National Income Measurement

advertisement

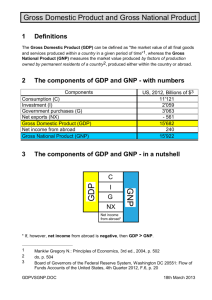

CHAPTER 2 NATIONAL INCOME (GDP and GNP) MEASUREMENT 1 What is income? 2 Income is the money earn or paid as a reward for the resources owned. For example: A worker earn income in the form of monthly payment. 3 Instead, What is National Income? 4 National Income is defined as: the total value of final outputs which comprises of goods and services produced by a country for a particular period of time, usually a year. 5 Tucker, defined national income as: total income earned by resources owners, that is: rents, wages, interest and profit. 6 National Income: is the total amount of money that factors of production earned during a year. This includes mainly payments of: wages, rents, profits and interest of capital. 7 NATIONAL INCOME = NATIONAL PRODUCT = NATIONAL EXPENDITURE (NI = NP =NE) 8 Or NI = National Product (NP) The national product refers to the value of output produced by an economy during the course of a year. Or NI = NP = National Expenditure refers to the value of money spent on goods and services in the economy in a year. 9 GDP and GNP GDP = Gross Domestic Product, is the value of all final goods and services produced by all sectors of the economy the citizens or foreign sectors within a country. GNP = Gross National Product, is the value of all final goods and services produced by all citizens of a country (within a country or abroad). 10 Circular Flow of Income Model: The basic circular flow model provides a general picture of the interactions in terms of : income, output and expenditure among all sectors in an economy. 11 Circular Flow of Income Economic Models 3 types: A 2-sector model of circular flow - Comprises of ‘Households’ and ‘Firms’ sectors A 3-sector model of circular flow - Comprises of ‘Households’ , ‘Firms’ and ‘Government’ sectors A 4-sector model of circular flow - Comprises of ‘Households’, ‘Firms’, ‘Government’ and ‘Foreign’ sectors 12 The 2-sector circular flow of national income and expenditure Y = C+I Expenditure, C on goods & services HOUSEHOLDS FIRMS Income,Y Wages, rent, interest, profit Factor payment Assumptions in a 2 – sector Circular Flow model All income received by households will entirely be spend on consumption. The households in the market will entirely purchase all goods and services produced by firms. Therefore, total income = total expenditure = total output 14 The 3 sector circular flow of national income and expenditure Y = C+I+G Net Taxes Net Taxes G. Expenditure G. Expenditure GOVERNMENT Expenditure, C Financial Institutions FIRMS HOUSEHOLDS Income,Y 15 Assumptions in a 3–sector Circular Flow model C: households is assumed to spent only a portion of their income on consumption. Part of it as savings in financial institutions and for paying taxes. I: Investors are getting loans for capital investment thus produced goods and services in an economy. G: Government expenditure will be made based on tax revenue collected. t: when government sector is included in the model; tax revenue (t) will be collected (from households – personal income tax, and from firms – corporate income tax). 16 The concept of disposable income The household income (Y) that can be spent by households will now be lesser after deducting the tax portion (t) paid to government. It is now called as: disposable income (Yd). Yd = Y – t. and Disposable NI = NI – t. 17 The 4-sector circular flow of national income and expenditure Net Taxes Net Taxes G. Expenditure G. Expenditure GOVERNMENT Expenditure, C Financial Institutions HOUSEHOLDS Income,Y Y = C+I+G+(X-M) FIRMS FOREIGNERS Assumptions in a 4 –sector Circular Flow model Households now supply resources to both domestic and foreign markets. Households also consume both local and imported goods. Firms purchased capital goods and engaged foreign workers from abroad to help them produce more new goods and services. They also exports goods and services produced to abroad or overseas. Government involves either directly or indirectly with foreign sector. They may import as well as exports goods and services to abroad. 19 Lets have a 5 minutes break 20 Methods of Measuring National Income NI can be measured using 3 common approach: a) Income approach b) Output approach c) Expenditure approach Irrespective of which approach used in calculating NI, will give us the same value 21 i) INCOME APPROACH National Income is the total money values of all incomes received by productive persons and enterprises in the country during the year. It is the total income of all factors of production including the income of self-employed person, labourers, capital and land (L,L,K,E) 22 “Transfer Payment” should not be included in calculating NI to avoid double counting problem. Transfer payment refers to income received without any direct contribution to the production of goods and services. is simply transferred from one group or people to another; without the recipients adding any value to production or volume of goods and services in the country. 