Click to

advertisement

CHAPTER NO. 5

WORKING CAPITAL

MANAGEMENT &

FINANCE

WORKING CAPITAL MANAGEMENT

Capital required for a business can be classified under two

categories VIZ.,

(1) Fixed capital

(2) Working capital

Investments in the long term assets represent that part of

firm’s capital which is blocked on a permanent of fixed

basis is called fixed capital

Funds also needed for short term purposes for the purchase of

raw materials, payments of wages etc are known as

working capital.

“ Working capital is the amount of funds necessary to cover the

cost of operating the enterprises”

SHUBIN

CONCEPTS OF WORKING CAPITAL

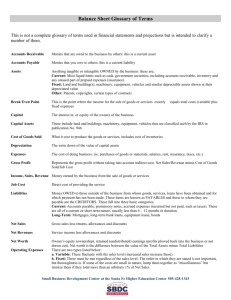

BALANCE SHEET

CONCEPT

GROSS WORKING

CAPITAL- it refers to

that amount of capital

which is invested only in

current assets of the

firm.

NET WORKING

CAPITAL

= Current assets –

current assets

NWC may be negative or

positive.

OPERATING CYCLE OR

CIRCULAR FLOW

CONCEPT

Investment in current

assets keep revolving

fast & are being

constantly converted

in to cash & this cash

flows out again in

exchange for other

current assets known

as revolving or

circulating capital.

GROSS WORKING CAPITAL

Total Current assets

Where Current assets are the assets that can be

converted into cash with in an accounting year &

include cash , debtors etc.

Referred as “Economics Concept” since assets are

employed to derive a rate of return.

FEARTURES OF CURREN ASSETS

Short Life Span

cash balances may be held idle for a week or two , thus

a/c may have a life span of 30-60 days etc.

Swift Transformation into other Asset forms

each CA is swiftly transformed into other asset forms like cash is

used for acquiring raw materials , raw materials are transformed

into finished goods and these sold on credit are convertible into

cash

NET WORKING CAPITAL

Current Assets – Current Liabilities

Referred as ‘point of view of an Accountant’.

It indicates liquidity position of a firm &

suggests the extent to which working

capital needs may be financed by

permanent sources of funds.

It indicates the margin of protection

available to the short term creditors

It indicates the financial soundness of the

firm

CONSTITUENTS OF CURRENT

ASSETS & LIABLITIES

CURRENT ASSETS

CASH IN HAND

BILLS RECEIVABLE

SUNDRY DEBTORS

SHORT TERM LOANS &

ADVANCES

TEMPORARY INVESTMENTS

OF SURPLUS FUNDS

PREPAID EXPENSES

ACCRUED INCOMES

INVENTORIES OF STOCK

(1) RAW MATERIAL

(2) WORK-IN-PROCESS

(3) STORES & SPARES

(4) FINISHED GOODS

CURRENT LIABLITIES

BILLS PAYABLE

SUNDRY CREDITORS

OUTSTANDING

EXPENSES

SHORT TERM LOANS

,ADVANCES& DEPOSISTS

DIVIDEND PAYABLE

BANK OVERDRAFT

PROVISION FOR

TAXATION

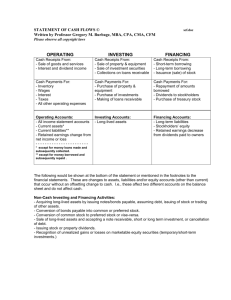

OPERATING CYCLE OR CIRCULAR FLOW CONCEPT

1. Cash

received

from debtors

& paid to

suppliers of

raw material

4. Sale of

finished

goods

Operating

cycle

3. Finished

goods

produced

2. Raw

material

introduced

in to process

OPERATING CYCLE OR CIRCULAR FLOW CONCEPT

1. Gross operating cycle

2. Net operating cycle

Raw

material

conversion

period

Receivable

conversion

period

Gross

operating

cycle is the

sum total of

these 4

Finished

goods

conversion

period

Work in

process

conversion

period

Net

operating

cycle

period =

Gross

operating

cycle

period -

Payable

deferral

period

OPERATING CYCLE

Purchase Resources

Pay

Sell on Credit

Receive Cash

Inventory Conversion

Receivables Conversion

Payables Period

Cash Conversion Cycle

Operating Cycle

9

FORMULA TO DETERMINE NET OPERATING CYCLE PERIOD

1.

