ACCT120_Sept2011 - Heartland Community College

advertisement

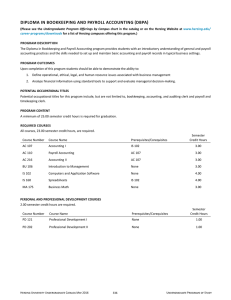

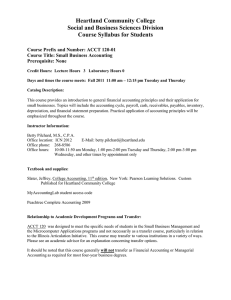

Heartland Community College Master Course Syllabus Division name SBS Course Prefix and Number ACCT 120 Course Title: Small Business Accounting DATE PREPARED: July 30, 1998 DATE REVISED: September 1, 2010 PCS/CIP CODE: 12-520302 IAI NO. (if available): EFFECTIVE DATE OF FIRST CLASS: January 1, 2011 CREDIT HOURS: 3 CONTACT HOURS: 3 LECTURE HOURS: 3 LABORATORY HOURS: 0 CATALOG DESCRIPTION (Include specific prerequisites): This course provides an introduction to general financial accounting principles and their application for small businesses. Topics will include the accounting cycle, payroll, cash, receivables, payables, inventory, depreciation, and financial statement preparation. Practical application of accounting principles will be emphasized throughout the course. TEXTBOOKS: Slater, Jeffrey, College Accounting, 11th edition, New York: Pearson Learning Solutions. Custom Published for Heartland Community College. RELATIONSHIP TO ACADEMIC DEVELOPMENT PROGRAMS AND TRANSFERABILITY: ACCT 120 was designed to meet the specific needs of an Associate of Applied Science degree or certificate programs and not necessarily as a transfer course, particularly in relation to the Illinois Articulation Initiative. This course may transfer to various institutions in a variety of ways. Please see an academic advisor for an explanation concerning transfer options. LEARNING OUTCOMES: Course Outcomes General Education Outcomes 1. Describe the role of accounting as an information development and communication system that provides information for economic decisionmaking. 2. Apply the accrual basis accounting rules to analyze and record transactions throughout the accounting cycle including year-end adjustments for accruals and deferrals and closing entries. 3. Prepare a classified balance sheet, a single-step income statement for a service business, and a multi-step income statement for a merchandising business. 4. Utilize payroll accounting record keeping procedures to compute, record, and report payroll and payroll tax obligations. 5. Analyze and record sales, inventory, and cost of goods sold transactions using the periodic inventory method. 6. Identify and analyze the components of an internal control system and the internal control activities necessary to safeguard assets and assure the accuracy and reliability of accounting records. 7. Analyze and record transactions related to vendors and customers utilizing a subsidiary ledger system. 8. Analyze and record transactions related to the acquisition, depreciation, and disposal of plant assets. 9. Analyze and record owner equity transactions for sole proprietorship or a partnership. 10. Utilize accounting general ledger software to record basic accounting transactions. Throughout the semester, students will achieve the following Gen Ed outcomes: PS 1 PS 2 CT 1 CT 2 Program Outcomes Accounting Foundations* Throughout the semester, students will achieve the following Accounting Foundations program outcomes: AF 1 AF 2 AF 3 AF 4 Range of Assessment Methods Throughout the semester, the following assessment methods will be used to measure the course, program, and Gen Ed learning outcomes: Homework, Exams, Quizzes, Cases and other activities as determined by the instructor. * Accounting Foundations Outcomes: AF 1 Use critical thinking skills to complete all steps of the accounting cycle according to generally accepted accounting practices, both manually and using computerized accounting software, and to prepare financial statements for a company. AF 2 Create, manage, and protect the accounting information systems, accounting records, payroll records, and customer and vendor information in accordance with appropriate laws and regulations, ethical standards, and management policies AF 3 Prepare accounting records and documentation necessary to prepare sales, payroll, and income tax returns. AF 4 Understand and practice professional work habits expected in the accounting field, including confidentiality and accounting ethics. COURSE/LAB OUTLINE: 1. 2. 3. 4. 5. 6. 7. 8. 9. Introduction to Accounting and the Accounting Model The Accounting Cycle Accounting for Cash and Internal Control Accounting for Payroll and Related Liabilities Accounting for Merchandising Businesses Accounting for Receivables and Payables Accounting for Plant Assets Accounting for Owners’ Equity for Partnerships Classified Financial Statements METHOD OF EVALUATION (Tests/Exams, Grading System): Assessment Method Exams and Quizzes Homework Cases Other activities to be determined by instructor TOTAL % of final grade 50 – 85 % 5 – 20 % 5 – 20 % 5 – 10 % 100 % Course grades will be determined by total points accumulated during the semester with a minimum grading scale as follows: GRADING SCALE: A 90% - 100% B 80% - 89% C 70% - 79% D 60% - 69% F Below 60% REQUIRED WRITING AND READING: The text and related reading materials required are designed to provide the basis for the study of accounting and will be approximately 550 pages for the semester. Homework activities, problems and/or cases that are assigned throughout the course may require written communication of their findings. The nature of the writing assignments and total number of written pages will be determined by the instructor.