Here - Drexel University

advertisement

New Ideas Inc.

306 N. 32nd Street

Philadelphia, PA

Prepared By

Gillian E. Kelly

Dear Mr. and Mrs. Sam and Amy Kratchman,

As we discussed in your initial consultation you have recently inherited $750,000 from a

wealthy grandparent. New Ideas Inc. has put together a mock portfolio, detailing all potential

assets to be included in the portfolio, as well as a forecast of the economy, markets, etc. and why

New Ideas, Inc. will provide a higher risk adjusted rate of return than other managers. Here is a

list of your objectives to the best of my understanding:

You would like to buy a new house, valued at $900,000 outside of Philadelphia

You would like to buy a vacation house in a beach town or travel more on an annual basis

You would like to retire at an age between 60 and 67 without having to pay any debts

You would like to budget to pay for your children’s (ages 5 and 8) college education in

full to a four-year institution

Your risk aversion does not exceed 11% for the nominal rate of return on the portfolio

Given these objectives and other stipulations your have voiced during our first meetings, I

have set up a portfolio that has an estimated return of 9.413% on an annual basis. There are 3

main tactics used in portfolio strategy: Security Selection, Market Timing and Asset Allocation.

New Ideas Inc. uses all three of these tactics with our clients however asset allocation is the main

driver behind secure, sustainable return of a portfolio. Asset Allocation allows the investor to

hedge their securities among various classes of investment vehicles. Diversification is the main

element in this theory because having a mixture of assets is more likely to meet your investment

goals.

1

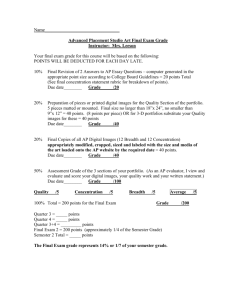

The following chart shows and example of the asset allocation I have chosen for you and the

benchmarks I have used to forecast performance:

Sector

Total Market:

Benchmark

Wilshire 5000

Percentage

Invested

100.00%

Dollar Value

Invested

$1,259,092.79

$1,259,092.79

Domestic Stocks:

Large Cap Equity

Mid Cap Equity

Small Cap Equity

Domestic Fixed Income

Developed International

Emerging Markets

Commodities

Real Estate

Cash

S&P 500

S&P Mid Cap 400

Russell 2000

Vanguard Total Bond Index

20.00%

19.00%

5.00%

15.00%

$251,818.56

$239,227.63

$62,954.64

$188,863.92

Vanguard Intern'tl Growth

MSCI Emerging Markets

Index

Dow Jones-AIG Commodity

Index DJC

Dow Jones Composite REIT

Index

13 week treasury

10.00%

$125,909.28

11.00%

$138,500.21

10.00%

$125,909.28

8.00%

$100,727.42

2.00%

$25,181.86

You already have a substantial amount of your wealth in Apple Stock (large cap equity)

however; I would like to diversify your stock portion of your portfolio by adding equal amount

of mid-cap stocks, which, as a sector, has returned higher in the last 20 years than other domestic

equity classes1. I have also added some small cap equity because there is a great potential of

growth among smaller companies.

I used Domestic Fixed Income, Real Estate and Cash in your portfolio to add to its

diversification. These types of instruments historically award a less-volatile return and are less

correlated and thus easy to hedge. For example cash and short term fixed income are affected

greatest by monetary policy unlike long term rates (like treasury notes or corporate bonds) where

inflation is the biggest driver of yields.

I have also added a great deal of weight into international markets. Emerging markets

have above average returns for the past 15 years but with a higher risk of volatility. Within the

past 10 years the returns have stabilized but are still seeing steady growth.

1

The Vanguard Group.

https://advisors.vanguard.com/VGApp/iip/site/advisor/researchcommentary/commentary/article?File=IWE_News

MktComm2QTR07. Retrieved 11/15/08

2

I’ve added commodities into your portfolio on the theory that return will rise in upcoming

years through the push for alternative energies. This allocation needs to be monitored on a

stringent basis because I believe presently a modest investment in oil will be beneficial on the

assumption of many economists that our dependency is not near an end. But in the near future I

believe the drive toward ethanol and other energy sources will increase the return for corn,

soybeans, nuclear energy and others. In which case, the type of commodity in your portfolio will

change.

Financial Market Analysis

From the beginning of the third quarter, 2006, through the first quarter of 2007 the spread

between the 10 year U.S. Treasury and the 3-month T-bill was negative (spread at the end of the

first quarter in 2007 stood at a negative 29 basis points)2, indicating an inverted yield curve and

predictive of a slowing economy or looming recession. Federal Reserve Chairman Ben

Bernanke argued that it resulted from global liquidity that had led to unusually heavy purchasing

of longer-term notes by pension funds, oil producing and developing nations with high

purchasing power against the dollar3. This high demand of UST increases prices and drives

yields to an artificial low (prices and yields move inversely). During this time period the Federal

Reserve was lowering short term rates as part of an expansionary policy, so aggressively, in fact,

that inflation was the main concern through the first half of 2007.

