Who Has Control Of Your Brand?

advertisement

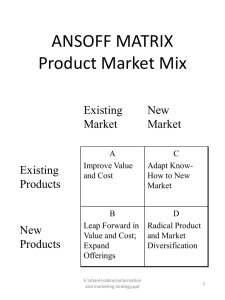

CPG Industry Trends & Drivers 2003 – 2008 February 3, 2003 www.hoytnet.com 8912 East Pinnacle Peak Road • Scottsdale, AZ 85255 Phone (480) 513-0547 • Fax (480) 513-0548 • E-Mail: chrishoyt@hoytnet.com • nancyswift@hoytnet.com Today Key Trends Implications For Retailers How Retailers Differentiate Themselves Typical Performance Scorecards What Suppliers Need To Do What Separates The “Great” Suppliers From The Average 2 LabattCPGFinale.ppt Welcome to Our Mini Workshop On CPG Industry Trends This is your meeting – feel free to interrupt at any time with questions If you have a question, don’t be shy – it’s probably the same question everyone else has too Take the best and leave the rest Feel free to disagree with anything we say – but if you do, you must speak-up Feel free to get up and move around The benefits you derive from this workshop will directly reflect the time and effort you put into it: • Proactive participation will bring happiness and deep inner satisfaction • Use us! – we are here to answer your questions and clarify points to the best of our ability 3 LabattCPGFinale.ppt Evolution of CPG Marketing: From “Consumer Pull” to “Trade Push” 1945 - Present 4 LabattCPGFinale.ppt History of CPG Brand Marketing From 1945 to Present Is A History Of Unwitting Power Transference From Manufacturers To Retailers Period 1945 - 1975 1975 - 1985 1985 - 1995 1995 - 2000 2000 + Beyond Trend Characteristics Mass Marketing Regional Marketing Account-Specific Marketing Efficient media Very few trade allowances Definitely “consumer pull” Manufacturers in control Cable TV Scanners introduced Off-invoice/slotting becomes prevalent Forward buying and diverting Fragmented media Erosion of brand loyalty “Partnering” Store Brands Category Marketing Consolidation Trade spending explodes Category, not brand Now “trade push” Retailers gain control ASM/ Co-Marketing Consumer becomes “self-loyal” Retailer becomes marketer All of the ground rules change 5 LabattCPGFinale.ppt Milestones in Trade Control Progression Slotting (1968-69) Nixon Price Freeze (1973-75) UPC Codes/ Scanners Introduced (1978) Mass Merch. Becomes Competitors (1980-82) Trade Wrests Information Control (1988) Consolidation/ Mega-Retailers (1999-2000) 1960 2000 Off-Invoice (1970-71) Introduction of Cable TV (1975) Fragmentation of Media (1979) 6 Category Management (1985) Wal-Mart Sets The Strategy For Everyone (1992) LabattCPGFinale.ppt Present Day Core Issues Retailers Manufacturers 7 LabattCPGFinale.ppt Outlet Saturation 1950’s Today No Fast Food 120K Convenience Stores No Mass Merchandisers 32K Supermarkets No Clubs 6K Mass Merchandisers No Supercenters 20K Drug Stores Independents Dominated Drug 1K Club Stores 6K Dollar Stores A&P Dominated Food Most CPG-type Products Sold Through Supermarkets McDonalds Burger King Wendy’s Jack-in-The-Box Most Meals Prepared and Eaten at Home 45% of Food Dollars Spent Away From Home 8 LabattCPGFinale.ppt SKU Proliferation SKU Growth: 1945 - 1995 60,000 50,000 40,000 30,000 20,000 10,000 0 1945-1964 1965-1980 1981-1995 1995+ Source: Insight Out of Chaos, 2001 9 LabattCPGFinale.ppt Mass Availability Of Same Items In Different Channels % Buyers In Grocery Non-Choc. Candy Chocolate Candy Artificial Sweeteners Ground Coffee Dried Fruit Snacks HH Cleaners Toilet Tissue Paper Towels Liquid Soap Soft Drinks 79.4% 83.6% 80.2% 90.2% 83.2% 78.6% 86.4% 77.8% 55.4% 97.5% Mass 62.0% 58.0% 21.8% 30.0% 22.8% 42.9% 50.3% 25.1% 45.0% 44.7% Super Centers 18.0% 16.6% 8.1% 11.3% 7.2% 12.1% 16.5% 6.6% 11.6% 16.9% Clubs 12.6% 10.4% 11.9% 15.5% 12.7% 11.4% 10.4% 10.0% 10.3% 9.2% Drug C-Stores 43.5% 5.1% 5.2% 7.7% 4.2% 14.7% 19.8% 9.5% 9.9% 24.1% 9.5% 1.5% 0.4% 1.0% 0.8% 0.8% 1.6% 0.6% 0.2% 20.4% Source: Scarborough Research, 1999-2000 10 LabattCPGFinale.ppt Price-Based Competition Channel Pricing Index on Selected Consumables (Scottsdale, AZ, 8/7/2002) Formula 409 Pine Sol Pledge Lysol Disinfecting Spray Windex Arrowhead Water Tea Bags Maxwell House Coffee Sweet ‘n Low Equal Hershey’s Kisses M&M’s Bath Tissue – 36-48 Roll Bath Tissue – 12-24 Roll Napkins Towels (roll) Food Drug Super Center Club 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 117 100 100 120 70 100 80 121 86 78 94 100 N/A 108 99 114 61 92 68 66 59 92 49 71 92 72 66 65 54 73 60 77 53 58 57 54 37 65 45 N/A 43 48 67 54 41 57 39 73 Source: Hoyt & Company Store Checks w/o 8/7/2002. Largest sizes carried indexed to Food on a per unit (oz/sheet/count) basis. 