Draft 3, August 29, 2014 JOHN F. KENNEDY SCHOOL OF

advertisement

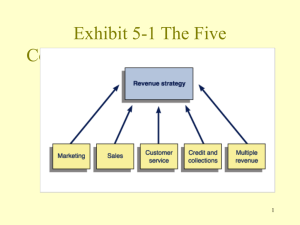

Draft 3, August 29, 2014 JOHN F. KENNEDY SCHOOL OF GOVERNMENT HARVARD UNIVERSITY Entrepreneurial Finance MLD-829MA Fall Term, Mod2 (0.5 credits) Carl Byers Adjunct Lecturer in Public Policy Harvard Kennedy School Carl_Byers@hks.harvard.edu Tuesdays and Thursdays 11:40 PM – 1:00 PM Littauer 140, Harvard Kennedy School, 79 JFK Street Shopping Session: Friday, 9/2/2014, 10:10a-11:25a, LAND classroom (Belfer Building, 4th Floor) Note: The shopping session is not where/when the course will be conducted First Session: Tuesday, October 21st Office Hours: Tuesdays, 10:00 AM – 11:30 AM, Starting 10/28/2014; other hours to be added 124 Mount Auburn St., Suite 100 (wait in suite lobby) By appointment, via online signup: http://ow.ly/zSsDi Course Assistants: Ibraheem Mehmood; Ahmed El Mahi (contact details to be provided) CA Hours: See course page announcement Faculty Assistant: Veronica Chapman (veronica_chapman@hks.harvard.edu, 617-495-8833) Page 1 Draft 3, August 29, 2014 Overview “Creating something from nothing,” the essence of entrepreneurship, requires more than the capacity to innovate, recruit, inspire, and strategize. Building a new organization also demands facility with the language of commerce. Whether leading for-profit or not-for-profit ventures, entrepreneurs must speak fluently with those who fund, oversee, and support them about the financial dynamics of their operations. This course teaches such leaders essential financial terms, tools, and concepts with an emphasis on “business plan” development. Those interested in innovation from the standpoint of policy, regulation, or politics also will benefit from gaining this type of knowledge about independent enterprises, as will those who seek to be “intrapreneurs” in governments or corporations. Subject matter will include the entrepreneurial process, expectations of investors / funders, key accounting terms / concepts, valuation, and the practical application of these topics to financial planning and performance analysis. Students will acquire familiarity and comfort with financial statements (income statements, balance sheets, statements of cash flows) and with related accounting issues. We also will review how an understanding of economic drivers enables the successful development of an organization’s strategy, forecasts, systems, and culture. Lecture, discussion, case studies and small working groups are employed in the class. The class also engages real-world entrepreneurs and financiers from the for-profit and not-for-profit sectors in panel discussions to probe more deeply the application of these concepts. As they learn key concepts and practices, students construct an integrated financial plan for their proposed (or hypothetical) venture, sharing their work with the instructor via Dropbox. Each student pursues a unique plan, engaging in small working groups for feedback and support. The course concludes with a business plan competition within the class for those who chose to enter. This course precedes MLD-839M “Entrepreneurial Finance II” that extends the concepts and develops in greater depth the financing process for entrepreneurial ventures. Students with a background in finance / accounting and a well-developed venture plan may take MLD-839M alone, with the permission of the instructor. Approach Many books and courses about financial topics focus first on systems of accounting, diving immediately into debits and credits or the process of recordkeeping. Others take a theoretical Page 2 Draft 3, August 29, 2014 bent, going into mathematical proofs to translate concepts of supply, demand, and risk into quantitative tools. These approaches can leave potential entrepreneurs unfulfilled because they require an extensive investigation of mechanics before they can be applied to the core objectives of a new venture. This course looks at similar subject matter from a different perspective. Regarding new ventures, we first will ask about what exactly the new organization / initiative will do and how it will do it. We will build financial