Document

advertisement

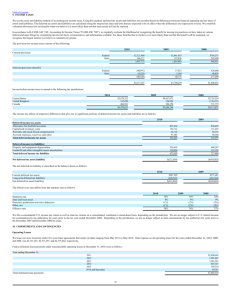

Governmental Accounting: New and Not So New Alaska GFOA Anchorage, Alaska November 17, 2014 1 Topics • Pension accounting changes • Government combinations • Nonexchange financial guarantees • Deferred outflows and inflows • Common misconceptions 2 Part 1 PENSION ACCOUNTING CHANGES 3 Our focus • Defined benefit plans • Single-employer & agent multiple employer plans • Cost-sharing plans 4 Preliminary note • No effect on governmental funds • Report expenditures rather than expense • No effect on fund balance 5 Employers in Single-employer and agent multipleemployer plans 6 Key changes 1. 2. 3. 4. 5. Employer liability Employer expense Discount rate Actuarial method Amortization 7 1. Employer liability • Current: Annual required contribution (ARC) Less: Actual contributions Net pension obligation (NPO) • New: Total pension liability (TPL) Less: Fiduciary net position (FNP) Net pension liability (NPL) 8 Employer liability - Illustration 9 2. Employer expense • Current guidance • Calculation tied to funding • ARC adjusted for the cumulative effect of prior differences between required contributions and actual contributions • New guidance • Calculation tied to cost • Changes in the net pension liability (NPL) 10 3. Discount rate • Current guidance • Estimated long-term investment yield for the plan, with consideration given to the nature and mix of current and expected plan investments • New guidance • Modification necessary if it is expected that FNP will not be sufficient to pay benefits to active employees and retirees • Single blended rate 11 Discount rate – single blended rate • Single rate equivalent to the combined effect of using the following rates: • For projected cash flows up to the point the FNP will be sufficient • Long-term expected rate of return on plan investments • For projected cash flows beyond that point • A yield or index rate on tax-exempt 20-year, Aa-orhigher rated municipal bonds. 12 4. Actuarial method • Current guidance • Whatever actuarial method is used for funding • Six acceptable methods • Must be applied within parameters defined by GASB • New guidance • No tie to actuarial method used for funding • All employers will use the entry age method for accounting and financial reporting purposes (with service cost determined as a percentage of pay) 13 5. Amortization • Background • Circumstances that could affect the net pension liability (NPL) A. Changes in benefit terms B. Changes in economic and demographic assumptions C. Differences between economic and demographic assumptions and actual experience (other than investment returns) D. Differences between expected and actual investment returns 14 Amortization (cont.) • Current guidance • Effect amortized over a period not to exceed 30 years • New guidance • Effect to be amortized over a much shorter period • Different periods, depending on the circumstances 15 Amortization (cont.) • Amortization period A. Changes in benefit terms • Immediate recognition B. Changes in economic and demographic assumptions • Closed period equal to average remaining service period of plan members • Average remaining service period of retirees = 0 years 16 Amortization (cont.) • Periods (cont.) C. Differences between economic and demographic assumptions and actual experience (other than investment returns) • Closed period equal to average remaining service period of plan members • Average remaining service period of retirees = 0 years D. Differences between expected and actual investment returns • Closed 5-year period 17 Employers in cost-sharing plans Cost-sharing plans 18 Key changes 1. Employer liability 2. Employer expense 19 1. Employer liability • Current guidance • Liability only if employer contribution is less than the contractually required amount • New guidance • Liability equal to the employer’s proportionate share of the total NPL of all participating employers 20 2. Employer expense • Current guidance • Expense = contractually required contribution • New guidance • Expense = employer’s proportionate share of total pension expense of all participating employers 21 Effective date • Implementation first required • Fiscal year ending 6/30/15 • Earlier application encouraged 22 Implementation 23 Major challenges • Audit implications • Funding guidelines • Explaining the change 24 GASB Statement No. 68 implementation challenges Audit implications 25 Responsibility for financial statements • Management • Independent auditors 26 Challenge • Reasonable basis needed for assuming responsibility • Systems managed, governed, and audited separately • Impossible to audit numbers that the employer cannot support or document 27 Meeting the challenge • Need for cooperation between plan auditor and employer auditor • Guidance from AICPA • Whitepapers (best practices) • Interpretations of auditing standards • Forthcoming creation of a pension chapter for State and Local Governments (“Audit Guide”) 28 Solution – cost-sharing plans • Information needed on the employer’s proportionate share of total for all employers • Supplemental schedule of employer allocations (audited by plan auditor) • Schedule of plan pension amounts by employer (audited by plan auditor) 29 Schedule of employer allocations Employer A B C D E F G H I Total Actual Employer Contributions $ 72,000 $ 58,000 $ 36,000 $ 8,000 $ 12,400 $ 16,000 $ 5,000 $ 18,500 $ 2,000 $ 227,900 Employer Allocation Percentage 32% 25% 16% 4% 5% 7% 2% 8% 1% 100% 30 GASB Statement No. 68 implementation challenges Funding guidelines 31 Information challenge • Accounting and financial reporting information no longer directly useful in assessing the adequacy of funding 32 Funding guidelines • “Big 7” public interest groups • GFOA • National Association of State Auditors, Comptrollers, and Treasurers • National Association of State Retirement Administrators • National Council on Teacher Retirement 33 Essential elements • Use actuarially determined contributions (ADC) as a basis for actual employer contributions • Guidelines for making principled decisions regarding the calculation of the ADC • Actuarial cost method • Asset smoothing • Amortization • Provide information needed to assess funding progress 34 GFOA best practice • Adopts and adapts funding guidelines • Specific recommendations on how to apply the guidelines • Recognition that a transition period may be necessary 35 GASB Statement No. 68 implementation challenges Explaining the change 36 Nothing has “happened” • The accounting and financial reporting has changed, not the underlying factual situation • Essential information already in the note on employer funding progress 37 Response to the NPL • Different liabilities are funded differently • Compensated absences are not funded in advance because they are already budgeted as payroll • Key consideration with pension liabilities = disciplined, systematic funding over time • Assured by actuarially determined contributions • Appropriate actuarial method and assumptions • Comparison – funding a child’s college education 38 Employer contributions vs. expense • Difference • What something costs (expense) • How we pay for it (contributions) 39 Part 2 GOVERNMENT COMBINATIONS 40 Why guidance needed? • Private-sector guidance largely inapplicable • Presumes conditions and circumstances typically not present in public-sector combinations • Fails to address important factors typically present in public sector combinations 41 GASB response • GASB Statement No. 69, Government Combinations and Disposals of Government Operations 42 Types of government combinations • Loss of separate legal identity • Included as part of a completely new entity (A+B = C) • Absorbed into an existing entity (A + B = B+) • Specific operation moved to separate legal entity • Including “spinoff” of an operation as a separate legal entity 43 Terminology • Loss of separate legal identity? • Exchange of significant consideration? • Yes = acquisition • No = merger • Specific operation moved to separate legal entity • Transfer of operations 44 Clarification • Transfers of operations • Distinguish from • Purchase, contribution, or disposal of assets • Assumption of liabilities • Two essential criteria • Operation = an integrated set of activities conducted and managed for the purpose of providing identifiable services with associated assets or liabilities • Operation must continue to provide essentially the same services 45 Mergers - timing • Recognize as of the date the combination becomes effective (merger date). • Creation of new entity (A + B = C) • Reporting period starts as of merger date • Absorption into continuing government (A + B = B+) • Report as though merger had occurred as of the start of the continuing government's fiscal period 46 Mergers – measurement of financial statement elements • Two possible situations • Merger date = reporting date of merged entity • Carrying value as of merger/reporting date • Merger date ≠ reporting date of merged entity • Carrying value that would have been as of the reporting date 47 Mergers – capital asset impairments • Intent = disposal • Use prior to disposal? • Report at carrying value until disposal • No use prior to disposal? • Evaluate for potential impairment • Intent = change in manner or duration of use • Evaluate for potential impairment 48 Acquisitions - timing • An acquisition should be recognized as of the date the acquiring government obtains control of the assets and becomes obligated for the liabilities of the acquired entity (acquisition date) • Normally: acquisition date = closing date 49 Acquisitions – measurement of financial statement elements • Measurement = acquisition value 50 Acquisition value - assets • Market-based entry price • Price to acquire similar assets having similar service capacity 51 Acquisition value - liabilities • Amount necessary to discharge liabilities assumed • Exceptions: regular GASB rules apply to • • • • Compensated absences Pension and OPEB obligations Obligations for termination benefits Obligations for municipal solid waste landfill closure and postclosure care costs • Obligations for pollution remediation 52 Acquisition value – deferred outflows/inflows • Normally = carrying value 53 Acquisitions – consideration • Amount of consideration • Assets remitted + liabilities incurred • Contingent amounts • Report as liability when probable and measurable 54 Consideration > net position • Deferred outflow of resources • Recognized in operations in a systematic and rational manner consistent with the circumstances of the acquisition 55 Consideration < net position • Form of economic assistance? • Yes • Difference = contribution • No • Reduce acquisition values assigned to noncurrent assets (other than financial assets) • Excess = special item 56 Acquisition costs • Recognize when services received 57 Acquisitions – within the financial reporting entity • Assets acquired continue to be reported at their carrying value • Difference between acquisition price and carrying value • Reporting entity statements • Blended component unit = transfer • Discretely presented component unit = subsidy • Separate financial statements • Special item 58 Transfers of operations • Government reporting continuing operations • Treated like a merger • Transferring government • Treated like a disposal (gain or loss = special item ) 59 Application to governmental funds • Report only financial statement elements consistent with measurement focus and basis of accounting • No capital assets • No long-term debt • Net change in fund balance = special item 60 Effective date • Implementation first required • Fiscal year ending 12/31/14 • Prospective implementation • Earlier application encouraged 61 Part 3 NONEXCHANGE FINANCIAL GUARANTEES 62 Why guidance needed? • Private sector • Financial guarantees almost always arise from exchange transactions • Public sector • Financial guarantees frequently arise independently (nonexchange financial guarantees) 63 GASB response • GASB Statement No. 70, Accounting and Financial Reporting for Nonexchange Financial Guarantees 64 Definition of financial guarantee • Agreement to indemnify a third party should the issuer of the guaranteed obligation not fulfill its requirements under the obligation • Three separate parties • Issuer of the obligation being guaranteed • Those entitled to payment • Guarantor 65 Scope • Excludes • Obligations related to revenue-supported debt • Obligations related to special assessments • “Joint and several” obligations • Obligations that are not legally binding. 66 Guarantors - recognition • Two-step approach • Consider qualitative factors and historical data that indicate likelihood of payments • Point of recognition = “more likely than not” to occur 67 Guarantors – qualitative factors • Issuer bankruptcy or financial reorganization • Issuer breach of debt covenant • Indicator of significant financial difficulty • • • • • • Issuer receipts intercepted Debt holder concessions Significant investment losses Loss of a major revenue source Significant increase in noncapital disbursements Issuer subject to financial supervision 68 Obligations with similar characteristics • Example = student loan receivables • May need to consider qualitative factors and historical data from perspective of group as a whole 69 Guarantors - point of recognition • “More likely than not” • Likelihood as little as 51% • Contrast with normal treatment of contingencies • “Probable” • Likelihood well in excess of 50 percent 70 Guarantors - valuing the liability • Discounted present value of estimated future payments • Range of possible values? Normal rules apply • One amount = “best estimate” • Recognize that amount • No amount better than any other • Recognize the minimum amount of the range 71 Guarantors – governmental funds • Report an expenditure only when due and payable • Classify in the same manner as grant/financial assistance payments 72 Issuer accounting/reporting • Guaranteed obligation • Continue to report until legally released as obligor • Ultimate decrease = revenue • Reclassify payments that must be reimbursed to guarantor • Receivable recognition • Normal rule against recognizing gain contingencies • Exception = guarantees within the primary government • Liability to issuer matched by issuer receivable 73 Implementation • Implementation first required FYE 6/30/14 • Earlier application encouraged • Application generally retroactive • Exception • Prospective disclosure for cumulative payments • Disclose starting date 74 Part 4 DEFERRED OUTFLOWS AND INFLOWS 75 Why guidance needed? • GASB Concepts Statement No. 4 introduced two new financial statement elements • Deferred outflows of resources • Previously classified as assets • Deferred inflows of resources • Previously classified as liabilities • GASB reserves the right to identify which specific items qualify for deferral 76 GASB response • GASB Statement No. 65, Items Previously Reported as Assets And Liabilities 77 Assets vs. deferred outflows • Assets • Resources with present service capacity that the government presently controls • Example: prepaid rent • Deferred outflows • Consumption of net assets applicable to a future reporting period 78 Liabilities vs. deferred inflows • Liability • Present obligations to sacrifice resources that the government has little or no discretion to avoid • Deferred inflow • Acquisition of net assets applicable to a future reporting period 79 Previous decisions • GASB Statement No. 53 – derivatives • Change in the fair value of a derivative used as part of an effective hedge • GASB Statement No. 60 – service concession arrangements • Consideration received from the operator (less any contractual obligations reported as liabilities) 80 GASB’s objective • Review items currently reported as assets or liabilities • Three options • Continue to report as asset/liability • Report instead as a deferred outflow/inflow of resources • Report as an outflow/inflow of the period 81 GASB’s approach • Test 1: • Meet the definition of an asset or liability? • Yes? - report as asset or liability • Test 2: • Meet the definition of a deferred outflow/ inflow of resources? • Yes? - report as deferred outflow/inflow of resources • Default: • Outflow/inflow of the current period 82 Asset deferred outflow • Resources provided to a grantee when the only eligibility criterion that has not been met by the recipient is a time requirement • If other eligibility requirements are not met = receivable • Excess of the reacquisition price of refunded debt over its net carrying amount 83 Asset outflow • Debt issuance costs (other than prepaid insurance) 84 Liability deferred inflow • Revenue of a governmental fund that is not recognized solely because it is