11 LabattCPGFinale.ppt Category Hijacking Dry Grocery Sales Trends In Drug Chains vs. Food Stores Food ‘95 to ‘99 Snacks - Health Bars & Sticks Spaghetti - Canned Water - Bottled Cereal – Ready-to-Eat Ravioli – Canned Soup - Canned Snacks – Potato Chips Coffee - Ground Soft Drinks - Carbonated Dry Dinners - Pasta Jelly Dog Food - Dry Type Cat Food - Dry Type Granola & Yogurt Bars 387% 6% 77% -8% 35% 13% 16% -16% 30% 21% -2% 24% 16% -9% Drug ‘95 to ‘99 681% 183% 160% 159% 128% 119% 68% 60% 59% 58% 50% 48% 41% 29% Source: AC Nielsen 12 LabattCPGFinale.ppt Store Disloyalty In 2000: 100% of U.S. HH shopped Supermarkets 1.7x’s per week and spent an average of $32.00 per trip. 94% of HH shopped Mass Merchandisers every other week and spent about $36.00 per trip. 86% of HHs shopped a Drug chain a little more than 1x per month and spent an average of $18.00 per trip. 52% shopped a Convenience store about 1x per month and spent about $8.00 per trip. 49% shopped a Club about once every 6 weeks and spent $82.00/trip. 47% shopped a Dollar Store once every 5 weeks and spent about $10.00 per trip. And now – the internet! 13 LabattCPGFinale.ppt Trip Loss In Core Channels Shopper Trips By Channel (1996 – 2001) (Avg. # Trips/Channel/Year) 100 90 80 70 60 50 40 30 20 10 0 95 75 Total Trips Down 2 Billion Trips in Five Years 29 Drug 180 167 11 13 23 16 15 Grocery 1996 2001 8 10 Clubs Discount 13 15 6 C&G Dollar Stores Supercenter Source: AC Nielsen Homescan 14 18 LabattCPGFinale.ppt For Most Food Is Now A “Low Involvement” Purchase… Food As A % of Personal Consumption $ 30 25 20 15 10 5 0 1960 1970 Food 1980 Food at Home 1990 2000 Purchased Meals & Beverages BLS, 2002 15 LabattCPGFinale.ppt On Top Of This, We Have… Time-Pressured, Fickle Consumers Shopper’s Decision Time Percent of Total Shoppers More than 15 seconds 5 seconds or less 25% 42% 33% 6-15 seconds Source: Price Knowledge and Search of Supermarket Shoppers – P Dickson and A. Sawyer 16 LabattCPGFinale.ppt Splintering Population Along Ethnic Lines Projected Population Growth by Segment, 2000 - 2050 2000 Pop. Segment 2050 MM % MM % 194 70.5 213 50.7 110 Hispanic 32 11.6 98 23.3 306 Black 35 12.7 59 14.0 168 Asian/So. Pacific 11 4.0 38 9.0 345 3 1.2 12 2.8 400 257 100.0 420 100.0 152 White non-Hispanic Other Totals Index vs. 2000 Source: U.S.B.L.S., 2000. 2050 numbers are BLS estimates 17 LabattCPGFinale.ppt Splintering Along Lifestyle Lines Growth of 55+ Population Between 2000 and 2020 (As a % of total pop.) 120 100 80 60 30% of total pop. 22% of total pop. 97.5MM 60.5MM +61% vs. 2000 40 20 0 2000 (275M Base) 2020 (325MM Base) +18% vs. 2000 Source: U.S. Census Bureau 18 LabattCPGFinale.ppt Splintering Along Economic Lines 2000 Distribution of Total U.S. Income By Population Fifths Quintile I 20% 49.6% 20% 23.0% III 20% 14.8% IV 20% 8.9% 20% $65.7K Middle Class $42.4K $25.3K 12.5% 40% V $141.6K 72.6% 40% II Mean Income % Distribution of Income 3.6% $10.2K Source: U.S. Census Bureau, 2000; Dept of Commerce 19 LabattCPGFinale.ppt No Relief In Sight Mean Income Trends By Population Fifths, 1967 - 2000 (2000 Dollars - Per Household $K) Top 20% $160.0 $141.6 79.5% $140.0 $120.0 $100.0 $80.0 $60.0 $78.9 $45.5 $40.0 $31.1 $19.5 $20.0 $7.1 $0.0 $65.7 44.4% $42.4 36.3% $25.3 $10.2 1967 29.7% 43.7% 2000 Source: US Census, Bureau of Labor Statistics, 2000. All data adjusted for inflation. 20 LabattCPGFinale.ppt Consumer Dissatisfaction With The “Shopping Experience” Is Shopping Fun? (10 = Highest) 2000 Ranking 1999 2001 1. Wholesale Clubs 7.17 (C-) 7.04 (D) 2. Mass Merchandisers 6.49 (D-) 6.69 (D) 3. Specialty Food Stores 6.90 (D) 6.76 (D) 4. Supermarkets 6.30 (D-) 6.27 (D-) 5. Chain Drug Stores 6.05 (D-) 5.93 (F) 6. Fast Food Restaurants 6.02 (D-) 5.76 (F) 7. Convenience Stores 5.12 (F) 5.14 (F) Source: Progressive Grocer: 67th and 68th Annual Report of the Grocery Industry, April, 2000 and 2001 21 LabattCPGFinale.ppt Sideways Or Inconsistent Retailer Margin Performance CPG Retailer Gross And Net Margin Performance: FY2000 vs. FY1990 Retailers Grocery Gross Margin 1990 2000 %∆ 25.4 28.4 Net Profits 1990 2000 %∆ 12% 1.3 1.9 Drug 28.8 24.3 -16% 2.6 .6 Wal-Mart 22.8 23.0 1% 4.0 3.3 Target 27.7 31.5 14% 2.8 3.4 Costco 11.0 12.6 15% 1.6 1.2 Walgreens 29.1 28.2 -3% 2.9 3.6 Safeway 26.7 31.9 19% .3 3.4 September, 2002 – Kroger shares hit 52 week low October, 2002 – Safeway downgraded because of increasing competitive threat from Wal-Mart 2002 – Shares of Kroger, Safeway and Albertson’s have dropped 34% since May 31 vs a loss of 17% in the S&P 500 Source: Value Line, 1991 and 2001 22 LabattCPGFinale.ppt Net For Retailers: Consumers are becoming more “self-loyal” than store loyal: • For example, 83% of shoppers surveyed in 2001 think all supermarkets are alike Driven by: • Price pressures • Time pressures • Ethnic or lifestyle preferences • General indifference to or even dissatisfaction with shopping experience Exacerbated by “choice