For the banking sector, the inverted yield curve reduces the margin between earnings

from investments (long term rates charged to borrowers) and expenses (short term rates; i.e.

2

Federal Reserve Bank of San Francisco. http://www.frbsf.org/news/speeches/2007/0221.html. Retrieved

10/27/2008

3 Wines, Leslie. Steeper yield curve may signal improving economy. June 20, 2007.

http://www.marketwatch.com/news/story/steeper-yield-curve-stirs-debate/story.aspx?guid={675A092A-6B3C49E6-8417-7BB2D2CD19B2}. Retrieved 11/19/08

3

interest payments to depositors). This will usually validates banks to invest in riskier securities in

attempt to balance out the loss by (possibly) achieving a higher return. This often pulls the yield

curve out of inversion because if demand for liquid securities increases so will prices; yields will

decrease in the short term. I believe this is one component that pulled the yield curve back to

regular in 2Q of 2007 without a change in monetary policy by the Fed, which kept short term

rates at 5.25%.

The end of the second quarter the yield 10-year treasuries pushed to 5.116% and short

term rates remained over 50 basis points lower. This was caused because there was such large

fear of inflation that investors were adding in the predicted raise of interest rates by the Fed and

heavily sold long term securities before prices decreased. However some economists believe this

was not that case and the selling of securities should have been viewed as the first sign of the

sub-prime mortgage crisis; managers needed to hedge their portfolios, by selling notes and

bonds, to compensate for the deteriorating value of the assets in soured mortgage-backed

securities2.

Investors began to reassess their risk aversion and yields between high- and low-quality

fixed-income securities widened significantly as 2007 dragged on. The 3-month t-bill lowered

almost 70 bps in the third quarter because demand was so high for these safe securities. The

Federal Reserve lowered the discount rate by 50 bps in August and September and lowered the

Fed Funds rate to 4.75% to aid in the credit crunch’s first signs of an illiquid Commercial Paper

market, and causing concern for inflationary pressures.

As expected, in the fourth quarter for 2007 treasury yields declined, helping fixed income

investors that bet on the slowing economy, but minimizing returns of investors holding corporate

debt instruments because concerns over liquidity. Concerns over bond insurers guaranteeing the

4

credit worthiness added to the credit crunch. Even investors in high yielding bonds (junk bonds)

only saw flat returns during the 4th quarter.

Liquidity anxiety and aggressive Fed interest rate cuts started 2008 with the steepest yield

curve since 2004. The rate cuts helped long term risk-free US bonds to gain because there was a

drastic flight to quality, making UST extremely tradable. Tax free bonds declined because faith

in local governments was jeopardized due to rising foreclosures and declining property values.

The spread between high yield, high risk bonds and US treasuries widened.

In the second quarter, The Fed kept trying to stimulate the economy by lowering Fed

Funds to 2.00% however futures predicted a raise in by the end of the year4. The two- and fiveyear treasuries rose most signficantly with 104 and 89-bps changes, respectively. This steapened

the yield curve in the short term slightly. Bond prices, moving inversely with yields, fell and

caused returns for the quarter to reach negative. However this was a short-lived wave of

optimism in the economy and the beginning of a very tumultuous summer for investors.

According to Bloomberg, third quarter yields on speculative grade bonds rose to

distressed levels for the first time since 2002. By the end of the quarter, investors were

demanding close to 1,000 basis points to chose corporate high yield bonds over treasuries. For

investment grade corporate debt, investors were demanding exceeding 4.5 percentage points by

the end of September5.

After the third quarter, on the 29th of October the Fed lowered interest rate to 1.00%,

tying its lowest level in half a century. Although less than two weeks later, domestic fixed

income has saw a rise in all yields and a slight steepening of the yield cureve. The US t-bill

yield rose 0.15%, indicating a slight shift into riskier assets. The 2-year note rose 1.22%, while

4

The Vanguard Group. Global Market Currents. Second Quarter 2008.

https://advisors.vanguard.com/iwe/pdf/GlbCurrt_2Q08.pdf. Retrieved 11/15/08

5

Bloomberg. www.bloomberg.com. Retrieved 11/20/08.

5

the 10-year and 30-year bonds rose 3.72% and 4.22%, respectively. This can be viewed as an

increased confidence in the stock market or an artificial bump as inflation-sensitive investors

wait for fed funds rate cut befeore the end of the year. Contrary to the yield curve’s perception

of an improving economy, the inter-bank lending has tightened through November thus pushing

banks to further restrict lending practices to consumers.

Economic Analysis

The Federal Open Market Committee began in 2001 what turned into almost three years

of a monetary stimulus plan. After a long time of keeping the federal funds rate at a very low

level, by mid-2004, the Committee began to raise the federal funds rate and continued to do so,

on a quarter-point basis, for 17 consecutive quarters6. In late 2006, the Committee voted to not

raise the rate another quarter point and paused the rate at 5 ¼%. Tightening of monetary policy

is a tactic used by The Fed to slow the economy of the United States to a more sustainable

growth rate. The main concern with rapid growth is inflation. The slow approach of The Fed to

pause the interest rate and not lower it is so they can then monitor the inflation level and avoid a

severe downturn caused by too much volatility.

