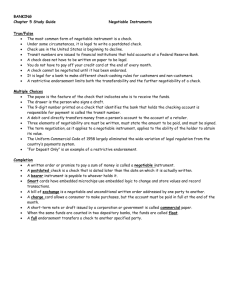

NI Presentation Final

advertisement

Definition: Section 13 of the Negotiable Instrument Act, 1881, defines a negotiable instrument as: “A negotiable instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer.” Meaning : Negotiable means transferable. Instrument means document. Negotiable instrument, therefore, means a transferable document. The law relating to negotiable instruments is contained in the Negotiable Instruments Act, 1881 Explanation: The Act narrows down the meaning of instrument. It regulates only three types of instruments, viz., Promissory Notes, Bills of Exchange and Cheques. A negotiable instrument is one which entitles the holder to the receipt of money. It gives him the right to transfer the same by mere delivery or endorsement thereon. The negotiability of the instrument continues till its maturity. Characteristics\Features of Negotiable Instrument Property (does not exactly give possession of the instrument, but right to property) Good Title to the Instrument (gets the instrument free from all defects of any previous holder.) Rights of Holder in Due Course (not affected by certain defences which might be available against previous holder, for example, fraud, criminal, smugglers, to which he is not a party) Writing & Signature (it must be written and signed by all the parties according to the rules ) Payment (A negotiable instrument may be made payable to two or more payees) Payable by legal Tender Money of India (The liabilities of the parties of negotiable instruments are fixed in terms of legal tender money only.) No Need of giving Notice Promissory Notes (Section 4) Definition: Section 4 defines a promissory notes as under: “A ‘promissory note’ is an instrument in writing (not being a bank-note or a currency-note), containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to, or to the order of a certain person, or to the bearer of the instrument.” Promissory Notes (Section 4) Essentials Characteristics of a Promissory Note All kinds of negotiable instruments, including a promissory note, must be in writing The instrument must contain an express or unconditional promise to pay Unconditional The promissory note must be signed by the maker, otherwise, it is incomplete and of no effect with free consent Both the drawer and the payee must be indicated or designated with certainty on the face of the promissory note Specific Sum Promise to pay must be money only Stamping 4 Types of Promissory Notes Promissory notes payable on demand; Promissory notes payable after date; Joint promissory notes Joint and several promissory notes Case Study on Promissory Note: A lady called Gangabai was entitled, by endorsement, to a Government promissory note, which she had acquired through a broker named Acharya. Subsequently Acharya obtained possession of the note from Bai Gangabai, and he forged her endorsement on the note to himself. Subsequently he endorsed the note over to the defendants, the Bank of India, Ltd. The Bank sent the note, with other notes, to the Government Securities Department with a request for its renewal, and the note was in due course renewed by the prescribed officer of the Government Securities Department. When it was ultimately established that the signature of Bai Gangabai on the note had been forged by Acharya, Bai Gangabai sued the Secretary of State for the value of the note, and she recovered judgment for the amount due on the note with interest and costs. In this suit the Secretary of State sues the Bank of India, Ltd., and claims that the Bank is liable to indemnify him against the loss which he incurred by acting on the request of the Bank for the renewal of the note. Alternatively he claims that the renewed note, or the value thereof, may be returned to him on the basis that it was issued without consideration, or under a mistake of fact. Bills of Exchange (Section 5) Definition: “Section 5 defines a bill of exchange as an instrument in writing containing an unconditional order, signed by the maker, directing a certain person, to pay a certain sum of money only to, or to the order of a certain person, or to the bearer of the instrument.” Essentials\Characteristics of Bill of Exchange Writing Parties Drawee and Acceptor Order to Pay An Unconditional Order to Pay Signed by Drawer Payee must be certain Stamping 5 Types of Bills of Exchange Bill of exchange payable on demand Bill of exchange payable after date Inland bill of exchange Foreign bill of exchange Accommodation bill of exchange Case study on Bill of Exchange: An exporter recently approached AIB Trade Finance Services with a common problem. The company was spending a lot of time chasing their debtors for payment. The Financial Director complained that despite having delivered their goods to the buyer, they were incurring considerable expense in staff time and communication costs in order to chase their money The exporter had agreed to sell on an open account basis and was sending the shipping documents directly to the buyer to enable them to take possession of the goods prior to receiving payment. This meant that once the shipment had been made there was no control over when payment would be received. Despite the buyer's agreement to pay at the end of the month following the invoice date, the exporter found that payment was actually received 30 to 60 days later. In addition the time spent chasing the payment was creating additional costs as well as increasing the time spent on the account by the credit control function CAN THE EXPORTER REGAIN CONTROL? AIB Trade Finance Services advised the company to consider using a Documentary Collection to obtain payment, or a commitment to pay from the buyer. This meant the exporter was encouraged to send their shipping documents to the buyer through the banking system accompanied by a Bill of Exchange* drawn on the buyer with a payment date at the end of the month following the date of shipment. The exporter instructed AIB Trade Finance Services, who in turn instructed the buyer's bank, to only release the shipping documents to the buyer against their acceptance of the Bill of Exchange and their agreement to make the payment on the due date. In addition AIB Trade Finance Services was able to instruct the buyer's bank to hold the accepted Bill of Exchange and present it to the buyer for payment on the due date. Cheques (Section 6) Definition: The negotiable instrument act of 1881 defines cheque as, “A cheque is a bill of exchange, drawn on a specified banker and not expressed to be payable otherwise than on demand.” Types of Cheque Bearer cheque: Those which are uncrossed are popularly known as “bearer” or open cheques Crossed Cheques ESSENTIAL features of a cheque: A cheque is a ‘Bill’ of exchange It contains an unconditional order to pay a certain sum of money only A drawee is always a bank It must be signed by the drawer The order must be to pay money only A cheque involves three parties viz., drawer, drawee and payee A cheque is always payable on demand and it cannot be made payable after a fixed period of time Acceptance of the cheque by the bank is not required Difference between cheque and bill exchange Case study on Bill of Exchange: In Canara Bank vs. Canara Sales Corporation and Others [(1987)2 Supreme Court Cases 666] The company has a current account with the bank which was operated by the Company’s Managing Director. The Company’s account in whose custody the cheque book was, forged the signature of the Managing Director in 42 Cheques totaling Rs.326047.92 over a period of time. This was detected by another accountant. The company immediately on detected of the fraud demanded the amount from the bank. The bank refused payment and therefore the company files a suit against the bank. The bank lost the suit and took the matter up to the Supreme Court. The Supreme Court dismissed the appeal of the bank and held that Since the relationship between the customer and the bank is that of a creditor and debtor, the bank had no authority to make payment of a cheque containing a forged signature. The bank would be acted against the law in debiting the customer with the amount of the forged cheque as there would be no mandate on the bank to pay. The Supreme Court pointed out that the document in the cheque form on which the customer’s name as drawer was forged was a mere nullity. The bank would succeed only when it would establish adoption or estoppels. In dealing the case the Supreme Court relied on its earlier judgment in Bihta Cooperative Development and Cane Marketing Union Ltd vs. bank of Bihar (AIR 1967 Supreme Court 389) Question and Answers Thank You and Wish you All the best in your presentation