DOCX: 12942 KB - Department of Industry, Innovation and Science

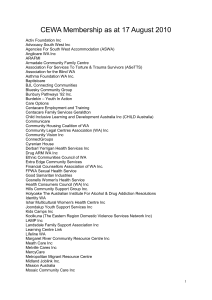

advertisement