strong LEADERSHIP PARTNERSHIP OPPORTUNITY

Sabre Holdings

Sam Gilliland

Chairman and CEO

Merrill Lynch Conference

February 9, 2005

2

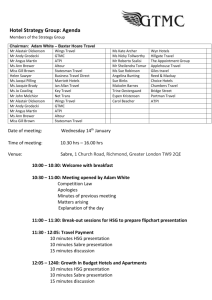

Agenda

• Overview

• 2004 Performance by Business

• Key Trends and Current Industry Assessment

• Company Strategy and Opportunity

• 2005 Strategic Priorities

• Financials

3

Sabre Holdings

A world leader in

travel commerce

,

retailing travel products and providing distribution and technology solutions for the travel industry

4

Sabre at a Glance

• S&P 500 Company

• 6,800 employees in 45 countries

• Revenues of $2.13 billion in 2004

• 2004 earnings per share growth > 75%

• Three distinct businesses serving travelers, corporations, travel agents and travel suppliers

2004 Performance all about execution

5

Maximize Business Unit Performance

•

Travelocity profitability

• Cross-portfolio technology investments

Accelerate Travel Retailing and Portfolio Initiatives

• Travelocity content and capabilities expanded

•

GDS merchandising programs launched

Reduce Costs for Competitive Advantage

•

Reduced company-wide costs by over $80 million

• Lowered the rate of incentive growth

Return of Capital

• Returned ~ $270 million to shareholders

•

Dividends of $41 million;repurchased $228 million in stock

Travelocity : 2004 Accomplishments

Profitable for the full year on an adjusted basis

• >$65 million turnaround in YOY operating income

• Revenue growth of 30% (adjusted); 27% (GAAP)

Differentiated and enhanced consumer brand

• Major redesign of web site and new logo

•

New advertising campaign launched: the Roaming Gnome

International expansion

•

Buy-in of European joint venture

•

Entered French online marketplace

• Acquired travelchannel.de in Germany

Delivered best-in-class capabilities

• Merchant hotel program; >17,000 properties

• Flight Navigator – industry leading air shopping path

•

Travelocity Partner Network: Southwest Airlines Cruises,

AARP, American Express

Travelocity Business

•

Revamped user interface

• Signed large customer accounts: Aetna, General Dynamics, AMA

6

7

Sabre Travel Network: 2004 Accomplishments

Met revenue and well exceeded earnings growth targets

•

Revenue growth ~2 percent (adjusted) and flat (GAAP)

• Operating margin of 19% (adjusted) and 17% (GAAP)

Expanded Distribution and Marketing Services for Hoteliers

•

Launched Hotel Spotlight

• Acquired SynXis Corporation

Rolled out numerous merchandising programs

•

Impressive gains for specific hotel properties

• Last minute packaging through the GDS

Cost Reductions across the business

•

Consolidated customer call centers in Latin America

• Assured Vantage Program launched to help slow growth of incentive costs

Channel shift slowed

• Averaged under two points for the year

GetThere transactions increased >30%

• Rolled out industry’s first fully-automated online ticket exchange

Airline Solutions: 2004 Accomplishments

Revenue and earnings growth dampened by tough year in software sales

•

Revenue growth of ~5%;operating margin ~6%

•

Fourth quarter revenue rebounded

Further developed and integrated products and services

•

Launched SabreSonic, a new generation of airline passenger solutions suite

Expanded presence in high-growth markets

•

Signed a multi-year, multi product agreement with low-cost carrier Frontier Airlines

• Moved into Canada’s low-fare carrier market by signing a five-year agreement to support WestJet

Continued international diversification

•

Signed Aeroflot and Air One for our SabreSonic suite of products

8

9

Key Trends and Current Industry Assessment

Industry Consolidation

• Intermediaries vertically integrating

Channel Shift

• Supplier-direct movement slowing

Online Growth

• Robust in North America

• Accelerating globally

Low-Cost Carriers

• Rapid growth, worldwide

• Focus on direct distribution

Deregulation

• CRS deregulation in US

• Now under review in Europe

Emerging Trends

• Travel Search Engines

Industry Growth global opportunity

$ 1,000

$ 900

$ 800

$ 700

$ 600

$ 500

$ 400

$ 300

$ 200

$ 100

$ 0

2007 Global Gross Travel Spend

$ 870 B

$ 80

$ 11

Rail

Cruise

$ 257 APAC

$ 51 LA

$ 419 Hotel

Corporate

$ 492 Indirect

$ 280 EMEA

$ 40 Car

63.7%

$ 520 Leisure

$ 378 Direct

$ 282

US and

Canada

$ 320 Air

REGION SUPPLIER

3.9%

SEGMENT CHANNEL

$ 695 Offline

$ 175 Online

CHANNEL

Data Source: PhoCusWright, Jupiter, EuroMonitor, Sabre Holdings Analysis

10

Channel Trends indirect and direct

Global Air Spend Mix

Leisure + Corporate

$400

$300

$200

$100

0

2003

OFFLINE

57%

Indirect

ONLINE

OFFLINE

ONLINE

2004 2005 2006

Data Source: PhoCusWright, Jupiter, EuroMonitor, Sabre Holdings Analysis

2007

43%

Direct

11

Extending From Reseller to Retailer leveraging scale and growth

12

Core Global Distribution System (GDS)

