Week 5

advertisement

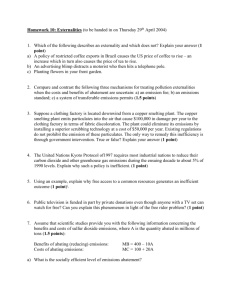

Class 7 Environmental Policy Tools http://www.agecon.purdue.edu/staff/shively/courses/AGEC406/index.htm Possible Interventions 1. Moral suasion 2. Government provision of goods 3. Damage prevention 4. Command and control 5. Economic Incentives Economic Incentives 1. Tax (per-unit penalty) 2. Subsidy (per-unit reward) 3. Transferable Permits (market-based) Focus on case of negative externality and compare: 1. Command and control (direct regulation) 2. Tax 3. Subsidy Command and Control Set limit on emission or specify technology MAX SMC = PMC + MD PMC PMB=SMB QM Q Pigouvian Tax Set tax = marginal damage rate SMC = MC + tax MC Tax = MD Q Subsidy Often used in conjunction with technology MSC (Tech 1) MSC (Tech 2) MPC (Tech 2) MPC (Tech 1) Subsidy Command and Control Consists of government-specified rules and regulations, often with fines and charges for violations. Most effective: 1. When monitoring costs are high 2. When optimal emission is near zero 3. During random or emergency events Drawback of C+C: If marginal abatement costs are different for different pollutors, then C+C will lead to an inefficient allocation of clean up burden among different producers. Marginal abatement cost function Marginal abatement = pollution reduction of one unit. The marginal abatement cost (MAC) function measures the dollar amount of the cost of reducing pollution by one unit. Marginal abatement cost function Shape of curve depends on technology of clean-up Cost MAC Marginal Abatement Cost Total Abatement Cost C1 E1 EU Emissions Marginal damage function Dollar measure of incremental damage from pollution Damages MD D Total Damage E Emissions Optimal level of pollution Damages, Costs MAC MD Total Damage Total Abatement Cost E1 EU Emissions Socially inefficient (sub-optimal) levels of pollution Damages, Costs MAC MD Excess social cost from too much abatement Excess social cost from too little abatement E1 EU Emissions Advantages of Economic Incentives 1. In most cases economic incentives will minimize the total costs of abatement. 2. By penalizing polluting behavior or rewarding clean behavior, economic incentives tend to encourage research into better abatement measures. Pollution tax Goal: set tax = marginal damage cost Why: encourage polluter to “internalize” the externality Key: Tax the externality, not the product. Polluter behavior with tax Costs MAC = 10 - E Potential Tax Payment Tax=4 Tax Avoidance T*Q=24 Actual Tax Payment E1=6 EU=10 Emissions Key points regarding tax 1. Tax achieves socially optimal level of pollution 2. MAC may exceed MD for some levels of pollution. Therefore, the optimal level of pollution is likely to be greater than 0. 3. Individual polluters adjusts emissions to point where MAC = tax, therefore MACs are equal for all polluters, which minimizes total cost of obtaining target level of pollution. Tradable Pollution Permits 1975 the U.S. EPA started an Emissions Trading Program to reduce air pollution. Support for this market-based approach has grown both among businesses and environmentalists. What is a tradable permit? Flexible approach to reaching target level of pollution Any source that reduces emissions more than required receives an “emission reduction credit” (ERC). ERCs can be used to satisfy emission targets at other discharge points for which the MAC is higher. ERCs can transferred or sold, thus allowing sources to find the cheapest means to controlling emissions. Policy context ERC is “currency” Policies governing use include: Offset policy: firm uses ERC to continue polluting at another source Bubble policy: total emissions within “bubble” are regulated, trade within is OK. Emissions banking: firm can “stockpile” ERCs Applications Air pollution (1975) Lead in gasoline (1982-1987) CFCs and other ozone-depleting chemicals (1988-) SO2 Acid rain (1993-) Mobile sources (1993-) Greenhouse gases (proposed) Polluter behavior with regulation: Specify 4 units of emission each Costs Costs MAC = 10 - E1 MAC = 8 - 2 E2 C1=6 18 C2=0 E1=4 EU=10 E2=4 Polluter behavior with permit 1. Total Target Emission Level = 8, so E1 + E2 = 8 2. Set MAC1=MAC2 and solve. 10 - E1 = 8 - 2E2 10 - E1 = 8 - 2(8-E1) 10-8+16 = 3 E1 18 = 3 E1 6 = E1 Polluter behavior with permit: firms determine allocation of emissions Costs Costs MAC = 10 - E1 MAC = 8 - 2 E2 C2=4 C1=4 8 E1=6 4 EU=10 E2=2 EU=4 Key messages: 1. Target Emission Level is reached. 2. Total cost of abatement is lower (12 vs. 18) 3. Optimal allocation is reached where firms equate MACs. 4. Permits allow low-cost firms to abate more than they otherwise would. Implementation Problems: 1. Transaction costs 2. Spatial considerations 3. Temporal considerations 4. Market power 5. Environmental justice (equity)