Net operating income

advertisement

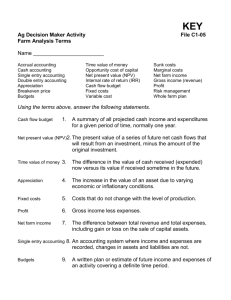

Financial Profile of Canadian Farms (2005 Taxfiler Data – Preliminary Estimates) March 2007 Financial Profile of Canadian Farms (2005 Taxfiler Data – Preliminary Estimates) Research and Analysis Directorate Strategic Policy Branch December 2006 Any policy views, whether explicitly stated, inferred or interpreted from the contents of this publication, should not be represented as reflecting the views of Agriculture and Agri-Food Canada (AAFC). AAFC does not control the availability of Internet web sites featured in this report. Therefore, it does not take responsibility for severed hyperlinks or discontinued web pages mentioned herein. Links to these web sites are provided solely for the convenience of users. AAFC does not endorse these sites, nor is it responsible for the accuracy, the currency or the reliability of the content. Users should be aware that information offered by sites other than those of the Government of Canada are not subject to the Official Languages Act. Project No.: 07-018-dp Aussi disponible en français sous le titre : Profil financier des exploitations agricoles canadiennes (Données des déclarants de 2005 – Estimations provisoires) 2 Preface • Taxfiler data are collected from samples of unincorporated and incorporated tax returns and are compiled by Statistics Canada. The Taxation Data Program is funded by Agriculture and Agri-food Canada. This Financial Profile of Canadian Farms (2005 Taxfiler Data – Preliminary Estimates) provides highlights and comparisons of farm level revenues and expenses by farm type, revenue class and province. • Comments on this information package can be sent to David Culver at culverd@agr.gc.ca, telephone (613) 759-1894 or Mathieu Delorme at delormem@agr.gc.ca, telephone (613) 694-2395. 3 Table of Contents • Introduction ……………………………………………………………………………………………………… 5 • Overview ………………………………………………………………………………………………………… 6 • Average Net Operating Income, Canada, 1992-2005……………………………………………………… 8 • Average Net Operating Income, before Capital Cost Allowance, by revenue class, Canada, 2003 to 2005………………………………………………………………………………………….. 9 • Average Farm Operating Expenses, per Farm, by Categories, Canada, 2005 ……………………........ 10 • Average Farm Operating Revenues, per Farm, by Source, Canada, 2005 ……………………………… 11 • Average Operating Revenues, Expenses, Net Operating Income and Margins by Farm Type, 2005…………………………………………………………………………………… 12 • Average Net Operating Income, before Capital Cost Allowance, by Farm Type, Canada 2005 ………. 13 • Average Net Income, after Capital Cost Allowance, by Farm Type, Canada 2005……………………… 14 • Average Operating Revenues, Expenses, Net Operating Income and Margins by Province, 2005…… 15 • Average Net Operating Income, before Capital Cost Allowance, by Province, Canada 2005………….. 16 • Average Net Income, after Capital Cost Allowance, by Province, Canada 2005………………………… 17 • Distribution of Farms by Revenue Class, Canada, 2005 …………………………………………………… 18 • Glossary …………………………………………………………………………………………………………. 19 4 Introduction • • • • The 2005 taxation data presented in this document cover unincorporated farms with farm sales $10,000 and over, and incorporated farms with total farm sales of $25,000 and over, based on 50% or more of their sales coming from one agricultural activity. The data also include communal farming organizations. Operating margin is defined as net operating income per dollar of revenue. In 2001, the Taxation Data Program adopted the North American Industry Classification System (NAICS). Poultry hatcheries are now included with poultry and egg farms. This makes previous-year comparisons difficult for this farm type and the overall Canadian level since the inclusion of poultry hatcheries had a substantial impact on the aggregate data. This profile from the taxfiler data is only available on the Internet. 5 Overview • • • • • Average net operating income per farm increased from $28,784 in 2004 to $29,303 in 2005. Revenue per farm was up 8.3% on average from 2004 to $221,211 in 2005. At the same time, average operating expenses increased 8.4% to $191,905 in 2005. Higher revenues from potato (20.8%), hogs (13.8%), and dairy (11.5%) did not entirely offset higher expenses for grain and oilseeds (10.4%) and for fruits and tree nuts. The average operating margins decreased by 0.5 cents to 13.2 cents for Canadian farms in 2005, according to taxation records. Revenue from cattle was up 9.2% in 2005 compared to the sales of 2004. This was mainly due to the expansion in slaughter cattle sales following the easing of restrictions on beef trade. Average program payments and insurance proceeds increased 14.2%. In 2005, they accounted for 10.2% of the average operating revenue, the highest share since 1992. 