The first quarter exemplified an inverted yield curve as mentioned earlier. By March,

investors saw a slow start to the year- GDP growth was 1.1% but the cost of capital was still high

at 5.25%7. Historically, when the cost of borrowing is higher than the GDP growth it is

indicative of turbulent times in markets that depend on leveraged assets (real estate i.e.

mortgages) for two main reasons. First, the market value of such assets is tied to the strength of

the economy: GDP growth. Second, because GDP is a measure of the return on capital; if the

6

Federal Reserve Bank of San Francisco. http://www.frbsf.org/news/speeches/2007/0221.html. Retrieved

10/27/2008

7

St. Louis Fed. http://research.stlouisfed.org/fred2/data/FEDFUNDS.txt. Retrieved 11/15/08

6

cost of capital is higher than the return, investors’ cash flows suffer and begin to liquate those

markets, inevitably below book value.

US stocks returned 6.1% in the second quarter of 2007, up from 1.4% in first quarter.

(MSCI US Investable Market 2500 Index). Economic growth was up to 4.8% prompting

inflationary pressures and long term investors to anticipate a rate increase by the Fed. Main

concern by mid-year was not a possible recession but the risk of global economic overheating.

Month of volatility started in the fixed income markets as bond yields rose to almost 5.5%, the

highest in five years8 amid pressures that China and other nations would cut back purchases of

US treasuries due to the sliding value of the dollar. By the end of the second quarter and the start

of the third, investors began to predict the crises in the housing market due to a high rate of

defaulted loans. This also brought concern to the equity markets and Wall Street’s exposure to

mortgage backed securities.

In the third quarter; US equity market returned a 1.6% gain but the bond market returned

2.8%, up from the negative returns of last quarter. This flight to quality came on the heels of the

subprime and MBS market crisis. Also in the third quarter, what many economists see as the

first sign of crisis is Bear Stearns banned hedge fund withdraws from two sub-prime backed

funds.

By the end of 2007, what started in the third quarter accelerated in the fourth; flight to

quality increased, UST yields continued to fall and the Fed continued to lower the Fed Funds rate

at each meeting ending the third quarter at 4.00%.9 Global overheating was no longer an issue

and the world economy started to see the implications of the subprime mortgage crisis across all

8

The Vanguard Group.

https://advisors.vanguard.com/VGApp/iip/site/advisor/researchcommentary/commentary/article?File=IWE_News

MktComm2QTR07. Retrieved 11/15/08

9

http://research.stlouisfed.org/fred2/data/FEDFUNDS.txt. Retrieved 11/15/08

7

markets. The Bureau of Economic Analysis (BEA) singled out four industries in 2007 that they

predicted would cause the largest percent of economic slowdown in the United States.

According to preliminary industry accounts statistics those industries include: finance and

insurance, real estate, construction, and mining. In 2008, the BEA found economic analysis to

confirm their predictions. These groups accounted for nearly a quarter of real GDP in 2007,

however they accounted for nearly 80 percent of the economic slowdown. Informationcommunications-technology industries continued their double-digit growth for the fourth

consecutive year, increasing 13.2 percent in 2007. These industries accounted for 3.9 percent of

the economy but for 22.3 percent of real economic growth10.

First Quarter 2008

If it wasn’t obvious before January, the Fed’s emergency meeting to cut rates amid the

Bank of China’s announcement to have over $8 billion in sub-prime write-offs, followed by

another cut one week later definitely drove the economy into emergency mode. Over the course

of the first quarter the combination of Federal Funds rate decreasing from 4.25% to 2.25% and

the uncertainty of the future strength of the economy causing investors to move into quality

instruments, contributed to driving US treasury yields lower. The Fed also lowered the discount

rate from 4.75% to 2.5% and opened the discount window to all investment banks after Bear

Stearns informed the Fed of their solvency issues. The Fed helped save Bearn Stearns from

filing for bankruptcy when JP Morgan was able to buy the company to prevent

illiquid/essentially “frozen” markets. This was the government’s first wave of its “bailout”.