23 e.g; Transfer Payment Pensions Welfare benefits Scholarships Unemployment benefits Sale of a second-hand goods e.g. an existing house Allowances to housewife Interest on national debt 24 Example1: En. Ahmad previously was a self-employed man with an income of RM1, 500. He later quit from business become an employee of a manufacturing company and earn a salary of RM3, 200 per annum. In closing down his business, he had to dismiss two assistants, each previously receiving a salary of RM700 and RM800 respectively. Each of the assistants subsequently now received social security benefits (unemployment benefit) worth RM300 per month. What is the net change in national income? The change in national income as a result of this was: Previously self-employed RM1, 500 Presently employed + RM3, 200 Dismissal of 2 assistants RM1, 500 __________ Net Increase of NI is: + RM 200 Social security benefit is an example of transfer payment, 25 so is not included in the calculation of national income. Total Domestic vs Total National Income Total Domestic Income is the total income earned within a territorial or geographic boundary. It includes income earned by its citizens as well as its non-citizens i.e. foreign workers residing or working in the country. Total National Income is the total income earned by citizens of the country irrespective whether the citizens reside / working in the country or outside the country (abroad). It will exclude all income earned by foreign workers in the country. 26 Example 2: Given the following data, find the national income of country XYZ; Domestic Income RM800m Income paid abroad RM200m Income received from abroad RM180m Answer: The national income of country XYZ is as follows: RM800m 200m + 180m = RM780m 27 Personal Income vs Personal Disposable Income Personal Income is the gross receipt of income regardless of its source. It can come from productive and non-productive sources (transfer payment). And minus the contribution to Employees Provident Fund (EPF) and contribution to SOCSO. Thus it is totally different from gross earning of factor income (GDI or GNI). Personal Disposable Income is gross personal income less by the personal income tax paid. 28 Income Approach The components of this approach include: Wages and salaries Interest and dividends Rent and imputed rent Profits: distributed and undistributed profits, income of self-employed = Gross Domestic Income (at factor cost) Income paid abroad + Income received from abroad = Gross National Income Depreciation or capital consumption = Net National Income (OR NATIONAL INCOME) RM xxx xxx xxx xxx xxx XXXX xxx xxx XXXX xxx XXXX 29 ii) OUTPUT APPROACH Also known as Product Approach. National Income (=GNP) is equivalent to the money value of all goods and services produced by all sectors in the country during a year. 30 The problem of double counting: To avoid double counting, we only sum-up all the “value-added” of each sectors or at each stage of production to give us the national income value. 31 Value-added concept To avoid double counting, calculation must be based on either one of the followings: a) Measure only the total market value of all final goods and services produced in the country. OR b) Calculate national output based on the value added. 32 EXAMPLE: Firm Stage of Production Purchasing Selling Value ____ ________________ Price (RM) Price (RM) Added (RM) A Landowner sells trees 100 100 to sawmill owner B Sawmill owner cut into 100 180 80 timber sheets to furniture manufacturer C furniture manufacturer 180 290 110 turns timber sheets into furniture and sells to retailer D retailer sells furniture to final 290 420 130 consumer TOTAL VALUE 570 990 420 Total value added = Total value of Sales – Cost of intermediate goods = 990 – 570 = 420 The concept of Market Price and Factor Cost In most cases, Market Price (MP) > Factor cost (FC) Market Price = FC + indirect taxes – subsidies OR Factor Cost = MP – indirect taxes + subsidies 34 Output Approach The components are: The total value of final goods and services in the economy or the total sum of “value-added” of all industry or stage of production. = Gross Domestic Product at market price (GDP at mp) Income paid abroad + Income received from abroad = Gross National Product at market price (GNP at mp) Indirect taxes or taxes on expenditure + Subsidies = Gross National Product at factor cost (GNP at fc) Depreciation or capital consumption = Net National Product at factor cost (NNP at fc OR NATIONAL INCOME) RM XXXX xxx xxx XXXX xxx xxx XXXX xxx XXXX 35 iii) EXPENDITURE APPROACH 4 components included here: a) Household or consumer expenditure on consumption goods, (C). b) Firm or producer expenditure of capital goods. Also known as gross investment or gross