexities arise due to the relationship(s) between the CEO and the board? The power of influence – Ralph Stacey – Complexity Theory. Zahara and Pearce (1989) have stated, “There are countless lists of what boards should do. Yet evidence of ‘what boards actually do’ is not well documented… there is a pressing need to document what boards actually do: (pp325 – 326). Zahara, S.S & Pearce, J.A., (1989) “Boards of directors and corporate financial performance: A review and integrative model. Journal of Management, 15,291-334. Board members often lack skills in understanding financial management reports Meaningless reports are being presented Large asset purchase decisions being made by members with little understanding of the financial position or future forecast Cash flow forecasts either being non-existent or provided with limited information and understanding Movement away from ‘Community’ based committees/ boards being replaced with ‘Skills’ based board membership Agenda set and led by internal staff Longevity of membership linked to ‘power’ by either board or staff depending on term. Strategic planning led by staff, with limited input by Board Dominance of position linked to longevity New members have silenced voices Selection of board members led by CEO/internal staff Shielding - Lightbody M (2000) – agenda set by internal staff creating opportunity to shield information due to differentiating between operational and governance activity of the board. Dominance and power observed through robust conversations, (or lack thereof), linked to longevity of membership and skill – Renz,D(2001), Ralph Stacey lens – the interplay of human dynamics and relating that are apparent around the board room table To Stacey an organisation is not a system, but a set of inter-connections. Complex nature of humans, a set of interactions and relations Two organisation observed – both Company Ltd by Guarantee reporting compliance to Australian Securities Investment Commission (ASIC) Further research to broaden the scope of services observed, diversifying entity type and governance models Investigate board member selection practices Little research has been conducted into the composition of not for profit boards in Australia. Organisation 1 ( Org 1) Organisation 2 (Org 2) Entity Type: Company Limited by Guarantee Company Limited by Guarantee Reporting to: Australian Securities Investment Commission Australian Securities Investment Commission (ASIC) (ASIC) Corporations Act 2001. Corporations Act 2001. Australian Accounting Standards Board (AASB) Australian Accounting Standards Board(AASB) Australian Taxation Office (ATO) Australian Taxation Office (ATO) Current Board Membership 7 7 Membership mix Staff representatives, Project Volunteers and Directorship volunteer capacity – no Community members remuneration Financial Reporting compliance: Note CEO holds position of Company Secretary Community or Skills based board Mixed Transitioning from Community representatives to Skills based board Funding source 70% Government grants 77% Government grants Total revenue $1,021,000 $8,254,000 Interest Income $14, 648 – 1.4% of total revenue $131,563 – 1.6% of total revenue What is the future sustainability of the non profit sector when research identifies such gaps. With accountability mechanisms and compliance increasing, coupled with a shrinking pool of funds/resources/volunteers – how will the development of government intervention – ACNC impact the sectors sustainability How can boards strengthen their skills and understanding of financial management without loosing the value of community based membership? Presentation of financial data Sources of income Risk – dependencies Outgoings Critical cost areas Monitoring and tracking trends What is the ‘back-story’ the financial reports reveal about your service How do we portray this story to other members Strengthening/empowering the board with informative data to aid in effective decision making The accounting concepts Balance sheet items Understanding the financial position of the organisation Understanding the performance Inflow and outflows of funds… vulnerabilities/reliance's/ diversifying income.. Moderating expenditure.. Maximising efficiencies How do we know what we want to measure… Ratio analysis – snap shot of data, showing big picture outcomes.. Dashboard of key performance indicators Pie charts Trends Ratio analysis Key critical cost areas – what are we trying to measure / monitor ? Are reports aligned with strategy Key critical sources of income How do we manage these ? 5 4 Series 1 3 Series 2 2 Series 3 1 0 Category 1 Category 2 Category 3 Category 4 Sources of Income Grant Income Room Hire Fee for service Interest 14 12 10 8 Forecast 6 Current Last Year 4 2 0 Category 1 Category 2 Category 3 Category 4 Gross Profit Margin Gross Profit Income - % of each income dollar is gross profit - determines the adequacy of direct income/selling price Operating Expense Ratio Total Operating Expense Income Indicates the % of each income dollar absorbed by operating costs Helps control operating expenses (Lower the better ) Wage cost ratio Wages x 100 Income Lower the better, indicates the level of wages to income Current Ratio Current Assets Current Liabilities Measures cash position Assets available for every dollar of current liability (Higher the better) Liquidity or Quick Ratio Current Assets less stock Current Liabilities less overdraft Better measurement of cash measures liquid (cashable) current assets (Higher the better) Cash reserves in weeks Cash – Grants in Advance Total Expenditure / 52 (weeks) Indicates how many weeks an organisation could continue to operate if all income was ceased immediately Thinking differently about the presentation of financial data Monitoring and review of critical income and cost area Importance of governance and effective reporting to enhance/support effective decision making aligned with strategy Importance of a robust induction process for new board members Understanding the complex nature of board dynamics. Tips and Tools available for download www.betterboards.net www.communitycompass.org.au Adele Johns Community Compass Inc adele@communitycompass.org.au