literacy starting with the activities of the proposed organization. By developing finance and accounting vocabulary in the context of practical questions about the way a new venture will operate, students can absorb concepts in a manner that is immediately relevant to what they propose to accomplish. Hence, the criteria applied to the design and content of this course are: (1) What financial dynamics entrepreneurs need to understand about proposed ventures? (2) What language entrepreneurs need to speak to engage others in supporting them? Course Objectives 1. To help students build financial literacy, so that their new ventures can be properly described, discussed, and managed 2. To enable students to development dynamic, integrated and insightful financial plans for new ventures 3. To provide students with a pragmatic understanding of what it takes for a venture to succeed, including what is required to meet the expectations of sources of funding Outline This course employs a few related streams of activity and learning that work together to support the course objectives: o Readings, discussion, and assessments about finance concepts to build literacy o Case analyses to apply these concepts to real-world scenarios o Panel discussions to hear first-hand from entrepreneurs and funders o An integrated, cumulative financial planning project to develop a plan for a specific proposed venture These work-streams are structured around five key topic areas: 1. The activity of the organization and how it relates to REVENUE 2. The delivery of services and how it relates to EXPENSES AND MARGINS 3. Financial dynamics and how they relate to the BALANCE SHEET 4. The purpose and insights provided by analysis of CASH FLOWS Page 3 Draft 3, August 29, 2014 5. How social impact and financial investors assess VALUATION when funding enterprises Each topic area will include a mix of lecture, discussion, and case study analysis, in addition to a concept review short assignment and work on a relevant part of the financial planning project With case studies, there are often many aspects of each situation worthy of consideration; we will focus on how financial concepts come into play o Specific questions and /or data will be presented prior to each case discussion to focus students on aspects of entrepreneurial finance within each scenario o Weeks noted as “mini-case” days are not necessarily shorter case documents, but questions asked and time used in class will be narrower than other case days The class also includes two panel discussions during class time, to help bring the ideas to life and to allow students to tailor questions to their specific ideas and plans o An Not For Profit Entrepreneur / Financier Panel o A For Profit Social Entrepreneur / Financier Panel The short assignments noted in this syllabus (informational forms and concept-review short assignments) will be posted on the class website when assigned o The two informational forms will help the instructor and the class understand the backgrounds and goals of students collectively and will set-up the proposed venture financial planning project o The five concept review short assignments are designed to cover key aspects of each concept, to draw on use of required readings and to ensure that everyone is following content that builds cumulatively over the course Guidance regarding how to construct your Excel file will be provided on the course page after completion of the Personal Profile and Proposed Venture short assignments The following diagram shows the relationship of lectures, case studies, panels, review assignments, and project deliverables to the five key topic areas (with dates shown for each) Page 4 Draft 3, August 29, 2014 Page 5 Draft 3, August 29, 2014 Course Requirements and Grading There are two informational forms and five concept review short assignments, all of which are graded on a “check,” “check minus” or “check plus” basis, leading to a cumulative result Each student will develop an integrated set of financial projections (which can be a planned venture, if so desired, or a hypothetical enterprise) o These financial projections will