Structure and Responsibilities of Organizations in the Fully Funded

advertisement

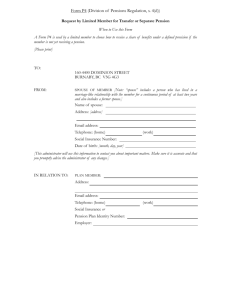

Agency for supervision of Fully Funded Pension Insurance (MAPAS) Budgetary aspects of the Macedonian Pension Reform Zorica Apostolska Director, MAPAS April 9, 2008 Bucharest Agenda Pension system design and Macedonian Case Actuarial projections in Macedonia Parametric reforms of PAYG system in Macedonia Reformed pension system design and its expected effects Transitional deficit Preparation and implementation Future Challenges Pension system design and Macedonian Case No two pension systems are the same General categories (by method of financing) PAYG Fully funded DB DC Another features of pension systems: Who is covered Covered risks Contribution rate Replacement rate Design depends on many “external” factors: economy, political, sociological and cultural environment, etc. Pension system design and Macedonian Case (cont.) Macedonian pension system before the reform System features PAYG, DB More tan 50 years of existence Mandatory High level of coverage Types of pension benefits (risks covered) • old age • survivors • disability • minimum pension guarantee Pension system designs and Macedonian Case (cont.) Macedonian pension system problems Economic factors o Unfavorable economic and labor market developments o Contribution evasion Demographic factors Decrease of the number of contributors Increase of the number of pensioners o Ageing of population Expected insolvency of the Public Pension and Disability Insurance Fund 1400000 70% 1200000 60% 1000000 50% 800000 40% 600000 30% 400000 20% 200000 10% 0 0% 2001 2010 2020 2030 2040 2050 2060 2070 2080 2090 2100 year proportion number Actuarial projections Population 60+ / Population 18 - 59 population 18 - 59 population 60 + proportion Actuarial projections Ratio contributors / pensioners 700000 2.0 600000 1.6 1.2 400000 300000 0.8 200000 0.4 100000 0 0.0 2001 2010 2020 2030 2040 2050 2060 2070 2080 2090 2100 year proportion number 500000 contributors pensioners proportion Actuarial projections (Contributions – Pensions) / GDP 16% 13% percentage 10% 7% incomes 4% expenditures surplus (deficit) 1% -2% -5% -8% 2001 2010 2020 2030 2040 2050 2060 2070 2080 2090 2100 year Parametric reforms of the Macedonian pension system Features of the system that influence its flexibility Retirement age o Increase in the retirement age o Age exclusive condition o Termination of early retirement provisions Decrease of the replacement rate Change of pension indexation method Sustainable contribution rate and replacement rate 70% 60% percent 50% 40% 30% 20% 10% 0% 2001 2020 2040 2060 2080 2100 year contribution rate replacement rate Design of the reformed pension system and its expected effects Mandatory pension and disability insurance based on generational solidarity (first pillar) Mandatory fully funded pension insurance (second pillar) Voluntary fully funded pension insurance (third pillar) Design of the reformed pension system and its expected effects (cont.) For the system Solvent pension system Increasing national savings Strengthening the investment power Economy growth Increasing the Macedonian labor market efficiency For the individual Greater security of the pension Risk diversification Transparency of the operations Transitional deficit What is transitional deficit? Part of the contributions that flow to the second pillar (outflow from the first pillar) How can we measure the deficit? Number of switchers Size of second pillar contributions How can we finance this deficit? Issuance of Government bonds (debt financing) Use of the privatization proceeds of public enterprises Fiscal contraction (tax financing) Combination Transitional deficit (cont.) Transitional deficit (cont.) How can we control the deficits? Measure the transitional deficit Set the maximum acceptable level of the deficit Design the system to fit that level First pillar parametrical reforms help financing transitional deficit Macedonian case 35% of pension contributions go to the second pillar Mandatory entrance only for new labor force entrants (employed after January 1, 2003) Voluntary entrance for current works Only 5 to 7 years accrued right for switchers recognized Preparation and Implementation Government commitment to Pension Reform • Pension Steering Committee Established • Actuarial Unit Established • Comparative analysis prepared Development of a concept, discussion and legislation adoption Public informative and educational campaign Ministers Council • Makes key policy and political decisions • Chaired by Minister of Labor • Controls overall pension reform implementation strategy Working Group • All major institutions represented • Meets weekly • Manages overall implementation project USAID and World Bank assisting Preparation and Implementation (cont.) Obstacles Size and ways of financing transition costs Low scope - small country, low number of contributors and assets in fully funded pension insurance at start Underdeveloped and in-depth financial and capital market, absorbing power of the market, not enough instruments existing Absence of custodian function at commercial banks Preparation and Implementation (cont.) Ways to overcome obstacles Foreign and domestic experts prepared assessment of fiscal, financial and macroeconomic aspects of different pension reform options and analysis of capital markets Action plan developed for legal and institutional changes in pension regulation and financial and capital market Working group (Ministry of Finance and Central Bank of Republic of Macedonia) – Strategy for Development of Government Securities Market (September 2003) • One of its objectives: Creating financial instruments adequate to the needs of institutions to emerge from pension system reform • Another objective: Financing transitional deficit Preparation and Implementation (cont.) Ways to overcome obstacles (cont.) Start of second pillar contributions flow connected by Law with issuance of first continuous issuance of government bonds (Issuance: 24 November 2005, Start of contributions: January 1, 2006) Central Bank – Custodian for the first 5 years of the system (transitory provision) Regular actuarial projections prepared on annual basis PDIF balance and transitional deficit submitted to the Ministry of Finance Future challenges Improved contribution collection and evasion elimination, increase of employment rate Regular recalculation of the transitional deficit Appearance of new instruments (corporate bonds, mortgage backed securities, etc.) Custodian function at commercial banks Start of third pillar operations Start of payments of pension benefits from second pillar Thank you for you attention! www.mapas.gov.mk