ABC Marketing Plan Draft

advertisement

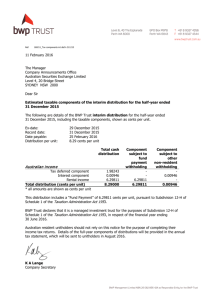

ABC Holdings Ltd Interim Results to June 2009 0 HIGHLIGHTS BWP Attributable profits (‘000s) Basic EPS (thebe) Dividend per Share ( thebe) Cost to income ratio (%) June 09 % change June 08 Dec 08 36,494 50% 73,638 85,818 25.4 50 % 51.2 60.3 - 8.00 8.00 22 % 50% 59% 72% Net asset value (‘000s) 505,281 22 % 412,852 437,654 NAV per share (thebe) 3.51 22 % 2.87 3.04 4,083,081 22 % Total assets (‘000s) 1 3,338,641 3,967,938 HIGHLIGHTS • African Banking Corporation successfully re-branded to BancABC across all operating territories • Total income 9% up to BWP 235 m (H108: BWP 215 m) • Cost to income ratio increased to 72% (H108: 50%) Retail banking development Dollarisation of the Zimbabwe economy and costs iro strengthening the existing operations • Attributable profit of BWP 36.5 m (H108: BWP 73.6 m), and EPS of 25.4 thebe (H108: 51.2 thebe) • Strong operational and financial performance in Mozambique entrenches BancABC’s positioning in that market • Retail banking development progressing well - branch network to be rolled out H209. 2 ECONOMIC OVERVIEW 3 ECONOMIC OVERVIEW 8 Dot-com Crisis Asian Crisis % GLOBAL GDP GROWTH 6 4 2 0 -2 Differential between SSA and World Growth Source: IMF 4 World Growth SSA Growth 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 -4 ECONOMIC OVERVIEW KEY INDICATORS • Global economy is projected to decline by 1.4% in 2009 • SSA economic growth suffering from the negative impact of global recession but still projected to grow at 1.5% in 2009, outperforming global economy • Negative growth in Botswana • Zimbabwe expected to registered GDP growth for the first time in 10 yrs • Commodity prices weakened significantly in sympathy with the global economic downturn resulting in weak export earnings • Inflation pressures have generally been low on the backdrop of weak global demand and subdued oil prices • Zimbabwe burst the inflation bubble following the adoption of multi-currency system – hyperinflation turned to deflation 5 ECONOMIC OVERVIEW GDP COUNTRY OPPORTUNITY Banking Deposits (USDm) Banking Credit (USDm) Banking Assets (USDm) Jun 2009 Jun 2009 Jun 2009 (USDm) GDP Growth rate 2009 2009 est Botswana 12,200 -10.4% 4,883 2,573 6,580 1.8 12 Mozambique 10,380 4.3% 2,876 1,962 4,109 21.2 12 Tanzania 21,854 2.5% 4,739 4,626 6,770 40.6 36 Zambia 13,931 4.0% 2,059 1,535 2,942 12.9 14 Zimbabwe 3,498 3.7% 706 263 1,009 12.6 28 Country Source: Central Banks, Ministries of Finance and Central Statistical Offices 6 Population 2009 est (m) No. of banks ECONOMIC OVERVIEW COUNTRY OPPORTUNITY • SSA currencies are recovering from significant declines against the USD experienced in Q408 and Q109 • Volatility in forex markets higher than previously experienced • Zimbabwe presents great growth opportunity despite low asset base • Depreciation of ZMK has reduced deposit base • Banking assets however continued to grow, albeit at a slower pace 7 ECOMOMIC OVERVIEW Country Inflation Rate June-2009 Avg. TB Yield Rate June-2009 Avg. Prime Lending Rates 2009 Avg. Prime Lending Rates 2008 Zimbabwe* 0.6% --- 9.6 % 3,700% Botswana 7.0 % 11.4 % 15.5 % 16.6% Mozambique 2.7 % 11.5 % 16.4 % 20.1% Zambia 14.4 % 14.0 % 20.9 % 25.2% Tanzania 10.7 % 11.6 % 13.5 % 13.6% *Monthly inflation 8 INFLATION AND INTEREST RATES COUNTRY OVERVIEW 9 COUNTRY OVERVIEW BWP’000s BancABC Botswana ATTRIBUTABLE PROFIT % % % June 09 contribution June 08 contribution Dec 08 contribution 5,959 41% 5,968 12% 13,193 23% BancABC Mozambique 17,475 120% 7,340 15% 16,644 29% BancABC Tanzania 1,678 12% 2,666 7% 10,096 17% ABC Zambia* (12,669) -87% 4,710 10% (7,223) -13% BancABC Zimbabwe 2,133 14% 27,613 56% 