private capital formation (I). c) Government expenditure on goods and services, excluding transfer payment (G). d) Expenditure on exports and imports (X – M). Y = C + I + G + (X – M) 36 Gross vs Net Investment Gross Investment is the expenditure on new construction, purchase on new equipment and change in stock Net Investment is gross investment minus depreciation of capital. Depreciation (capital consumption) is defined as an allowance that is put aside for machinery wears out and stocks used up due to its obsolete and deteriorated nature after being used for some time. Net Investment = Gross Investment – Depreciation of capital 37 Expenditure Approach The components include; the household expenditure (C), firm expenditure or gross investment (I) and government expenditure (G). + or – change in stock =Total Domestic Expenditure at market price (TDE at mp) + Exports and Imports =Gross Domestic Expenditure at market price (GDE at mp) Income paid abroad + Income received from abroad =Gross National Expenditure at market price (GNE at mp) Indirect taxes + Subsidies =Gross National Expenditure at factor cost (GNE at fc) Depreciation or capital consumption = Net National Expenditure at factor cost (NNE at fc) (OR NATIONAL INCOME) RM xxx XXXX xxx XXXX xxx xxx XXXX xxx xxx XXXX xxx XXXX 38 Few things to remember: 1) To change from market price to factor cost: minus indirect tax plus subsidies. DIRECT TAXES INDIRECT TAXES Personal Income Tax Expenditure or Business/ Corporate Tax Consumption Tax Custom duties Profit Tax Export Tax Import Tax Tariff Services Tax 39 Few things to remember: 2) 3) 4) 5) To change from Domestic to National value: plus or minus NPIFA To change from Gross to Net value: minus capital consumption. To change from NI to Personal Income (PI): plus transfer payment and any benefits minus any contribution (EPF, SOCSO) To change from PI to DPI: minus income tax 40 41 Income Approach Given the information: Total wages and salaries received RM million 255,650 Total interest and dividends received 10,000 Total rent and imputed rent 80,880 Gross trading profits from companies 65,500 Total income of self-employed 33,700 Income paid abroad 54,345 Income received from abroad 76,680 Capital consumption Find: i) GDP at factor cost ii) GNP at factor cost iii) NI 445 42 Answer: Income Approach Total wages and salaries received RM million 255,650 Total interest and dividends received 10,000 Total rent and imputed rent 80,880 Gross trading profits from companies 65,500 Total income of self-employed 33,700 GDI fc (GDP fc) 445,730 Less income paid abroad (54,345) Add income received from abroad 76,680 GNI fc (GNP fc) Less Depreciation on capital consumption NNI fc 468,065 (445) 467,620 43 Output Approach RM million Agriculture, forestry and fishing 4,296 Mining and quarrying 6,700 Manufacturing 28,965 Construction 15,550 Services 13,220 Net exports 3,000 Appreciation in stock 2,000 Income paid abroad 15,432 Income received from abroad 17,66 Indirect taxes 599 Subsidies 333 Depreciation of capital 1,545 Compute the value for: i) GDP at market price ii) GNP at market price 44 iii) GNP at factor cost iv) NI Answer: Output Approach Agriculture, forestry and fishing Mining and quarrying Manufacturing Construction Services Net exports Appreciation in stock GDP mp Less income paid abroad Add income received from abroad GNP mp Less indirect taxes Add subsidies GNP fc Less depreciation NNP fc (NNI) 4,296 6,700 28,965 15,550 13,220 3,000 (2,000) 69,731 (15,432) 17,66 70,965 (599) 333 70,699 (1,545) 69,154 45 Expenditure Approach Total consumer expenditure (C) Gross investment (I) Government expenditure (G) Add exports (X) Less imports (M) Change in stock Net factor Income from abroad Expenditure taxes Subsidies Capital consumption RM million 50,000 20,000 18,500 9,000 ( 8,565) 1,000 250 870 695 2,750 Given the information above, calculate the values for: i) GDP at market price ii) GNP at market price iii) GNP at factor cost 46 iv) NI Answer: Expenditure Approach Total consumer expenditure (C) Gross investment (I) Government expenditure (G) Add exports (X) Less imports (M) Change in stock GDE mp (GDP mp) Less Income paid abroad Add income received from abroad GNE mp (GNP mp) Less Indirect taxes Add subsidies GNE fc (GNP fc) Less Depreciation NNI fc (NI) RM million 50,000 20,000 18,500 9,000 ( 8,565) 1,000 89,935 (3,700) 3,950 90,185 (870) 695 90,010 (2,750) 47 87,260 Uses of National Income 48 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. 49 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. 