6 Overview • • • Among farm types, poultry & egg farms ranked first in term of average net operating income before capital cost allowance ($125,783) in 2005, followed by potatoes ($122,866) and hogs ($100,736). Poultry and egg farms posted the largest profit after capital cost allowance ($82,700) in 2005, followed by dairy ($52,999) and hog farms ($50,390). In 2005, Quebec farms ranked first in terms of average net operating income before capital cost allowance ($50,514), followed by Newfoundland ($49,138) and New Brunswick ($45,836). Quebec farms also reported the highest net operating income after capital cost allowance ($26,229), followed by Newfoundland ($23,223) and Nova Scotia ($17,315). In 2005, farms with operating revenues below $100,000, which represented more than 59% of all farms in Canada, accounted for about 12% of total farm revenues and recorded a margin of 7 cents per dollar of revenue. 7 Average Net Operating Income, Before Capital Cost Allowance in Current Dollars, Canada, 1992-2005 35 29.1 Thousands of dollars 30 23.6 23.9 24.1 23.6 25 20 19.1 20.5 20.7 25.9 30.1 28.8 29.3 25.5 22.7 15 10 5 0 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 8 Average Net Operating Income, Before Capital Cost Allowance, by Revenue Class, Canada, 2003 to 2005 Average Net Operating Income 2003 Revenues Class Average Net Operating Income 2004 Average Net Operating Income 2005 Dollars $10,000-$49,999 (1,215) (1,304) (68) $50,000-$99,999 13,672 9,416 10,213 $100,000-$249,000 27,932 29,249 28,060 $250,000-$499,999 62,590 64,278 64,601 $500,000 and over 161,090 187,605 172,060 25,167 28,784 29,314 All farms 9 Average Farm Operating Expenses, per Farm, by Categories, Canada, 2005 240,000 191,905 200,000 Dollars 160,000 120,000 80,000 40,000 63,171 29,561 48,356 20,490 19,176 11,150 0 Crop Livestock Machinery expenses expenses expenses Salaries Net Other* Total Interest Expenses Operating Expenses Expenses * Other general expenses include such items as utilities, insurance, rent, custom work, net property taxes, building maintenance, miscellaneous and marketing expenses. Exclude salaries and net interest expenses. 10 Average Farm Operating Revenues, per Farm, by Source, Canada, 2005 240,000 221,211 200,000 Dollars 160,000 109,701 120,000 80,000 69,203 40,000 22,640 19,607 Program Payments* Other sales 0 Crop sales Livestock sales Total Operating Revenues * Includes gross crop insurance proceeds. 11 Operating Revenues, Expenses, Net Operating Income and Margins, per Farm, Before Capital Cost Allowance, by Farm Type, 2005 Avg. Operating Revenues Farm Type Avg. Operating Expenses Avg. Net Operating Income Operating Margin cents per $ of revenue Dollars Grain and oilseed 150,636 127,369 23,267 15.4 Potato 746,060 623,194 122,866 16.5 Other vegetable and melon 340,767 293,873 46,894 13.8 Fruit and tree nut 179,648 159,547 20,101 11.2 Greenhouse, nursery and floriculture 746,796 674,790 72,006 9.6 92,542 77,151 15,391 16.6 Beef cattle and feedlots 169,967 158,629 11,338 6,7 Dairy and milk production 379,343 284,607 94,736 25.0 Hog and pig 943,158 842,607 100,736 10.7 Poultry and egg 832,090 706,307 125,783 15.1 Other animal 102,346 98,722 3,624 3,5 All farms 221,211 191,905 29,306 13.2 Other crop 12 Average Net Operating Income, Before Capital Cost Allowance, by Farm Type, Canada, 2005 Potato 122,866 Poultry & Egg 125,783 Dairy 94,736 Greenhouse & Nursery 72,006 Hog 100,736 Other Vegetable 46,894 Grain & Oilseed 23,267 All Farms 29,306 Other Crop 15,391 Fruit & Tree Nut 20,101 Other Animals 3,624 Beef Cattle/Feedlots 11,338 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 Dollars 13 Net Income, per Farm, After Capital Cost Allowance, by Farm Type, Canada, 2005 Potato 42,992 82,700 Poultry & Egg Dairy 52,999 24,896 Greenhouse & Nursery Hog 50,390 21,665 Other Vegetable Grain & Oilseed All Types Other Crop Fruit & Tree Nut Other Animal Beef Cattle/Feedlots -8,000 2,439 8,807 2,348 6,429 -6,265 -811 12,000 32,000 52,000 72,000 92,000 Dollars 14 Operating