Dr Sarah Wilson - The Business History Conference

advertisement

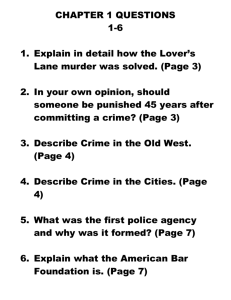

Judging winners and losers in business in 19th century Britain: Criminal Liability as the ultimate statement in inequality? Dr Sarah Wilson Business History Conference BHC-EBHA Meeting, 2015 ‘One is very conscious of how thin is the line between success leading to wealth and a knighthood and failure leading to disqualification or even imprisonment …’ Rt Hon Leonard Hoffmann, 1997. Lord Hoffmann – Lord Ordinary in Appeal • Highly profiled UK Law Lord until his retirement in 2009 • One of the most influential of his generation - and no stranger to controversy: - Pinochet affair- led to unprecedented setting aside of a House of Lords’ judgment - Significant impact in a number of spheres including tort and company law and property law (across the sweep of family property and commercial disputes) - Most highly profiled company law judge of his generation: very profound influencing force on minority shareholder legal activism and also the modern law relating to company directors’ duties. Lord Hoffmann and ‘snakes and ladders’ • Part of controversial narrative of re-mapping company directors’ duties: rewriting traditional combination of strictly configured fiduciary obligations and very lax common law expectations in skill, care and diligence • Lord Hoffmann led the fatal assault on entirely subjective approach in Re City Equitable Fire Assurance Co (1925): First instance decisions in Norman v Theodore Goddard (1991) and Re D’Jan of London (1994) provided the basis for codification under the Companies Act 2006 • Controversy? Circumspection in 1997: in many instances the ‘extension of liability is not sufficiently accompanied by thought for the defensive measures likely to be taken to avoid it’. ‘ … the defendants in the Guinness case had landed on both the snakes and the ladders in the course of their careers’. Rt Hon Leonard Hoffmann, 1997. The ‘snakes and ladders’ problem for mapping legal responses- especially criminalization ‘Individuals who commit financial crime should be treated like the criminals they are – and they will be. For let us be clear: there is no trade-off between high standards of conduct and competitiveness. Far from it …’ Rt Hon George Osborne MP, Mansion House Speech, June 2015. Difficulties in mapping fortune and misfortune: perspectives present- and past • Stephen Byers, then Secretary of State for Business, Mansion House Speech, 2000: Lamenting that there is still too much conformity to the ‘old stereotype of the British preferring people to fail than to achieve genuine and deserved success’, and even that there is a ‘great British tradition of praising the plucky loser and then decrying those who are successful’ • Barbara Weiss The Hell of the English (1986): Weiss’ analysis of how stigmatization associated with nineteenth-century bankruptcy law and practice became attached to middle and upper class indebtedness maps persuasively onto a narrative of fear of failure in business and muted views on success • PS Atiyah The Rise and Fall of Freedom of Contract (1979): significance of individualism as an aspirational touchstone grounded in values of sobriety and industry, along with moderation, prudence and self-effacing would also suggest attenuated views of success. And the case for historical enrichment of current challenges - from regulators • Treasury Committee Report on Northern Rock 2007-8: Overend & Gurney 1866 as a lesson on causes and consequences of ‘bank runs’ • Bank of England: Paul Tucker (2009) - history shows bank vulnerability to loss of public confidence and to ‘deposit runs’; Andy Haldane (2009) - history shows the importance of a banking system founded on trust; Mervyn King, (2012) - Pre crisis Bank should have paid greater attention to ‘lessons’ from history • FSA: Sally Dewar (2009) – need to counter views that ‘history teaches nothing’ • PCBS (2013) - recommendations for the Bank of England (FPC and beyond). Aligning regulatory discourses and academic methodological support for studies of the past • Regulators’ allusions to the past and its significance - without actually engaging with intellectual underpinnings of using the past in commentaries on the present - can be aligned with: - Legal Scholarship: particularly the established ‘branch’ known as legal history, as classically seen in the work of Ibbetson (1999) and Baker (2000) - Modern History: particularly that relating to historical methodology, notably associated with Sewell (2005) and Tosh (1996; 2010) • Key to utilising studies of nineteenth-century attempts to map fortune and misfortune in business. The importance of the nineteenth century for historians and for lawyers- past and present • Black and Macraild (2003) - ‘All periods in history centre on the interplay of change and continuity. The 19th century was a century of striking change and a great pressure for change. It was a modern age, not the modem age of the 20th ... but it was radically different from what had come before’ • A Century of Law Reform, Council of Legal Education (1901) – ‘Men of other professions have been proclaiming the advancement of science, the wonders of invention, the extension of trade, the increase in population, and of the country’s material wealth, during that period. And it is surely right that … attention … should be expressly directed to the great improvements which have been made, both to our law and in its administration, since the year 1800’. Tying together understandings of society economy and law: Chantal Stebbings (2012) • The nineteenth century - Age of ‘sheer exuberance and confidence’ - Dynamism and curiosity encompassing the view that nothing was impossible - Evident in all areas of human endeavour, where astonishing boldness remains visible, setting foundations for what we recognise today and (continue to) associate with confidence and progress • Importance for Developments in Law: ‘A century of law reform’ - Pervasive confidence, dynamism and curiosity also evident in developments in law - Belief in common law combined with an extensive legislative programme would provide the basis for meeting the social, economic and political dynamics - Unsurprising that law making was prodigious and a major pre-occupation for the Victorians. The 19th century ‘discovery’ of financial crime and Victorian social and legal confidence • The nineteenth century- an ‘age of opportunity’ - Wilson (2014): the new ‘enterprise economy’ brought increased overall transacting and new types of transacting and greater transactional freedom for enterprise itself, and opportunities for private individuals to prosper through investment opportunities • The nineteenth century – an ‘age of insecurity’ - Hilton (1989): time of middle and upper class obsession with catastrophe; particularly pronounced in experiencing ‘great commercial upheavals’ - Lobban (1996): time of great economic and social upheaval with a stock market crash roughly once a decade. Mapping (mis)conduct in business with legal liability from mid-nineteenth century years • The enterprise economy, equipoise and upheaval: Increased transactional freedom and breakdown in traditional transactional governance: increased overall transacting and new types of transacting; decline in ‘face to face’ City dealings, and influx of new participants • Influence mid-century crises: role of 1840s railway crisis and 1850s ‘commercial distress’ on concretizing perceptions of business as harmful as well as beneficial • Victorian recognition of ‘‘High Art’ crime’: precipitated the emergence of attitudinal patterns and ones of response which are recognisable today as being associated with ‘financial crime’. Reflections on the significance of 19th century experiences of financial crime • Harold Perkin (1969): ‘From the “railway mania” of 1846-47 onwards the investing public was compulsorily educated in a whole new world and vocabulary of ingenious crime, which could only be perpetrated by business men and by large, prominent, wealthy or at least credit-worthy business men at that’ • DM Evans (1859): ‘From time immemorial clerks have been discovered embezzling the property of their employers’, however, the 1850s bore witness to the ‘inauguration, development, and rapid progress” of “High art” crime’ • Sarah Wilson (2014): the lasting significance of nineteenth-century experiences and Victorian ‘conscious past’ of financial crime. Criminalization of business misconduct as a conscious choice • Contemporary reflections that some wrongs cannot be righted by financial redress between individuals (Mr Serjeant Kinglake, Hansard, 1857) • Determination to respond to business misconduct as criminal activity: - That amounting to ‘infamous crime’ which it would be ‘a disgrace to leave unpunished’ - Committed by occupants of ‘high office’, persons of ‘unquestioned honour’ - Distinctive trajectory of response: configured on ‘actor’ and ‘activity’ labelling used by criminologists. Financial crime- current difficulties and a trajectory originating in Victorian law reform • Influence of Victorian responses to financial crime in the emergence of current conceptions of financial crimes and their perpetrators: - Persons (actors) with ‘esteemed cultural attainments’; ‘respectable criminals’; - Activities (acts) ‘lacking immediate moral outrage’; ‘not real crime’ • Attributable to how financial crime sat at the intersection of two colossus of Victorian agendas for law and law reform - The articulation of law and industrial capitalism - The reform of the criminal law. New framework for Criminal Law and its administration • Criminal law reforms from 1820s channelling new approaches to criminal responsibility (conscious choice voluntary action and culpability) accompanied by revolutions in policing (a new ‘economy of deterrence, D Eastwood (1993)) and penal policy (proportion and efficacy through punishment and reform (Enlightenment, e.g. Beccaria (1764)); Movement has been analyzed as seeking to maintain ‘the illusion that socially dangerous and unacceptable activity was predominantly the province of the lower orders’ (Norrie (1993)) • 1830s: Earliest recognition of the ‘criminal within