ch10 - Cal State LA - Instructional Web Server

advertisement

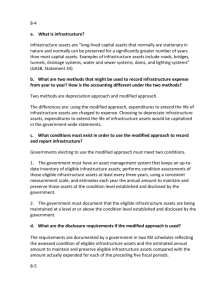

Chapter 10 Objectives: • Learn about permanent funds • Learn about fiduciary funds • Learn how gains and losses are treated • How trusts guard against inflation • Learn about benefits issues • Learn about agency funds Permanent Fund Trust fund but on behalf of the governmental unit rather than external beneficiaries Financial resources accounted for Governmental fund so use modified accrual Fund will have few depreciable assets Nonexpendable resources On government-wide statements combined with other governmental funds Fiduciary Funds Full Accrual Separate column on governmental fund financial statements Excluded on government-wide statements except as restricted net assets Examples: pension, investment trust, private purpose Gains and Losses • Use of income, gains and losses can be stipulated by donor • Otherwise free to be used • If added to principal, guards against loss of value due to inflation •Governments mark to market and recognize the unrealized gains (can be transferred to other funds) Closing Entries Close revenue and expenditures for Permanent Fund Revenue Expenditures Income available for transfer Income Available for transfer Fund Balance Closing Entries, con’t Transfer to Special Revenue Fund: Operating Transfer out Cash Closing: Fund Balance Operating Transfer out Financial Statements Statement of fiduciary net assets Statement of changes in fiduciary net assets See page 413 All fiduciary funds of a similar type combined and reported in a separate column on the fiduciary fund statements Pensions • Defined Benefit vs. Defined Contribution • Actuarial determined • Life expectancy • Employee turnover • Mortality • Wage trends • Estimated returns • Discount rate • Can have multiple employer plans Formula for Pension Expense • Actuarially determined expense/expenditure based on all of the assumption • Service cost + • Interest on projected benefit obligation + • Actual return on pension assets + • Gain or loss on investments • Difference between actual return and expected return • Amortization of the unrecognized net gain or loss from previous periods • Amortization of prior service cost Expense vs. Expenditure • Expenditure is the amount transferred to the pension trust fund • If not equal to actuarial amount then keep track of the liability • Expense is the actuarial determined amount • If not fully funded, liability on the balance sheet • See pension expense illustration problem Pension Expenditures Recognize as expenditure, the cash transfer to the pension fund Government-wide and proprietary funds recognize pensions like corporations Pension Liabilities • Created when pension is not fully funded • Liability created with transition losses • Improvements in plan • Change in estimates • Can be amortized over a period Disclosures • • • • Plan assets Funded status Contribution requirements Assumptions made Pension Reporting Limitations: • Since reported by fund, comprehensive amounts usually not available • Liabilities are only the unfunded portion • So many estimates •To compensate, numerous disclosures are required Post Employment Benefits • Treated similarly to pension funds • Assumption include trend rate in health care costs Agency funds • No Budget • Modified accrual • Objective is to hold funds for other entities • Pass through grants • Collections of special assessments if not guaranteeing the debt Agency Funds on the statements • Separate column on the fiduciary fund statement of net assets • Not on government-wide statements • Assets = Liabilities Entries Agency Fund Cash Due to ….. Interest receivable Due to …. Due to….. Cash Review Learn the differences between expendable and nonexpendable trust funds Know the transactions in each type of trust fund Know about permanent funds Know what an agency fund is