confusion” due to: • Outlet saturation • SKU proliferation Food purchasing no longer a big deal 23 LabattCPGFinale.ppt Retailer Response Foxhole mentality – dig in and defend Claw profits from every source With prices capped, leverage supplier resources to the hilt 24 LabattCPGFinale.ppt The Retailer’s Biggest Bullets: Supplier trade promotion funds/slotting fees Financial margin or “float” (vendor financed inventories) 25 LabattCPGFinale.ppt Use of Trade Promotion $ To Increase Gross Margins How It Works Retail: Cost: Profit: Allowance: Total: Retailer Invests 50% of Allowance In Promotion: Balance: Margin $2.35 (capped) 1.39 (fixed) $0.96 $0.24 $1.20 ($0.12) $1.08 40.9% 51.1% 46.0% This is the heart of the retailer’s blast-furnace appetite for supplier trade promotion dollars and the single biggest source of conflict between suppliers and retailer today: • Supplier = spend less/get more • Retailer = get more/spend less • Retailer = Controls distribution; controls shelf 26 LabattCPGFinale.ppt Surveys Show that Obtaining Manufacturers’ Allowances Consistently Ranks at the Top of Supermarket Priority Lists Supermarket Priorities Rank 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Obtaining Manufacturer Allowances Media Advertising Store Brand Program Store Circulars In-Store Promotions Co-Marketing Programs with Manufacturers Sponsoring Community Events In-Store Advertising Media Consumer Market Research Promotion Evaluation/Follow-Up Micromarketing Frequent Shopper Card Program Rating 4.4 4.3 4.1 4.1 3.9 3.6 3.5 3.4 3.3 3.2 2.9 2.9 1 = Not Important, 5 = Very Important Source: Supermarket News Brand Marketing 27 LabattCPGFinale.ppt The History Of Trade Promotion Expenditures Since 1978 Shows That Retailers Have Been Remarkably Successful In Achieving This Objective % CPG Manufacturer A&P Spending Trends: 1978-2001 1978 1985 1995 2001 % vs ‘78 Trade Promotion 33% 38% 51% 61% +85% Consumer Promotion 27% 27% 24% 15% -44% Advertising 40% 35% 25% 24% -41% 100% 100% 100% 100% N/A % A&P/Total Sales 13% N/A 22% 27% 107% % Trade/Total Sales 5% N/A 13% 16% 220% Totals Source: Carol Wright, Accenture, Cannondale, Donnelly, 1980 - 2002 28 LabattCPGFinale.ppt In Fact, The Whole Trade Promotion Thing Has Escalated To The Point Where It Is Now Equivalent to The Roach Motel Syndrome: Once In, Can’t Get Out THE ROACH MOTEL Advertising/ Feature Fees Consignment/ Scan-Based Invoicing Investment in CatMan Services and CrossFunctional Selling Teams Supplier-Provided Labor Slotting Fees Temporary Price Reductions Retailer-Sponsored Local Events & Charities Fixture and POS Fees 29 LabattCPGFinale.ppt The Other Major Objective of Every MegaRetailer Is 100% Vendor Financed Inventories This is known as selling it before one has to pay for it or “making money on the float”: Supplier Terms: 2%/30, net 60 Order Turnaround Time (from order to sale): 18 days “Float”: 12 days Size of Order: $200K Overnight Interest At Prime: 6.25% Annual Return (365 Days): $12,500 Per Day $34.24 12 Days $411.00 Annual Turnover (365 ÷ 18) 20.3 Total Annual Profit (20.3 Xs $411.00) $8,343 30 LabattCPGFinale.ppt Beyond Trade Promotion Dollars And Vendor Financed Inventories, Retailers Are Determined To Transfer As Many Costs Of Doing Business As Possible To Suppliers Store labor (over 50% of most retailers’ operating expenses) Analytical support (Category Management analysis) Warehousing costs (slotting) Consignment (scan-based invoicing) Deductions without descriptions (triangulation/procrastination) Trial balloons – intimidate small suppliers first with some outrageous demand and then work upwards, using the “cave-ins” as validators 31 LabattCPGFinale.ppt It Should Be Said That In Pursuing These Objectives, Today’s Major Retailers Have A Very Different Definition of “Partnering” Than Do Manufacturers (or The FMI): “Partnering is when we are both making the same profit on the bottom line. If I am making 2% and the supplier is making 8%, we will finally become true partners when we are both making 5%. Because I cannot take prices up, I intend to get the other 3% from my suppliers.” Retailer CEO March, 2002 32 LabattCPGFinale.ppt Channel Trends 33 LabattCPGFinale.ppt Food/Supermarkets 34 LabattCPGFinale.ppt Food – Industry Trends Channel Store Counts (from ACNielsen) • > $4mm 23,400 • $2mm – $4mm 78,000 • Total <$2mm 31,200 • Supercenters: 1,500 Supermarket ACV grew +3.0% in 2001 (vs. +4.8% in 2000) Projected five year sales growth (2001-2006) for supermarkets is +2.4% vs. +16.8% for supercenters Supermarket net profit margin was 2.1% in 2001 (vs. 1.8% in 2000) Industry merger and acquisition was relatively quiet in 2001 (15 transactions in ’01; 16 in ’00; 25 in ’99) Source: February 2002 Retail Forward Report 35 LabattCPGFinale.ppt Food – Consumer Trends Shopper Mix: 70% Female, 30% Male % Household Penetration: 100% in Supermarkets vs 63% for Supercenters (Supercenters up from 47% in 1998) Supermarket Frequency Down: 75 times per year (vs 85 in 1998), Supercenters annual frequency is 18 (vs 14 in 1998) Weekly Shoppers: 55% in Supermarkets vs 20% in Supercenters Most supermarket shoppers (62%) do not bring any shopping aids with them to the store. Only 26% bring a shopping list. • The shopper relies heavily on in-store stimuli to help recall needed grocery items. Marketing must therefore extend to inside the outlet. 