LecturePPTSample - Toronto School of Finance

advertisement

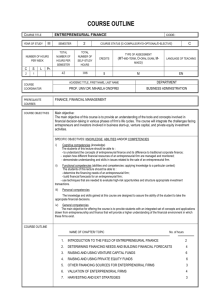

1- 1 Entrepreneurial Finance Lecture 1: Introduction Anton Miglo Fall 2015 Entrepreneurial Finance 1, Anton Miglo 1- 2 Organizational comments Blackboard: course outline, grades, announcements, PPT slides Quizzes Assignments Business cases On-line game Excel practice Class participation Entrepreneurial Finance 1, Anton Miglo 1- 3 Course plan Introduction Start-up financing Short-term financial planning and cash management Entrepreneur’s financial portfolio and wealth management Financial analysis Financial projections and bank financing Venture capital and angel financing Capital structure management Financial distress Succession strategy and exit strategy Entrepreneurial Finance 1, Anton Miglo 1- 4 Lecture 1: Topics Entrepreneurship Entrepreneurial finance Entrepreneurial finance ideas and principles Financially sound business plan Screening entrepreneurial ideas vs. traditional firm’s analysis Choice of organizational type and form for entrepreneurial firms and entrepreneurial ventures. On-line game: overview and quarter 1 Exercises: evaluating the financial attractiveness of entrepreneurial ideas, choice of org. form, Long. Ch.10 situation 1,2 Excel: ROA etc. ideas, start-up cost calculations? Cases: 1) Longenecker p. 492 Case 3, 2) Long. Ondraga Readings: Leach 1,2,3 Long. 1, 10, Adelman 1,2 Entrepreneurial Finance 1, Anton Miglo 1- 5 ENTREPRENEURIAL OPPORTUNITY In 2010, 2.7 million Canadians were selfemployed and according to a report published by the BDC, indicators show that the level of entrepreneurial activity in Canada has increased. Approximately 10 % of the Canadian population currently owns a business and, looking to the future, 11.2 % of Canadians intend to start a business at some point in their lives Entrepreneurial Finance 1, Anton Miglo 1- 6 Entrepreneurship Fundamentals Entrepreneurship: process of changing ideas into commercial opportunities and creating value Entrepreneur: individual who thinks, reasons, and acts to convert ideas into commercial opportunities and to create value Entrepreneurs: active owner-managers second-generation operators of family-owned firms franchisees owner managers who have bought out the founders of existing firms Small business managers: receive specified compensation do not assume ownership risks Entrepreneurial Finance 1, Anton Miglo 6 1- 7 WHAT IS A SMALL BUSINESS? Criteria Financing supplied by one person or small group Localized business operations (except marketing) Business’ size small relative to larger competitors Fewer than 100 employees According to Statistics Canada, in 2009: 1,114,915 small businesses in Canada 98 % have fewer than 100 employees contribute about 42 % to Canada’s GDP employ 48 % of total labour force in private sector 46 % have female ownership 87 % of Canadian exporters and make up 21 % of Canada’s total value of exports 75 % operate in service industries 25 % in goods-producing industries Entrepreneurial Finance 1, Anton Miglo 1- 8 Entrepreneurial Finance Entrepreneurial Finance application and adaptation of financial tools and techniques to the planning, funding, operation, and valuation of an entrepreneurial firms and venture firms focuses on the financial management of a firm as it moves through its life cycle, beginning with its development stage & continuing through to when the entrepreneur exists or harvests the venture Entrepreneurial Finance 1, Anton Miglo 1- 9 Checkpoint Entrepreneurs provide the financing to individuals who think, reason, and act to convert ideas into commercial opportunities and create opportunities. True False Entrepreneurial finance is the application and adaptation of financial tools and techniques to the planning, funding, operations, and valuation of an entrepreneurial firm or venture firm. True False Entrepreneurial Finance 1, Anton Miglo 1- 10 E-Finance Principles 1. Real, Human, and Financial Capital Must be Rented from Owners Money has owners and therefore costs: Time value and Risk Expect to provide a return or the venture will not survive in a market economy 2. While