CLASSIFIACATION OR KINDS OF WORKING CAPITAL

GROSS WORKING

CAPITAL

ON THE BASIS OF

CONCEPT

NET WORKING

CAPITAL

KINDS OF

WORKING

CAPITAL

PERMANENT OR

FIXED WORKING

CAPITAL

ON THE BASIS OF

TIME

TEMPORARY OR

VARIABLE

WORKING

CAPITAL

REGULAR

WORKING

CAPITAL

RESERVE

WORKING

CAPITAL

SEASONAL

WORKING

CAPITAL

SPECIAL

WORKING

CAPITAL

THE NEEDS OR OBJECTS OF

WORKING CAPITAL

For the purchase of raw materials, components & spares

To pay wages & salaries

To incur day to day expenses & overheads costs

To meet selling costs

To provide credit facilities to the customers

To maintain the inventories of raw material, work-in-process, stores

and spares & finished goods.

As profits earned depend upon magnitude of sales and they do not

convert into cash instantly, thus there is a need for working capital in

the form of CA so as to deal with the problem arising from lack of

immediate realization of cash against goods sold.

This is referred to as “Operating or Cash Cycle” .

It is defined as “The continuing flow from cash to suppliers, to

inventory , to accounts receivable & back into cash

ADEQUATE WORKING CAPITAL

ADVANTAGES OF

ADEQUATE WORKING

CAPITAL

o

SOLVENCY OF THE

BUSINESS

ADVANTAGES OF

DISADVANTAGES OF

INADEQUATE /EXCESSIVE

WORKING CAPITAL

•

•

o

GOODWILL

o

EASY LOANS

•

o

CASH DISCOUNTS

•

o

o

o

REGULAR SUPPLY OF RAW

MATERIALS

REGULAR PAYMENTS OF

SALARIES,WAGES,&

OTHER DAY TO DAY

COMMITMENTS

EXPLOITATION OF

FAVOURABLE MARKET

CONDITIONS

•

•

•

•

IDLE FUNDS

LEADS TO UNNECESSARY

BUYING HABITS

DEFECTIVE CREDIT POLICY

CREATES OVERALL

INEFFICIENCY

RISE IN SPECULATIVE

TRANSACTION

DIFFICULTY IN PAYING SHORT

TERM LIABLITIES

DIFFICULTY IN AVAILING

DISCOUNT

RATE OF RETURN FALLS

FACTORS DETERMINING THE WORKING CAPITAL

REQUIREMENTS

1. Nature & character of business

2. Size of business/ scale of operation

3. Production policy

4. Manufacturing process/ length of production cycle

5. Seasonal variations

6. Working capital cycle

7. Rate of stock turnover

8. Credit policy

9. Business cycle

10. Rate of growth of business

11. Earning capacity & dividend policy

12. Price level changes

13. Other factors

WORKING CAPITAL MANAGEMENT

Management of working capital is concerned with the problems

that arise in attempting to manage the current assets, the

current liabilities & the inter-relationship that exists between

them or we can say it refers to all the aspects of

administration of both current assets & current liabilities.

Working capital management policies of a

firm have a great effect on its profitability, liquidity &

structural health of the organization. In this context, working

capital management is three dimensional in nature ;

1.

PROFITABILITY

,RISK,

LIQUDITY

2.

COMPOSITION

& LEVEL OF

CURRENT

ASSETS

3.

COMPOSITION

& LEVEL OF

CURRENT

LIABLITIES

3 DIMENSION

OF WORKING

CAPITAL

MANAGEMENT

WORKING CAPITAL MANAGEMENT

Decisions relating to working capital and short term financing

are referred to as working capital management. Short term

financial management concerned with decisions regarding to CA

and CL.

Management of Working capital refers to management of CA as

well as CL.

If current assets are less than current liabilities, an entity has a

working capital deficiency, also called a working capital deficit.

These involve managing the relationship between a firm's shortterm assets and its short-term liabilities.

Active working capital management is an extremely effective way to

increase enterprise value. Optimizing working capital results in a

rapid release of liquid resources and contributes to an improvement

in free cash flow and to a permanent reduction in inventory and

capital costs, thereby increasing liquidity for strategic investment

and debt reduction. Process optimization then helps increase

profitability.

GOALS OF WORKING CAPITAL MANAGEMENT

The goal of working capital management is to ensure that

the firm is able to continue its operations and that it has

sufficient cash flow to satisfy both maturing short-term

debt and upcoming operational expenses.

Businesses face ever increasing

pressure on costs and financing requirements as a result

of intensified competition on globalised markets. When

trying to attain greater efficiency, it is important not to

focus exclusively on income and expense items, but to also

take into account the capital structure, whose

improvement can free up valuable financial resources

Investment in CA represents a

substantial portion of total investment.

Investment in CA and level of CL have

to be geared quickly to changes in sales.