36 LabattCPGFinale.ppt Food – Customer Trends Customer decision points continue to shift. Buying and other key decisions are moving away from local control to HQ. • This approach is being implemented by key large customers (e.g. Kroger and Safeway) Wal-Mart: • In terms of volume, Wal-Mart remains the biggest food retailer in the U.S. Grocery/HBC. Sales generated through its various formats reached nearly $71 billion in 2001, up from $61 billion in 2000 • By year end 2002, there will be 1,251 Wal-Mart supercenters in operation (+187 units vs. 2001) • Wal-Mart continues to test its Neighborhood Market Food and Drug concept. – By year end 2002, they expect to have 45-50 in operation – Funded entirely from float = no out-of-pocket investment $ 37 LabattCPGFinale.ppt Grocery – Key Issues Labor sourcing, labor costs – costs now 53% of sales Loss of center store business to alternate formats Sales Lost Over 9 Year Period Total of 9 Categories: Detergent, Hair Care, Paper Towels, Dentifrice, Diapers, Coffee, Bath, Fabric, Peanut Butter 52 Weeks Ending Fiscal Year Grocery Mass Merchants Warehouse/Club All Other Outlets 1989/1990 1998/1999 75.6% 13.1% 3.5% 7.8% 54.5% 26.9% 9.6% 9.0% Source: Procter & Gamble and “Growing the Center Store” AC Nielsen Traditional focus on making money on the buy rather than on the sell = consumer clueless Expensive to deal with – suppliers strategizing away from channel Have not developed an effective response to supercenter threat 38 LabattCPGFinale.ppt The Biggest Threat: Supercenters Are Siphoning Dollars Away From the Supermarket Channel. Supermarket shoppers are daily converting to supercenters and spending less and less in traditional supermarkets (30.5% down 1.2%) Share/Share Chg of Supercenter Shopper $ by Channel -0.6 A/O 30.9% GROCERY $2MM+ 30.5% -1.2 +0.1 DOLLAR STORES 1.2% +0.0 DRUG STORES 3.4% CONV/GAS 1.0% -0.2 WAREHOUSE CLUBS 5.9% +0.3 SUPERCENTERS 13.4% +2.1 MASS MERCH W/O SUPERS 13.7% -0.5 Source: ACNielsen Cross Outlet*Facts 2000; Total US 39 LabattCPGFinale.ppt This is Starkly Illustrated Below in Supermarket Trip Loss Between 1998 & 2001 Household Shopping Frequency Trips per Household 75 78 Grocery 83 85 23 25 26 Mass Merch 28 '01 18 17 Supercenters* 15 14 Drug 15 15 15 15 Conv/Gas 15 14 13 13 '00 '99 '98 11 10 10 Dollar 9 10 10 Warehouse 9 9 0 10 20 30 40 50 60 70 80 90 Source: ACNielsen Homescan Panel *Includes Kmart, Target & Wal-Mart Supercenters 40 LabattCPGFinale.ppt Food – Opportunities 78% of all U.S. households currently participate in at least one Frequent Shopper Program 80% 66% 70% 70% 74% 78% 55% 60% 50% 40% 35% 30% 20% 10% 0% 1996 1997 1998 1999 2000 2001 ACNielsen 2001 Frequent Shopper Update 41 LabattCPGFinale.ppt Mass Merchandisers 42 LabattCPGFinale.ppt Mass – Industry Trends Projected compound annual sales growth rate for the Mass Channel including Supercenters for 2000 – 2005 is +8.4% Conventional Discount Stores projected growth rate for 2000 - 2005 is +1.7% Mass retailers focus on adding supercenters at the expense of existing conventional stores Continued store closings by regional players 43 LabattCPGFinale.ppt Mass – Consumer Trends Shopper mix females 74%, males 26% which is the highest % female shopper channel % household penetration in the Mass Merchandiser Channel is 97% Mass Merchandiser Channel is loosing household shopping frequency from 28 trips per year in 1998 to 23 in 2001 Average $ basket ring has increased from $36.34 in 1998 to $38.75 in 2001 % of Weekly shoppers are 29%, +2% from 1999 % of Monthly shoppers are 61%, +1 from 1999 44 LabattCPGFinale.ppt Target & Wal-Mart, While Both Mass Merchandisers, Have Each Done An Outstanding Job In Positioning Themselves Against Very Different Consumer Segments Target vs. Wal-Mart Shopper Demographics Indexed to Total US Categories Wal-Mart Super Center Target Income $30 - $49 $50 - $74 $75+ 109 100 74 102 117 129 Education High School College Post 104 81 77 102 125 120 Home Value $0 - $99M $100M+ 140 75 85 137 Age 18 – 34 35 – 54 55+ 108 96 98 112 108 87 Source: Hoyt & Company/Scarborough Research 2000 45 LabattCPGFinale.ppt Drug Chains 46 LabattCPGFinale.ppt