Accounting is the Language of Business, Cash is the Currency Cash flow is a new venture’s lifeblood 3. New Firm’s Financing Involves Search, Negotiation, and Privacy Private Financial Markets: customized contracts bought and infrequently sold in inefficient private negotiations Entrepreneurial Finance 1, Anton Miglo 10 1- 11 E-Finance Principles (cont.) 4. A Firm’s Financial Objective can be different from public companies Initial stages of development vs. later stages Venture firms vs. traditional small business Firm’s objectives vs. personal ones Often, the unifying financial objective is to increase value 5. It is Dangerous to Assume that People Act Against Their Own Self-Interest Aligning incentives (investors, founders, employees, spouses, etc.) is critical As situations change, incentives diverge and renegotiation is important Owner-manager conflicts: differences between a manager’s self-interest and that of the owners who hired him/her Owner-debtholder agency conflict: divergence of the owners’ and lenders’ selfinterests as the firm gets close to bankruptcy 6. Firm’s Character and Reputation Can be Assets or Liabilities Firms have character that can be different from the individuals who founded or manage it Many entrepreneurs state that reputation is one of a firm’s most important assets and is critical to long-term success and value Entrepreneurial Finance 1, Anton Miglo 1- 12 Checkpoint New Firm’s Financing Involves Search, Negotiation, and Privacy. True False Entrepreneurial Finance 1, Anton Miglo 1- 13 Components of a Sound Business Model Generate Revenues (You must have customers and sell them something) Make Profits (You must eventually have revenues that exceed the expenses of generating those revenues) Produce Free Cash Flows (You must generate cash inflows that exceed net working capital and capital expenditures) Entrepreneurial Finance 1, Anton Miglo 1- 14 Best Financial Practices Prepare detailed monthly financial plans for the next year and annual financial plans for the next five years Anticipate and obtain multiple rounds of financing as the venture grows Efficiently and effectively manage the firm’s assets, financial resources, and operating performance Plan an exit strategy consistent with the entrepreneur’s objectives and business plan Entrepreneurial Finance 1, Anton Miglo 1- 15 Checkpoint Best practices of entrepreneurial or venture firms applied in the financial practices area include preparing detailed monthly financial plans for the next year and annual financial plans for the next three-five years. True False Entrepreneurial Finance 1, Anton Miglo 1- 16 Screening Entrepreneurial Opportunities Opportunity screening: assessment of an idea’s commercial potential to produce revenue growth, financial performance, and value Our approach: Qualitative screening: Interview with the Founder Quantitative screening: Indicators Entrepreneurial Finance 1, Anton Miglo 1- 17 Qualitative Screening: Interview Four Factor Categories Initially Evaluating a Potential Firm’s Attractiveness: 1. 2. 3. 4. The Big Picture Know Thy Customer Production and Development Challenges Financial Fortune-Telling Entrepreneurial Finance 1, Anton Miglo 1- 18 Entrepreneurial Finance 1, Anton Miglo 1- 19 Entrepreneurial Finance 1, Anton Miglo 1- 20 Quantitative Screening: Indicators Attempt to quantify the following areas Industry/Market Pricing/Profitability Financial/Harvest Management Team Supplement to, rather than replacement of, basic qualitative Q&A approach Entrepreneurial Finance 1, Anton Miglo 1- 21 Example 1 ATTRACTIVENESS Criterion Favorable Unfavorable Need for the product Well identified Unfocused Customers Reachable; receptive Unreachable; strong loyalty to competitor’s product or service Value created for customers Significant Not significant Market structure Emerging industry; not highly competitive Mature or declining industry; highly concentrated competition Market growth rate Growing by at least 15% a year Growing by less than 10% a year Moderate to strong Weak to nonexistent Proprietary information or regulatory protection Have or can develop Not possible Response/lead time advantage