PRINCIPLES OF

WORKING CAPITAL

MANAGEMENT POLICY

PRINCIPLE OF

RISK VARIATION

PRINCIPLE OF

COST OF CAPITAL

PRINCIPLE OF

EQUITY POSITION

PRINCIPLE OF

MATURITY OF

PAYMENTS

METHODS OF

ESTIMATING WORKING

CAPITAL

REQUIREMENTS

PERCENTAGE OF

SALES METHOD

REGGRESSION

ANALYSIS METHOD

CASH FORECASTING

METHOD

OPERATING CYCLE

METHOD

PROJECTED

BALANCE SHEET

METHOD

FACTORS REQUIRING CONSIDERATION

WHILE ESTIMATING WORKING CAPITAL

1. Total cost incurred

on material, wages, &

overheads

2. The length of time

for which raw

materials are to

remain in stores

before they are issued

3. The length of the

production cycle or

work in process

4. The length of sales

cycle during which

finished goods are to

be kept waiting for

sales

5. The average period

of credit allowed to

customers.

6. The amount of cash

required to pay day to

day expenses of the

business

7. The average

amount of cash

required to make

advance payments

8. The average cerdit

period expected to be

allowed by suppliers.

9. Time lag in the

payments of wages &

other expenses.

INVESTMENT DECISION PROCESS

Monitor cash flow forecasts

annually / quarterly / monthly / weekly / daily

Identify surpluses

Determine:

{

{

Now and at

period end

20

Amount / currency

Duration / location

Internal policy covering

Investment types

Risk

Ratings

Time frames

Liquidity

Performance objectives

Funding subsidiaries

Tax

External Factors:

INVESTMENT

DECISION

Investment action

Confirmation

Recording / monitoring / reporting

Liquidation

Interest rates / trends

Currency exchange rates

Economic factors

Availability

FINANCING OF WORKING CAPITAL

a.

Financing of

permanent/fixed

/long term

working capital

b.

Financing of

temporary, variable

or short term

working capital

1. Commercial

. SHARES

2.

1

2.

3. PUBLIC

DEPOSITS

Indigenous bankers

3. Trade

DEBENTURES

4.

banks

creditors

Installment credits

Accounts

receivable

5.

4. Ploughing back of

profits

6.

5. Loans from

financial institutions

Accrued expenses

7. Commercial papers

8. advances

9. Commercial banks

WORKING CAPITAL MANAGEMENT

DETERMINING THE

WORKING CAPITAL

FINANCING MIX/

APPROACHES TO

FINANCING MIX

NEW TRENDS IN

FINANCING WORKING

CAPITAL BY BANKS

1. DEHEJIA

COMMITTEE

THE

HEDGING

OR

MATCHING

APPROACH

THE

CONSERVATIVE

APPROACH

THE

AGGRESSIVE

APPROACH

4.

MARATHE

COMMITT

EE

WORKING CAPITAL ANALYSIS OR

NEASURING THE WORKING CAPITAL

(A) RATIO ANALYSIS

1. CURRENT RATIO

2. ACID TEST RATIO

3. ABSOLUTE LIQUID

RATIO

4. INVENTORY

TURNOVER RATIO

5. RECEIVABLE

TURNOVER RATIO

6. PAYABLES TURNOVER

RATIO

7. WORKING CAPITAL

TURN OVER RATIO

8. RATIO OF CURRENT

LIABLITIES TO

TANGIBLE NET WORTH

(B) FUNDS FLOW

ANALYSIS

1. CASH FLOW

ANALYSIS

2, FUND FLOW

ANALYSIS

(C) WORKING CAPITAL

BUDGET

1. LONG TERM WORKING

CAPITAL BUDGET

2. SHOT TERM WORKING

CAPITAL BUDGET

THE FINANCING DECISION PROCESS

Monitor cash flow forecasts

annually / quarterly / monthly / weekly / daily

Identify deficits

Determine:

Amount / currency

Duration / location

Internal policy covering

Borrowing internally

Instruments

Financing policy

Existing limits

Performance objectives

Existing facilities

Balance sheet/ratio impact

Tax

External Factors:

FINANCING DECISION

Financing action

Documentation

Recording / monitoring / reporting

Liquidation

Interest rates / trends

Currency exchange rates

Economic factors

Liquidity of market

ZERO WORKING CAPITAL

APPROACH

When, total of current assets = total of current

liabilities then working capital requirement will be

equal to zero . such a situation maybe called as zero

working capital situation.

Total of current assets – total of current liabilities = zero

ZWC approach, which aims at saving in opportunity cost

of funds invested in current assets & ensuring a smooth

& uninterrupted working capital cycle, is a recent

technique of working capital management.

THANK YOU