Revenues, Expenses, Net Operating Income and Margins, per Farm, Before Capital Cost Allowance, by Province, 2005 Average per farm Operating Revenues Provinces Operating Expenses Net operating* income Operating margin Cents per $ of revenue Dollars Newfoundland 479,843 430,705 49,138 10.2 Prince Edward Island 320,322 288,333 31,989 10.0 Nova Scotia 232,257 197,069 35,188 15.2 New Brunswick 310,808 264,972 45,836 14.7 Quebec 301,933 251,419 50,514 16.7 Ontario 240,959 208,333 32,629 13.5 Manitoba 225,429 196,341 29,088 12.9 Saskatchewan 138,140 119,869 18,271 13.2 Alberta 219,935 195,572 24,363 11.1 British Columbia 264,547 236,221 28,326 10.7 All Farms 221,211 191,905 29,306 13.2 15 Average Net Operating Income, per Farm, Before Capital Cost Allowance, by Province, Canada, 2005 29,306 Canada B.C. 28,326 24,363 Alta. Sask. 18,271 29,088 Man. Ont. 32,629 Que. 50,514 N.B. 45,836 N.S. 35,188 P.E.I. 31,989 N.L. 49,138 0 10,000 20,000 30,000 40,000 50,000 60,000 Dollars 16 Net Income, per Farm, After Capital Cost Allowance, by Province, Canada, 2005 Canada 8,807 B.C. 7,673 Alta. 3,734 Sask. 1,977 Man. 6,436 Ont. 11,497 Que. 26,229 N.B. 17,230 N.S. 17,315 P.E.I. 3,470 N.L. 23,233 0 5,000 10,000 15,000 20,000 25,000 30,000 Dollars 17 Distribution of Farms by Revenue Class, Canada, 2005 Number of farms = 199,120 45 42.2 40 35 Percent 30 25 20.75 20 17.27 15 11.43 8.35 10 5 0 $10,000 to $49,999 $50,000 to $99,999 $100,000 to $249,999 $250,000 to $499,999 $500,000 and over Farm Revenues Class 18 Glossary The following definitions appear in Statistics Canada, Statistics on income of farm families, 2001. Catalogue no. 21-207-XIE. For further information please contact: Whole Farm Data Projects Section, Agriculture Division, Statistics Canada. www.statcan.ca. • • • • • Net market income: is the sum of total operating revenues less total operating expenses minus net program payments. Net program payments: program payments and insurance proceeds after deducting stabilization levies or fees (government levies). Net operating income: The profit or loss of the farm operation measured by total operating revenues less total operating expenses, excluding capital cost allowance, the value of inventory adjustments and other adjustments, for tax purposes. Or the sum of the preceding components: net market income and net program payments. Capital Cost Allowance (CCA): A tax term for depreciation used to define the portion of the cost of the depreciable property, such as equipment and buildings, that is tax-deductible. After the calculation of the capital cost allowance, farmers may deduct any amount up to the maximum allowable. Total income: The total income of each tax filing member of the family. It is the sum of the net operating income and the off-farm income of a family involved in a single, unincorporated farm. 19 Glossary (cont’d) The following definitions appear in Statistics Canada, Statistics on income of farm families, 2001. Catalogue no. 21-207-XIE. For further information please contact: Whole Farm Data Projects Section, Agriculture Division, Statistics Canada. www.statcan.ca. • • Median income: The value of income for which half of the units in the population have lower incomes and half have higher incomes. Total income adjusted for CCA: The total income adjusted for capital cost allowance of each tax filing member of the family. It is the sum of the net operating income adjusted for capital cost allowance (e.g., net operating income less capital cost allowance) and the off-farm income of a family involved in a single, unincorporated farm. 20 Glossary (cont’d) Program payments and insurance proceeds: Income from the following six sources: • • • • • • • Provincial stabilization programs, Federal and provincial disaster assistance programs such as the Agricultural Income Disaster Assistance (AIDA) Program and the Canadian Farm Income Program (CFIP), Gross Revenue Insurance Program (GRIP), now terminated, Government payments and other subsidies (such as hog incentive programs, acreage payments, assistance for clearing land and government grants), Aggregate amounts reported for subsidies, patronage dividends and reimbursements, Insurance proceeds from programs (private and government) for crops and livestock due to adverse weather conditions, disease and other reasons, Dairy subsidies are not included in programs payments nor are NISA withdrawals for unincorporated farms. 21