Competition slow, nonresponsive Unable to gain an edge Legal/contractual advantage Proprietary or exclusive Nonexistent Well developed; accessible Poorly developed; limited Return on investment 25% or more; sustainable Less than 15%; unpredictable Investment requirements Small to moderate; easily financed Large; difficult to finance Time required to break even or to reach positive cash flows Under 2 years More than 4 years Management Capability Management team with diverse skills and relevant experience Solo entrepreneur with no related experience Fatal flaws None One or more Market Factors Competitive Advantage Control over prices, costs, and distribution Barriers to entry: Contacts and networks Economics and Finance Entrepreneurial Finance 1, Anton Miglo 1- 22 “High” gives score 3, average -2 and low -1 Entrepreneurial Finance 1, Anton Miglo 1- 23 ROA Model Considerations Case 1: High Profit Margins & Low Asset Turnovers (often high price/high performance) Examples: products and services based on technological innovations Case 2: Low Profit Margins & High Asset Turnovers Examples: commodity-type products and services Entrepreneurial Finance 1, Anton Miglo 1- 24 Checkpoint All else held constant, a higher asset turnover usually: a. increases ROA b. decreases ROA c. has no effect on ROA Entrepreneurial Finance 1, Anton Miglo 1- 25 Smitty’s Li’l Haulers Entrepreneurial Finance 1, Anton Miglo 1- 26 K. Ondraya Entrepreneurial Finance 1, Anton Miglo 1- 27 Forms of Business Organization Sole proprietorship Ease of formation/ termination Owners liability Easy Unlimited Separate legal entity Degree of control Taxes Transfer of ownership Partnership Relatively Easy Usually unlimited No Complete Opportunities to raise capital Strong Entrepreneurial Finance 1, Anton Miglo Requires agreement of the partners Limited Complex Limited Yes Based on personal Income taxes Limited Corporation Separation of control and ownership Corporate Income Tax & tax on dividends Unlimited Large 1- 28 Checkpoint 1. Which one of the following is correct regarding a limited partnership? a. A single partner(s) is given control over the operations of the partnership. b. Each partner has unlimited liability for the partnership debts. c. Each partner's liability for the firm's debts is limited to each partner's investment in the firm. Entrepreneurial Finance 1, Anton Miglo 1- 29 Entrepreneur’s Personal Finance vs. Firm’s Finance Personal Budget List all Income Items Net income, spouse’s net income Rental income, pension income, alimony, EI, public assistance, allowance List all Expense Items Home, utilities, food, family obligations (daycare, baby-sitting, child support, alimony) Health and medical (insurance, fitness clubs, massages) Transportation (car payments, gas, maintenance, insurance, license, tolls) Debt payments (student loans, credit cards, lines of credit, other loans) Entertainment / Recreation (cable, internet, movies, alcohol, hobbies, vacations) Investments & Savings (RSP contributions, non-registered savings, emergency fund) Miscellaneous (gifts, grooming, toiletries, pets, others) Monthly Income minus Monthly Expenses = Surplus or Deficit Entrepreneurial Finance 1, Anton Miglo 1- 30 Financial Statement (Personal Form) Used for single bank loan application form (personal or individual business purposes) which incorporates two individual financial forms: Statement of financial position • Cash • Cash Equivalents • Invested Assets • Use Assets • Liabilities • Net Worth Personal cash flow statement • Income • Fixed Expenses • Variable Expenses Entrepreneurial Finance 1, Anton Miglo 1- 31 Table 3 -1, Financial Statement, Personal Form FINANCIAL STATEMENT Personal Form FIRST ANY KIND OF BANK: NAME: ADDRESS: CITY, STATE, ZIP SPOUSE NAME: ASSETS CASH IN THIS BANK: CHECKING SAVINGS: CASH IN OTHER FINANCIAL INSTITUTIONS: MARKETABLE STOCKS AND BONDS; (SCHEDULE 1) ACCOUNTS RECEIVABLE: (SCHEDULE 2) TOTAL CURRENT ASSETS NOTES OR MORTGAGES RECEIVABLE: (SCHEDULE 3) CASH SURRENDER VALUE LIFE INSURANCE: (SCHEDULE 4) VEHICLES (YEAR & MAKE): REAL ESTATE: (SCHEDULE 5) OTHER PERSONAL PROPERTY: TOTAL ASSETS: ANNUAL INCOME: GROSS