The Lehman Bond Aggregate Index boasted 2.2% return as prices rose to match the

falling yields and investors fled to quality. Unfortunately the US stock market is not faring so

well and suffered near double-digit losses in the first quarter posting a -9.4% loss to the MSCI

10

http://www.bea.gov/newsreleases/industry/gdpindustry/gdpindnewsrelease.htm. Retrieved 10/27/2008

8

US Investable Market 2500 Index. It isn’t surprising seeing that stock markets worldwide tried

to weather a credit crisis, slowing economic growth, rising commodity prices, the declining

dollar and disappointing earnings.11

High energy prices took a toll on consumer confidence and the credit crisis started to

spread into all markets, this resulted in reduced discretionary spending. Job growth has been

slowing over the past couple of years; technology and outsourcing driving this in the US. 2008

started out with exceeding high reports of job losses (76,000 in January and February and 80,000

in March alone). The Bureau of Labor Statistics reported the unemployment rate to be at 5.1%

in March. The Institute for Supply Management had surveyed manufacturing and

nonmanufacturing firms and concluded a contraction in business activity; however, the

weakening dollar has kept GDP growth positive with increased exports. Consumer prices rose at

a 3.1% rate for the first quarter of 2008 that compares to a 4.1% increase from all of 2007.

Energy prices advanced at 8.6%, in comparison to the 17.4% increase of 2007.12 Perspective at

the end of March was that both the CPI and energy prices were on target to reach an all time

inflationary high this year.

Poor sector returns continued to drive forecasts toward an inevitable recession. The

biggest loser was surprisingly not financials but rather information technology. This puts large

woes into investment outlooks because the last recession was excentuated by downtern in

technology spending that lasted until 20028. Energy stocks even took a loss in the first quarter of

over -7%. This was surprising due to the sharp rise of oil prices. This was unnerving because at

this time, economists felt the energy sector would be a main factor in recovery in up-coming

months.

11

The Vanguard Group. Global Market Currents. First Quarter 2008.

https://advisors.vanguard.com/iwe/pdf/GlbCurrt_1Q08.pdf. Retrieved 11/15/08

12

http://www.bls.gov/cpi/cpid0803.pdf

9

Second Quarter 2008

Slowing growth and rising inflation took main concern in June. Investors learned in May

that unemployment was at a 4-year high, while consumer confidence fell to its lowest point since

1992. All these factors contribute to the suspected scenario of stagflation.13

US equities market were again in the red, returning -1.5% with the 1-year return equaling

-12.3%. Investors are continuing to liquite their positions in the equity markets and putting their

assets in safer securites, however, the Lehman Aggregate Bond Index showed a negative return

for the 2nd quarter at -1.0% but the 1-year return is above 7.0%. The bond market was battling

conflicting pressures through the first half of 2008. Many financial services firms are caught in

the middle of the credit crisis and couldn’t raise capital because they were so highly leveraged it

was against their bond provisions to issue more debt. The only market with liquidity was for US

treasuries. By 2008 both households and financial services debts exceeded 100% of income and

GDP, respectively14.

Risk spreads continue to increase as the market questions government entities Fannie

Mae and Freddie Mac. Home foreclosures continue to rise above 250,000 a month and accelerate

13

The Vanguard Group. Global Market Currents. Second Quarter 2008.

https://advisors.vanguard.com/iwe/pdf/GlbCurrt_2Q08.pdf. Retrieved 11/15/08

14

Steidtmann, Carl: Deloitte Investment Advisors. Economic and Market Review. Second Quarter 2008.

http://www.deloitte.com/dtt/cda/doc/content/dtt_dr_emr2q2008.pdf. Retrieved 11/15/08

10

the de-leveraging process of households. Analysts predict as many as 3% of homeowners could

lose their homes this year.

In May, rebate checks gave disposible income a boost but many surveys indicate that

citizens believe most of that will be absorbed by increasing energy prices. Oil prices soared 38%

over the course of the third quarter.

Financials are down 16.4% and massive write downs have put a need for fast capital but

investors are risk adverse to this failing sector. Rising commodity prices are putting a large

pressure on all places of the economy, even the consumer staples sector that usually fairs well in

economic slowdown. Proctor and Gamble fell 13% on the inability to pass costs off to

consumers. However the S&P 500 earnings per share report shows that the economy still has a

(slower) steady growth.

Third Quarter 2008

Bankruptcies and frozen credit markets caused investors to suffer the most volatile

quarter in history. The S&P 500 posted +/- 1% on over half of the trading days between June and

September. Equity investors fled to the biggest names of the S&P to ensure safety. The top 50

corporations returned 0.44% while the remaining 450 returned -8.40%15.

Global governments and central banks took unprecedented action to try and improve

liquidity and curb skepticism in the security markets. The Troubled Asset Relieve Program

(TARP) was first denied and not passed through the House of Representatives. The Dow

crashed nearly 800 points, and the S&P fell 9% only to recover more than half that value in the

next 24 hours. The TARP gave the US Treasury the right to inject over $700 billion into the

financial services sector. The intent was to create a market for toxic securities and sustain

15

American Century Ivestments. Quarter in Review.

https://institutional.americancentury.com/institutional/pdf/quarterly_reviews/in_market_commentary_3Q08.pdf.

Retrieved 11/20/2008.

11

solvency. As mentioned earlier, the credit crisis started with the Commerical Paper market in

late 2007. At this time, the government agreed to buy Corporate Commercial Paper from main

street businesses, essentially squashing the suggestions that the US government is only helping

the wealthy Wall Street corporations.