• Comprehensive content, pricing aggregation, and global reach

• High availability and real-time information

• Accurate pricing and inventory

• Leading technology and scalable platforms

• Process automation and data integration

SCALE and EFFICIENCY

Retailer

DIRECT & INDIRECT

• Brand building and management

• Customer Insight

• Customer loyalty

• Wholesale product creation and distribution across channels

• Comprehensive product availability

• Partner point of sale technology

AREAS of GROWTH

POWERFUL

GLOBAL

NETWORK

Optimize the Core GDS Business

Global Scale

• Cost advantage through leading transaction scale

• Content advantage through leading demand aggregation

Technology Investment

• World-class shopping and pricing

• Improved transaction efficiency

• Leverage TSG portfolio investment ― packaging

Business Model Evolution

• Agents ― choice, efficiency, high margin content, and Marketing Services ― Jurni Network / Nexion

• Suppliers ― flexibility, value-based options, merchandising

13

Growth through Retailing

Travel

Retailing

Direct / Indirect

Hotel Packaging

Global

Expansion

Data and Customer Insight

Differentiated, High-Margin Content

Marketing Services

Leading Technology

14

Travel Retailing across the network

Supplier

DIRECT

PRIVATE LABEL

INDIRECT

PASSIVE

15

Traveler

Economic Opportunity increasing revenue per trip

Retailing

HEAVY

Retailing

LITE

Booking Fee

Degree of influence over travel product sold

TODAY

HIGH

LOW

Revenue

Per Trip

~ 7X

~ 4X

~ 2X

$ X

Data Source: Internal

16

2005 Strategic Priorities

Grow Retail Revenue Across the Global Network

• Direct and indirect

• Hotel and packages

Expansion in Asia and Europe

• Large and growing segments

• Increase our presence

Leverage the Scale and Efficiency of the Distribution Business

• Grow scale, reduce cost

Deliver Leading Scaled Technology

• Innovate and differentiate

• Shopping and pricing, corporate, leisure

17

2005 Financial Estimates

Total Company

• Total company revenue growth approaching 10%

• Total company earnings per share growth in the range of 2% to 9%

Solid financial results while making well placed investments for future growth

18

2005 Growth Projections

Sabre Travel Network

2004 Revenue

(in millions)

$1,553

Travelocity

Sabre Airline Solutions

Eliminations

Total Revenue (net elims)

$503

$243

($168)

$2,131

Earnings Per Share, Adjusted

Earnings Per Share, GAAP

$1.47

$1.38

2005 Growth

Projections

Low Single Digits

25% - 30%

~ 10%

Approach 10%

$1.50 - $1.60

$1.41 - $1.51

19

Other Financial Projections and Capital Structure

Full year Adjusted EBITDA expected to be ~ $400 million

• GAAP Net income of ~ $190 million

Free cash flow expected to be ~ $200 million

• Cash flow from operations ~ $300 million

Enhance shareholder return through dividends and share repurchases

• Increased quarterly dividend 20 percent, to $0.09 per share

20

In Summary

• Superior Execution

• Pursue Growth Opportunities

• Manage Costs for the Long Term

• Invest for the Future

21

Cautionary Statement

Statements in this presentation which are not purely historical facts or which necessarily depend upon future events, including statements about forecasted financial performance or other statements about anticipations, beliefs, expectations, hopes, intentions or strategies for the future, may be forward-looking statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. Readers are cautioned not to place undue reliance on forward-looking statements. All forward-looking statements are based upon information available to Sabre Holdings Corporation on the date of this presentation. Sabre Holdings Corporation undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Any forward-looking statements involve risks and uncertainties that could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including risks or uncertainties related to the Company's revenues being highly dependent on the travel and transportation industries. Sabre Holdings Corporation may not succeed in addressing these and other risks.

Further information regarding factors that could affect our financial and other results can be found in the risk factors section of Sabre Holdings Corporation's most recent filing on Form 10-Q with the Securities and Exchange Commission.

References to non-GAAP financial statements and the reconciliation to GAAP can be found on the Sabre Holdings' website http://www.sabre-holdings.com/investor/highlights/index.html in the investor relations section.

22