SALARY: SPOUSE'S GROSS SALARY: BONUSES & COMMISSIONS: INCOME FROM SECURITIES: (SCHEDULE 1) RENTAL OR LEASE INCOME (SCHEDULE 3) MORTGAGES OR CONTRACT INCOME (SCHEDULE 3) OTHER INCOME (DESCRIBE): TOTAL GROSS INCOME: LESS - TOTAL EXPENSES: NET CASH INCOME: Entrepreneurial Finance 1, Anton Miglo IN DOLLARS OFFICE: SOCIAL SECURITY NO: BUSINESS PHONE: HOME PHONE: SOCIAL SECURITY NO: LIABILITIES: LOANS PAYABLE THIS BANK: LOANS PAYABLE OTHER FINANCIAL INSTITUTIONS: (SCHEDULE 6) ACCOUNTS PAYABLE OTHER FIRMS & INDIVIDUALS: (SCHEDULE 6) CREDIT CARDS: INCOME & OTHER TAXES PAYABLE: REAL ESTATE TAXES: TOTAL CURRENT LIABILITIES: OTHER REAL ESTATE INDEBTEDNESS (SCHEDULE 5): LIFE INSURANCE LOANS: (SCHEDULE 4) OTHER LONG TERM DEBTS: (DESCRIBE) TOTAL LIABILITIES: TOTAL ASSETS - TOTAL LIABILITIES = NET WORTH ANNUAL FIXED EXPENSES: REAL ESTATE PAYMENTS: (SCHEDULE 3) RENT INCOME TAXES: PROPERTY TAXES: ALIMONY, CHILD SUPPORT: INSURANCE PREMIUMS: OTHER (DESCRIBE): TOTAL ANNUAL EXPENSES: IN DOLLARS Personal Income Statement 1- 32 (Cash Flow Statement) Income: include all sources Wages, tips, overtime Interest on savings, stock dividends, etc. Fixed Expenses Contractual, which must be paid Rent, Insurance, Utilities, Car Payments, etc. Variable Expenses You control level of expenses (food, clothing) Entrepreneurial Finance 1, Anton Miglo 1- 33 Table 3-2 Jones Family, Personal Income Statement The Tom Jones Family Personal Income Statement (Cash Flow Statement) January 1, 2013 to December 31, 2013. INCOME Salaries Interest Income TOTAL INCOME FIXED EXPENSES Mortgage Payment Automobile Payment Property Taxes Insurance Income Taxes Savings & Investment Personal Loan Payment TOTAL FIXED EXPENSES $ $60,740 $ 9,600 5,040 1,235 4,500 5,032 1,200 900 VARIABLE EXPENSES Food $ 5,485 Transportation 2,500 Utilities 1,800 Clothes & Personal 2,700 Recreation & Vacation 2,780 TOTAL VARIABLE EXPENSES TOTAL EXPENSES (Cash Balance at the end of the year) Entrepreneurial Finance 1, Anton Miglo 60,000 740 $ 27,507 $ 15,265 $ 42,772 $ 17,968 1- 34 Business Income Statement Basic Format Sales, Revenues, Income from doing business. Less Cost of Goods Sold Gross Profit Less Operating Expenses Operating Income Less Interest Net Income (Explain) Entrepreneurial Finance 1, Anton Miglo 1- 35 Table 3-3 The Tom Jones Company Income Statement January 1, 2013, through December 31, 2013 Gross Sales $ 350,642 Less: Returns and Allowances 2,366 Net Sales $ 348,276 Cost of Goods Sold 124,276 Gross Profit Operating Expenses: Salaries Expense Rent Expense Property Taxes Expense Depreciation Expense Utilities Expense Advertising Expense Insurance Expense Total Operating Expenses $ 224,000 $ 95,000 24,000 2,500 6,000 10,250 9,250 3,000 150,000 Operating Income Other Expenses: Interest Expense Net Income* $ 74,000 $ 64,000 10,000 *This line on an Income Statement for a Corporation appears as Net Income before Income Taxes see Table 3-3a Entrepreneurial Finance 1, Anton Miglo 1- 36 Table 3-3a Income Statement, Corporation The Tom Jones Company Income Statement January 1, 2013, through December 31, 2013 Net Income before Income Taxes* $ Less: Provision for Income Taxes Net Income Net earnings per share of common stock: (100,000 shares outstanding) Entrepreneurial Finance 1, Anton Miglo 64,000 11,000 $ 53,000 $ 0.53 1- 37 Balance Sheet (Statement of Financial Position) Basic Accounting Equation Individual Total Assets Total Liabilitie s Net Worth Sole Proprietorship Total Assets Total Liabilitie s Owner ' s Equity Partnership Total Assets Total Liabilities Partner' s Equity Corporation Total Assets Total Liabilities Stockholder ' s Equity Entrepreneurial Finance 1, Anton Miglo Table 3-4 Statement of Financial Position (Balance Sheet) The Tom Jones Family Statement of Financial Position As of December 31, 2013 Assets Cash and Cash Equivalents Cash and Checking Account $ 1,900 Savings Account 4,000 1- 38 Total Cash and Cash Equivalents Need to follow closely. It can become negative (!) for sole proprietorships and partnership that can lead to bankruptcy Invested Assets Stocks and Bonds Life Insurance Cash Value $ 38,000 5,500 Total Invested Assets Use Assets Residence