Monthly Market Update

advertisement

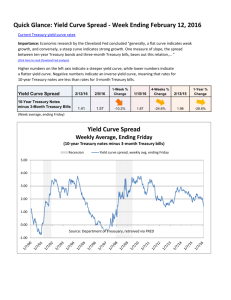

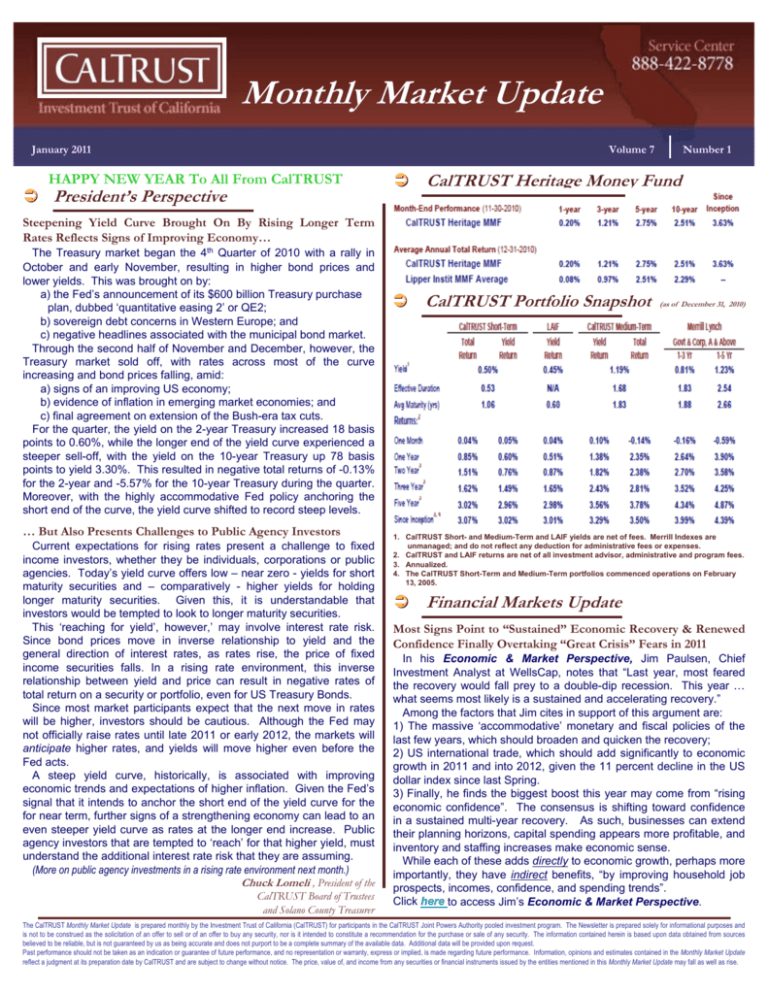

Monthly Market Update January 2011 HAPPY NEW YEAR To All From CalTRUST President’s Perspective Volume 7 Number 1 CalTRUST Heritage Money Fund Steepening Yield Curve Brought On By Rising Longer Term Rates Reflects Signs of Improving Economy… The Treasury market began the 4th Quarter of 2010 with a rally in October and early November, resulting in higher bond prices and lower yields. This was brought on by: a) the Fed’s announcement of its $600 billion Treasury purchase plan, dubbed ‘quantitative easing 2’ or QE2; b) sovereign debt concerns in Western Europe; and c) negative headlines associated with the municipal bond market. Through the second half of November and December, however, the Treasury market sold off, with rates across most of the curve increasing and bond prices falling, amid: a) signs of an improving US economy; b) evidence of inflation in emerging market economies; and c) final agreement on extension of the Bush-era tax cuts. For the quarter, the yield on the 2-year Treasury increased 18 basis points to 0.60%, while the longer end of the yield curve experienced a steeper sell-off, with the yield on the 10-year Treasury up 78 basis points to yield 3.30%. This resulted in negative total returns of -0.13% for the 2-year and -5.57% for the 10-year Treasury during the quarter. Moreover, with the highly accommodative Fed policy anchoring the short end of the curve, the yield curve shifted to record steep levels. … But Also Presents Challenges to Public Agency Investors Current expectations for rising rates present a challenge to fixed income investors, whether they be individuals, corporations or public agencies. Today’s yield curve offers low – near zero - yields for short maturity securities and – comparatively - higher yields for holding longer maturity securities. Given this, it is understandable that investors would be tempted to look to longer maturity securities. This ‘reaching for yield’, however,’ may involve interest rate risk. Since bond prices move in inverse relationship to yield and the general direction of interest rates, as rates rise, the price of fixed income securities falls. In a rising rate environment, this inverse relationship between yield and price can result in negative rates of total return on a security or portfolio, even for US Treasury Bonds. Since most market participants expect that the next move in rates will be higher, investors should be cautious. Although the Fed may not officially raise rates until late 2011 or early 2012, the markets will anticipate higher rates, and yields will move higher even before the Fed acts. A steep yield curve, historically, is associated with improving economic trends and expectations of higher inflation. Given the Fed’s signal that it intends to anchor the short end of the yield curve for the for near term, further signs of a strengthening economy can lead to an even steeper yield curve as rates at the longer end increase. Public agency investors that are