not yet considered to be available • Property taxes received or recognized as a receivable prior to the period they were intended to finance 85 Liability deferred inflow (cont.) • Other imposed nonexchange revenues received or recognized as a receivable prior to the period when the use of the resources is either required or first permitted • Resources received from a grantor when the only eligibility criterion that has not been met by the recipient is a timing requirement • If other eligibility criteria not met = liability 86 Liability deferred inflow (cont.) • The excess of the net carrying amount of refunded debt over its reacquisition price • A reduction in the present value of the payments due from a lessee under a capital lease as a result of the lessor’s passing on the economic advantages of a refunding of tax-exempt debt 87 Specialized accounting for regulated industries (optional) • Rates set in anticipation of future charges • Deferred inflows or resources • Expenses or losses recoverable from future rates • Deferred outflows of resources 88 Determination of major funds (10 percent and 5 percent tests) • Application of 10 percent and 5 percent tests • Assets + deferred outflows of resources • Liabilities + deferred inflows of resources 89 Use of the term “deferred” • Current practice – used to describe • Unearned amounts (liability) • Amounts related to future periods (deferred inflows of resources) • Unavailable amounts (deferred inflow of resources) • Future practice • Use limited to deferred outflows/inflows of resources 90 Effective date • First mandatory for FYE 12/31/13 • Earlier application encouraged 91 Part 5 COMMON MISCONCEPTIONS 92 Background • Most often the product of “half truths” • “Believability factor” 93 “Number of funds” principle • Half truth: • The “number of funds principle” means “the fewer funds the better” • Full truth: • Use all the funds and fund types needed, but only the funds and fund types needed—no more, no less • It is possible to report “too few” funds. 94 Blending and fiduciary-type units • Half truth: • Data from fiduciary-type component units should be “blended” • Full truth: • Technique is the same, but terminology is different • Term blended = method of including component unit data in the government-wide financial statements 95 Liabilities in governmental funds • Half truth: • Liabilities should be recognized in governmental funds only if they are due and payable • Full truth: • Applicable only for liabilities not normally expected to be liquidated with expendable available financial resources • Salaries and wages recognized when earned • Vendor payables recognized when goods and services provided 96 Operating subsidies to component units • Half truth: • Operating subsidies to component units should be reported as transfers • Full truth: • True for blended component units, but not true for discretely presented component units • For discretely presented component units, treat like any other grant (expenditure/expense) 97 Criteria for special items • Half truth: • A special item is a transaction or event that meets just one of the two criteria for an extraordinary item • Full truth: • Must also be subject to management control • Exclude natural disasters that are not infrequent in occurrence (hurricanes in Florida) 98 Long-term internal borrowings • Half truth: • A long-term borrowing within the government should be reported as a fund liability • Full truth: • True only within the primary government • Borrowing from another fund = liability • Borrowing from a discretely presented component unit = other financing source 99 Transactions with discretely presented component units • Half truth: • Transactions with discretely presented component units should be treated just like transactions with outside parties • Full truth: • Capital assets cannot change value within the financial reporting entity • Difference between carrying value and consideration given not capitalized • Reported instead as expense/expenditure of purchaser 100 Option to classify a fund as major • Half truth: • A government has the option to voluntarily classify a given fund as major • Full truth: • Option available only for governmental funds and enterprise funds • Fiduciary funds can never be reported as major funds 101 Interest capitalization in proprietary funds • Half truth: • Interest capitalization is required in proprietary funds • Full truth: • Interest capitalization does not apply to internal service funds • Otherwise interest expense would be reported as a functional expense in governmental activities 102 Application of benefit/burden criterion • Half truth: • A legally separate entity should be included as a component unit if there is an ongoing relationship of financial benefit or burden. • Full truth: • Financial benefit/burden only relevant if either • Fiscal dependency • Board appointment 103 Availability criterion • Half truth: • Revenue should be recognized in governmental funds as soon as amounts become available. • Full truth: • Availability is only a consideration subsequent to earning/eligibility. • Cash received in advance is not revenue, even though it is available. 104 Revenue from expendituredriven grants • Half truth: • All legal requirements need to be met before revenue from an expenditure-driven grant can be recognized. • Full truth: • Routine administrative requirements (filing grant reports) should not delay revenue recognition. 