Automobiles Furniture, clothing, jewelry, etc. $ 43,500 310,000 45,000 52,000 Total Use Assets $ 407,000 Total Assets Liabilities and Net Worth Liabilities Homeowners Insurance Payable Credit Card Payable Automobile Note Payable Home Mortgage Payable Total Liabilities Net Worth Total Liabilities and Net Worth Entrepreneurial Finance 1, Anton Miglo 5,900 $ 456,400 975 4,500 22,400 138,000 $ 165,875 290,525 $ 456,400 1- 39 Table 3-5 Balance Sheet (Statement of Financial Position), Sole Proprietorship The Tom Jones Company Balance Sheet As of December 31, 2013 Assets Current Assets Checking Account Certificates of Deposit Accounts Receivable Inventory Total Current Assets Connected to previous slide Fixed Assets Land Buildings Less: Accumulated Depreciation Equipment Less: Accumulated Depreciation Total Fixed Assets $ 2,000 50,000 40,000 35,000 $ 127,000 $ 50,000 $ 250,000 50,000 $ 50,000 6,000 200,000 44,000 $ 294,000 Total Assets Liabilities and Owner's Equity Current Liabilities Accounts Payable--Trade Notes Payable--Bank Taxes Payable $ 421,000 $ 16,500 5,000 3,000 Total Current Liabilities Long-Term Liabilities Building Mortgage Payable Equipment Loan Payable Total Long-Term Liabilities Total Liabilities Owner's Equity Total Liabilities and Owner's Equity Entrepreneurial Finance 1, Anton Miglo $ 24,500 $ 180,000 30,000 $ 210,000 $ 234,500 $ 186,500 $ 421,000 1- 40 Table 3-6 Balance Sheet, Partnership Tom Jones and Partners Partners' Equity Tom Jones Larry Smith Kathy Moore Total Partner's Equity Total Liabilities and Partners' Equity Entrepreneurial Finance 1, Anton Miglo $ 18,650 83,925 83,925 $ 186,500 $ 421,000 1- 41 Table 3-7 Balance Sheet (Statement of Financial Position), Corporation The Tom Jones Corporation Balance Sheet As of December 31, 2013 Assets Current Assets Checking Account Certificates of Deposit Accounts Receivable Inventory $ 2,000 50,000 40,000 35,000 Total Current Assets $ 127,000 Total Fixed Assets $ 294,000 Total Assets $ 421,000 $ 35,500 Total Long-Term Liabilities $ 210,000 Total Liabilities $ 245,500 $ 175,500 $ 421,000 Fixed Assets Land Buildings Less: Accumulated Depreciation Equipment Less: Accumulated Depreciation $ $ $ Liabilities and Stockholder's Equity Current Liabilities Accounts Payable--Trade Notes Payable--Bank Taxes Payable Total Current Liabilities Long-Term Liabilities Building Mortgage Payable Equipment Loan Payable Stockholders' Equity Preferred Stock, $5 par (10,000 Shares) Common Stock, $0.10 par (100,000 Shares) Paid-in Capital in Excess of Par--Common Total Paid-in Capital Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholder's Equity Entrepreneurial Finance 1, Anton Miglo 250,000 50,000 50,000 6,000 50,000 200,000 44,000 $ $ $ $ 16,500 5,000 14,000 180,000 30,000 50,000 10,000 50,000 110,000 65,500 1- 42 Table 3-7a Balance Sheet (Statement of Financial Position), Corporation The Tom Jones Company Balance Sheet As of December 31, 2012 Assets Current Assets Checking Account Certificates of Deposit Accounts Receivable Inventory $ 3,000 23,000 18,000 Total Current Assets $ 44,000 Total Fixed Assets $ 150,000 Total Assets $ 194,000 $ 11,500 Total Long-Term Liabilities $ 170,000 Total Liabilities $ 181,500 Fixes Assets Land Buildings Less: Accumulated Depreciation Equipment Less: Accumulated Depreciation Liabilities and Owner's Equity Current Liabilities Accounts Payable--Trade Notes Payable--Bank Taxes Payable Total Current Liabilities Long-Term Liabilities Building Mortgage Payable Equipment Loan Payable Owner's Equity Total Liabilities and Owner's Equity Entrepreneurial Finance 1, Anton Miglo $ $ $ 100,000 45,000 50,000 5,000 50,000 55,000 45,000 $ 8,000 3,500 ` $ $ 135,000 35,000 12,500 12,500 $ 194,000 1- 43 Table 3-8 Statement of Cash Flows The Tom Jones Corporation Statement of Cash Flows For the Year Ended December 31, 2013 Increase (Decrease) in Cash and Cash Equivalents (Amounts in thousands) Cash flows from operating activities Net Income Adjustments to reconcile net income to net cash provided by operating activies Depreciation Expense Increase in Accounts Receivable Increase in Inventory Increase in Accounts Payable Increase