tempted to ‘reach’ for that higher yield, must understand the additional interest rate risk that they are assuming. (More on public agency investments in a rising rate environment next month.) Chuck Lomeli , President of the CalTRUST Board of Trustees and Solano County Treasurer CalTRUST Portfolio Snapshot (as of December 31, 2010) 1. CalTRUST Short- and Medium-Term and LAIF yields are net of fees. Merrill Indexes are unmanaged; and do not reflect any deduction for administrative fees or expenses. 2. CalTRUST and LAIF returns are net of all investment advisor, administrative and program fees. 3. Annualized. 4. The CalTRUST Short-Term and Medium-Term portfolios commenced operations on February 13, 2005. Financial Markets Update Most Signs Point to “Sustained” Economic Recovery & Renewed Confidence Finally Overtaking “Great Crisis” Fears in 2011 In his Economic & Market Perspective, Jim Paulsen, Chief Investment Analyst at WellsCap, notes that “Last year, most feared the recovery would fall prey to a double-dip recession. This year … what seems most likely is a sustained and accelerating recovery.” Among the factors that Jim cites in support of this argument are: 1) The massive ‘accommodative’ monetary and fiscal policies of the last few years, which should broaden and quicken the recovery; 2) US international trade, which should add significantly to economic growth in 2011 and into 2012, given the 11 percent decline in the US dollar index since last Spring. 3) Finally, he finds the biggest boost this year may come from “rising economic confidence”. The consensus is shifting toward confidence in a sustained multi-year recovery. As such, businesses can extend their planning horizons, capital spending appears more profitable, and inventory and staffing increases make economic sense. While each of these adds directly to economic growth, perhaps more importantly, they have indirect benefits, “by improving household job prospects, incomes, confidence, and spending trends”. Click here to access Jim’s Economic & Market Perspective. The CalTRUST Monthly Market Update is prepared monthly by the Investment Trust of California (CalTRUST) for participants in the CalTRUST Joint Powers Authority pooled investment program. The Newsletter is prepared solely for informational purposes and is not to be construed as the solicitation of an offer to sell or of an offer to buy any security, nor is it intended to constitute a recommendation for the purchase or sale of any security. The information contained herein is based upon data obtained from sources believed to be reliable, but is not guaranteed by us as being accurate and does not purport to be a complete summary of the available data. Additional data will be provided upon request. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in the Monthly Market Update reflect a judgment at its preparation date by CalTRUST and are subject to change without notice. The price, value of, and income from any securities or financial instruments issued by the entities mentioned in this Monthly Market Update may fall as well as rise.