The Fed also is now allowing corporations to borrow money from the discount window.

This allows companies to borrow at a significantly lower rate however there are many

regulations that come with the government’s money16. Coinciding with the United States’

‘bailout’ plan, other central banks are creating relief with government intervention. By the end

of the third quarter Central banks worldwide coordinated cuts in target interest rates. These

incentives failed to help the companies (formerly) known as: Fannie Mae, Freddie Mac, Lehman

Brothers, Merrill Lynch, Washington Mutual, and Wachovia. Also AIG accepted government

intervention. On September 14th the US government announced it will not bail about Lehman

Brothers. The bankruptcy of Lehman Brothers caused a large money market fund to ‘break the

buck’ meaning that the net asset value per share was less than $1. The US Treasury then

implemented a program to support money market mutual funds.

US stocks are returning (1-year) -21.1% (-8.6% on the quarter). Lehman Aggregate Bond

Index held at -0.5% for the quarter, and is still in the black at 3.7% 1-year17. This indicates

investors were keeping all instruments in short term cash-like instruments and also keeps bond

yields near zero. The market has made very high-risk spreads and low-to-zero return on risk free

assets.

Institute for Supply Management’s reports manufacturing has shriveled to its lowest level

since 2001 indicating a looming recession. Exports were down from July but are still 15%

16

The Vanguard Group. Global Market Currents: Third Quarter 2008.

https://advisors.vanguard.com/iwe/pdf/GlbCurrt_092008.pdf. Retrieved 11/16/08

17

MSCI US Investable Market 2500 Index. As of September 30, 2008. Retrieved 11/16/08

12

higher than last year.and are no longer saving GDP growth measures from entering into the

negatives.

The dollar value has started to gain on the Euro and the British pound thus decreasing

values of exports so few think a recession is not near. Partially this is due to the exponential loss

in international equity markets, -21.9% for the quarter and -30.3% for the one year return (MSCI

ACWI ex US). In developing countries, there were large losses in the 3rd quarter due to plunging

commodity prices, especially oil which reached its bubble burst, and is well under $70 at this

point, after hitting a peak in July. Gold prices also lost about 20% of its value in the 3rd quarter

after trading above $1,000 an ounce. Some believe the end of September marked the bottom of

the recession and see the election as a ‘fresh beginning’. Although some see many other

corporations being brought down by the credit crisis and without a bouy because they aren’t

eligble to participate in the government bailout plan.

Fourth Quarter 2008

The focus during the start of the fourth quarter was details of the bailout plan. The

deadline for banks to apply for the TARP program was extended to Novemeber 15th for nonpublicly traded instituions18. This could broaden its scope to over 4,000 banks. The government

further indicated that financing arms’ of automakers would not be included in the over $700

18

http://biz.yahoo.com/ap/081031/financial_meltdown.html?.v=23

13

billion plan. However signals of another $100 billion could be allocated to purchase bad assets,

such as auto loans, so they can remove them from their balance sheets.

Volatility was again the theme of October. The best week in 34 years when the Dow rose

144 points on the 31st could not come back from a $2.5 trillion loss for the month of October

(17.7% loss)19. The first days of the month, the Dow lost 2,400 points and there were only 3

days when the change in volume (negative or positive) didn’t reach triple digits.

The bailout package changed in November. The US Treasury will no longer buy toxic

assets from troubled financial institutions. This made investors and citizens uneasy about

effectiveness of government intervention. The market continues to lose faith in the potential to

“turn it all around”. If toxic/unvaluable assets are still on the balance sheet of nearing-bankrupt

companies, how will the $700 bailout plan save them from re-entering the crisis of past months?

As for economic indicators, CPI was down 0.3% for October. This was a good report for

those questioning inflationary pressures, however this can be seen as a negative report for the

status of consumer confidence. The CPI will not rise if the demand for products decreases. Oil

continues to fall irregardless of OPEC’s consensus to cut production. Prices held under

$60/barrel for the first 2 weeks of November. This helps retailers because they are not as quick

to pass the savings on to consumers as they were to raise prices with the bubble in July. Thus

their margin for profit continues to grow. Imports and exports both recorded losses, -4.7, -1.9%

respectively. The dollar has been gaining on the Euro and Yen so the export loss is expected

because international consumers lose purchasing power, however the import decrease was

surprising to most economists. It proves that domestic demand trumpts what should have

happened.

19

Dow Jones Wilshire 5000 Index. October 31, 2008.

14

The corporate landscape continues to flood the market with bad news. Company layoffs,

rising unemployment and drop in retail sales all remind people of economic slowdown.

Consumer staples and discount retailers are the only industry showing postitive earnings, but

even their bottom line is squeezed by higher costs and lower demand. McDonalds sales in the US

was +5.3%, in the EU was +9.8%, and in Asia was+11.5%. AIG is asking for a new life line of

$150 bil which leads investors to doubt the solvency of the company.

