Risk-Adjusted Performance and Informed Decision Making

advertisement

Risk-Adjusted Performance and

Informed Decision Making

www.mcubeit.com

Dr. Arun Muralidhar

Arun Muralidhar - Bio

Chairman of Mcube Investment Technologies, LLC and

Managing Director at FX Concepts, Inc.

Head of Investment Research and Member of Investment

Management Committee, World Bank Investment Department,

1995-1999

Derivatives and Liability Management, World Bank Funding

Department, 1992-1995

Managing Director and Head of Currency Research, JPMIM,

1999-2001

BA, Wabash College (1988); PhD, MIT Sloan (1992)

2

Agenda

Background

Why the information ratio is wrong – M2

Risk budgeting – connecting returns to risk – M3

Confidence in skill: History matters - SHARAD

Optimal portfolio construction using these measures

3

Relative Risk – Tracking Error

Most commonly used measure

Ann. standard deviation of excess returns

Depends on the standard deviation of the

benchmark, strategy and correlation

Few test ex-ante forecast with ex-post outcomes

Papers that recommend that managers stay within

tracking error ranges are WRONG

4

Performance Measures

Returns – Absolute and Relative

Annualized versus

Cumulative

Ratios – Risk-Adjusted

Sharpe,

Information Ratio, Sortino Ratio

Risk-Adjusted Returns

M2,

M3, SHARAD

Skill Measures

5

How to Calculate Standard Measures?

Unadjusted measures

Excess return = Portfolio return - Benchmark return

Risk-adjusted ratio measures

Sharpe ratio = Excess over risk free rate/standard

deviation of portfolio

– higher the ratio, the better the investment opportunity

Information ratio = Excess over benchmark/standard

deviation of excess returns

– higher the ratio, better the manager

6

Some Advanced Risk-Adjusted Measures

Sortino ratio = Excess/Downside risk measure

Risk-adjusted measures (in return terms)

M2 = extended Sharpe ratio (in basis points)

M3 = extended M2 ratio; corrects for correlation

SHARAD = Normalizes for different length of history

Confidence in Skill – Tells how confident one can be that

there is skill (as opposed to noise) in a given track record

7

Information Ratio is Wrong - M2

Need to normalize for different Std. deviations

Active portfolio A

Return

Active portfolio B

Benchmark

Riskless asset

Market

risk

Standard deviation

Standard

deviation of

unlevered

portfolio

B has a negative Information Ratio!

8

Portfolio B has a Higher M2 Return

M2 Return for B

M2 Return for A

Benchmark Return

Benchmark

Riskless asset

Market risk

Standard deviation

Problem: Need to normalize for different correlations

i.e., have different tracking error

9

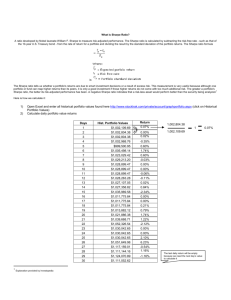

Correlation-Adjustment: M3 Measure

Correcting for tracking error – different rankings

Standard

deviation

(%)

M2

(%)

Fund

Return

(%)

(1)

(2)

(3)

(4)

F

5.50

0.00

0.00

B

17.09

13.27

1.00

17.09

1

33.24

27.57

0.71

2

25.63

24.93

3

25.04

4

(6)

TE(basic)

(%)

TE(M2)

(%)

M3

(%)

(7)

(8)

(12)

18.85

20.45

10.14

18.43

0.77

16.21

17.02

9.04

17.43

25.02

0.73

15.86

17.74

9.68

17.41

24.08

21.33

0.80

17.06

13.34

8.38

17.65

5

21.95

21.75

0.59

15.53

17.52

11.97

17.68

6

21.90

13.84

0.84

21.21

7.76

7.57

19.26

7

21.61

14.37

0.83

20.37

8.13

7.74

18.91

8

20.89

23.06

0.79

14.36

15.07

8.69

16.70

9

20.77

14.00

0.89

19.97

6.53

6.32

18.83

10

20.56

14.79

0.92

19.00

5.74

5.24

18.43

F = Risk-free asset; B = Benchmark (S&P500)

10

Ranking Portfolios: Different Methods

M3 is the only one consistent with Skill

Ranking

Unadjusted

Skill using

raw returns

M2 or

Sharpe

Skill using

M2

M3

Skill using

M3

Information

ratio

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

First

Second

Third

Fourth

Fifth

Sixth

Seventh

Eighth

Ninth

Tenth

1

2

3

4

5

6

7

8

9

10

6

9

7

10

1

4

2

3

5

8

6

7

9

10

1

4

2

3

5

8

6

9

7

10

1

4

2

3

5

8

6

7

9

1

10

5

4

2

3

8

6

7

9

1

10

5

4

2

3

8

1

6

10

9

7

4

2

3

5

8

Information ratio, Sharpe or M2 say little about Skill

Skill = Confidence in Skill Measure M3

11

Which Measure Should you Use?

Manage portfolio yourself – Sharpe, Information Ratio or M2

External manager and with a tracking error budget – M3

(Previous papers ignore possible actions by client)

Worried about skill – M3

M2 provides valuable advice on leverage/ deleverage; M3

provides valuable advice on (a) active versus passive (“beta”)

and leverage/deleverage

Important to have a risk budget

12

How Do You Compare 2 Strategies with

Different Data Histories?

In the past – drop non-overlapping data

Lose valuable information on strategy with longer history

SHARAD Measure – Normalizes for different risk and

different data history

SHARAD = {M3 return}*{Confidence in skill (of M3 portfolio)}

Confidence in skill acts as a probability measure and

explicitly captures the length of data history – more history,

greater the confidence in skill

13

Risk Budgeting is only First Step

Cannot force tracking error ranges on managers – client

needs to be evaluate how good manager is in dynamically

managing risk

Risk-adjusted performance measures are the right way to go,

but many are paid on the basis of excess returns

Measures can tell you how good manager is at managing risk

Use creative measures along with risk budgets to achieve

optimal portfolio performance

14