Drug – Industry Trends Projected compounded annual sales growth rate 2000 – 2005 +6.2% Consumer spending on prescription drugs is forecasted to grow at an annual rate of +8.5% over the next 5 year Growth in pharmacy by continued competition from other retail channels especially Supermarkets and Mass Merchandisers Front end sales, where competition is fiercest, have been stagnant 47 LabattCPGFinale.ppt Drug – Consumer Trends Shopper mix females 66%, males 34% % household penetration - 86% (same as in Y2000) and has remained the same over the past few years Household shopping frequency – 15% (even vs. 2000) has remained the same over the past few years Average $ basket ring has increased from $17.72 in 1999 to $19.38 in 2001 Drug Stores continue to appeal most to a frequent shopper base that skews slightly upscale and heavily older 48 LabattCPGFinale.ppt Drug Chains – Issues - Pricing Beauty/HBC: Walgreens CVS RiteAid Kmart Cover Girl Clean Makeup $5.19 $5.39 $5.49 $3.49 Revlon Super Lustrous Lipstick $8.75 $8.73 $8.75 $7.29 Maybelline Express Finish $3.19 $3.89 $3.79 $3.29 Wal-Mart Kmart CVS Eckerd No Nonsense Regular Pantyhose $1.87 $1.89 $2.39 $2.39 L’eggs Silken Mist Control Top $3.24 $3.29 $3.99 $3.99 Private Label Brand Reinforced Toe $2.97 $2.49 $1.99 $1.69 N/A $4.79 $5.09 $5.09 $1.87 $1.89 $2.29 $2.29 General Merchandise: Hosiery L’eggs Silky Tights No Nonsense Sheer Toe Knee Highs In 25 different price comparisons, the 4 largest drug chains had an average price premium of 33% above the lowest price discounter. 49 LabattCPGFinale.ppt Drug Chains – Issues – Shopper Base Demographics % of Heavy Shoppers By Age of Female Grocery Conv/Gas Drug Discount WHC 30 25 28 28 24 28 27 27 25 24 23 21 22 25 25 22 20 20 15 17 13 13 15 14 12 12 12 12 10 10 5 0 <35 45-54 35-44 50 65+ 55-64 LabattCPGFinale.ppt Convenience & Petroleum Stores 51 LabattCPGFinale.ppt Convenience – Industry Trends Store count in 2000 was 119,800, forecast 123,000 in 2002 Nominal sales 1995 to 2000 were +11.9% and projected to be only +2.4% for 2000 to 2005 Channel blurring is one of the largest challenges for Convenience Retail • 5% of all fuel purchases in 2001 were made at non-traditional fuel outlets and that figure is projected to triple by 2005 Overall In-store gross profit margin has declined steadily • Avg. non-alcoholic beverage gross margin percentage in 2000 was 31.6% • Opportunity for beer? Both in-store traffic and visit frequency declined in 2001 Source: Retail Forward Industry Outlook, December, 2001 / NACS 2001 State of the Industry / NPD 2001 Annual Report 52 LabattCPGFinale.ppt Convenience – Consumer Trends Consumer Trends: Shopper mix Females 48%, Males 52% • Convenience Retail is the only channel Males dominate the percentage of trips to the outlet The Convenience Retail channel has experienced a significant decline in Household Penetration while other retail channels have remained flat or grown slightly • 2001 penetration at 45%, declined 7 points since 1998 Household shopping frequency= 15 times per year (+1 versus 2000) Average basket ring $10.38, lowest of all Channels 24% of visits are Pay at the Pump • Pay at the Pump consumers reason for visit is gas only. Only about 7% claimed to be thirsty Sources: 2001 Household Panel Annual Review and 2002 CCNA Consumer Segmentation Study 53 LabattCPGFinale.ppt Convenience – Key Learnings & Implications Summary Convenience Retail is facing increased competition from other retail channels • Retailers rely on suppliers to develop innovative ways to maintain relevancy for the channel • Non-traditional gasoline retailers may utilize fuel as a loss leader which will attract more fuel shoppers In store sales and traffic have declined: • Puts increased pressure on retailers as in-store sales account for 1/3 of total outlet sales and 2/3 of the profit Source: Convenience Store News March 2002 54 LabattCPGFinale.ppt Convenience Retail Key Learnings & Implications Summary The consumer in this channel is more diverse than any other retail channel • Need for more flexible marketing programs that are relevant to several consumer groups Customer consolidation levels in the Convenience Retail channel remain at relatively low levels compared to other retail channels • Ensure strategies and tactics are “executable” in local & regional accounts of all sizes • Focus on improving relationships and account coverage for “up & down” the street customers 55 LabattCPGFinale.ppt Wholesale Clubs 56 LabattCPGFinale.ppt Definition – Wholesale Clubs Wholesale Clubs Trade Class The Wholesale Club Trade Class includes membership club stores distributing packaged and bulk foods, alcoholic beverages and general merchandise. They are characterized by high volume