Fixed Income Portfolio

I believe we are at the bottom of the financial crisis. I predict things will turn around

within the next 6-9 months in which case interest rates will rise and prices will fall in the fixed

income markets. So I have selected bonds that have a duration shorter than the Lehman

Aggregate Bond Benchmark (currently at 4.39). Your portfolio will have a significantly lower

credit quality than the Lehman Benchmark. Lehman breakdown: 79.2% in AAA rated bonds;

5.4% in AA, 8.2% in A, and 7.2% in BBB. Your portfolio has 11.76% in AAA, 17.65% in AA,

30.88% in BBB, and 39.71% in CCC or junk bonds. This agrees with my predictions that

interest rates will rise in the near furture, thus the lower-quality, high-yields bonds will beat the

benchmark. Current yield on your portfolio equals 6.58% and convexity is over 23. Below is a

chart showing your portfolio to the Lehman Aggregate followed by details about your bond

portfolio:

Lehman

Aggregate

Portfolio of Fixed Income

YTM

Current Yield

Duration

Convexity

15

13.324%

6.008%

3.6398

20.0993

0.020%

0.080%

4.39

n/a

Corporate Bond Analysis 1:

USEC Inc. CCC rating since initial evaluation on 2/26/2007

Commercial power plants use low enrichment uranium to produce fuel to generate

electricity. USEC Inc. is a leading supplier for US plants. One kilogram of uranium can produce

about 20 trillion joules of energy (2×1013 joules); as much energy as 1500 tones of coal.20

Commercial nuclear reactors began using enriched uranium in the 1960s when the U.S.

government transferred some of its capacity from military to civilian use.

In the early 1990s, USEC was created as a government corporation in order to restructure

the government’s uranium enrichment operation and prepare it for sale to the private sector.

USEC went private with an IPO July 28, 1998. USEC Inc.’s subsidiary, United States

Enrichment Corporation, operates the only uranium enrichment facility in the United States.

USEC’s core business is to supply low-enriched uranium or ‘depleted’ uranium. But they also

provide services and transportation of uranium for the global market.

USEC is the U.S. government’s executive agent for the Megatons to Megawatts program;

a 20-year, $8 billion, commercially-funded nuclear nonproliferation initiative of the U.S. and

Russian governments. This unique program is recycling 500 metric tons of weapons-grade

uranium taken from dismantled Russian nuclear warheads (the equivalent of 20,000 warheads)

into low enriched uranium used by USEC’s customers to generate electricity21.

I chose this bond to add to your portfolio because USEC Inc. is forward-thinking,

innovative, and is pioneering the effort into alternative energy. The long-term outlook for the

nuclear industry continues to strengthen as government policy, public acceptance and

environmental concerns about climate change have encouraged utilities to begin the process of

20

21

Emsley, Nature's Building Blocks (2001), page 479. Retrieved 11/18/08

http://www.usec.com/quickfacts.htm

16

building new nuclear reactors in the United States for the first time in four decades. The US

Nuclear Regulatory Commission has indicated that nearly 36 new applications for construction

of nuclear reactors are expected by 201222.

According to financial analysis, USEC has historically had very strong liquidity ratios.

The debt within the Cash Flow Statement is mostly long term so their current ratio is more

similar to that of a AAA company. What appears to be a severe cash flow problem (TIE and

Cash Flow Adequacy ratios) is explained clearly in the company’s annual report. Basic synopsis

is that they have fixed-price contracts for the electric power they purchase (they are one of the

largest industrial consumers of electric power in the US). In 2008 where it appears their cash

flow problems began, the fuel cost adjustment has increased over the base contract price by 13%

through September 3023. They have a very low liabilities-to-asset ratio which secures repayment

if they default. More so most of their assets are short term and thus very liquid. USEC Inc also

does not have a large amount of outstanding debt so I do not foresee repayment as an issue.

The current yield and yield to maturity is significantly higher than what can be achieved

in US treasuries (a common characteristic of low-grade junk bonds). However I feel this is a

safe investment because most of their book of business is with US government subsidiaries:

Department of Energy and Gaseous Diffusion Plants (GDPs). They also do not have any

competition in that they are they only uranium enrichment facility in the United States.

I chose this bond to analyze because it is in an unpopular, under-discovered industry. I

wanted to create a fairly aggressive portfolio so I focused on low coupon bonds with higher

convexity than competitors. I believe interest rates will rise (there is not much room to go down

from 1.00%) so I want to keep the maturity under 7 years.

22

23

USEC Annual Report. http://usec.com/SECfilings. Retrieved 11/19/2008

USEC Quarterly Report. http://biz.yahoo.com/e/081105/usu10-q.html. Retrieved 11/18/08

17

Corporate Bond Analysis-2

Molson Coors (TAP): BBB rating since initial evaluation on 11/16/2007

Molson Coors Brewing Company (MCBC) originated as Adolph Coors Brewing

Company in 1873 and changed its name to Molson Coors in 2005. The company produces and

sells beer and other beverages. Common brand names are Coors, Molson, Blue Moon Belgian

White Ale, Keystone, George Killian’s, Amstel, and Heineken, and others. According to the

company website, MCBC is the fifth largest brewer by volume with 42.1 million barrels sold in

2006, 56% of that sold in the United States.24 Coors Light is its best seller and recorded about

45% of its sales volume.

