lec 15 Climate Change

advertisement

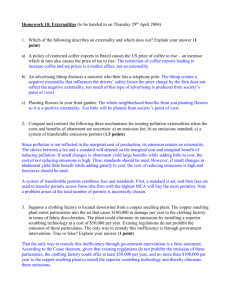

1 Climate Change 2 What is climate change? • IPCC: A change in the state of the climate that can be identified by changes in the mean and/or the variability of its property and persists for an extended period, typically decades or longer. Climate change may be due to 1. natural internal processes or 2. external forcings, or 3. to persistent anthropogenic changes in the composition of the atmosphere or in land use. 3 4 5 6 7 The economic side • Why is there any economic problem? ▫ Greenhouse gas emission benefits the emitter and hurts the world external effect ▫ Nobody owns the atmosphere so everybody uses it as a dumping site for the emissions Public good ▫ Benefit accrue today while adverse consequences mostly affect future generation 8 What can we do? • Repair the market by ▫ Making people pay for emissions Taxes Emission permits ▫ Paying people for not emitting subsidies ▫ Directly controlling firms standards 9 More than “standard” economics? • Why is there any economics problem? ▫ Future generations are not participating in today’s market! How to trade welfare over time? ▫ We cannot predict the consequences of today’s action with certainty! Should we, therefor, not care about the consequences? Or should we do everything to minimize the risk of a future harm? 10 Economic Impact of Climate Change • How do economists estimate the economic impact of a change in climate? ▫ Statistical analysis of individual impacts (like crop yields) ▫ Full blown complex integrated assessment models (IAMs): simulations of stylized models of the economy that try to predict overall costs of climate change 11 Any other problems?? • Even if we know what policy instruments work, and what emission levels would be globally optimal▫ How do we reach international cooperation? ▫ There is no “world government” ▫ Individual countries can benefit from non-participation in international emission reduction agreements (free riding) 12 Regulations Source: PEW(2005) For example: 2.2 billion tons of CO2*11 €/tCO2*$1.5/€ 13 Should the Government Intervene with Pigouvian Taxes? • A.C. Pigou (1938) argued that an externality cannot be mitigated by contractual negotiation between the affected parties. • Pigou argued that direct coercion by the government or judicious use of taxes should be used against the offending party. • These taxes are referred to as Pigouvian taxes. 14 An Externality Tax on Output 15 An Externality Tax on Output MSC = MPC + MDpollution $ a MPC1 b Demand Q* Q1 Quantity of steel 16 Pigouvian Taxes • An externalities tax equal to the divergence between MPC and MSC would raise the steel firms’ private costs. • The tax would shift the MPC curve by an amount equal to the distance from a to b • The market would arrive at an optimal equilibrium of Q*. • This is known as internalizing an externality. • More precisely, the tax should be placed on the externality itself (the amount of pollution emissions) rather than on output (amount of steel). 17 Marginal Damage Function • The marginal damage function represents the damages that pollution generates by degrading the environment. • The marginal damage function specifies the damages associated with an additional unit of pollution. • The total damages generated by a particular level of pollution is represented by the area under the marginal damage function. 18 Marginal Damage Function 19 Marginal Abatement Cost Function • Abatement Costs are those costs associated with reducing pollution to a lower level so that there are fewer damages. • Abatement costs include: ▫ ▫ ▫ ▫ Labor Capital Energy needed to lessen emissions Opportunity costs from reducing levels of production or consumption. 20 Marginal Abatement Cost Function • The marginal abatement cost function represents the costs of reducing pollution by one more unit. 21 Optimal Level of Pollution • Optimal level of pollution minimizes the total social costs of pollution (the sum of total abatement costs and total damages). • This level occurs at the point where marginal abatement costs are equal to marginal damages. 22 The Optimal Level of Pollution Cap 23 Economic Incentives and Minimized Total Abatement Costs • Consider the following graph. • A polluter is polluting at an unregulated level of 10 units. • The government imposes a tax equal to t dollars per unit of pollution. • The polluter compares the tax of t dollars to the marginal abatement cost (MAC) of reducing pollution. • As long as the MAC is less than the tax, polluter will reduce level of emissions. • Each polluter will chose an emission level which equates MAC and the tax. 24 Economic Incentives and Minimized Total Abatement Costs 25 Economic Incentives and the Certainty of Attaining a Target Level of Pollution • If the aggregate marginal abatement cost function is know, then achieving a targeted level of pollution is easily accomplished. • If the aggregate marginal abatement cost function is not known, the appropriate tax level is much harder to determine. • Consider the following graph, where evidence suggests that the true MAC function lies between an upper and lower bound set of MAC’s. 26 Economic Incentives and the Certainty of Attaining a Target Level of Pollution 27 Economic Incentives and the Certainty of Attaining a Target Level of Pollution • Suppose policymakers believe MAC1b is the true MAC. In an effort to achieve an emissions level of E1, they impose a tax of t1. • However, if MACt describes how polluters will respond, the emissions level will be E2. • E2 is higher than the desired level of pollution. • Because the choice of pollution abatement and production technologies is sensitive to specific tax structures, it may not be easy to change the tax to achieve the desired level of pollution emissions. 28 Economic incentives and incentives for research for a firm Firm cost initially = a + b + c (tax bill) + d + e (abatement cost) damages, costs, $ Firm cost after R&D = MAC initially a (tax bill) + b + e (abatement cost) MAC d e Abatement after R&D t c b a 29 Tax versus Cap-&-Trade (Quantities) • Pros for tax? ▫ … No price volatility ▫ Revenue allows for “double-dividend” ▫ … Can address distributional effects (consumers) • Pros for cap-&-trade? ▫ ▫ ▫ ▫ … Emissions certainty … Can raise revenues through auctioning … Can address distributional effects (producers) Political feasibility in countries that are “taxation-averse” (e.g. U.S.)