on a restricted line of popular merchandise in a no-frills environment. The average club stocks approximately 4,000 SKUs, 40% of which are grocery items. Examples: BJ’s, SAM’s Club, Costco 57 LabattCPGFinale.ppt Club – Industry Trends Current stores in Channel: 900 in 2001, 950 by 2002 Third year of double-digit industry growth – +12% sales growth Adding more higher end merchandise to drive traffic and incremental in-store sales Channel net profit margin 2.0% in 2000 Projected compounded annual sales growth rate 2000 – 2005 +6.5% Channel is emerging as a alternative stock up shopping occasion to supermarkets 58 LabattCPGFinale.ppt Club – Consumer Trends Shopper mix females 63%, males 37% % household penetration – 50% (+1 vs 2000) Household shopping frequency – 10 times per year (even vs 2000) Average $ basket ring $82.19 (-$0.78) highest of all channels Weekly shoppers in channel only 6% vs 54% in supermarkets Monthly shoppers in channel 20% vs 71% in supermarkets 65% consumer shopping base, 35% business base – BUT – Consumers account for only approximately 35% of sales Small businesses account for 65% The big orders are out the back door, not the front door 59 LabattCPGFinale.ppt Wholesale Club Group Members (Personal) Shopper Demographics Costco Member Demographics 1998 Survey US Average 49 Years Old 42 Years Old 81% Are Married 59% Are Married $68,400 Median Household Income $35,700 Median Household Income 44% College Graduates 20% College Graduates 87% Own a Home 69% Own a Home 7.5 Length of Residence 2.9 Length of Residence Source: Costco 1998 60 LabattCPGFinale.ppt Wholesale Club Membership and Sales – 1999 Membership By Type: 1999 Wholesale 30% 9.4MM Sales By Type: 1999 Group 35% $20.4B Group 70% 22.5MM Wholesale 65% $37.5B Group members drive membership fee revenues Wholesale members drive merchandise sales revenues 61 LabattCPGFinale.ppt Wholesale Business vs. Personal Sales, 2000 % Club Sales For Business vs. Personal Use: 2000 (Based 1999 Ratios Applied to 2000 Sales) Total 2000 Sales = $57.9B “Pure” Business 44% Wholesale (Home Use) 21% $12.1B Wholesale Only 44% $25.4B “Pure” Personal 56% Group 35% $20.4B Source: Corporate 10ks 62 LabattCPGFinale.ppt Wholesale Club – Issues Continued profitable expansion – Typical club store needs a per store population base of 250 - 275M families to succeed: • At 1,000 units nationally at end of 2001, Wall Street estimates that Club maximum potential will be reached at 1,500 units in 3 years. Supercenter growth and one-stop shopping appeal to time pressured, affluent two wage earner families – Clubs have lower prices but carry only 4,000 - 6,000 items. • Repeated surveys show that the affluent are now willing to trade price for time savings. • Supercenters are starting to carry wide assortment of club items without membership fee. 63 LabattCPGFinale.ppt How Retailers Differentiate Themselves 64 LabattCPGFinale.ppt Name that Channel: 65 LabattCPGFinale.ppt Surprised? 66 LabattCPGFinale.ppt Channel Financial Architectures Highlight Why Finding a Consumer Niche is Critical: Channel Financials, FY 2000 - ‘01 (% Net Sales) Dollar Stores Drug Stores Supermarkets Mass Merch Super Centers Clubs Gross Margin 31.3 26.8 26.5 22.4 18.3 11.9 Operating Expense 22.7 21.0 21.6 18.7 N/A 8.5 Operating Margin 8.6 5.8 5.0 4.5 N/A 3.4 Net Profit Margin 5.3 3.5 2.1 2.7 1.1 2.0 Source: Zack’s, 5/2001. Supermarket numbers are composites *Supercenter Financials refer to food products only 67 LabattCPGFinale.ppt The Differences in Financial Architectures are Reflected in Pricing: Retails Required To Meet Gross Margins at $1.50/Unit Cost Diff vs. Supermarket Avg. Trade Channel Avg. Gross Margin Minimum Retail Required Dollar Stores 31.3% $2.18 +$.14 +6.9% Drug Chains 26.8% $2.05 +$.01 +.05% Supermarkets 26.5% $2.04 – – Mass Merch 22.4% $1.93 -$.11 -4.9% Supercenters 18.3% $1.84 -$.20 -9.8% Clubs 11.2% $1.69 -$.35 -17.2% 68 % +/- vs. $2.04 LabattCPGFinale.ppt When Applied To 2000 Average HH Food-At-Home Expenditures, This Difference Can Start Adding Up To Big Savings For the Average Family Average Retail Margin Impact on 2000 Average F.A.H. Expenditures Trade Channel Avg. Gross Margin Difference vs. Supermarkets 2000 Avg. $/HH Cost/Savings +/- vs. $4,687 Dollar Stores 31.3% +6.9% $5,010 +$323 Drug Chains 26.8% _.05% $4,710 +$23 Supermarkets 26.5% – $4,687 – Mass Merch 22.4% -4.9% $4,457 -$230 Supercenters 18.3% -9.8% $4,228 -$459 Clubs 11.2% -17.2% $3,880 -$807 2000 Food-At-Home Expenditures = $4,587 ($494B ÷ 105MM HH) U.S. Census 2000 69 LabattCPGFinale.ppt Current Retailer Objectives and Priorities Supermarkets: Exploit competitive edge in perishables Combine full service with convenience – gasoline pumps, separate convenience “store within a