There are several factors that contributed to my decision to add Molson Coors to your

bond portfolio. First are there very public efforts to reduce costs ($250 million Resources for

Growth initiatives) and strengthen the brand name. Part of this effort was combining synergies

with other developed companies. In 2007 they announce that effective July 1, 2008 Molson

Coors and Miller Brewing will combine the US and Puerto Rico operations. They exceeded their

synergies plan of $175 million and ended the program with over $180 million in savings.

They’ve initiated a Global Strategies Team that focuses on developed market penetration. One

of their main areas of interest is to develop markets in Europe, especially Ireland. In 2007 their

net sales growth was near 6% and refinanced ¼ of their debt reducing non-operating expenses by

over $26 million annually24.

Financial analysis indicates the Molson Coors is a leading competitor in its industry and

posed above-average numbers for liquidity, debt, and ratios. The liquidity ratios are above

averages for the industry and their main competitor however many of their current assets are tied

24

Molson Coors Company Website. http://www.molsoncoors.com/. Retrieved 11/20/08.

18

up in inventory. Their debt ratios are significantly lower than the industry meaning if they were

to go bankrupt you can be assured repayment of principal in the case of liquidation. The

company has reduced their interest expense significantly in 2008 after initiatives to redesign their

capital structure and write off ¼ of their debt, as mentioned earlier. This negatively affects the

cash flow ratios, and is possibly what make this company the lowest of investment grade ratings.

It appears they under-budget for their minimum required cash flows, which sits uneasy with

investors looking for high-grade bonds.

This follows my portfolio strategy of an aggressive fixed income portion. Molson Coors

has a low coupon, high convexity to its peers. I expect interest rates to rise in the near future (69 months) so I want to keep the maturity of the heaviest weights in my bond portfolio less than 7

years.

Additional Bonds

Wal-Mart Corporation: S&P AA rating since 8/29/01, Moody’s Aa2 rating since 3/7/96

Wal-Mart is a discount retailer that operates in different capacities worldwide.

Stores offer general merchandise, grocery merchandise, financial services and products,

pharmaceuticals, gasoline stations, and photo processing services through supercenters, discount

stores and Sam’s Club Stores.

I selected this bond to add to my portfolio to add some stability and hedge to the riskier

bonds I’ve selected. This is considered a safer instrument then the other bonds in your portfolio

(as given by the credit rating). Its higher credit rating means you can expect the yield will be

lower. It also has a lower convexity, and a higher coupon. This is cash flow oriented and

focuses on reinvestment. This is a tactic used when the future is uncertain and the investor wants

shorter time in a fixed payment.

19

Cash

I have liquidated $12,000 worth of t-bills to reallocate and diversify the total portfolio.

The remaining $25,000+ will satisfy my strategy of keeping of 2% of the total portfolio in cash.

This instrument also helps to balance out my aggressive fixed income portfolio. Here is a graph

of the current yield of 3-month t-bills with the pre-existing wealth:

Date

11/19/2008

CF

Capital

Gains

Beginning

Current Savings

Balance

$37,416.05

($12,234.19)

($21,350.58)

Aggregate

Savings

$25,181.86

Yield

0.70%

Ending

Balance

$25,225.92

$3,875.34

($775.07)

Real Estate and Commodities

I chose to allocate 8% of beginning wealth into real estate and 10% into commodities.

That constitutes for $100,727.00 and $125,909 respectively. I chose to put 50% of the real estate

allocation ($50,363) into Cohen and Steers ETF (NYSE: GRI). This investment seeks to

replicate the Cohen & Steers Global Realty Majors index. The fund normally invests at least

90% of total assets in common stocks and other equity securities that comprise the index, which

may include American depositary receipts, American depositary shares, global depositary

receipts and international depositary receipts. The index consists of the largest and most liquid

securities within the global real estate universe25. You already have a large percentage of your

portfolio in international markets, however, I believe that international real estate is a good

investment at this time because the real estate market in the US is essentially frozen with the

credit markets. Investing in international real estate will further diversify. This will be one part

of your portfolio we will closely monitor to re-allocate once we see an opening in global credit

markets. The remainder of the allocation toward real estate will go in a Vanguard REIT Index

25

Cohen and Steers Global Realty ETF. http://finance.yahoo.com/q/rk?s=GRI. Retrieved 11/21/08.

