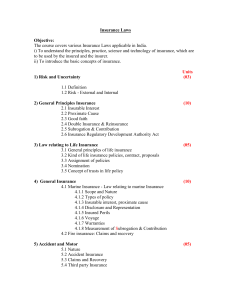

INSURANCE

advertisement

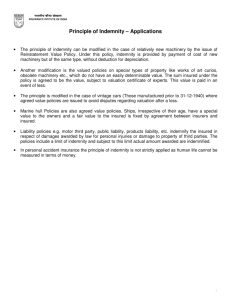

INSURANCE Insurance is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. • An insurer is a company selling the insurance. • The insured, or policyholder, is the person or entity buying the insurance policy. • The amount to be charged for a certain amount of insurance coverage is called the premium. Contract of Insurance Is a contract whereby the insurer undertakes to make good the loss of another called the insured by payment of some money to him on the happening of a specific event. Characteristics of insurance • • • • • • • Risk sharing Risk assesment Cooperation Payment at the time of contingency Quantum of compensation Insurance not a charity Larger the number ,better the care Insurable Risk • The law of large number. • The loss produced by the risk must be definite. • The loss must be fortuitous or accidental. • The loss must not be catastrophic. Criteria of determination of whether a risk can be insured or not • The risk must arise out of the ordinary course of business and it should not be artificially created by parties. • The risk must be common enough to justify its spreading at a nominal cost. • There must be an element of uncertainty as to the occurrence of risk or the time of the occurrence. • The party must have some real interest in avoiding the risk. Principles of Insurance Utmost Good Faith Insurable Interest Principle of Indemnity Principle of Contribution Principle of Subrogation Principle of loss Minimization Principle of ‘CAUSA PROXIMA’ Utmost Good Faith • Both the parties i.e. the insured and the insurer should a good faith towards each other. • The insurer must provide the insured complete ,correct and clear information of subject matter. • The insurer must provide the insured complete ,correct and clear information regarding terms and conditions of the contract. • This principle is applicable to all contracts of insurance i.e. life, fire and marine insurance. Insurable Interest • The insured must have insurable interest in the subject matter of insurance. • In life insurance it refers to the life insured. • In marine insurance it is enough if the insurable interest exits only at the time of occurrence of the loss • In fire and general insurance it must be present at the time of taking policy and also at the time of the occurrence of loss. • The owner of the party is said to have insurable interest as long as he is the owner of the it. • It is applicable to all contracts of insurance. Principle of Indemnity • Indemnity means a guarantee or assurance to put the insured in the same position in which he was immediately prior to the happening of the uncertain event. The insurer undertakes to make good the loss. • It is applicable to fire ,marine and other general insurance. • Under this the insurer agrees to compensate the insured for the actual loss suffered. Principle of Contribution • The principle is a corollary of the principle of indemnity. • It is applicable to all contracts of indemnity. • Under this principle the insured can claim the compensation only to the extent of actual loss either from any one insurer or all the insurers. Example…………………....[7.Contribution] A insures his house against fire for Rs.10,000 with insurer X, and for Rs.20,000 with insurer Y . A loss of Rs 12,000 occurs. X is liable for Rs.4,000 and Y for Rs.8,000. If the whole amount of the loss is paid by Y, he can recover Rs.4,000 from X. EXAMPLE: Principle of Subrogation • As per this principle after the insured is compensated for the loss due to damage to property insured , then the right of ownership of such property passes on to the insurer. • This principle is corollary of the principle of indemnity and is applicable to all contracts of indemnity Example…………………….[8.Subrogation] • A insures his goods with B for Rs 1,000. The goods are damaged by fire caused by C , a miscreant . A recovers the loss from B and subsequently he succeeds in recovering this loss from C also. He must hold the amount recovered from C in trust for B. Principle of Loss of Minimization Under this principle it is the duty of the insured to take all possible steps to minimize the loss to the insured property on the happening of uncertain event. Principle of ‘Causa Proxima’ • The loss of insured property can be caused by more than one cause in succession to another. • The property may be insured against some causes and not against all causes. • In such an instance, the proximate cause or nearest cause of loss is to be found out. • If the proximate cause is the one which is insured against ,the insurance company is bound to pay the compensation and vice versa. Example… [4.Causa Proxima: ] – The cargo of rice in a ship was destroyed by seawater flowing in the ship through a hole made by rats in bathroom lead pipe.Held, the underwriter was liable as the damage was due to a peril of the sea.The proximae causa of the damage in this case is sea water.If however , the loss is caused directly by rats or vermin, the underwriter will not be liable. [Hamilton Fraser & Co. vs.Pandroff(1887)] Significance of insurance • • • • • Protection against risk of loss Distribution of risk Capability to face competition Optimum utilization of capital Aid to foreign trade PRACTICAL PROBLEMS: CASE.1 • A ship insured against marine losses is sunk.The insurer pays the value in full.The ship is subsequently salvaged. Who is entitled to the sale proceeds of the salvaged ship.? Solution to Case.1 • The insurer is entitled to the sale proceeds of the salvaged ship.