MODULE 1a - CLSU Open University

advertisement

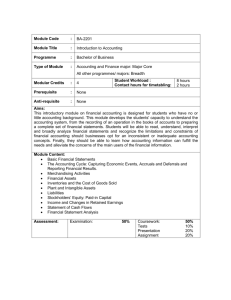

MODULE 1 AN INTRODUCTION TO FINANCIAL MANAGEMENT, ACCOUNTING AND CONTROL Financial Management, defined - Concerned with maintenance and creation of economic value or wealth. - Concerned with proper specifications of the financial goals of the firm as well as the measurement of performance relative to the achievement of this objective. - Responsible in allocating funds to current and fixed assets; to obtain the best mix of financing alternatives and to develop an appropriate dividend policy within the context of the firm’s objectives. Accounting, defined - It is an art of recording, classifying and analyzing business transactions and events. The person in charge of accounting is known as an accountant and this individual is typically required to follow a set of rules and regulations such as the Generally Accepted Accounting Principles. Accounting allows a company to analyze the financial performance of the business and look at its statistics such as net profit. Control, defined - is one of the managerial functions like planning, organizing, staffing and directing. It is an important function because it helps to check the errors and to take the corrective action so that deviation from standards are minimized and stated goals of the organization are achieved in desired manner. According to modern concepts, control is a foreseeing action whereas earlier concept of control was used only when errors were detected. Control in management means setting standards, measuring actual performance and taking corrective action. Thus, control comprises these three main activities. The Firm and its Environment The firm is viewed as an organization set up to perform a specific economic goal or mission. In undertaking this mission, the firm should be able to do two things: (1) meet and adjust to the demands of the environment, and (2) choose a set and corresponding policies and programs to meet these demands. Figure 1 suggests a framework for looking at the firm and its environment. On one hand, the firm consists of two groups –stockholders or owners and management. The stockholders provide the capital funds which are employed by the firm in its productive economic activities. As owners of the firm, they may delegate the actual day-to-day control of the firm to a second group of individuals called managers. This act of delegation, however, is accompanied by the assignment of responsibility, in the form of corporate goals set by stockholders for its management. The setting of corporate goals is the owners’ primary means of communicating their preferences to the managers. Based on these goals, management chooses and implements policies and programs which will achieve these objectives. Thus, the role of management is one of execution of policies. The other half of Figure 1 shows that the firm cannot be separated from various sectors of society. There are several influences which are immediately recognizable, namely: 1.) The preference of stockholders and the goals they set for the firm will partly depend on alternative uses and returns for capital invested in the firm. Thus, there are is a market for investor capital and the firm should be able to deliver to its stockholders the benefits which would have been derived if the funds were invested in this outside market. The same reasoning applies if the firm avails of loan funds from creditors. E.g. banks and financial institutions. 2.) The firm exists within a legal or political and economic framework. Its objectives and implementing policies/programs should not be inconsistent with society’s prevailing legal norms and values. This indicates that the firm should produce some direct or indirect benefits to society. Otherwise, it becomes an irrelevant institution and should be legislated out of existence. 3.) Management should not act as if it is accountable only to its stockholders and not to society. At the very least, the presence of alternative opportunities in the management labor market may influence managers to do a better job in order to increase their “market value”. 4.) The firm’s choice of operating plans – projects and product-service mix will - be done in face of a competitive market, except when the firm operates as a monopoly. ‘ Figure 1 The Firm and its Environment Firm Society/Environment Stockholders/Growers (Preferences and Opportunities) Outside Market for Capital The Setting of Objectives/Goals for the Firm Management (Preferences and Opportunities) Political and Economic Environment Outside Market for Managers The Choice of Policies and Programs to Achieve Stated Corporate Objectives Implementation of Policies/Programs Outside Market for Goods and Services with Other Firms The Potential Conflict between the Owner and Management Goals The evolution of many Philippine companies begins with the lone entrepreneur with a business idea. From a one-man operation, this entrepreneur begins to identify bigger opportunities and expand his business interests. Then comes the point when his own personal resources alone are not sufficient to sustain growth. At this time, the entrepreneur brings in partners with capital and/or banks with loan funds. Nevertheless, he may continue to retain controlling capital interest and to manage the firm himself. We can say that to this stage, the firm remains entrepreneurial in character. Finally, there comes a time when his business units and resources have grown far beyond his physical capability to control the firm. As a result, he may just sit in several Boards of Director and yield the day to day management to professional managers. At this point, the firm shifts from an