Checking Accounts & Banking Services

advertisement

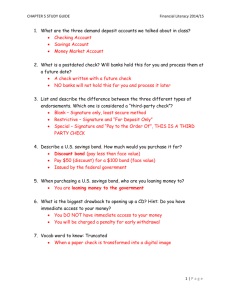

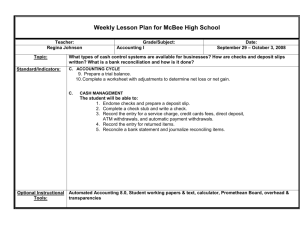

Checking Accounts & Banking Services Purpose • Checking account: an account that allows depositors to write checks to make payments • Check: written order to a bank to pay the stated amount to a person or business (payee) named on it Purpose • Also called a demand deposit – Money can be withdrawn at any time– “on demand” • Only the depositor can write checks on the account • Financial institutions often charge a fee or require a minimum balance Purpose • Process – Payee cashes check – Bank that cashes it returns it to your bank – To reimburse the payment, your bank withdraws the money from your account and sends it to the other bank – Your bank stamps the back of your check indicating that it has cleared • Successfully completed its trip through the system Purpose • Canceled check: check that bears the bank’s stamp, indicating it has cleared • Because of the stamp, you can use your canceled checks as proof of purchase or payment Purpose • Advantages – Provides convenient way to pay bills – Writing a check is safer than using cash – A checking account has a built-in record keeping system that you can use to track expenses and create budgets – You have access to other bank services • Online banking • ATM Purpose • Responsibilities – You must write checks carefully and keep an accurate record of checks written and deposits made – You must verify the accuracy of the bank statement you receive each month – You must maintain sufficient funds in your account to cover all the checks you write Purpose • Responsibilities – http://www.youtube.com/watch?v=b8 kh2Qx5LV0 Purpose • Some banks do not return cancelled checks – truncation Purpose • Overdraft: a check written for more money than your account contains • Bank stamps the check NSF– non-sufficient funds • “Bounced” • Bank will charge you a fee – Usually around $25 Opening an Account • Fill out and sign an authorization form • This provides an official signature to verify against forgery • Most banks require a minimum deposit amount Purpose • You are floating a check when you realize your account contains insufficient funds, but you write a check anyway, hoping that a deposit will clear before the check is cashed. • Risky now Purpose • Check Kiting: – Writing a check off of an account with NSF and then depositing a check into that account from another account that also has NSF – ILLEGAL! Parts of a Check • Check Number – Checks are number for easy identification – Checks are usually pre-numbered Parts of a Check • ABA number – American Bankers Assoc. number – Appears in a fraction • Top half indentifies the location and district of the bank the check is drawn from • Bottom half helps in routing the check to the specific area and bank on which it is drawn Parts of a Check • ABA number Parts of a Check • Name and Address – The maker is the person authorized to write check on the account – You should have this printed on your checks – You can add phone number, DLN, or SSN • However, because of identity theft it is recommended that you don’t put your DLN or SSN Parts of a Check • Name and Address Parts of a Check • Date – When you write the check – Do not postdate checks • Future date a check – Banks will not cash a check before the date written on it • May not honor a check after 6 months Parts of a Check • Date Parts of a Check • Payee – Whom the check is made payable Parts of a Check • Numeric Amount – Amount of dollars and cents being paid, written in numbers Parts of a Check • Written Amount – Shows the amount of dollars and cents being paid, written in words – Write the word “and” to separate dollar amounts from cents • Replaces the decimal point – Leave no space between the words – Draw a line from the end of the word to the word “Dollars” Parts of a Check • Written Amount – 12/100 means 12 cents, which is 12 one-hundredths of a dollar Parts of a Check • Signature – If the bank suspects fraud the teller can compare the check to your signature authorization form Parts of a Check • Account Numbers – Appears in bank coding at the bottom of the check Parts of a Check • Routing Number – Bank’s identification code for