respectability’ (Wiener, 1990) and ‘respectable crime’? Edwin Chadwick and the Rural Constabulary Commission Report 1839 - Financial crime was rising - Signalling a more civilised and less barbarous society - Crime yielding to ‘economic remedies’. Mid-century articulations of law with capitalism • Nascent company law- dual regulatory and facilitative agendas: making incorporation easier and cheaper, achieving legal separation of corporate entity from human agents, and the protection of third parties through disclosure requirements (1844; 1856); general availability of incorporation with limited liability (1855) • Strong commitment to ‘business knows business best’ – Foss v Harbottle (1843) predates Joint Stock Companies Act 1844 • Also became concerned about the limits of lawful decision-making in business- mapping impropriety in business as activity which is deemed to be unlawful. Financial crime and legal narrative • Challenges for finding a cogent legal narrative for financial crime - Criminal law reform - strongly pre-disposed towards (if not actually premised on) concertizing conceptions of a ‘criminal class’ - Nascent understanding of enterprise - lack of morality recognised and (widely) condoned • It was relatively more straightforward to castigate financial crime through attacks on its perpetrators rather than their actions - Attacks on actors rather than activity: actor focus invoked secondary attach on activity - Channelled through accusations that through their activities respectable people had fallen to the position of ‘common felons’ - Castigations of business conduct itself when made were couched within references to the respectable custodians of business and economy. Tradition and transformation • Business and underpinning practices and governance were difficult to navigate for many different reasons: - The importance of embedding the capitalist infrastructure - Its frameworks were almost entirely new and unchartered - Legal non-interventionism: age where ‘business knew business best’ e.g. Foss v Harbottle (1843); legal expertise nascent at best - e.g. Royal British Bank trial 1858, and atrocious elsewhere – e.g. ‘Long John’ Lawrance J, Rose v Bank of Australasia and origins of the Commercial Court 1885 • The criminal law and its underpinnings much less complex - Altogether much more familiar territory for lawyers in the common law tradition - Lawyers and juries understood respectability and esteem only too well in terms of its importance and its responsibilising qualities (rooted in tradition and social structure grounded in paternalism). Trajectory and challenges of criminalizing misconduct in business • Trajectory of determination: criminalisation of misconduct in business - 1840s - investigations of company directors with a view to criminal charges - 1850s developments - heightened concern about absence of morality within and harms emanating from business environs became manifested in: ~ LEGISLATION tackling directly fraud across a range of commercial interests (1857) ~ CRIMINAL TRIALS of some of the highest profiled business people of the day • Trajectory of unease and anxiety: about the reach of criminal liability and even conceptual acceptance of ‘financial crime’ (Mr Wigram, Hansard 1857) - Concern that extending the reach of the law would not carry public opinion - Insistence that the introduction of new offences required the country to be ‘properly awakened’ to what these offences were. Extending the reach of criminalization – justification and ambiguity • Increasing concern about the implications of engagement with ‘what is wrong to risk’ and also ‘what is foolish to risk’ (Lobban, 1996) • Concern about ‘over-trading’: ‘excrescent trade’ - where risk became inseparable from profit, and ‘the line between fair trade and foul” impossible to draw’ (Hilton, 1989) • Strengthening views that ‘[i]t is excessive much more than deliberately fraudulent adventure which brings on commercial convulsion’ (Hilton, 1989). The judg[e]ment of winners and losers? • Criminal trials of disgraced businessmen led to some quite spectacularly different outcomes: Judicial pronouncements on very similar facts that: - What has occurred is ‘infamous crime ... [and would be a disgrace if left unpunished]’ - Questioning ‘why ... [was] this prosecution was ever brought’? • What many had in common was that the business had failed: inviting contemporary concern about and historical reflection on the significance attached to business failure, and especially for determinations of criminal liability. Longstanding concern about the contingencies of business, and thus fortune and misfortune • There is plenty which is unclear in stating that “there is no trade-off between high standards of conduct and competitiveness” • Some failure within capitalism is inevitable: the survival of a business is often a matter of luck rather than the inevitable and indeed deserved outcome of a(n) (un)sound approach - Short-term cash flow difficulties will kill many businesses including sound ones - The survival of many businesses sound or otherwise is assisted by favourable market