be prepared in Microsoft Excel and will be developed incrementally as the course proceeds o At sequential “checkpoints” throughout the term, students will be expected to have applied the conceptual learning to their proposed venture; consultative groups will be formed among students to help each other with these steps and some students will be asked to share their interim work with the class o A letter grade will be given for this assignment A final exam will cover the key concepts of the course and evaluate each student’s ability to apply the concepts to real-world scenarios, which will receive a letter grade Student are expected to engage actively in class discussions Grades will be based on two factors: work done and participation o The work grade will be based 1/3 on the weekly short assignments, 1/3 on the financial projections project and 1/3 on the final exam o Typically, the work grade will drive the final letter grade o Participation is expected as a minimum condition of the course, both to facilitate your own learning and to help others learn o Students who are particularly engaged and helpful may earn a “bump up” of their grade; students who are particularly unengaged and unhelpful may earn a “bump down” of their grade o Ultimately, the instructor will adhere to the HKS grading standards, which indicated a range of grades; it is likely that the grading policies noted above will indicate a clear range of outcomes that will be translated to grades accordingly Work will be shared with the teaching team via Dropbox; each student should create a folder with their name as the title and share it with the following account: EntFin01@gmail.com Page 6 Draft 3, August 29, 2014 Schedule # 1 2 3 Day, Date Tues., 10/21 Thurs., 10/23 Tues., 10/28 4 Thurs., 10/30 5 Tues., 11/4 6 Thurs., 11/6 7 Thurs., 11/13 8 Tues., 11/18 1 Topic Entrepreneurial Finance as a Language Readings1 Text P&L: Revenue 1, Idea, Canvas, TAM, and Goto-Market P&L: Revenue 2, Case and Working Group P&L: Expense and Earnings 1, Unit Models, and Income Statements P&L: Expense and Earnings 2, Case and Working Group Balance Sheet: Assets and Liabilities 1, The Balance Sheet Mindset Balance Sheet: Assets and Liabilities 2, Case & Working Group Cash Flows: Cash Conversion Cycles, 2/19 Case Continued Text Project Q&A Concept Q&A Lecture Case TAM, Business Model and Sales Plan (Project) * Project Q&A Concept Q&A Case Review Working Group Consultation Project Q&A Concept Q&A Lecture Project Q&A Concept Q&A Case Review Working Group Consultation Project Q&A Concept Q&A Lecture Mini-Case Review Income Statement (Project.)* Text Article Case Text Text Article Case Text MiniCase Class Session Course Overview Lecture General Q&A Lecture Project Overview Profile Feedback Concept Q&A Case Review Working Group Consultation Due Personal Profile Form Assigned Dropbox Setup Personal Profile Form Proposed Venture Form Concept Review 1 Dropbox Setup Proposed Venture Form Concept Review 1 Concept Review 2 Concept Review 2 Concept Review 3 Concept Review 4 See week-by-week section of this syllabus for details. Page 7 Draft 3, August 29, 2014 # 9 10 Day, Date Thurs., 11/20 Tues., 11/25 Topic Valuation and Fund Raising, Process and Methods Readings1 Text Article Panel 1 11 Tues., 12/2 Panel 2 12 Thurs., 12/4 13 Tues., 12/9 14 TBD Overall Concept Summary & Plan Competition Panelist Info One reading Panelist Info One reading Text MiniCase Class Session Project Q&A Concept Q&A Lecture Due Balance Sheet (Project) * Concept Review 3 Panel 1: Not For Profit Entrepreneur / Financier Guests Panel 2: For Profit Social Entrepreneur / Financier Guests Project Q&A Concept Q&A Lecture Plan Competition Assigned Concept Review 5 Cash Flows (Project)* Concept Review 4 Concept Review 5 FINAL PROJECT, including Valuation / Impact* Take Home Final Exam * Please note that these project “checkpoints” are not firm deadlines and will not be checked by the instructor unless students seek feedback. Working groups are designed to facilitate learning and compliance related to these checkpoints. The grade on this project will be based on the work submitted by Monday, March 10th as the