50 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. Comparison between two or more countries can be made. 51 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. Comparison between two or more countries can be made. Able to know and analyze the contribution made and performance by each production sector in the economy and thus taken ample step for rectification 52 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. Comparison between two or more countries can be made. Able to know and analyze the contribution made and performance by each production sector in the economy and thus taken ample step for rectification Useful in measuring inequalities in the distribution of income. 53 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. Comparison between two or more countries can be made. Able to know and analyze the contribution made and performance by each production sector in the economy and thus taken ample step for rectification Useful in measuring inequalities in the distribution of income. Useful in revealing the expenditure pattern of a country. 54 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. Comparison between two or more countries can be made. Able to know and analyze the contribution made and performance by each production sector in the economy and thus taken ample step for rectification Useful in measuring inequalities in the distribution of income. Useful in revealing the expenditure pattern of a country. Useful in measuring the level and pattern of investment. 55 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. Comparison between two or more countries can be made. Able to know and analyze the contribution made and performance by each production sector in the economy and thus taken ample step for rectification Useful in measuring inequalities in the distribution of income. Useful in revealing the expenditure pattern of a country. Useful in measuring the level and pattern of investment. Balance of payments pattern. 56 Uses and Importance of National Income Useful in measuring the standard of living of a nation through estimating per capita income of the nation. Time series comparison (year to year). Measuring growth of the economy. Comparison between two or more countries can be made. Able to know and analyze the contribution made and performance by each production sector in the economy and thus taken ample step for rectification Useful in measuring inequalities in the distribution of income. Useful in revealing the expenditure pattern of a country. Useful in measuring the level and pattern of investment. Balance of payments pattern. National income as an indicator of success or failure of national planning. 57 Gross and Net Investment Gross investment is the total amount spent on purchases of new capital and on replacing depreciated capital. Net investment is the change in the stock of capital and equals gross investment minus depreciation. 58 Economic Growth eº = GDP1 – GDP0 X 100 GDP0 eº = rGNP1 – rGNP0 X 100 rGNP0 Higher economic growth shows higher economic activities and performance. 59 Real GNP: Real GNP = Price Index0 X Nominal GNP1 Price Index1 Nominal GNP is the current value of GNP according to the price in that particular year, in which might has experience a price rise from previous years because of inflation. Real GNP or GDP shows a better value of measurement for comparison purposes, because it has deflate the value from the problem of inflation. 60 The Difference between nominal and real income Nominal Income would be the actual wage or salary that is earned currently. The Nominal Gross Domestic Product measures the value of all the goods and services produced expressed in current prices. Nominal GDP of Malaysia for the year 2001 is RM334.6b 61 The Difference between nominal and real income Nominal Income would be the actual wage or salary that is earned currently. The Nominal Gross Domestic Product measures the value of all the goods and services produced expressed in current prices. Nominal GDP of Malaysia for the year 2001 is RM334.6b Real Income would be the income that has been deducted with the reduction in the “purchasing power” that the wage or salary has in the market place (i.e. rate of inflation is 3%). Real Gross Domestic Product measures the value of all the goods and services produced expressed in the prices of some base year. Real GDP of Malaysia for the year 2001 is RM210.5b 62 per capita income is defined as their total personal income divided by the number of people in the country. often used as a measure of the wealth of the population of a nation, particularly in comparison to other nations. usually expressed in terms of a commonlyused international currency such as the Euro or United States dollar. Malaysia’s per capita income for the year 2001 is US$3,392 or RM12,867. 63 2 major problems in measuring national income i) PRACTICAL PROBLEMS a) Problem of illiteracy b) Problem of expertise c) Problem of inaccessibility d) Lack of sophisticated software machineries. e) Problem of false information 64 ii) CONCEPTUAL PROBLEMS a) Arbitrary definition b) Problems in estimating the value of depreciation, imputed rent, etc. c) Problem of double counting d) Problem of measuring quality 65 THANK YOU 66