in Notes Payable Increase in Taxes Payable Net Cash provided by Operating Activities (150,000) Cash flows from financing activities: Proceeds from issuance of preferred stock Proceeds from issuance of common stock Proceeds from Mortgage Payable Payment of long-term debt Net cash inflow from financing activities 50,000 60,000 45,000 (5,000) Entrepreneurial Finance 1, Anton Miglo 53,000 $ (4,000) 49,000 6,000 (17,000) (17,000) 8,500 1,500 14,000 Cash flows from investing activities: Acquisition of plant assets Net cash outflow from investing activities Net increase in cash Cash balance, December 31, 2007 Cash balance, December 31, 2008 $ (150,000) $ 150,000 $ $ 49,000 3,000 52,000 1- 44 Some recent innovations Lean management: Inc.com Entrepreneurial Finance 1, Anton Miglo 1- 45 Marketplace game The Marketplace Live scenario follows the lifecycle of a new product and new business. Business decisions are introduced as they become relevant in the evolution of the company. The participants need to crystallize the financial implications of business decisions and how they flow to bottom-line performance. Entrepreneurial Finance 1, Anton Miglo 1- 46 How Conducted? Teams receives information on current situation. Current situation is evaluated, strategy formulated and tactics set in place. Team can acquire more information on what is happening in the game: – customer reaction to market decisions – competitor actions Tactical decisions are fed into the game simulator, along with decisions of opponents. Results of decisions are fed back to teams. Entrepreneurial Finance 1, Anton Miglo 1- 47 Game Scenario You and your business partners have decided to enter the international microcomputer industry. The microcomputer industry is in its introductory stage of the product life cycle. Several other international new venture firms are entering the market at the same time. Entrepreneurial Finance 1, Anton Miglo 1- 48 Entrepreneurial Finance 1, Anton Miglo Sales Offices 1- 49 Market Segments: Market Structure Entrepreneurial Finance 1, Anton Miglo 1- 50 Chronology of Events Q1: Organize the team, name the company, analyze market information, establish strategic direction and set up shop (design brands open a sales office and/or international web center, and build a factory). Q2: Test-market brands, prices, ad copies, media campaigns, sales staffing, and internet tactics. Determine compensation package for employees and production schedule for each brand. Q3: Study end user feedback, competitive tactics, employee productivity, factory operations, and financial performance and adjust strategy. Q4: Large injection of capital from outside investors. Q4 – Q6: Growth stage. Entrepreneurial Finance 1, Anton Miglo 1- 51 Equity Financing (Q1-Q3) The initial capitalization is $4M which is being invested by the executive team over the first 3 quarters; $2M in Q1 and $1M in Q2 and Q3. The executive team owns 100% of the company. Forty thousand shares of stock will be issued to the executive team in exchange for their $4M. The initial stock value is $100/share. Entrepreneurial Finance 1, Anton Miglo 1- 52 Equity Financing (Q4) At the start of Q4, the executive team will have the opportunity to request up to $4M from venture capitalists. (in real life the venture capitalists will expect a strategic plan for the second year in business, including an analysis of the current situation, priorities, strategic thrusts , tactical plan: geographic expansion, R&D, plant expansion, pro forma financial statements through Q6 etc. In our game the price of your shares in Q4 will be determined as weighted average of financial performance multiplied by 10 and wealth performance multiplied by 100 (discuss in class) Entrepreneurial Finance 1, Anton Miglo 1- 53 Debt Financing (Q4 and Beyond) The bank will extend a line of credit to the executive team equal to one and a half times the firm's equity position in the previous quarter. The bank is highly risk adverse and will call in your loan in part or whole if your debt capacity declines due to unusual or extended losses. Entrepreneurial Finance 1, Anton Miglo 1- 54 Special Financing Needs The