entrepreneurial to a professionally-managed firm. The crucial difference between entrepreneurial firms and professionally-managed firms, following the framework in Figure 1, lies in the non-identity of the interests of the owners and of the managers in the latter type of the firm. Many theories or models of the firm suggest that while the goals of owners may have been set rationally given the capital markets, there is an inherent divergence in managerial goals along the following possible lines: 1. Managers may “overspend” on salaries and pre-requisites (e.g. company cars, representation, plush officers) because these also have the effect of increased personal consumption. On the other hand, stockholders would only want to spend these prerequisites to the extent that they benefit the company. For example, representation expenses should be allowed only if they increase future sales of the company. Beyond this level, (e.g., if “too frequent” or if non-client guests are included), the management can only derive personal satisfaction from the expense without contributing to the profit goals of the stockholder. 2. Managers may engage in “shrinking” behavior, preferring leisure over any further exertion to achieve exceed the stockholders’ goals. This hypothesis is related to the concept of “sacrificing” behavior. Here, the manager may decide not to exert effort to exploit all opportunities for the stockholders, preferring instead to achieve the goal assigned to him with the minimum effort. 3. Managers may supplant the stated goals of the stockholders with some of their own. For example, management might attempt to expand sales and market share with little attention to the effects on the goals of stockholders for short run earnings. Managers might derive personal satisfaction from being the head of the billion=peso company or of the biggest nationwide branch network. 4. Managers may engage in outright manipulation and misrepresentation of corporate performance in order to show attainment of owners’ goals. A well-known case was that of a softdrink company in the late 1970s which showed that management can sometimes succeed in showing fictitious profits over an extended period. These theories of the firm and of managerial behavior are based on two crucial but often unstated premises. First, the assumption is that the “Theory X” version of individual behavior is valid, i.e., that man prefers less work to more and is driven by economic reasons or self-interest alone. Second, managerial decisions which adversely affect stockholder goals are possible and could remain undetected over time because the uncertainty in the environment effectively “disguises” the impact of the manager’s decisions and the owners are therefore unable to closely investigate the manager’s actions. Goals of the Firm The preferable goal of the firm should be maximization of shareholders’ wealth, by which we mean maximization of the price of the existing common stock. Not only will this goal be in the best interest of the shareholders, but it will also provide the most benefits to the society. In microeconomics, profit maximization is frequently given as a goal of the firm. Profit maximization stresses the efficient use of capital resources, but it is not specific with respect to the time frame over which profits are to be measured. A financial manager could easily increase current profits by eliminating research and development expenditures and cutting down on routine maintenance. Some of the corporate goals include the following: 1. Maximize corporate profits 2. Maximize the wealth of the stockholders as reflected in the market price of the company’s stock 3. Maximize profits or shareholders’ wealth subject to the satisfaction of such other goals as target market share, customer service and minimum acceptable risk of bankruptcy 4. Maximize profits or shareholders’ wealth while playing in active role as a participant in society’s current concerns 5. Maximize the value of the firm to its present stockholders. Traditionally, the concept of profit maximization carries a definite appeal due to its simplicity and its consistency with classical views of economic efficiency. Operationally, however, “profit “is not quite easy to define. There are several interpretations like: (a) net income from accounting reports; (b) earnings per share and (c) return on investment. A corporate goal stated in terms of total profits has the advantage of being specific and understandable to management. Furthermore, a total profit objective readily translates to operational plans and budgets to guide day-to-day management activities. The problem to total profit alone lies in its inability to simultaneously reflect changes in the capital position of the company. For example, total profits of the company may have increased during the year but this might be due to the investment of new shareholders’ capital on marginally profitable projects. New capital may be placed in a savings account with minimal interest rates and this would increase net income. Financial Policy, Planning and Control Functions Once a company has selected its specific financial goals, management must proceed to develop operating policies, strategies and mechanisms to achieve those goals. Due to the complexity of the finance activity in the typical business firm, it is not a simple task to categorize the various finance-related functions. We adopt an approach focusing on the organizational hierarchy for finance in our classification of the finance function into three types, namely: (a.) financial policy and strategy; (b.) financial management and control and (c.) financial planning. Generalizations, of course, are complicated by the fact that these