final project deliverable. Required Book Karen Berman and Joe Knight, Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Really Mean (Harvard Business Review Press, 2013, $27.00) This book is available for purchase at The Coop. Other Books Used in the Class What follows are books that we will read 1-3 chapters from. PDFs will be made available on the course page. Brad Feld and Jason Mendelson, Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist (John Wiley & Sons, Inc., 2013) Page 8 Draft 3, August 29, 2014 McKinsey & Company (Tim Koller, Richard Dobbs and Bill Huyett), Value: The Four Cornerstones of Corporate Finance (John Wiley & Sons, Inc., 2011) Alexander Osterwalder and Yves Pigneur, Business Model Generation (John Wiley & Sons, Inc., 2010) Stevenson, Howard with Shirley Spence, Getting to Giving: Fundraising the Entrepreneurial way by a billion-dollar fundraiser (Timberline LLC, 2011) Noam Wasserman, The Founder’s Dilemmas: Anticipating and Avoiding the Pitfalls That Can Sink a Startup (Princeton University Press, 2012) Reading Assignments Session 1 (10/21): Entrepreneurial Finance as a Language Berman & Knight, Financial Intelligence, Part One (Ch. 1-4, plus Toolbox, 32 pages together) Paul Graham, How to Get Startup Ideas, November 2012: http://paulgraham.com/startupideas.html Chris Dixon at Startup School 2013 (Y Combinator), 23 minutes, http://www.youtube.com/watch?v=akOazwgDiSI Wendy Kopp interview, “Charisma? To Her, It’s Overrated,” New York Times, July 4, 2009: http://www.nytimes.com/2009/07/05/business/05corner.html?pagewanted=all&_r=0 “Accounting Vocabulary” and “Accounting Grammar” handouts to be provided by instructor Session 2 (10/23): P&L: Revenue 1 – Idea, Canvas, TAM, and Go-to-Market Berman & Knight, Ch. 5 & 7 (12 pages together) http://www.ssireview.org/articles/entry/ten_nonprofit_funding_models (14 pages) Steve Blank, “Why The Lean Startup Changes Everything”, Harvard Business Review, R1305C, May 2013 (7 pages) Steve Blank and Bob Dorf, The Start-Up Owner’s Manual: The Step-By-Step Guide for Buidling a Great Company, excerpt from Chapter 4: Customer Discovery, Phase One: State Your Business Model Hypothesis, pp. 69-81 (13 pages) “How to Plan: Phase One” handout to be provided by instructor Page 9 Draft 3, August 29, 2014 Session 3 (10/28): P&L: Revenue 2, Case and Working Group CASE: Lifespring Hospitals: Delivering Affordable, High-Quality Maternal Health Care in India, Anant, Mukherjee et al, Ivey Publishing (ISB CEIBS SW), Case ID#9B12M105, February, 2013 (17 Pages) ABC News profile of LifeSpring Hospitals: http://www.youtube.com/watch?v=9KKVdPWTUI8 Osterwalder & Pigneur, Business Model Generation, Definition of a Business Model, Customer Segments through Revenue Streams, pp. 14-33 (19 pages) Discussion Questions 1. What is the scope of the problem Lifespring Hospitals aims to address? 2. Is this a social enterprise? 3. How would you characterize the business model using the Osterwalder & Pigneur framework? 4. How is this venture doing? What metrics support your view? 5. What questions remain about the venture’s prospects? 6. What path forward would you recommend? Session 4 (10/30): P&L: Expense and Earnings 1 – Unit Models, Margins and Income Statements Berman & Knight, Ch. 6, 8, and 9, plus Toolbox (31 pages together) Osterwalder & Pigneur, Definition of a Business Model, Key Resources through Cost Structure, plus iPod/iTunes example and Unbundling Business Models, pp. 34-59 (25 pages) “How to Plan: Phase Two” handout to be provided by instructor Session 5 (11/4): P&L: Expense and Earnings 2 – Case and Working Group CASE The “Tipping Point” and Green Dot Public Schools, (33 pages), Stanford GSB Case SI-109, 12/8/2008 http://www.fastcompany.com/1835678/how-green-dot-charter-turned-around-lasworst-schools http://articles.latimes.com/2013/aug/29/local/la-me-ln-api-scores-20130829 http://www.greendot.org/uploaded/uploads/homeoffice/documents/Green_Dot_Annu al_Financial_Report_FY12.pdf Discussion Questions 1. How would you characterize the Green Dot “business model” using the Osterwalder & Pigneur business model canvas framework we have covered? 