Ohio*s School Funding System

advertisement

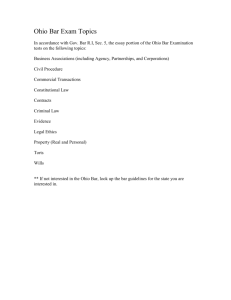

Ohio’s School Funding System It’s not that complicated. Really! Founders and Followers Education is the Original Heart of it All Land Ordinance of 1785 “There shall be reserved the lot No. 16, of every township, for the maintenance of public schools within the said township” Founders and Followers Ohio Constitution “The General Assembly shall make such provisions, by taxation, or otherwise, as, with the income arising from the school trust fund, will secure a thorough and efficient system of common schools throughout the state…” What Does That Mean? How it works: 1) The State calculates how much it should cost to provide an education in a school district 2)The state assumes each district can raise 22 mills in local property tax 3)The State picks up the rest What’s a Mill Anyway? One mill = $31/$100,000 home What if the Formula is off? What if the calculation is wrong? An Even Greater Property Tax Burden DeRolph v. Ohio 1991 Nathan DeRolph, a high school student in Perry County sues the state’s funding system 1997 Ohio Supreme Court rules that the system needed an overhaul and a reduction in the need for property taxes. 2000 Ohio Supreme Court considered the system again. Constitutional? 2001 Ohio Supreme Court considered the system again. Constitutional? 2002 Ohio Supreme Court considered the system again. Constitutional? “Until a complete systematic overhaul of the system is accomplished, it will continue to be far from thorough and efficient and will continue to shortchange our students. The overreliance on local property taxes is the fatal flaw that until rectified will stand in the way of constitutional compliance.” Ohio Supreme Court Justice Alice Robie Resnick, DeRolph IV, December, 2002 So the General Assembly got us a Constitutional Funding System, Right? Not So Fast! So What Happened? • The Ohio Supreme Court dropped its jurisdiction over the DeRolph case in 2002 18 years later… • In 2009, Gov. Ted Strickland introduced the Evidence-Based Model • It was a systemic overhaul that cut the need for property taxes by an average of 13 mills over 10 years. Present Day However, Gov. John Kasich eliminated the EBM Historic, Massive Cuts The biennial budget cuts nearly $3 billion from education Impact of Budget Cuts Increase, rather than decrease need for property tax levies to pay for schools On average, more than 3 mills will be lost to school districts Impact of Budget Cuts Disproportionately hurt districts that can’t raise much property tax Impact of Budget Cuts Example: Under the budget as passed, folks in Trimble, who make less than half what folks in Upper Arlington make, will have to tax themselves at 8 times the tax rate to replace the cuts On average, folks in Ohio’s most challenged districts have to raise more than 1 ¾ times the tax rates of the most advantaged districts Statewide Examples Amount cut Revenue Mills Needed between FY13 Generated to Replace District and FY11 from 1 Mill Cuts Trimble Local $ (538,783) $ 41,089 (13.11) Southern Local $ (551,322) $ 44,925 (12.27) Rock Hill Local $ (1,184,864) $ 98,795 (11.99) Olentangy $ (4,959,781) $ 3,174,460 (1.56) Dublin $ (6,660,786) $ 2,758,364 (2.41) Westerville $ (5,845,912) $ 2,476,884 (2.36) Cleveland $(50,556,682) $ 5,606,461 (9.02) Charter Schools and Vouchers Gov. Kasich and General Assembly leaders seek to expand Charter Schools and Vouchers What Are They Anyway? • Charter Schools: Public Schools that are freed up of most regulations school districts face, theoretically allowing them more creativity and innovation • Vouchers: A check the state gives to a parent for their child to attend a private school At What Cost? Percentage Increases Since Court Dropped Case 60.0% 50.0% 40.0% 30.0% Charter School Funding 20.0% Traditional Public School Funding 10.0% 0.0% 2004 -10.0% 2005 2006 2007 2008 2009 2010 2011 Bottom Line Post-DeRolph Charter Schools have seen a nearly 103% increase in state money over inflation Traditional Public Schools have seen a more than 13% cut in state money, relative to inflation Are the Choices Better? In a word, Ohio State Report Card • Rates districts and charter schools based on their pupils’ academic success • 5 levels: – Academic Emergency – F – Academic Watch – D – Continuous Improvement – C – Effective – B – Excellent – A – Excellent with Distinction – A+ Performance Difference Nearly Half of all Traditional Public Schools rate A or A+ on the State Report Card Nearly half of all Charter Schools rate either a D or F on the State Report Card So… Where does the $ come from? Money for Charter Schools and Vouchers is taken out of the amount the state distributes to a district The amount transferred out is almost always more than the state would have given the district for that pupil Example: • Columbus receives $2,040 per pupil from the state through the formula for the more than 65,000 kids it educates • The state transfers an average of $6,392 per pupil for each of the more than 2,000 kids Columbus loses to E-Schools • Implications: Columbus has to either cut services, or use local property taxes to make up the difference Comparing Costs for the State • Local school districts: $3,193/ pupil • Charter Schools: $7,219/ pupil • E-Schools: $6,320/ pupil • Vouchers: $5,200/ pupil Bottom Line On average, all Charter and Voucher options remove more state money per pupil from a district than the district ends up receiving per pupil from the state. Districts have to make up those losses through cuts or local property tax. Historic Annual Increases Charters: 30% EdChoice voucher program: 23% Increasing the Burden If they expand faster, then that’s more property tax that will have to be raised locally The budget would quadruple the EdChoice Voucher program to a greater than $200 million a year deduction Myth: Vouchers Allow Kids to Be “Rescued” from Failing Districts Fact: Vouchers have little to NO IMPACT on student success It’s All Teachers’ Fault • Unprecedented attack on the teaching profession • Like other public employees, teachers are also impacted by Senate Bill 5 Senate Bill 5 Anti-Teacher • Would permit school districts to adopt any method of evaluation they chose to determine merit pay • Ridiculous: How many football games have you attended? • Cruel: What sexual orientation are you? Budget Anti-Teacher Provisions Forces Merit Pay based on system developed by State School Board OOPS!!!!! Been There, Done That • Ohio’s already developed a Model Teacher Evaluation System with the cooperation of teachers over the last two years • In many ways it’s actually more rigorous than what the Radical Republicans passed Student Safety Jeopardized • Teachers would no longer be able to advocate for the safety of their students through negotiating things like: – Asbestos removal – Video monitoring equipment – Numbers of safety officers at school There is Hope! 1.3 million signatures gathered to kill the bill That’s more than 10% of all Ohioans!!! Summary Ohio’s taking a step back with this budget, furthering districts’ dependence on local property tax levies Summary Meanwhile, money will be increased dramatically to Charter Schools that in most cases perform much worse than traditional public schools Summary Senate Bill 5 represents an unprecedented attack on the teaching profession, hurting teachers’ ability to do their jobs while putting our children’s academic success and safety at risk Summary On school funding, legal measures have been exhausted, so it’s up to grassroots activism to advocate for our local school districts On Senate Bill 5? Kill it in November!! Remember that $8 Billion Budget Hole? So What? All these proposed cuts can be replaced! So SPEAK UP! Our Path to Prosperity Begins in the Classroom We Don’t Want our Kids Facing This Path We Want Them Facing This One www.innovationohio.org Questions? Stephen Dyer Education Policy Fellow Innovation Ohio msdyer923@yahoo.com Janetta King Executive Director Innovation Ohio king@innovationohio.org