store” concept and self-scan checkouts Leverage heavy shopper base via technology – direct mail, FSPs Drug Chains: Increase trip frequency by adding high penetration, frequent repurchase cycle elastic food items on 20/80 basis Become the outlet of choice for “total health solutions” Own the “55+” group while building a younger customer base 70 LabattCPGFinale.ppt Current Objectives and Priorities – More! Convenience & Petroleum Stores Change image from “Cokes and Smokes” to 20/80 Expand customer base from “young male/blue-collar” to white teens and young adults Get known as “true” short-stop convenience outlet – meet needs of “activity-rich/time-poor lifestyles” Mass Merchandisers/Supercenters Continue conversion to one-stop shop supercenters Use entire grocery department as “loss-leader” traffic puller 71 LabattCPGFinale.ppt Performance Score Cards 72 LabattCPGFinale.ppt How Retailers Size Up Suppliers On a Subliminal Basis Supplier’s overall (or potential) importance to retailer as a company Size and importance of category to overall store sales — whether category is growing or declining Supplier’s strength in category Potential contribution to category growth/retailer knowledge base Supplier technological expertise and willingness to share Innovation, energy, attitude and responsiveness of supplier as a company Supplier’s ability to execute at store level Whether supplier has size, strength and willingness to be objective when developing total category marketing and merchandising strategies as part of annual category business plan. 73 LabattCPGFinale.ppt Actual Scorecard For Evaluating Supplier Category Management Expertise Skill Area Planning and Strategy Analysis Criteria Importance • Does the manufacturer have strategic planning skills? • Does the manufacturer match its tactical recommendations to the role and strategy of the category? • Does the manufacturer exhibit creativity in the category plan? • Can the manufacturer identify the market drivers of the category and demonstrate category expertise? • Will the manufacturer use your POS data in the way you intend? • Does the manufacturer demonstrate category expertise that includes being aware of the role of private label within the category? 74 Grade 5 5 4 5 5 4 LabattCPGFinale.ppt Score Actual Scorecard For Evaluating Supplier Category Management Expertise (cont’d) Skill Area Technology Criteria Importance • Does the manufacturer have the necessary technology to develop and execute a category plan? (For example, category analysis and plan-o-gram software.) • Does the manufacturer have multifunctional resources to provide a total systems’ approach? (For example, product supply, financial operations and shelf management systems that are all integrated.) Consumer Focus • Does the manufacturer demonstrate knowledge of what the consumer is doing in the category? (For example, whether the consumer is spending more or less money in the category.) • Does the manufacturer use: •Diary panel •Substitution data •Switching and loyalty data •Product consumption information? • Does the manufacturer provide consumer behavior research? 75 Grade 5 4 3 4 3 3 3 5 LabattCPGFinale.ppt Score Actual Scorecard For Evaluating Supplier Category Management Expertise (cont’d) Skill Area Criteria Importance Implementation • Does the manufacturer provide resources to 5 Grade help execute tactical plans that accomplish the retailer’s goals for the category? Relationship • Does the retailer have a solid working relationship with the manufacturer? • If the category expert is taken out of the process, what will happen to category management at the manufacturer? (Is the process personality-driven or culturedriven?) Trust • Do you feel comfortable sharing confidential 5 5 5 information with the manufacturer? 76 LabattCPGFinale.ppt Score Actual Scorecard For Evaluating Supplier Category Management Expertise (cont’d) Skill Area Commitment Criteria Importance • Does the manufacturer have a long-term Grade 4 commitment to category management from top management down through its organization? • Has the manufacturer retrained its sales 5 force to acquire the new skills necessary for category management, such as strategic thinking, planning and working with retailers in a more collaborative manner? Total Score 87 77 LabattCPGFinale.ppt Score SAM’s Vendor Scorecard (2000) Action Priority Score Systems Required Marking on Packages Product Ordered-Product Received (Bar Code) Product Ordered-Product Received (UPC) Delivery Quantity Matched Order Accurate Information Product Always Available Timely Information Good Responsive Communication Proactive Order Status Communication Consistent Practices Clear Lines of Communication, Internal & External Unit Load Integrity