20

Fund Investor Shares. This is a no load fun that aims to track the return of the MSCI® US REIT

Index, a gauge of real estate stocks26. The Vanguard Index slightly outperforms the benchmark

in the 1-month, 1-, 3-, and 5- year returns. The following chart exhibits important information:

Fund Size

$7.2 billion

Minimum Investment

$3,000.00

Total Expenses:

*expense ratio

0.20%

*redemption (if < 1 yr)

1.00%

Beta

1

R2

1

Performance Benchmark

MSCI US REIT Index

Mgmt Tenure

Gerard O'Reilly since 1996

For the commodity portion of your portfolio, I suggest including 33% of the $125,909 in the TR

Price Latin America Fund (PRLAX). The investment seeks long-term capital appreciation. The

fund normally invests at least 80% of assets in Latin American companies27. It invests at least

four countries at any time. I chose this fund because the 5-year average return exceeds 20%.

There is some volatility in developing markets like Latin America. However the rates of return

have began to settle in the past five years and the sharpe ratio is increasing indicating a higher

return for less risk. Below is a chart showing relevant data:

Fund Size

Minimum Investment

Total Expenses:

*expense ratio

*redemption (if < 1 yr)

Beta- 5 year

SD- 5 year

R2- 5 year

Sharpe Ratio

Performance Benchmark

Mgmt Tenure

26

$2.26 billion

$2,500.00

1.20%

1.00%

1.66

30.49

79

0.7

MSCI US REIT Index

Gonzalo Pangaro since

1/31/2004

The Vanguard Group.

https://personal.vanguard.com/us/JSP/Funds/Profile/VGIFundProfile0123Content.jsf?tab=0&FundId=0123&FundI

ntExt=INT#hist::tab=0. Retrieved 11/21/08.

27

Yahoo! Finance. T. Rowe Price Latin America Fund. http://finance.yahoo.com/q/rk?s=PRLAX. Retrieved 11/21/08.

21

The remaining 70% of the commodity allocation, I would suggest putting in the DowJones Commodity Index Total Return (DJP). The investment seeks to link to the Dow JonesAIG Commodity Total Return index and reflects the returns that are potentially available through

an unleveraged investment in the futures contracts on physical commodities comprising the

index plus the rate of interest that could be earned on cash collateral invested in specified

Treasury Bills28. This helps to diversify your commodity exposure and is backed by actual

assets.

Please review this report and notice the propensity for New Ideas Inc. to provide a higher risk

adjusted rate of return than other managers. Of course all asset allocations are subject to

discussion if you feel your risk tolerance has changed or you need further assistance in

understanding the portfolio.

28

Yahoo! Finance. Dow Jones Commodity Index Total Return. http://finance.yahoo.com/q/pr?s=DJP. Retrieved

11/20/2008.

22

Additional Sources

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

Yahoo! Finance. www.finance.yahoo.com. Retrieved: 9/30/2008-11/22/2008

Bank Rate. www.bankrate.com. Retrieved: 10/18/2008-10/28/2008

MSCI/Barra. www.mscibarra.com. Retrieved: 10/20/2008

Vanguard. www.vanguard.com. Retrieved: 10/18/2008- 11/21/08

Federal Reserve Bank of St. Louis. www.frbsl.com. Retrieved: 10/17/2008

Case Shiller.

http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/.

Retrieved: 10/17/2008

Coldwell Banker. www.coldwellbanker.com. Retrieved: 10/22/2008

Securities Industry and Financial Markets Association. http://investinginbonds.com/.

Mergent Bond View.

http://bv.mergent.com.ezproxy.library.drexel.edu/view/scripts/corporate/index.php.

The Vanguard Group.

https://advisors.vanguard.com/VGApp/iip/site/advisor/researchcommentary/commentary/artic

le?File=IWE_NewsMktComm2QTR07. Retrieved 11/15/08

Federal Reserve Bank of San Francisco. http://www.frbsf.org/news/speeches/2007/0221.html.

Retrieved 10/27/2008

Wines, Leslie. Steeper yield curve may signal improving economy. June 20, 2007.

http://www.marketwatch.com/news/story/steeper-yield-curve-stirsdebate/story.aspx?guid={675A092A-6B3C-49E6-8417-7BB2D2CD19B2}. Retrieved 11/19/08

Bloomberg. www.bloomberg.com. Retrieved 11/20/08.

Federal Reserve Bank of San Francisco. http://www.frbsf.org/news/speeches/2007/0221.html.

Retrieved 10/27/2008

http://www.bea.gov/newsreleases/industry/gdpindustry/gdpindnewsrelease.htm. Retrieved

10/27/2008

http://www.bls.gov/cpi/cpid0803.pdf

Steidtmann, Carl: Deloitte Investment Advisors. Economic and Market Review. Second Quarter

2008. http://www.deloitte.com/dtt/cda/doc/content/dtt_dr_emr2q2008.pdf. Retrieved

11/15/08

American Century Ivestments. Quarter in Review.

https://institutional.americancentury.com/institutional/pdf/quarterly_reviews/in_market_com

mentary_3Q08.pdf. Retrieved 11/20/2008.

Emsley, Nature's Building Blocks (2001), page 479. Retrieved 11/18/08

http://www.usec.com/quickfacts.htm

23