25,338 44% 100% 48,297 100% 58,048 100% Banking operations 14,556 H.O. and other 21,938 25,341 27,770 TOTAL 36,494 73,638 85,818 *includes Microfin Africa 10 COUNTRY OVERVIEW BOTSWANA • Economy severely impacted by declining diamond prices • Loan book declined by 9% from Dec 08 but up 17% from June 08 • Impairments contained at prior year levels • Total income increased by 15% to BWP 39.1 m • Net interest income marginally down to BWP 16.9 m (H108: BWP 18.2m) • Other income increased significantly to BWP 22.3 m (H108: BWP 15.8m), predominantly foreign exchange trading income • Retail expansion and staffing costs impacted profitability • Attributable profit stable at BWP 6.0m 11 COUNTRY OVERVIEW MOZAMBIQUE • Impressive performance with attributable profit up 140% to BWP 17.5 m • Net interest income up 57% to BWP 21.5m • Loan book grown by 25% from Dec 08 and 75% from June 08 • Other income up 162% to BWP 28.6 m • Increase in business volumes • Higher margins owing to high volatility • Foreign exchange trading income • Low levels of impairments due to economy’s lesser dependence on commodity prices • Banc ABC’s strong niche position in market place reinforced 12 COUNTRY OVERVIEW TANZANIA • Net interest income increased to BWP 14.2 m (H108: BWP 11.6 m) • Loan book grew 43% YOY but declined 14% since Dec 08 • Other income grew by 32% to BWP 11.9 m • Impairments significantly higher at BWP 5.6 m (H108: BWP 1.0 m) • Attributable profit lower at BWP 1.7 m (H108: BWP 2.7 m) 13 COUNTRY OVERVIEW ZAMBIA • Zambian economy very hard hit by slump in copper prices during 2008, significant lag effect into broader economy and support sectors • High levels of impairments of BWP 22m due to resulting economic impact • Net interest income stable at BWP 32.4 m, but other income declined due to limited liquidity • Management changes implemented • Merger of Microfin and ABC Zambia operations expected to produce synergistic cost savings 14 COUNTRY OVERVIEW ZIMBABWE • Overall income down vs. H108, but improved from H208 • Net interest income BWP 2.6 m (H108: BWP 8.6m) • Other income BWP 12.8m (H108: BWP 32.1m) due to reduced investment property income and tight liquidity • Attributable profit of BWP 2.1 m (H108: BWP 27.6 m) • Significant cost increase due to dollarisation • Decision taken to divest of investment portfolio to fund banking operations • Promising signs of banking sector recovery in Zimbabwe • Stabilising Zimbabwe economy presents great growth opportunities off a very low base 15 FINANCIAL OVERVIEW 16 FINANCIAL OVERVIEW INCOME STATEMENT • Net interest income up 11% to BWP 78.7m • Non interest income up 8% to BWP 156.5m, driven by forex income • Total income up 9% to BWP 235 m (H108: BWP 215 m); • Net interest income contribution to total income stable at 33% • Cost to income ratio increased to 72% (H108: 50%) due to the retail banking development, dollarisation of the Zimbabwe economy and strengthening of human capital across the Group • Net interest income covered 47% of costs • Basic EPS 25.4 thebe (H108: 51.2 thebe); • Average return on equity remains positive at 16% (H108: 39%); 17 FINANCIAL OVERVIEW INCOME SPLIT 40% 60% June 05 61% 67% 67% 67% 39% 33% 33% 33% June 06 June 07 June 08 June 09 Net interest income Other income • Income composition consistent for last three years • Interest income to contribute proportionally more going forward • Expected return to stability in the global markets • Redeployment of capital from non-core assets to interest earning assets 18 FINANCIAL OVERVIEW OTHER INCOME % BWP’000s June 09 June 08 change Gains from investment activities 71,569 59,040 21% Dividends received 21 1,444 -99 % Fee and commission income 37,033 26,982 37 % Fx trading income and currency revaluation 44,046 17,015 159 % Fair value gains on investment properties (12,478) 32,901 -138 % Fair value adjustment: derivative instruments 9,762 (4,254) 329 % Rental and other income Total 6,589 156,542 11,693 144,821 -44 % 8% • Significant growth in foreign exchange trading volume, especially in Mozambique and Botswana 19 FINANCIAL OVERVIEW 5 YEAR EARNINGS • Trend shows effect of inflation adjusted accounting in Zimbabwe • Bar Zambia, all banking operations remain profitable 20 FINANCIAL OVERVIEW 21 BALANCE SHEET • Deposits increased by 4% from Dec 08 and 26% from June 08 to BWP 1.9 billion • Region’s high exposure to commodities impacted significantly on business growth and debt servicing • Group impairments as a result increased by 215% to BWP 41m, with Tanzania and Zambia increasing by 340% and 460% respectively • Strengthening of Group credit department and systems ongoing • Group balance sheet grew by 24% from June 08 and 4% from December 08 to BWP 4.1 billion • Loans and advances up by 38% to BWP 2.2 billion compared to June 08, but declined by 4% since December 08 due to deliberate policy to curtail lending • NAV per share increased by 15% from December 2008 and 22% from June 2008, to 3.51 thebe per share; FINANCIAL OVERVIEW DEPOSIT GROWTH 1,338 1,012 704 556 450 429 204 Botswana Mozambique Tanzania June 09 276 Zambia 124 113 Zimbabwe June 08 • 26% growth in deposits • Botswana, Mozambique and Tanzania grew by over 30% • Zambia recorded a decline 22 FINANCIAL OVERVIEW Zambia 7% Tanzania 19% Mozambique 24% 23 DEPOSIT BOOK SPLIT Zimbabwe 4% Botswana 46% FINANCIAL OVERVIEW LOAN BOOK GROWTH 676 581 530 455 361 354 260 336 100 0 Botswana Mozambique Tanzania June 09 Zambia Zimbabwe June 08 • Net loans increased by 38% from June 08 • All subsidiaries registered significant growth with the exception of Zambia which grew marginally 24 FINANCIAL OVERVIEW Zambia 17% Tanzania 25% 25 LOAN BOOK SPLIT Zimbabw e 5% Botsw ana 32% Mozambique 21% FINANCIAL OVERVIEW 26 5 YEAR NAV TREND • NAV per share increased 22% • Consistent NAV growth over the last 5 years • Zimbabwe operations positive contribution to capital in 2009 FINANCIAL OVERVIEW CAPITAL Capital* FCTR Capital* FCTR June 09 June 09 CAR June 08 June 08 BancABC Botswana 119,950 - 17% 105,810 - BancABC Mozambique 157,288 (5,514) 20% 113,533 (1,379) BancABC Tanzania** 130,045 (10,603) 14% 104,044 3,790 ABC Zambia*** 65,596 (2,968) 14% 146,484 26,900 BancABC Zimbabwe 92,922 (197) 45% 103,105 (157,058) BWP’000 *including Tier II ** including TDFL ***including Microfin 27 FINANCIAL OVERVIEW CAPITALISATION • Mutually agreed not to draw down the proposed US$25 m investment by CVCI • Zimbabwe investment portfolio of equity and real estate assets to be liquidated to fund banking operations – original capital preservation strategy for Zimbabwe no longer necessary • The proceeds are expected to meet the Group’s funding needs • Planned rights issue postponed • IFC to disburse 50% of US$13.5 m convertible loan • Balance to be drawn down over the next 12 months 28 RETAIL BANKING • Significant investment in retail banking made in systems and human capital • BWP 22 m in direct expenses • Investment in IT systems of US$3.2 m • Retail Banking head office now appropriately staffed, but contributed to overall higher employee costs • 9 branches to be opened by the end of 2009 • Costs expected to continue to increase as project rolls out • Retail banking expected to contribute meaningfully in 2nd half of 2010 • Branch profitability estimated at between 18 to 24 months 29 OUTLOOK CHALLENGES • Economies across the region beginning to show signs of recovery • Strengthening commodity prices