Optimize Unit Load Cube Fit the Footprint Optimize Shelf Space Standardized Transaction Individual Package Performance Systems Required Marketing on Case Standardized Information Optimize Transaction Cost Minimize Total handling Unloading Efficiency Optimize Warehouse Turns Optimize Numbers of Transactions Put Up Design Matches Cons, PO Regulations One Stop Shopping (Sales, Svc, Proc) Full Vendor Brand Line Availability 5.0 5.0 5.0 5.0 5.0 4.8 4.7 4.7 4.3 4.3 4.3 4.0 3.8 3.8 3.7 3.5 3.5 3.3 3.3 3.3 3.3 3.2 3.2 3.2 2.8 2.7 1.3 Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Priority Score: 5.0 = Must have now (highest score) 3.0 = Must have to grow 1.0 - Important longer term 78 LabattCPGFinale.ppt What Suppliers Need To Do 79 LabattCPGFinale.ppt What Suppliers Need to Do – FOR THEMSELVES! Establish and maintain above-buyer relationships! Add value to one’s brand beyond its distribution value by providing “solutions” that resonate with consumers Grow one’s brand while growing the category at the same time Build “partnership equity” to solidify one’s position with mega-retailers Maintain profitability in the face of global sourcing and global buying Build brand equity via direct-to-consumer and through trade-toconsumer simultaneously (use retailers own promotion and advertising vehicles) Capitalize on one-to-one marketing opportunities Leverage all technologies to the maximum – the web, wireless communications and paperless transactions Determine which accounts are profitable vs marginal and act accordingly 80 LabattCPGFinale.ppt What Suppliers Need to Do – FOR RETAILERS! Focus on helping improve return on net assets (RONA) – not just “profitable sales” or share growth Adjust terms or improve shipping efficiencies to effect 100% vendorfinanced inventories Help develop or participate in total store “themed” promotions requiring cooperation and collaboration of a number of different manufacturers Provide marketing and analytical expertise to segment and market to most profitable customers Become expert in store-specific marketing – defined as outlet-specific distribution and assortment, local tie-ins and local promotions Develop Category Management presentations that provide consumer solutions, not just “insights” Be willing to de-list one’s own brands on an outlet-specific basis for the sake of overall category sales and/or profit growth on a chainwide basis 81 LabattCPGFinale.ppt What Supplier’s Need To Do: Get The Right Mind-Set and Attitude Look at these challenges as opportunities rather than “problems” or obstacles – After all, building partnership equity with 30 accounts is a LOT easier than the 500 (or so) accounts one had to deal with in the 1970’s and 1980’s. Be prepared to withdraw support from or even de-list non-profitable accounts – Anathema to traditional CPG marketers but nevertheless a very real looming possibility in the current environment. Learn to think “category” and “solutions” in addition to “brand” – Because your brand must provide value-added to the retailer’s overall marketing mix beyond its distribution value and this comes from ideas. Know that “service excellence” is now equally important as “brand excellence” in how mega-retailers will evaluate your overall costbenefit to them as a supplier. 82 LabattCPGFinale.ppt Above All, Keep In Mind That The Name of The Game To Cut Through The Clutter and Maximize ROI On Human and Financial Resources These Days Is: Targeting: Channels Accounts Stores Consumer Segments Individual Consumers 83 LabattCPGFinale.ppt How Suppliers Address The Issues Trade Universe Level I 10/50 • Best People • Cross-Functional Selling Teams • Focus on BOTH Supply and Demand Sides Level II 20/80 • Supplier Employed and Trained Key Account Managers • Focus on Demand Level III All Other • 3rd Party Sales Representation Plus Overcalls 84 LabattCPGFinale.ppt What Separates The “Great” Suppliers From The “Average” 85 LabattCPGFinale.ppt Answer Top quality people Top quality training An environment that rewards initiative and out-of-the-box thinking An organizational structure that brings all sales and marketing resources to bear on the key issues – defined as: • Integrated marketing and sales focus • Marketing participation in key account planning • Key account equity budgeting in annual brand planning process • Sales teams that are empowered to spend over and above trade promotion budgets • Top-down commitment to excellence 86 LabattCPGFinale.ppt We want to thank Ronnie Tucker and Duke Maines for inviting us and hope that this has been both fun and helpful! www.hoytnet.com 8912 East Pinnacle Peak Road • Scottsdale, AZ 85255 Phone (480) 513-0547 • Fax (480) 513-0548 • E-Mail: chrishoyt@hoytnet.com • nancyswift@hoytnet.com