2. What drivers of student performance did Green Dot address? What do you imagine their “driver tree” would look like as it relates to student achievement? Page 10 Draft 3, August 29, 2014 3. What are the pros and cons of innovating within an established system as opposed to creating de novo alternatives? In this case, in what ways has impact been accelerated or diminished due to Green Dot’s approach? 4. Focusing on Exhibits 7 and 8, how would you characterize the Green Dot financial model? What is the role of fixed and variable costs? How does geographic concentration affect the model? 5. Do you accept the idea of a tipping point? Do you think Green Point should expand to new markets? What adaptations might be required to do so? Session 6 (11/6): Balance Sheet: Assets and Liabilities 1 – The Balance Sheet Mindset Berman & Knight, Part Three (Ch. 10-14, plus Toolbox, 32 pages together) HBS Note: The Accounting Framework, Financial Statements, and Some Accounting Concepts, William J. Bruns, Jr., Case 9-193-028, Revised September 13, 2004 (12 pages) “How to Plan: Phase Three” handout to be provided by instructor Session 7 (11/13): Balance Sheet: Assets and Liabilities 2 – Case & Working Group CASE: Gone Rural, Andre F. Perold, Harvard Business School Case 8-211-016, Revised March 23, 2011 (9 pages) Discussion Questions (from L. Viceira) 1. How is Gone Rural doing? 2. What is the company’s business and financial strategy? 3. Given its profitability, why is Gone Rural in need of cash? 4. What should be their policy towards offering customers discounts for shorter payment terms? 5. Is it important that Gone Rural be a for-profit company? Session 8 (11/18): Cash Flows: Cash Conversion Cycles and 2/19 Case Continuation Bergman & Knight, Part 4 (Ch. 15-19 plus Toolbox, 29 pages together) Continued consideration of Gone Rural Discussion Questions (from L. Viceira) 1. Assuming Gone Rural grows its revenues at 20% per annum over the next five years, what will be the company’s financing needs? 2. How will raising and investing R1 million in new facilities change the projections? 3. How fast should Gone Rural grow? How should Gone Rural finance itself? Session 9 (11/20): Valuation and Fund Raising, Process and Methods Page 11 Draft 3, August 29, 2014 Berman & Knight, Part 5 (37 pages) McKinsey & Company (Koller, Dobbs & Huyett), Value, Ch. 1 and 2 (24 pages) Acumen Fund’s BACO Framework for evaluating social impact investments: http://www.acumenfund.org/uploads/assets/documents/BACO%20Concept%20Paper% 20final_B1cNOVEM.pdf Optional suggested reading for NGO fundraising: Stevenson, Howard with Shirley Spence; Getting to Giving the Entrepreneurial Way by a billion-dollar fundraiser, Chapter 1 (23 pages) Session 10 (11/25): Panel 1 – Not For Profit Entrepreneur and Financier Guests We will be joined by at one or more entrepreneurs and financiers in the realm of not-forprofit organizations, including hybrid / impact guests. Invitations have tentatively been accepted by: Willie Foote, CEO of Root Capital; Sasha Chanoff, Co-founder and Executive Director of RefugePoint; and, Brian Trelstad, Partner at Bridges Ventures and former CIO of The Acumen Fund (via Skype); participants may change Bios and articles about panelists to be provided ahead of the session Session 11 (12/2): Panel 2 –For Profit Social Entrepreneur and Financier Guests We will be joined by at one or more entrepreneurs and financiers in the realm of not-forprofit organizations, including hybrid / impact guests. Invitations have tentatively been accepted by: Eric Paley, General Partner at Founder Collective and Ed Park, COO of athenahealth, Inc.; participants may change Bios and articles about panelists to be provided ahead of the session Session 12 (12/4): Valuation Discussion, Concept Summary & Working Group Feld and Mendelson, Venture Deals, Introduction and Ch. 1-3 (34 pages) Wasserman, The Founder’s Dilemmas, Ch. 9, “Investor Dilemmas: Adding Value, Adding Risks,” (48 pages) Suggested / Optional: Wasserman, Ch. 11, “Wealth vs. Control Dilemmas” (56 pages) We also will hold the 2nd HKS Entrepreneurial Finance plan competition for interested students (voluntary) Page 12