conditions over which individual businesses have little or no control. Judging criminal misconduct in business • The ‘winner takes all’ parameters of capitalism do not ensure that those whose approach to business is sound are rewarded and those whose is not receive opprobrium: ‘A rise in the market can compensate for the effect of some perfectly hair-raising piece of incompetence’ (Lord Hoffmann). • A matter of concern for any legal consequences attaching to failure: especially those which are public, centrally: - Disqualification from acting as a company director- loss of livelihood; - Criminal liability leading to many exclusions from civic participation and even loss of liberty. Judging misconduct? • Judging misconduct – or making judg[e]ment of failure? • How were these determinations made? - Judicial pronouncements on very similar facts that: What has occurred is “infamous crime ... [and would be a disgrace if left unpunished] (Royal British Bank trial 1858) and Questioning ‘why ... [was] this prosecution was ever brought’ (Overend and Gurney trial 1869)? - Judicial professed lack of legal expertise in matters of business - in contrast with juries of ‘men of commerce’ • Cases point to strong reliance placed by the legal community upon commercial interests in determining instances of failure amounting to wrongs incapable of being righted through financial reparation and instead requiring public sanction. Alliances between legal and commercial interests- an alliance of elites? • Different narratives of 19th century concerns about ‘over-trading’ - excessive risk-taking rather than deliberately fraudulent enterprises - Concern about how many respectable businesses could be encouraged to ‘indulge in ill-considered enterprises’: Making the location of risk impossible for potential investors and creditors and other interested parties interfering with market confidence - Concern about ‘over trading’ as a cover for socially conservative attitudes? Fears about ‘outsiders’ and ‘outlier’ practices as capitalism’s forces of disruption alongside its ones of innovation emerged- the reinforcement of dominant practices and established networks? • Outsider exclusion- myth or reality? The realities of external allocations of power … and implications • Reality of allocations of power outside the legal community • The implications of allocations of power to business interests • Criminal trials articulated public utility concerns about business propriety but did they also embed inequality and exclusion of those considered ‘outsiders’? 19th century concerns – accounting for the essence of success and failure in business • Contemporary concern: too little account taken of the complex matrix of contingent forces when judging business’ winners and losers – quite literally in the case of criminal liability • The reality of business: ‘inherently involves risk-taking … risk-taking is not exact science [and is instead]… judgement-based and future-looking’ (Treasury Consultation, 2012) • Was sufficient account taken of this reality when assigning grave legal consequences to disgraced business people? The City of Glasgow Bank trial 1878-9: the significance of Prosecutorial and Defence perspectives. Competing narratives of misconduct/misfortune: of success and failure and winning and losing? • The prosecution: ‘entrusted with millions by the public’ the directors and manager would ‘work that wreck ... which has befallen the City of Glasgow Bank’ - Far too much indulgence of interests of ‘so-called capitalists’ had occurred, whilst being very strict with ‘proper security from a poor fellow ... who wanted to get a little money in advance’ - Overseas land investment opportunities undertaken to make good losses on lending were ‘illegitimate’ speculations • The Defence: the benefit of hindsight is a luxury not afforded to business people - ‘it is easy … to say what these Directors should have done - put a match to the whole concern and blown it up, in the year 1876 … It might have been better, on the whole, than attempt to carry on this concern which was so deeply involved by these advances to the four debtors. They did their best’ - Overseas land investment- hindsight is a marvelous thing, and had this risk paid off it would be equally plausible to see it as innovative and those on trial as trailblazers or even heros. Is it really that straightforward … • Considerable care is required in making this kind of statement: ‘Individuals who commit financial crime should be treated like the criminals they are – and they will be. For let us be clear: there is no trade-off between high standards of conduct and competitiveness. Far from it …’ • And it is vital to recognize: - The importance of the implications of ‘how thin is the line between success leading to wealth and a knighthood and failure leading to disqualification or even imprisonment …’ - That determinations of criminal liability/absence of it can be influenced by external forces, raising questions of whether they are responses to socially injurious conduct reflecting the interests of society- or embody other agendas.