105 Difference between proprietary funds • Half truth: • The difference between internal service funds and enterprise funds is that the former serve internal customers, whereas the latter serve external customers. • Full truth: • Internal service funds assume cost recovery over time, whereas enterprise funds do not • Activities reported in enterprise funds may be subsidized 106 Netting capitalized interest • Half truth: • Interest expense on tax-exempt debt should be capitalized net of interest revenue on the reinvested proceeds. • Full truth: • Interest expense and interest revenue on the reinvested proceeds are netted only if the related debt is legally restricted to the acquisition or construction of specified qualifying assets. 107 Assets in governmental funds • Half truth: • Governmental funds should not report land, buildings, equipment, and similar assets. • Full truth: • Used in operations = capital asset • Not reported in governmental funds • Acquired for sale = financial asset • Reported in governmental funds 108 Netting disaster losses against recoveries • Half truth: • Disaster losses should be netted against recoveries. • Full truth: • True of insurance recoveries • Netting based on prior transfer of risk to insurer • Not true of disaster assistance • No prior transfer of risk 109 Cash flows: public vs. private sector • Half truth: • The essential difference between the public and private sectors is the use of two different financing categories • Full truth: • Categories defined differently • Operating activities (focuses on operating income) • Investing activities (excludes capital outlay) 110 Encumbrances and fund balance • Half truth: • Encumbrances should be included in assigned fund balance. • Full truth: • Not applicable to encumbrances that will be repaid from restricted or committed resources 111 Dedicated taxes as program revenue • Half truth: • Revenues that must be used for a specific program or function are properly classified as program revenues • Full truth: • Program revenues must come from outside the government’s tax base • Dedicated taxes are not program revenues 112 Segment disclosure and condensed data • Half truth: • Segment disclosure requires that condensed financial statements be provided in the notes to the financial statements for each segment. • Full truth • Only necessary if information not provided in the financial statements • Unnecessary for segments reported as major enterprise funds 113 Deficits in individual funds • Half truth: • Deficits in individual funds need to be disclosed in the notes to the financial statements. • Full truth: • Not true of major funds, since the deficit would already be visible 114 Condensed data and cash flows • Half truth: • Condensed financial statements should include a statement of cash flows. • Full truth • Two situations where condensed financial statements must be included in the notes • Segment disclosure • Major discretely presented component units 115 Condensed data (cont.) • Full truth (cont.) • Data for discretely presented component units always drawn from government-wide financial statements • Hence no requirement for statement of cash flows 116 Payments to a public-entity risk pool • Half truth: • Payments to a public-entity risk pool should be treated like insurance premiums. • Full truth: • Appropriate treatment depends on the characteristics of the pool • Participants transfer risk to pool? • Yes – treat like insurance premium • No – treat like deposit 117 MD&A and the letter of transmittal • Half truth: • The same topic should not be addressed in both management’s discussion and analysis (MD&A) and the letter of transmittal. • Full truth: • The letter of transmittal is properly used to provide more subjective information on topics treated in MD&A 118 Project-length budgets • Half truth: • Budgetary comparisons are not required for governmental funds with project-length budgets • Full truth: • Budgetary comparisons are required if a project-length budget is re-appropriated annually. • Annual reappropriation equivalent to annual budget 119 References to the notes • Half truth: • Financial statements should refer to the notes to the financial statements • Full truth • Only if fully audited • Not applicable to combining and individual fund financial statements that receive only an “inrelation to” opinion 120 10 percent and 5 percent tests • Half truth: • Governmental funds should be classified as major if they meet both the 10 percent and 5 percent tests • Full truth: • Both tests must be met for the same element • • • • Assets and deferred outflows of resources Liabilities and deferred inflows of resources Revenues Expenditures/expense 121 Location of budgetary disclosures • Half truth: • If budgets are presented as RSI, related disclosure should be in notes to RSI. • Full truth: • Excess of expenditures over appropriations = legal violation, therefore included in notes to the financial statements 122 Trust fund liabilities • Half truth: • Trust funds do not report liabilities to beneficiaries. • Full truth: • Liabilities are reported when due and payable to individual beneficiaries 123 Condensed data and revenuesupported debt • Half truth: • Segment reporting is required in connection with revenue-supported debt • Full truth: • Only if there is a requirement to separately maintain the data needed to present condensed financial statements • Only if the segment is not already separately reported as a major fund (or a single nonmajor enterprise fund) 124 Individual fund statements • Half truth: • Individual fund statements needed to support combining financial statements • Full truth: • Only if additional information is provided in the individual fund statements 125