bank is intolerant of poor financial management. If a firm ends a quarter with a negative cash position, the bank will contact a loan shark by the name of Guido to obtain an emergency loan to cover the firm's checking account. Entrepreneurial Finance 1, Anton Miglo 1- 55 Guido’s Financing Terms Guido requires repayment in the next quarter. The emergency loan interest rate is a sliding scale which begins at 10% per quarter and may go as high as 25% per quarter. For each $100 which Guido places in your checking account, he will take one share of stock in your firm. The issuing of stock to Guido causes a dilution of your stock value and your share of the company. Entrepreneurial Finance 1, Anton Miglo 1- 56 Bankruptcy A firm is technically bankrupt if its cumulative losses exceed its equity investment. Bankruptcy occurs when the sum of retained earnings and the common and preferred stock is a negative number. Stated differently, the management has used up all of the equity of the firm when the negative value of the retained earnings exceeds the value of the common stock. Entrepreneurial Finance 1, Anton Miglo 1- 57 Entrepreneurial Finance 1, Anton Miglo Balanced Scorecard 1- 58 The Following Slides are for Q1 Establish the Firm’s Strategic Direction and Setting Up Shop (with a focus on brand design considerations.) Organize the Business • Name the company • Assign the organizational responsibilities • Share personal learning goals • Establish team norms Entrepreneurial Finance 1, Anton Miglo 1- 59 Q1: Establish General Direction • Analyze market information to evaluate the market opportunity • Consider Available financial resources Costs to open sales outlets Costs to set up and operate factory • Establish general direction Formulate corporate and functional norms Entrepreneurial Finance 1, Anton Miglo 1- 60 Q1: Setup Shop – Tactical Decisions • Locate factory in Shanghai – all firms • Build fixed plant capacity • Develop channel options Decide on relative emphasis of brick and mortar offices versus web center Open initial sales office and/or web center • Design two brands for target market segments Entrepreneurial Finance 1, Anton Miglo 1- 61 Once You Select a Segment, You Must Design a Brand to Meet the Needs of the Segment. Using the computer on the road is important to the Traveler’s segment. What Features Would Enable a Computer to be Used on the Road? Using the computer on the road Slim, rugged, portable design Entrepreneurial Finance 1, Anton Miglo 10” color, flat screen for portable Network and internet connections 1- 62 How Far Do You Go in Giving the Customers What They Say They Want? Is more speed, software applications, memory, keys on the keyboard, etc. always valued? Could “more of some feature” even make a customer unhappy? To answer these questions, you must understand the elasticity of your components. Entrepreneurial Finance 1, Anton Miglo 1- 63 Take Any PC Segment, How Excited Will It Become if You Provide…? More memory More functions on the keyboard More software More… Just like the candy bar ingredients, you must discover the response function for each PC component. Entrepreneurial Finance 1, Anton Miglo Take Any PC Segment, How Excited Will It Become if You Provide? 1- 64 Portability Rugged casement Microcircuitry Use on road High res resolution flat LCD display Entrepreneurial Finance 1, Anton Miglo Wireless modem Connect to office 6-hour battery Low-profile, built-in disk, CD drives Compact keyboard Easy to use Trackball mouse Wrist rest on keyboard 1- 65 WEB SOURCES Atlantic Canada Opportunities Agency Government Services for Entrepreneurs Profit Magazine Canadian Council for Small Business and Entrepreneurship Canadian Federation of Independent Business Canadian Innovation Centre Canadian Youth Business Foundation Export Development Canada Guerrilla Marketing Statistics Canada GD Sourcing Industry Canada’s SME Benchmarking Tool Tax information for small business Canada Business Business Service Centers such as Canada Business www.canadabusiness.ca inc.com Lean management: Entrepreneurial Finance 1, Anton Miglo 1- 66 Last slide: Entrepreneurial Finance 1, Anton Miglo