especially copper, nickel and diamonds • Expected improvement in incidence of bad debts • Major thrust continues to be consolidation and ensuring modest growth notwithstanding high costs as a result of retail banking • Continued proactive management of the loan book • Merger of Zambia operations should result in cost savings and turn around • Deposit mobilization remains a key focus area for the group, particularly in Zambia • Dollarisation of the Zimbabwe economy brings liquidity challenges, but presents huge opportunities 30 THANK YOU 31 APPENDICES 32 33 0 Source: World Bank 0 Apr-09 Jan-09 200 Oct-08 100 Jul-08 400 Apr-08 200 Jan-08 600 400 Oct-07 500 Jul-07 300 800 Maize Price, US$/t International Grain Prices Apr-07 400 Maize Wheat Rice Rice, US$/mt 500 Jan-07 Jan-05 May-05 Sep-05 Jan-06 May-06 Sep-06 Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Maize & Wheat, US$/t ECONOMIC ENVIRONMENT GRAIN PRICES Regional Grain Prices 1000 World Moz Kenya Tanz Zambia 300 200 100 0 34 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 Apr-08 90 80 70 Appreciation 130 Jan-08 140 Oct-07 Jul-07 Apr-07 Jan-07 Exch. Rate Index, Jan 07=100 MZN/USD TZS/USD BWP/USD 120 Depreciation ECONOMIC ENVIRONMENT EXCHANGE RATES 150 ZMK/USD 110 100 ECONOMIC ENVIRONMENT GDP GROWTH 8 6 4 2 0 2007 '08 '09 Botswana 2007 '08 '09 Mozambique 2007 '08 '09 Tanzania 2007 '08 '09 2007 '08 '09 -2 -4 Zambia -6 -8 -10 Initial Projections Revised Projections 35 -12 Zimbabwe -14 ECOMOMIC ENVIRONMENT To 1 BWP 30 Jun-09 31 Dec-08 30 June-08 United States Dollar 0.15 0.13 0.15 Mozambique Metical 3.95 3.38 3.96 South African Rand 1.14 1.25 1.20 Tanzania Shilling 193 174 180 Zambian Kwacha 765 636 494 Zimbabwe Dollar - 88 Quad* 24.9 billion* •ZWD Old Mutual implied rate •ZWD revalued in 2008 36 EXCHANGE RATES ECOMOMIC ENVIRONMENT To 1 US dollar 30 Jun-09 31 Dec-08 30 June-08 Botswana Pula 7.76 7.54 6.53 Mozambique Metical 27.13 25.50 24.05 South African Rand 7.71 9.40 7.83 Tanzania Shilling 1 303 1 315 1 173 Zambian Kwacha 5 170 4 795 3 225 - 665 Quad* 162.6 billion* Zimbabwe Dollar •ZWD Old Mutual implied rate •ZWD revalued in 2008 37 EXCHANGE RATES FINANCIAL PERFORMANCE: NET INTEREST INCOME Ave. Yield on Ave. Cost IEA 38 Spread Spread 2009 2008 ABC Botswana 12.3% 11.3% 1.0% 1.3% ABC Mozambique 10.8% 5.1% 5.7% 5.4% ABC Tanzania 10.9% 7.2% 3.7% 3.7% ABC Zambia 14.4% 9.3% 5.1% 4.9% ABC Zimbabwe 21.4% 3.7% 17.7% 20.5% Microfin Zambia 67.6% 22.3% 45.3% 43.9% ECONOMIC OVERVIEW COMMODITY PRICES Oil Copper Nickel Platinum Palladium Soyabeans Coffee (Arabica) Gold Wheat Maize Cotton (A-Index) Rice Aluminum Coal 71.3 64.5 54.6 45.9 39.9 39.3 26 15.9 15.9 13.4 10.4 7.7 5.7 -8.7 -20 -10 % 0 10 20 30 40 50 60 70 • Commodity prices have recovered significantly from Dec-08 prices Source: World Bank 39 80 MARKET CAPITALISATION Mkt Cap as of 9-Mar-09 Mkt Cap as of 4-Aug-09 US$ Bn INTERNATIONAL BANKS 187 250 200 157 150 100 82 59 6 60 18 46 45 10 49 56 25 40 50 18 7 0 Citigroup HSBC JP Morgan RBS BNP Paribas Barclays Deutsche Bank Morgan Stanley • Modest recovery in banks mkt cap indicates that the worst of the banking crisis could be behind us 40 INTERNATIONAL EQUITY MARKET CAP Tokyo SE 14,413 4,043 9,200 3,100 15,600 4,300 London SE 3,175 2,400 4,000 NASDAQ NYSE US$ BILLIONS 3,309 1,800 3,800 2,106 Mkt Cap: Jun-09 1,400 Mkt Cap: Dec-08 3,700 Mkt Cap: Dec-07 Shanghai SE • International equity markets also showing signs of recovery 41 STOCK MARKET CAPITALIZATION 10,792 4,168 3,902 3,702 SSA Countries US$ m 1,480 Mkt Cap: Jul 2009 54,004 10,985 3,745 4,106 3,541 1,303 Mkt Cap: Dec 2008 67,790 Kenya Zim Zambia Botswana Tanzania Nigeria • JSE capitalisation up from US$485bn in Dec 08 to US$667bn in July 09 42