functions are interrelated in practice and certain decisions (e.g. project selection) involve all three types of functions. Nevertheless, it will be easier to recognize the nature of the finance functions in practice if our presentation an organizational motive. Financial policy and strategy formulation is normally a top level management prerogative. It covers investment and financing decisions with long-term implications on the overall risk, profitability and growth of the company. The financial management and control function is essentially a middle management level activity. Once strategies and policies have been set, middle managers’ role is to ensure that operational and day-to-day decisions are consistent with the chosen overall direction. Financial planning is primarily a staff function, providing the necessary informational and analytical support to both financial policy and control decisions. Some specific finance policies, decisions and planning roles follow: A. Financial Policy and Strategy 1. Investment Policy Choice of product lines and capital projects 2. Capital Structure Policy a. Working Capital Policy: balancing short-term VS long-term assets and liabilities b. Leverage Policy: balancing long-term financing, i.e. debt VS equity 3. Growth Strategy a. Whether growth should be pursued using internally generated funds or through mergers and consolidation b. Whether to integrate toward raw materials production and marketing (“vertical integration” or toward diverse products/services (“conglomerate” or “horizontal” integration) 4. Dividend Policy Whether to follow a systematic pattern or earnings retention or dividend distribution B. Financial Management and Control 1. Project Management Assure that long-term projects are implemented according to planned investment outlays and to yield forecasted cash returns 2. Working Capital Management a. Cash Management a.1. Provides for adequate cash balance for day-to-day operating needs a.2. Maximize return on idle cash through investment in marketable securities a.3. Institute proper control for cash b. Accounts Receivable Management b.1. Optimize the accounts receivable investment through an evaluation of the trade-off between lost sales opportunity and bad debts b.2. Institute sound credit evaluation and collection procedures c. Inventory Management c.1. Determine inventory levels by optimizing the trade-off between inventory carrying cost, ordering cost and lost sales opportunity c.2. Institute sound inventory control procedures 3. Management of Fund Sources a. Identify possible sources of short-term and long-term funds b. Negotiate and monitor credit facilities with financial institutions 4. Dividends Policy Implementations a. Determine dividend amounts and form b. Schedule dividend payments C. Financial Planning 1. Financial Forecasting a. Cash Budgeting: forecast of cash needs and sources b. Profit planning: forecast of revenues and expenditures c. Balance Sheet forecasting: anticipating future assets, liabilities and networth position of the firm 2. Financial Analysis a. Capital budgeting techniques: evaluation of long-term investment b. Operating leverage analysis: cost-volume profit 3. Financial Performance Evaluation a. Financial ratios as overall indicators of performance b. Market-wide financial indicators A schematic presentation of the listing of finance functions, decisions and organizational levels is shown in Figure 2. Table 1 Major Finance Functions Classified by Organization and Decision Type ORGANIZATION DECISIONS LEVEL AND GOAL Investment Top Management 1. Investment Policy (Policy and Strategy) 2. Growth Strategy Financing 1. Capital Structure Policy 2. Dividends Policy Operating Management (Control) 1. Project Management 2. Working Capital 1. Management of Fund Sources 2. Administration of Dividends Policy Financial Planning Staff (Technical Support) 1. Financial Forecasting and Budgeting 2. Financial Analysis 3. Financial Performance and Evaluation At this point, we direct our attention to how the unique Philippine business environment and its characteristics can influence the goals and functions of finance. Activity 1 Do you have an email address? Kindly send it to me (ceecyn39@yahoo.com) so that you can be a member of the clsu_financialmanagement@yahoogroups.com where I am the moderator. Kindly answer the following questions without necessarily copying the text above and send your answer to my email address. 1. What is Financial Management? ________________________________________________________________________ ________________________________________________________________________ 2. What is Accounting? ________________________________________________________________________ _______________________________________________________________________ 3. What is Controlling function? ________________________________________________________________________ _______________________________________________________________________ 4. Discuss the relationship that exists between the Firm and its Environment. Discuss this in the viewpoint of Financial Management. ________________________________________________________________________ _______________________________________________________________________ _______________________________________________________________________ 5. What are the financial goals of the firm? ________________________________________________________________________ _______________________________________________________________________ _______________________________________________________________________ 6. Differentiate the three types of the financial functions. ________________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________