electronic sorting and routing of checks Parts of a Check • Memo – Provides a place to write the purpose of the check – Not mandatory Using Your Account • Writing Checks 1. Always use a pen; one with dark ink 2. Write legibly 3. Sign your name exactly how it appears preprinted on the check and signature card 4. Avoid mistakes • Void the check and write a new one 5. Be certain you have deposited adequate funds to cover each check you write John Smith pays a bill to Duke Energy for $154.96 on November 1, 2011. Jane Doe pays for gas at Huck’s. She got $45.00 worth of gas on 10/31/11. Tom buys pizza at Pizza Hut for $19.08. Endorsing Checks • A check cannot be cashed until it has been endorsed. • When two or more people are the payee, all payees must endorse. Endorsing Checks • To endorse: – The payee named on the front signs the back of the check in ink. – There is usually a space, but if there is not, this should be no more than 1 ½ inches from the trailing edge Endorsing Checks • Three types of endorsements: – Blank – Special – Restrictive Endorsing Checks • Blank Endorsement – Signature of the payee written exactly as his/her name appears on the front Jane Public Endorsing Checks • In a blank endorsement, if your name is spelled incorrectly on the front, you will write the incorrect version and then the correct version right below it Mrs. Balt Endorsing Checks • Special Endorsement Mrs. Bault Endorsing Checks • Restrictive Endorsement – Restricts or limits the use of the check • Example “For Deposit Only” • Safer than Blank Endorsement for mailing deposits or night deposits • If the check is lost, the finder cannot cash it Endorsing Checks • Restrictive Endorsement Mrs. Bault Endorsing Checks Endorsing Checks • Special Endorsement, or endorsement in full, is an endorsement that transfers the right to cash a check to someone else. • Consists of the words “Pay to the order of (new payee’s name)” and the signature of the original payee Deposits Deposit means to add money to an account. Deposit slips can be found in the back of your checkbook and at the bank. Most banks will require your signature on a deposit slip. What does a deposit slip look like? Making Deposits • You should complete a form every time you deposit money into your account. • You will have to sign a form to withdraw money from your account. Making Deposits • Preparing a Deposit Slip: – Insert the date of the transaction – In the cash section, write the total of currency and coin you are depositing – Write the amount of each check you are depositing Making Deposits • Preparing a Deposit Slip (cont’d): – Total the currency, coin, and check amounts. – Write this figure on the subtotal line – If you want cash back fill in the “Less Cash Received” line with the amount Making Deposits • Preparing a Deposit Slip (cont’d): – Subtract the cash received from the subtotal – Write the final amount on the net deposit line – If you get cash back you will need to sign your deposit slip – You will receive a receipt after your transaction. Keep this for your records Making Deposits Making Deposits Making Deposits • John Smith wants to deposit: – A $100 bill – A $25 check (#101) – A $25 check (#390) Making Deposits • Jane wants to deposit: – A $58.76 check (#523) – A $456.07 check (#1937) – And get $100 cash back On September 5, 2015, you deposited $25 in cash and one check for $98.72 into account 158975. You took no cash back. On February 20, 2015, you deposited three checks into account 778590: one for $50, one for $62. 45, and one for $100. You wanted $75 back in cash. On May 3, 2015, you deposited $5 in cash and two checks, one for $46.33 and one for $87.20 into account number 9003021. You wanted to keep $25 in cash. On September 5, 2015, you deposited $25 in cash, and 1 check for $98.72 into account 158975. You took no cash back. On February 20, 2015, you deposited 3 checks, one for $50, one for $62. 45, and one for $100 into account 778590. You wanted $75 in cash back. On May 3, 2015, you deposited $5 in cash, a check for $46.33, and a check for $87. 20 into account number 9003021. You wanted to keep $25. Check Registry A register is a record of withdrawals and deposits made into an account. Example Assignment Complete the check register assignment.