[Subrogation] PRACTICAL PROBLEMS: CASE.2 • A house is insured against fire for Rs.50,000.It is burnt down but it is estimated that Rs.30,000 will restore it to the original condition. How much is the insurer is liable to pay ? Solution to Case.2 • Insurer is liable to pay Rs.30,000 only.(Indemnity) PRACTICAL PROBLEMS: CASE.3 • A insures his house against fire for Rs.40,000 with B and for Rs.60,000 with C.A fire occurs and a loss is estimated at Rs. 14,000.A recovers Rs.14,000 from B. What are the rights of B against C ? Solution to Case.3 • B can claim Rs. 8,400 from C as the loss of Rs.14,000 will be borne by B and C in the ratio of 40,000: 60,000 [Contribution]. PRACTICAL PROBLEMS: CASE.5 • A contracted to build a house for B for which he was to be paid Rs.2,00,000.All the materials were to be supplied by B. Can A insure the materials for the period during which the building is being constructed.? Solution to Case.5 • A can insure the materials . (Insurable interest). PRACTICAL PROBLEMS: CASE.6 • A’s goods in a warehouse are insured.B is the insurer.The goods are burnt.A recovers their full value of Rs.1,000 from B.Then A sues the warehouse keeper and recovers Rs.1,000 from him.B claims this amount from A but A refuses to make over the amount to B. How would you decide the dispute between A and B ? Solution to Case.6 • A is bound to pay Rs.1,000 to B. (Castellain vs.Preston) PRACTICAL PROBLEMS: CASE.7 • A firm of contractors assured a lorry against fire.In reply to a question in the proposal form, “ state the address at which the lorry will be usually garaged” a wrong address was given.The policy contained a clause that answers to the queries in the proposal form were the basis of the contract.The risk of fire was the same as the address given and at the correct address. If the lorry is damaged by fire, are the insurers liable ? Solution to Case.7 • The insurers are not liable. [ Dawsons Ltd. Vs.Bonnin (1922) ] Insurance Classification Insurance Life Insurance Fire General Insurance Marine Health Auto Life insurance • It is contract where insurance company agrees to pay a particular sum of money to the insured on expiry of certain time or on death of the person whose life is insured Types of life insurance • • • • Term policy Whole life policy Endowment policy ULIP Defining General Insurance • It is a contract of indemnity whereby the insurer undertakes to pay compensation to the insured for actual loss only. If loss does not occur, the payment need not be made Types of General Insurance Main types of general insurance are: • • • • • • • • Fire Health Marine Motor Vehicle Unemployment insurance Credit insurance Workmen compensation insurance Cash transit insurance Insurance organisation • LIC • GIC LIC (life insurance corporation Set up in 1956 LIC was formed by nationalizing 245 life insurance companies. The main aim was to spread insurance Mobilize savings Investing funds Act as trustees Continue….. promoting a sense of pride and job satisfaction among agents and employees Diversification by LIC LIC HOUSING FINANCE LIC MUTUAL FUNDS Jeevan bima sahyog assets mgt co(JBSAMC) LIC International EC vision & Mission Mission "Explore and enhance the quality of life of people through financial security by providing products and services of aspired attributes with competitive returns, and by rendering resources for economic development." Vision "A trans-nationally competitive financial conglomerate of significance to societies and Pride of India." g.i.c. (GENERAL INSURANCE CORPORATION) It was incorporated on 22 November 1972. The Government of India (GOI), through Nationalisation took over the shares of 55 Indian insurance companies and the undertakings of 52 insurers carrying on general insurance business. Main objective:GIC was formed for the purpose of superintending, controlling and carrying on the business of general insurance. vision & Mission Vision “To be a leading global reinsurance and risk solution provider” Mission: Building long-term mutually beneficial relationship with business partners Practicing fair business ethics and values Applying “state-of-art” technology, processes including enterprise risk management and innovative solutions. Developing and retaining highly motivated professional team of employees Enhancing profitability and financial strength befitting the global position Difference between life and general insurance • • • • • Contract of indemnity Insured event Purpose of insurance Calculation of premium Doctrine of subrogation Players in the Industry Life Insurance General Insurance Life Insurance Corporation of India. General Insurance Corporation of India. 1. Oriental Insurance Company Ltd. 2. New India Assurance Company Ltd. 3. National Insurance Company Ltd. 4. United India Insurance Company Ltd. New Entrants ICICI Prudential Life Insurance Ltd. Bajaj Alliaz General Insurance Company Ltd. Tata AIG Life Insurance Corporation Ltd. Reliance General Insurance Company Ltd. ING Vysya Life Insurance Corporation Ltd. Tata AIG General Insurance Company Ltd. Kotak Mahindra Life Insurance Corporation Ltd. Royal Sundaram Alliance Insurance Company Ltd. Strategies for commercial viability • • • • • • • develop efficient distribution system Direct marketing Development of customer specific products Entry in rural market Cooperative promotion Launching crop insurance for farmers Lean office infrastructure for rural areas.